Page 1 of 2

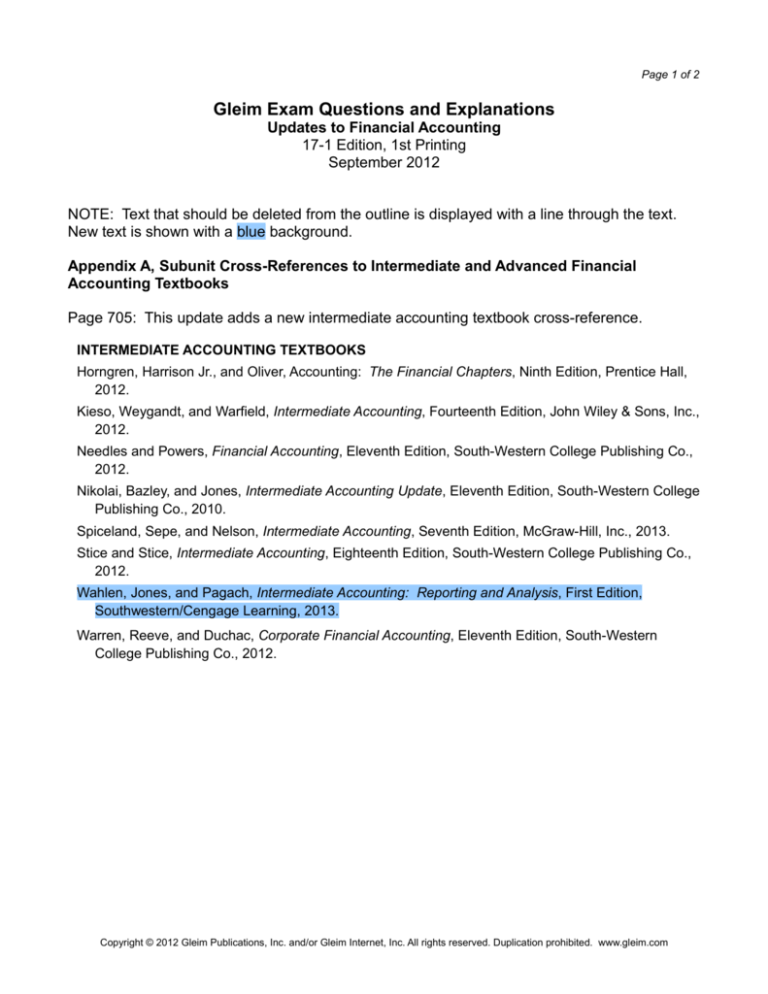

Gleim Exam Questions and Explanations

Updates to Financial Accounting

17-1 Edition, 1st Printing

September 2012

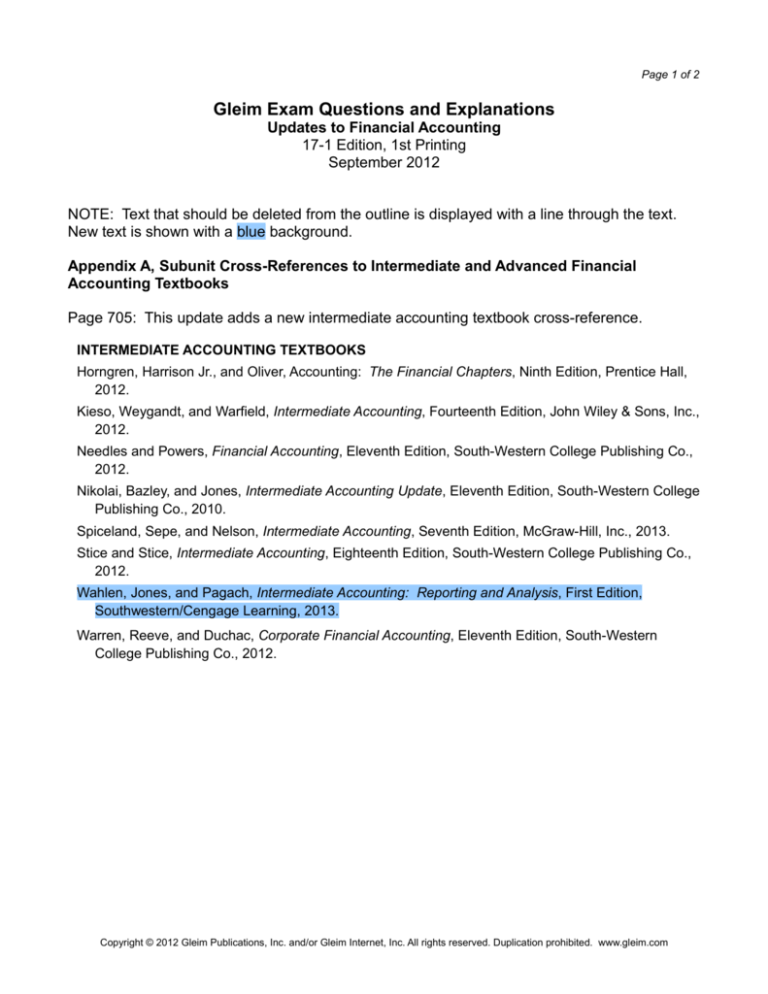

NOTE: Text that should be deleted from the outline is displayed with a line through the text.

