Padini Holdings Berhad

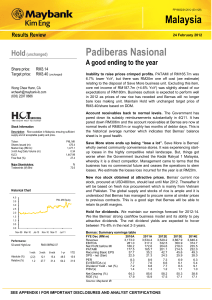

advertisement

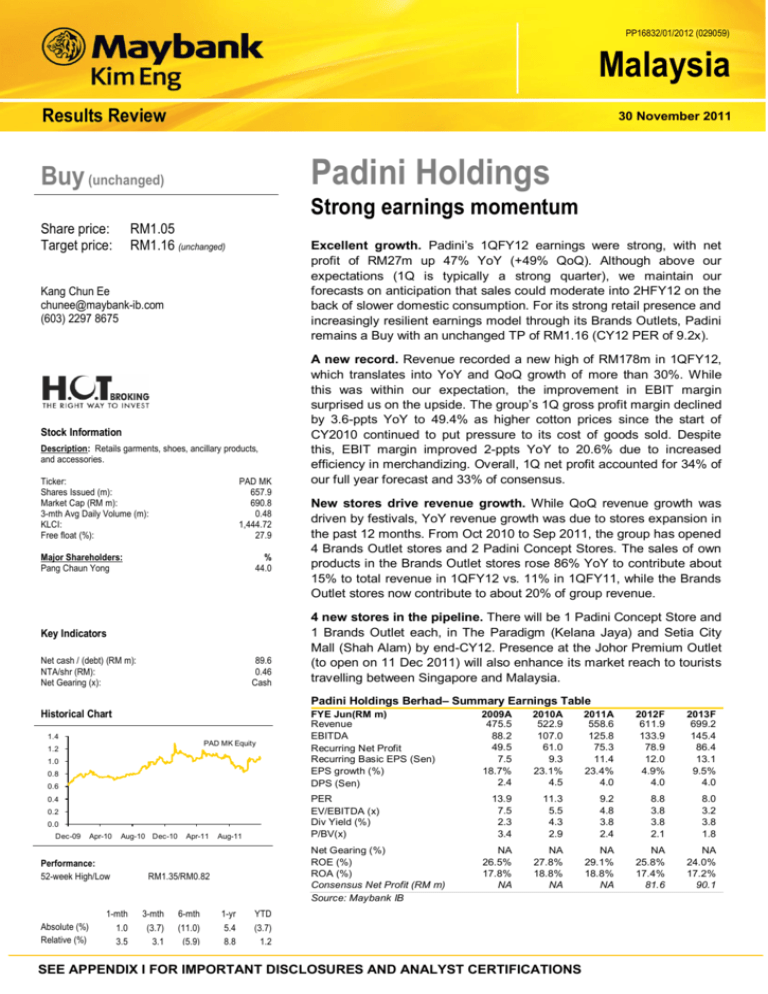

PP16832/01/2012 (029059) Malaysia Results Review 30 November 2011 Padini Holdings Buy (unchanged) Strong earnings momentum Share price: Target price: RM1.05 RM1.16 (unchanged) Excellent growth. Padini’s 1QFY12 earnings were strong, with net profit of RM27m up 47% YoY (+49% QoQ). Although above our expectations (1Q is typically a strong quarter), we maintain our forecasts on anticipation that sales could moderate into 2HFY12 on the back of slower domestic consumption. For its strong retail presence and increasingly resilient earnings model through its Brands Outlets, Padini remains a Buy with an unchanged TP of RM1.16 (CY12 PER of 9.2x). Kang Chun Ee chunee@maybank-ib.com (603) 2297 8675 Stock Information Description: Retails garments, shoes, ancillary products, and accessories. Ticker: Shares Issued (m): Market Cap (RM m): 3-mth Avg Daily Volume (m): KLCI: Free float (%): PAD MK 657.9 690.8 0.48 1,444.72 27.9 Major Shareholders: Pang Chaun Yong % 44.0 Key Indicators Net cash / (debt) (RM m): NTA/shr (RM): Net Gearing (x): 89.6 0.46 Cash A new record. Revenue recorded a new high of RM178m in 1QFY12, which translates into YoY and QoQ growth of more than 30%. While this was within our expectation, the improvement in EBIT margin surprised us on the upside. The group’s 1Q gross profit margin declined by 3.6-ppts YoY to 49.4% as higher cotton prices since the start of CY2010 continued to put pressure to its cost of goods sold. Despite this, EBIT margin improved 2-ppts YoY to 20.6% due to increased efficiency in merchandizing. Overall, 1Q net profit accounted for 34% of our full year forecast and 33% of consensus. New stores drive revenue growth. While QoQ revenue growth was driven by festivals, YoY revenue growth was due to stores expansion in the past 12 months. From Oct 2010 to Sep 2011, the group has opened 4 Brands Outlet stores and 2 Padini Concept Stores. The sales of own products in the Brands Outlet stores rose 86% YoY to contribute about 15% to total revenue in 1QFY12 vs. 11% in 1QFY11, while the Brands Outlet stores now contribute to about 20% of group revenue. 4 new stores in the pipeline. There will be 1 Padini Concept Store and 1 Brands Outlet each, in The Paradigm (Kelana Jaya) and Setia City Mall (Shah Alam) by end-CY12. Presence at the Johor Premium Outlet (to open on 11 Dec 2011) will also enhance its market reach to tourists travelling between Singapore and Malaysia. Padini Holdings Berhad– Summary Earnings Table Historical Chart 1.4 PAD MK Equity 1.2 1.0 0.8 0.6 0.4 PER EV/EBITDA (x) Div Yield (%) P/BV(x) 0.2 0.0 Dec-09 Apr-10 Aug-10 Dec-10 Performance: 52-week High/Low Apr-11 Aug-11 Net Gearing (%) ROE (%) ROA (%) Consensus Net Profit (RM m) Source: Maybank IB RM1.35/RM0.82 1-mth 3-mth 6-mth 1-yr YTD 1.0 3.5 (3.7) 3.1 (11.0) (5.9) 5.4 8.8 (3.7) 1.2 Absolute (%) Relative (%) FYE Jun(RM m) Revenue EBITDA Recurring Net Profit Recurring Basic EPS (Sen) EPS growth (%) DPS (Sen) 2009A 475.5 88.2 49.5 7.5 18.7% 2.4 2010A 522.9 107.0 61.0 9.3 23.1% 4.5 2011A 558.6 125.8 75.3 11.4 23.4% 4.0 2012F 611.9 133.9 78.9 12.0 4.9% 4.0 2013F 699.2 145.4 86.4 13.1 9.5% 4.0 13.9 7.5 2.3 3.4 11.3 5.5 4.3 2.9 9.2 4.8 3.8 2.4 8.8 3.8 3.8 