Gleim Exam Questions and Explanations Updates to Financial

advertisement

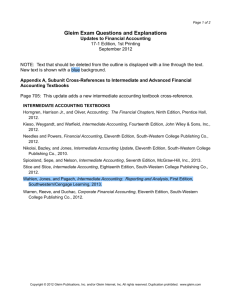

Page 1 of 4 Gleim Exam Questions and Explanations Updates to Financial Accounting 17-1 Edition, 1st Printing March 2014 NOTE: Text that should be deleted is displayed with a line through the text. New text is shown with a blue background. Appendix A – Subunit Cross-References to Intermediate and Advanced Financial Accounting Textbooks Page 705: These edits update the Appendix to reflect the most recent editions of all of the textbooks we reference. INTERMEDIATE ACCOUNTING TEXTBOOKS Horngren, Harrison Jr., and Oliver, Accounting: The Financial Chapters, Ninth Edition, Prentice Hall, 2012. Kieso, Weygandt, and Warfield, Intermediate Accounting, Fourteenth Edition, John Wiley & Sons, Inc., 2012. Kieso, Weygandt, and Warfield, Intermediate Accounting, Fifteenth Edition, John Wiley & Sons, 2013. Needles and Powers, Financial Accounting, Eleventh Edition, South-Western College Publishing Co., 2012. Nikolai, Bazley, and Jones, Intermediate Accounting Update, Eleventh Edition, South-Western College Publishing Co., 2010. Nobles, Mattison, and Matsumura, Horngren’s Accounting: The Financial Chapters, Tenth Edition, Prentice Hall, 2014. Spiceland, Sepe, and Nelson, Intermediate Accounting, Seventh Edition, McGraw-Hill, Inc., 2013. Stice and Stice, Intermediate Accounting, Eighteenth Edition, South-Western College Publishing Co., 2012. Stice and Stice, Intermediate Accounting, Nineteenth Edition, South-Western College Publishing, 2014. Wahlen, Jones, and Pagach, Intermediate Accounting: Reporting and Analysis, First Edition, SouthwWestern/Cengage Learning College Publishing, 2013. Warren, Reeve, and Duchac, Corporate Financial Accounting, Eleventh Edition, South-Western College Publishing Co., 2012. Warren, Reeve, and Duchac, Corporate Financial Accounting, Twelfth Edition, South-Western College Publishing, 2014. Page 2 of 4 ADVANCED ACCOUNTING TEXTBOOKS Baker, Christensen, and Cottrell, Advanced Financial Accounting, Ninth Edition, McGraw-Hill, Inc., 2011. Beams, Anthony, Bettinghaus, and Smith, Advanced Accounting, Eleventh Edition, Prentice Hall, Inc., 2012. Fischer, Taylor, and Cheng, Advanced Accounting, Eleventh Edition, South-Western College Publishing Co., 2011 2012. Halsey and Hopkins, Advanced Accounting, First Edition, Cambridge Business Publishers, 2012. Halsey and Hopkins, Advanced Accounting, Second Edition, Cambridge Business Publishers, 2013. Hamlen, Huefner, and Largay, Advanced Accounting, Second Edition, Cambridge Business Publishers, 2013. Hoyle, Schaefer, and Doupnik, Advanced Accounting, Tenth Edition, McGraw-Hill, Inc., 2011. Hoyle, Schaefer, and Doupnik, Advanced Accounting, Eleventh Edition, McGraw-Hill, 2013. Jeter and Chaney, Advanced Accounting, Fifth Edition, John Wiley & Sons, Inc., 2012. Pages 706-711: The following are newly added textbooks. INTERMEDIATE ACCOUNTING TEXTBOOKS Kieso, Weygandt, and Warfield, Intermediate Accounting, Fifteenth Edition, John Wiley & Sons, 2013. Chapter 1 - Financial Accounting and Accounting Standards - 1.7-1.9 Chapter 2 - Conceptual Framework for Financial Reporting - 1.1-1.5 Chapter 3 - The Accounting Information System - 2.1-2.4 Chapter 4 - Income Statement and Related Information - SU 3 Chapter 5 - Balance Sheet and Statement of Cash Flows - SU 19 Chapter 6 - Accounting and the Time Value of Money - SU 4 Chapter 7 - Cash