New text is shown with a blue background.

Appendix A, Subunit Cross-References to Intermediate and Advanced Financial

Accounting Textbooks

Page 705: This update adds a new intermediate accounting textbook cross-reference.

INTERMEDIATE ACCOUNTING TEXTBOOKS

Horngren, Harrison Jr., and Oliver, Accounting: The Financial Chapters, Ninth Edition, Prentice Hall,

2012.

Kieso, Weygandt, and Warfield, Intermediate Accounting, Fourteenth Edition, John Wiley & Sons, Inc.,

2012.

Needles and Powers, Financial Accounting, Eleventh Edition, South-Western College Publishing Co.,

2012.

Nikolai, Bazley, and Jones, Intermediate Accounting Update, Eleventh Edition, South-Western College

Publishing Co., 2010.

Spiceland, Sepe, and Nelson, Intermediate Accounting, Seventh Edition, McGraw-Hill, Inc., 2013.

Stice and Stice, Intermediate Accounting, Eighteenth Edition, South-Western College Publishing Co.,

2012.

Wahlen, Jones, and Pagach, Intermediate Accounting: Reporting and Analysis, First Edition,

Southwestern/Cengage Learning, 2013.

Warren, Reeve, and Duchac, Corporate Financial Accounting, Eleventh Edition, South-Western

College Publishing Co., 2012.

Copyright © 2012 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com

Page 2 of 2

Page 708: This update adds a new intermediate accounting textbook cross-reference.

Wahlen, Jones, and Pagach, Intermediate Accounting: Reporting and Analysis, First Edition,

Southwestern/Cengage Learning, 2013.

Part I: Financial Reporting & Statements: Objectives, Concepts, & Analysis

Chapter 1 - The Demand for and Supply of Financial Accounting Information - N/A

Chapter 2 - Financial Reporting: Its Conceptual Framework - 1.1, 1.2, 1.3, 1.4, 1.5

Chapter 3 - Review of a Company’s Accounting System - 2.1, 2.2, 2.3

Chapter 4 - The Balance Sheet and the Statement of Shareholders’ Equity - 1.5, 1.6, 5.1, 11.5, 21.1, 21.5, SU 23

Chapter 5 - The Income Statement and the Statement of Cash Flows - 3.1, 3.2, 3.3, 3.5, 16.1, 16.2, SU 19, 21.4, SU 26

- Time Value of Money Module - SU 4

Part II: Business Operating Activities

Chapter 6 - Cash & Receivables - SU 5

Chapter 7 - Inventories: Cost Measurement and Flow Assumptions - 6.1, 6.2, 6.3, 6.4, 6.5

Chapter 8 - Inventories: Special Valuation Issues - 6.5, 6.6, 6.7

Chapter 9 - Current Liabilities and Contingent Obligations - SU 11

Part III: Investing Activities

Chapter 10 - Property, Plant, and Equipment: Acquisition and Subsequent Investments - 7.1, 7.2, 7.3, 7.4, 7.6

Chapter 11 - Depreciation, Depletion, Impairment, and Disposal - 7.5, SU 8

Chapter 12 - Intangibles - SU 9

Chapter 13 - Investments & Long-Term Receivables - 5.7, SU 10

Part IV: Financing Activities

Chapter 14 - Financing Liabilities: Bonds and Long-Term Notes Payable - SU 12

Chapter 15 - Contributed Capital - 15.1, 15.4, 15.5

Chapter 16 - Retained Earnings and Earnings Per Share - 15.2, 15.3, 15.4, 16.1, 16.2

Part V: Special Topics in Financial Reporting

Chapter 17 - Advanced Issues in Revenue Recognition - 22.1, 22.2, 22.3

Chapter 18 - Accounting for Income Taxes - SU 17

Chapter 19 - Accounting for Post-Retirement Benefits - SU 13

Chapter 20 - Accounting for Leases - SU 14

Chapter 21 - The Statement of Cash Flows - SU 19

Chapter 22 - Accounting for Changes and Errors - SU 18

Copyright © 2012 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com