2.1 8.0 3.2 3.8 1.8 NA 26.5% 17.8% NA NA 27.8% 18.8% NA NA 29.1% 18.8% NA NA 25.8% 17.4% 81.6 NA 24.0% 17.2% 90.1 Kim Eng Hong Kong is a sub sid iar y of Malayan B anking B erh ad SEE APPENDIX I FOR IMPORTANT DISCLOSURES AND ANALYST CERTIFICATIONS Padini Holdings Padini: Results Summary Table Quarterly FY Jun (RM m) Sales Cost of Goods Sold Gross Profit Other income / (loss) Administrative Expenses Selling and Marketing Expenses EBIT Interest Income Interest Expense Pretax Profit Tax Net Profit 1QFY12 178.1 (90.2) 88.0 1.3 (8.1) (44.5) 36.7 0.6 (0.5) 36.7 (9.8) 26.9 1QFY11 136.6 (64.3) 72.3 0.5 (7.8) (39.7) 25.3 0.6 (0.3) 25.7 (7.3) 18.3 49.4 20.6 26.7 52.9 18.6 28.5 Gross profit margin (%) EBIT margin (%) Tax rate (%) % YoY 30.4 40.2 21.6 150.7 3.8 12.1 44.6 (1.3) 85.8 43.2 34.1 46.9 +/- p.pts YoY (3.6) 2.0 (1.8) 4QFY11 132.1 (65.0) 67.1 0.7 (7.6) (35.0) 25.2 0.6 (0.4) 25.4 (7.3) 18.1 % QoQ 34.8 38.7 31.0 85.0 7.4 27.0 45.3 (0.7) 10.3 44.9 34.4 49.1 +/- p.pts QoQ (1.4) 1.5 (2.1) 50.8 19.1 28.7 Source: Company, Maybank IB Padini Holdings: One-year forward PER PE (x) 25 20 15 +1sd: 12.9 mean: 9.2 10 5 -1sd: 5.5 Jun-11 Jun-10 Jun-09 Jun-08 Jun-07 Jun-06 Jun-05 Jun-04 Jun-03 Jun-02 Jun-01 Jun-00 Jun-99 Jun-98 0 Source: Bloomberg, Maybank IB 30 November 2011 Page 2 of 5 Padini Holdings INCOME STATEMENT (RM m) FYJun BALANCE SHEET (RM m) 2010A 2011A 2012F 2013F FYJun Revenue EBITDA Depreciation & Amortisation Operating Profit (EBIT) Interest (Exp)/Inc Associates One-offs Pre-Tax Profit Tax Minority Interest Net Profit Recurring Net Profit 522.9 107.0 (21.8) 85.2 1.1 0.0 0.0 86.3 (25.3) 0.0 61.0 61.0 558.6 125.8 (22.3) 103.5 1.1 0.0 0.0 104.6 (29.3) 0.0 75.3 75.3 611.9 133.9 (26.7) 107.1 2.4 0.0 0.0 109.6 (30.6) 0.0 78.9 78.9 699.2 145.4 (29.1) 116.3 3.7 0.0 0.0 120.0 (33.5) 0.0 86.4 86.4 Revenue Growth % EBITDA Growth (%) EBIT Growth (%) Net Profit Growth (%) Recurring Net Profit Growth (%) Tax Rate % 10.0% 21.3% 24.4% 23.1% 23.1% 29.3% 6.8% 17.6% 21.5% 23.5% 23.5% 28.0% 9.5% 6.4% 3.5% 4.8% 4.8% 28.0% 14.3% 8.6% 8.5% 9.5% 9.5% 28.0% 2010A 2011A 2012F 2013F 86.3 21.8 (1.1) 24.7 (26.7) (11.5) 93.5 (25.6) 0.0 (0.8) (26.4) 0.0 0.0 0.0 0.0 3.1 3.1 70.2 104.6 22.3 (1.1) (66.1) (29.2) (1.5) 29.1 (24.0) 19.7 2.3 (2.0) 10.2 0.0 0.0 0.0 (32.9) (22.7) 4.4 109.6 26.7 (2.4) 10.6 (34.4) (23.9) 86.2 (30.9) 0.0 0.0 (30.9) 0.0 0.0 0.0 0.0 (1.8) (1.8) 53.5 120.0 29.1 (3.7) (2.6) (37.6) (22.6) 82.5 (34.0) 0.0 0.0 (34.0) 0.0 0.0 0.0 0.0 0.6 0.6 49.1 CASH FLOW (RM m) FYJun Profit before taxation Depreciation Net interest receipts/(payments) Working capital change Cash tax paid Others (incl'd exceptional items) Cash flow from operations Capex Disposal/(purchase) Others Cash flow from investing Debt raised/(repaid) Equity raised/(repaid) Dividends (paid) Interest payments Others Cash flow from financing Change in cash 2010A 2011A 2012F 2013F Fixed Assets Other LT Assets Cash/ST Investments Other Current Assets Total Assets 80.0 12.3 135.0 129.3 356.6 83.6 10.5 138.6 212.2 444.9 89.0 11.4 217.9 145.9 464.1 93.9 16.5 266.0 164.1 540.5 ST Debt Other Current Liabilities LT Debt Other LT Liabilities Minority Interest Shareholders' Equity Total Liabilities-Capital 26.1 85.2 10.1 0.8 0.0 234.3 356.6 32.1 114.0 15.0 1.6 0.0 282.3 444.9 22.0 101.5 11.3 0.0 0.0 329.4 464.1 26.4 117.1 7.5 0.0 