and Receivables - 5.2-5.6 Chapter 8 - Valuation of Inventories: A Cost-Basis Approach - 6.1-6.4 Chapter 9 - Inventories: Additional Valuation Issues - 6.5-6.7 Chapter 10 - Acquisition and Disposition of Property, Plant, and Equipment - SU 7 Chapter 11 - Depreciation, Impairments, and Depletion - 7.5, SU 8 Chapter 12 - Intangible Assets - SU 9 Chapter 13 - Current Liabilities and Contingencies - SU 11 Chapter 14 - Long-Term Liabilities - SU 12 Chapter 15 - Stockholders’ Equity - SU 15 Chapter 16 - Dilutive Securities and Earnings Per Share - 16.1-16.2 Chapter 17 - Investments - SU 10 Chapter 18 - Revenue Recognition - 1.5, SU 21 Chapter 19 - Accounting for Income Taxes - SU 17 Chapter 20 - Accounting for Pensions and Postretirement Benefits - 11.4, SU 13 Chapter 21 - Accounting for Leases - SU 14 Chapter 22 - Accounting Changes and Error Analysis - SU 18 Chapter 23 - Statement of Cash Flows - SU 19 Chapter 24 - Full Disclosure in Financial Reporting - 10.7, SU 20 Page 3 of 4 Nobles, Mattison, and Matsumura, Horngren’s Accounting: The Financial Chapters, Tenth Edition, Prentice Hall, 2014. Chapter 1 - Accounting and the Business Environment - SU 1 Chapter 2 - Recording Business Transactions - SU 2 Chapter 3 - The Adjusting Process - SU 2 Chapter 4 - Completing the Accounting Cycle - SU 2 Chapter 5 - Merchandising Operations - 6.1 Chapter 6 - Merchandise Inventory - SU 6 Chapter 7 - Accounting Information Systems - 2.1-2.4 Chapter 8 - Internal Control and Cash - 5.2 Chapter 9 - Receivables - 5.3-5.5 Chapter 10 - Plant Assets, Natural Resources, and Intangibles - SU 7, SU 9 Chapter 11 - Current Liabilities and Payroll - SU 11 Chapter 12 - Partnerships - SU 23 Chapter 13 - Corporations - SU 3, SU 15 Chapter 14 - Long-Term Liabilities - SU 12 Chapter 15 - Investments - SU 10 Chapter 16 - The Statement of Cash Flows - SU 19 Chapter 17 - Financial Statement Analysis - SU 22 Stice and Stice, Intermediate Accounting, Nineteenth Edition, South-Western College Publishing, 2014. Chapter 1 - Financial Reporting - SU 1 Chapter 2 - A Review of the Accounting Cycle - SU 2 Chapter 3 - The Balance Sheet and Notes to the Financial Statements - SU 20 Chapter 4 - The Income Statement - SU 3 Chapter 5 - Statement of Cash Flows and Articulation - SU 19 Chapter 6 - Earnings Management - N/A Chapter 7 - The Revenue/Receivables/Cash Cycle - 5.2-5.5, SU 21 Chapter 8 - Revenue Recognition - SU 21 Chapter 9 - Inventory and Cost of Goods Sold - SU 6 Chapter 10 - Investments in Noncurrent Operating Assets -- Acquisition - 7.1-7.3, SU 9 Chapter 11 - Investments in Noncurrent Operating Assets -- Utilization and Retirement - 7.4-7.6, SU 8 Chapter 12 - Debt Financing - SUs 11-12 Chapter 13 - Equity Financing - SU 15 Chapter 14 - Investments in Debt and Equity Securities - SU 10 Chapter 15 - Leases - SU 14 Chapter 16 - Income Taxes - SU 17 Chapter 17 - Employee Compensation -- Payroll, Pensions, and Other Compensation Issues - 11.4, SU 13 Chapter 18 - Earnings per Share - 16.1-16.2 Chapter 19 - Derivatives, Contingencies, Business Segments, and Interim Reports - 10.6, 11.5, 20.4, SU 25 Chapter 20 - Accounting Changes and Error Corrections - SU 18 Chapter 21 - Statement of Cash Flows Revisited - SU 19 Chapter 22 - Accounting in a Global Market - SU 26 Chapter 23 - Analysis of Financial Statements - SU 22 Page 4 of 4 Warren, Reeve, and Duchac, Corporate Financial Accounting, Twelfth Edition, South-Western College Publishing, 