COST-VOLUME-PROFIT RELATIONSHIP

advertisement

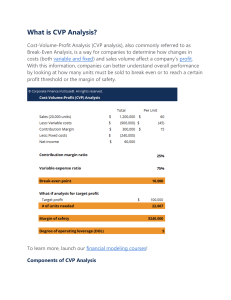

COST-VOLUME-PROFIT RELATIONSHIP By: G.E ZAFRAN ATENEO Graduate School of Business 2011-2012 Series 1 6 Series 2 5 Series 3 4 3 2 1 0 Category 1 Category 2 Category 3 Category 4 LEARNING OBJECTIVES: After studying chapter 6, you should be able to: • Explain how changes in activity affect Contribution Margin and Net Operating Income. • Prepare and interpret a cost-volume-profit (CVP) graft and profit graft • Use the contribution Margin ratio (CM Ratio)to compute changes in Contribution and Net Operating Income resulting from changes in Sales Volume • Show the effects on Contribution Margin of changes in Variable Costs, Fixed Costs, Selling Price and Volume - • Determine the level of sales needed to achieve a desired target profit • Determine Break-even point • Compute the margin of safety an explain its significance • Compute the degree of operating leverage at a particular level of sales and explain how it can be used to predict changes in net operating income • Compute the Break-even point for a multiproduct company and explain the effects of shifts in the sales mix on contribution margin and the breakeven point WHAT IS COST-VOLUME PROFIT ANALYSIS AND ITS RELATIONSHIP? • When Managers start to manufacture certain product, these 3 vital tools must first be considered before the production is initiated as to how much will it COST the company to produce per unit of product. Fixed cost Variable cost Total cost - When COST PER UNIT is identified, the company will consider how many units will then be produced (VOLUME) to get a certain margin of PROFIT for certain VOLUME of Products sold PER UNIT COST($10) X NUMBER OF UNITS(100) GROSS PROFIT ($1000) COST VOLUME ANALYSIS PROFIT VARIABLE + FIXED EXPENSE ANALIZING THE FF: NUMBER OF UNITS SOLD Selling Price, sales volume, unit variable cost, total fixed cost, mix of product sold PROFIT NET OPERATING INCOME Cost-Volume-Profit (CVP)Analysis -Is the powerful tool that helps managers understand the relationship among cost, volume, and profit. -CVP Analysis focuses on how profit are affected by the following FIVE FACTORS: 1. 2. 3. 4. 5. Selling Prices Sales volume Unit variable cost Total fixed cost Mix of products cost • Selling Price: is the amount actually attach to the product or the value of a product • Sales volume: is the number of unit sold in a transaction • Unit variable cost: a non-fixed cost or expense incurred to manufacture a certain product • Total fixed cost: is the overall sum of fixed cost or expenses • Mix products sold: pertain to two or more varieties of product sold THE IMPORTANCE OF CVP ANALYSIS • CVP analysis helps managers understand how profits are affected by these 5 key factors. Selling price MIX OF PRODUCT SALES VOLUME MARKET UNIT VARIAB LE COST TOTAL FIXED COST SOLD - • It is a vital tool in many business decisions. These decision include what product and services to offer, what price to charge, what marketing strategy to use, and what cost structure to implement. • It will help the managers decide on certain aspect of operation whether certain product is significant in some areas for profit margin • It will help what product is saleable and what is not • It will also help the company reach its ROI THE BASIC OF COST-VOLUME-PROFIT (CVP) ANALYSIS To help understand the role of CVP analysis in business decisions, consider the case of acoustic concept Inc where cost behavior is carefully analyze with the contribution of income statement. The contribution of income statement emphasizes the behavior of cost s and therefore is extremely helpful to managers in judging the impact on profits of changes in selling price and cost or volume. XYZ Paint Industry Contribution Income Statement Note: Volume in kilos Price in Phil Peso TOTAL PER UNIT Sales (volume: 1,231,000) 306,862,000 249.28 Variable Expense (1,231,000) 210,500,000 171.00 Contribution Margin 96,362,000 78.28 Fixed Expenses 17,800,00 Net Operating Income 78,562,000