0.0 389.5 540.5 Share Capital (m) Gross Debt/(Cash) Net Debt/(Cash) Working Capital 65.8 36.3 (98.8) 153.0 65.8 47.0 (91.6) 204.7 65.8 33.3 (184.6) 240.3 65.8 33.9 (232.1) 286.6 FYJun 2010A 2011A 2012F 2013F EBITDA Margin % Op. Profit Margin % Net Profit Margin % ROE % ROA % Net Margin Ex. El % Dividend Cover (x) Interest Cover (x) Asset Turnover (x) Asset/Debt (x) Debtors Turn (days) Creditors Turn (days) Inventory Turn (days) Net Gearing % Debt/ EBITDA (x) Debt/ Market Cap (x) 20.5% 16.3% 11.7% 27.8% 18.8% 11.7% 2.1 NA 1.5 9.8 11.3 63.2 107.7 NA 0.3 0.1 22.5% 18.5% 13.5% 29.1% 18.8% 13.5% 2.9 NA 1.3 9.5 15.3 63.2 238.0 NA 0.4 0.1 21.9% 17.5% 12.9% 25.8% 17.4% 12.9% 3.0 NA 1.3 14.0 15.3 63.2 86.1 NA 0.2 0.0 20.8% 16.6% 12.4% 24.0% 17.2% 12.4% 3.3 NA 1.3 15.9 15.3 63.2 82.0 NA 0.2 0.0 RATES & RATIOS Source: Company, Maybank IB 30 November 2011 Page 3 of 5 Padini Holdings APPENDIX 1 Definition of Ratings Maybank Investment Bank Research uses the following rating system: BUY HOLD SELL Total return is expected to be above 10% in the next 12 months Total return is expected to be between -5% to 10% in the next 12 months Total return is expected to be below -5% in the next 12 months Applicability of Ratings The respective analyst maintains a coverage universe of stocks, the list of which may be adjusted according to needs. Investment ratings are only applicable to the stocks which form part of the coverage universe. Reports on companies which are not part of the coverage do not carry investment ratings as we do not actively follow developments in these companies. Some common terms abbreviated in this report (where they appear): Adex = Advertising Expenditure BV = Book Value CAGR = Compounded Annual Growth Rate Capex = Capital Expenditure CY = Calendar Year DCF = Discounted Cashflow DPS = Dividend Per Share EBIT = Earnings Before Interest And Tax EBITDA = EBIT, Depreciation And Amortisation EPS = Earnings Per Share EV = Enterprise Value FCF = Free Cashflow FV = Fair Value FY = Financial Year FYE = Financial Year End MoM = Month-On-Month NAV = Net Asset Value NTA = Net Tangible Asset P = Price P.A. = Per Annum PAT = Profit After Tax PBT = Profit Before Tax PE = Price Earnings PEG = PE Ratio To Growth PER = PE Ratio QoQ = Quarter-On-Quarter ROA = Return On Asset ROE = Return On Equity ROSF = Return On Shareholders’ Funds WACC = Weighted Average Cost Of Capital YoY = Year-On-Year YTD = Year-To-Date Disclaimer This report is for information purposes only and under no circumstances is it to be considered or intended as an offer to sell or a solicitation of an offer to buy the securities referred to herein. Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Opinions or recommendations contained herein are in form of technical ratings and fundamental ratings. Technical ratings may differ from fundamental ratings as technical valuations apply different methodologies and are purely based on price and volume-related information extracted from Bursa Malaysia Securities Berhad in the equity analysis.Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. This report is not intended to provide personal investment advice and does not take into account the specific investment objectives, the financial situation and the particular needs of persons who may receive or read this report. Investors should therefore seek financial, legal and other advice regarding the appropriateness of investing in any securities or the investment strategies discussed or recommended in this report. The information contained herein has been obtained from sources believed to be reliable but such sources have not been indepe ndently verified by Maybank Investment Bank Berhad and consequently no representation is made as to the accuracy or completeness of this report by Maybank Investment Bank Berhad and it should not be relied upon as such. Accordingly, no liability can be accepted for any direct, indirect or consequential losses or damages that may arise from the use or reliance of this report. Maybank Investment Bank Berhad, its affiliates and related companies and their officers, directors, associates, connected parties and/or employees may from time to time have positions or be materially interested in the securities referred to herein and may further act as market maker or may have assumed an underwriting commitment or deal with such securities and may also perform or seek to perform investment banking services, advisory and other services for or relating to those companies. Any information, opinions or recommendations contained herein are subject to change at any time, without prior notice. This report may contain forward looking statements which are often but not always identified by the use of words such as “anticipate”, “believe”, “estimate”, “intend”, “plan”, “expect”, “forecast”, “predict” and “project” and statements that an event or result “may”, “will”, “can”, “should”, “could” or “might” occur or be achieved and other similar expressions. Such forward looking statements are based on assumptions made and information currently available to us and are subject to certain risks and uncertainties that could cause the actual results to differ materially from those expressed in any forward looking statements. Readers are cautioned not to place undue relevance on these forwardlooking statements. Maybank Investment Bank Berhad expressly disclaims any obligation to update or revise any such forward looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events. This report is prepared for the use of Maybank Investment Bank Berhad's clients and may not be reproduced, altered in any way, transmitted to, copied or distributed to any other party in whole or in part in any form or manner without the prior express written cons ent of Maybank Investment Bank Berhad and Maybank Investment Bank Berhad accepts no liability whatsoever for the actions of third parties in this respect. This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. 30 November 2011 Page 4 of 5 Padini Holdings APPENDIX 1 Additional Disclaimer (for purpose of distribution in Singapore) This report has been produced as of the date hereof and the information herein maybe subject to change. Kim Eng Research Pte Ltd ("KERPL") in Singapore has no obligation to update such information for any recipient. Recipients of this report are to contact KERPL in Singapore in respect of any matters arising from, or in connection with, this report. If the recipient of this report is not an accredited investor, expert investor or institutional investor (as defined under Section 4A of the Singapore