2014. Chapter 1 - Introduction to Accounting and Business - SU 1 Chapter 2 - Analyzing Transactions - SU 2 Chapter 3 - The Adjusting Process - SU 2 Chapter 4 - Completing the Accounting Cycle - SU 2 Chapter 5 - Accounting for Merchandising Businesses - 6.1 Chapter 6 - Inventories - SU 6 Chapter 7 - Sarbanes-Oxley, Internal Control, and Cash - 5.3 Chapter 8 - Receivables - 5.3-5.5 Chapter 9 - Fixed Assets and Intangible Assets - SUs 7-9 Chapter 10 - Current Liabilities and Payroll - SU 11 Chapter 11 - Corporations: Organization, Stock Transactions, and Dividends - SU 15 Chapter 12 - Long-Term Liabilities: Bonds and Notes - SU 4, SU 12 Chapter 13 - Investments and Fair Value Accounting - SU 10 Chapter 14 - Statement of Cash Flows - SU 19 Chapter 15 - Financial Statement Analysis - SU 22 ADVANCED ACCOUNTING TEXTBOOKS Halsey and Hopkins, Advanced Accounting, Second Edition, Cambridge Business Publishers, 2013. Chapter 1 - Accounting for Intercorporate Investments - SU 24 Chapter 2 - Introduction to Business Combinations and the Consolidation Process - 24.1-24.5 Chapter 3 - Consolidated Financial Statements Subsequent to the Date of Acquisition - 24.5-24.8 Chapter 4 - Consolidated Financial Statements and Intercompany Transactions - 24.5, 24.8 Chapter 5 - Consolidated Financial Statements with Less than 100% Ownership - 24.1-24.5 Chapter 6 - Consolidation of Variable Interest Entities and Other Intercompany Investments - 24.5-24.8 Chapter 7 - Accounting for Foreign Currency Transactions and Derivatives - SU 26 Chapter 8 - Consolidation of Foreign Subsidiaries - 26.1, 26.2 Chapter 9 - Government Accounting: Fund-Based Financial Statements - SU 27 Chapter 10 - Government Accounting: Government-Wide Financial Statements - 27.7, 27.8 Chapter 11 - Accounting for Not-for-Profit Organizations - SU 28 Chapter 12 - Segment Disclosures and Interim Financial Reporting - 20.4, SU 25 Chapter 13 - Accounting for Partnerships - SU 23 Hoyle, Schaefer, and Doupnik, Advanced Accounting, Eleventh Edition, McGraw-Hill, 2013. Chapter 1 - The Equity Method of Accounting for Investments - 10.3 Chapter 2 - Consolidation of Financial Information - SU 24 Chapter 3 - Consolidations - Subsequent to the Date of Acquisition - 24.5-24.8 Chapter 4 - Consolidated Financial Statements and Outside Ownership - 24.5-24.8 Chapter 5 - Consolidated Financial Statements - Intercompany Asset Transactions - 24.5, 24.8 Chapter 6 - Intercompany Debt, Consolidated Statement of Cash Flows, and Other Issues - 24.5, 24.8 Chapter 7 - Consolidated Financial Statements - Ownership Patterns and Income Taxes - N/A Chapter 8 - Segment and Interim Reporting - 20.4, SU 25 Chapter 9 - Foreign Currency Transactions and Hedging Foreign Exchange Risk - SU 26 Chapter 10 - Translation of Foreign Currency Financial Statements - 26.1 Chapter 11 - Worldwide Accounting Diversity and International Accounting Standards - N/A Chapter 12 - Financial Reporting and the Securities and Exchange Commission - N/A Chapter 13 - Accounting for Legal Reorganizations and Liquidations - N/A Chapter 14 - Partnerships: Formation and Operation - 23.1-23.4 Chapter 15 - Partnerships: Termination and Liquidation - 23.5 Chapter 16 - Accounting for State and Local Governments, Part I - SU 27 Chapter 17 - Accounting for State and Local Governments, Part II - SU 27 Chapter 18 - Accounting for Not-for-Profit Organizations - SU 28 Chapter 19 - Accounting for Estates and Trusts - N/A