Securities and Futures Act), KERPL sh all be legally liable for the contents of this report, with such liability being limited to the extent (if any) as permitted by law. As of 30 November 2011, KERPL does not have an interest in the said company/companies. Additional Disclaimer (for purpose of distribution in the United States) This research report prepared by Maybank Investment Bank Berhad is distributed in the United States (“US”) to Major US Institutional Investors (as defined in Rule 15a-6 under the Securities Exchange Act of 1934, as amended) only by Kim Eng Securities USA, a brokerdealer registered in the US (registered under Section 15 of the Securities Exchange Act of 1934, as amended). All responsibility for the distribution of this report by Kim Eng Securities USA in the US shall be borne by Kim Eng. All resulting transactions by a US person or entity should be effected through a registered broker-dealer in the US. This report is for distribution only under such circumstances as may be permitted by applicable law. The securities described herein may not be eligible for sale in all jurisdictions or to certain categories of investors. This report is not directed at you if Kim En g Securities is prohibited or restricted by any legislation or regulation in any jurisdiction from making it available to you. You should satisfy yourself before reading it that Kim Eng Securities is permitted to provide research material concerning investments to you under relevant legislation and regulations. Without prejudice to the foregoing, the reader is to note that additional disclaimers, warnings or qualifications may apply if the reader is receiving or accessing this report in or from other than Malaysia. As of 30 November 2011, Maybank Investment Bank Berhad and the covering analyst does not have any interest in in any companies recommended in this Market themes report. Analyst Certification: The views expressed in this research report accurately reflect the analyst's personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report. Additional Disclaimer (for purpose of distribution in the United Kingdom) This document is being distributed by Kim Eng Securities Limited, which is authorised and regulated by the Financial Services Auth ority and is for Informational Purposes only.This document is not intended for distribution to anyone defined as a Retail Client under the Financial Services and Markets Act 2000 within the UK. Any inclusion of a third party link is for the recipients convenience only, and that the firm does not take any responsibility for its comments or accuracy, and that access to such links is at the individuals own risk. Nothing in this report should be considered as constituting legal, accounting or tax advice, and that for accurate guidance recipients should consult with their own independent tax advisers. Published / Printed by Maybank Investment Bank Berhad (15938-H) (A Participating Organisation of Bursa Malaysia Securities Berhad) 33rd Floor, Menara Maybank, 100 Jalan Tun Perak, 50050 Kuala Lumpur Tel: (603) 2059 1888; Fax: (603) 2078 4194 Stockbroking Business: Level 8, Tower C, Dataran Maybank, No.1, Jalan Maarof 59000 Kuala Lumpur Tel: (603) 2297 8888; Fax: (603) 2282 5136 http://www.maybank-ib.com 30 November 2011 Page 5 of 5