Malaysia Kimlun Corporation

advertisement

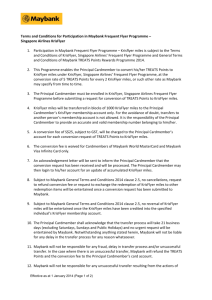

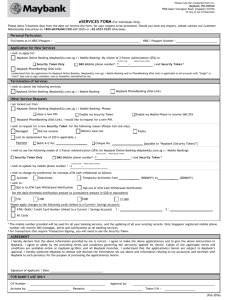

PP16832/01/2013 (031128) Malaysia Initiating Coverage 28 May 2013 Kimlun Corporation Buy (new) Rock Solid Fundamentals Share price: Target price: MYR1.91 MYR2.50 (new) Initiating with a BUY. We like Kimlun for its: (i) construction business in the strong property market of Iskandar Malaysia; and (ii) precast concrete manufacturing for MRT systems in the KV and Singapore, where there are few investible building material stocks. We forecast FY14/15 earnings step-ups of 18%/9%, backed by contributions from its maiden property development project and a margin recovery at its precast business. We initiate on Kimlun with a BUY and TP of MYR2.50 (10x FY14 PER). Lee Yen Ling lee.yl@maybank-ib.com (603) 2297 8691 Description: A Johor-based construction company, backed by a precast concrete manufacturing arm Construction-cum-building material. Kimlun is a medium-sized construction group which predominantly undertakes high-rise/landed residential property jobs in Johor. It is also one of three key precast concrete (i.e. tunnel lining, segmental box girder) suppliers in Malaysia and Singapore. Construction and precast manufacturing accounted for 75% and 25% of gross profit respectively in FY12. Ticker: Shares Issued (m): Market Cap (MYR m): 3-mth Avg Daily Turnover (USD m): KLCI: Free float (%): KICB MK 240.5 459.3 0.44 1,767.13 40.7 Riding on Iskandar property strength. Kimlun is poised to benefit from rising construction works from the tremendous public and private investment flows into Iskandar Malaysia, especially with its Industrialised Building System capability. YTD, the group has secured at least MYR200m worth of construction jobs (FY12: MYR900m). % 33.4 7.2 5.8 Direct MRT play. The expansion of the MRT networks in Malaysia and Singapore provides Kimlun with long-term manufacturing earnings visibility. The oligopolistic nature of the precast concrete industry ensures superior gross margins (FY12: 24%) at Kimlun’s manufacturing arm, much higher than margins in the crowded construction sector and on par with those of the similarly oligopolistic cement industry. (125.1) 1.15 0.5 Undemanding valuations. Kimlun’s outstanding order book stood at MYR1.6b (1.8x FY12 total revenue) as at Dec 2012. Our FY13/14/15 EPS growth forecasts of 1%/18%9% are based on: (i) total job wins of MYR870m/MYR920m/MYR1.2b in FY13/14/15; and (ii) higher construction billings, maiden property earnings and margin recovery at its precast business in FY14-15. At a forward PER of 8x, Kimlun is cheap (vs. construction sector: 14x PER, cement sector: 23x). Stock Information Major Shareholders: PHIN SDN BHD TIN PANG KHANG HAU PANG Key Indicators Net cash / (debt) (MYR m): NTA/shr (MYR): Net Gearing (x): Historical Chart 2.0 KICB MK Equity 1.8 Kimlun – Summary Earnings Table 1.6 FYE Dec (MYR m) Revenue EBITDA Recurring Net Profit Recurring Basic EPS (sen) EPS growth (%) DPS (sen) BVPS (MYR) 1.4 1.2 1.0 May-11 Sep-11 Jan-12 May-12 Sep-12 Jan-13 Performance: 52-week High/Low Absolute (%) Relative (%) PER EV/EBITDA (x) Div Yield (%) P/BV(x) MYR2.03/MYR1.28 1-mth 3-mth 6-mth 1-yr YTD 25.7 22.4 46.9 38.0 42.5 32.6 28.2 14.3 37.4 32.8 Net Gearing (%) ROE (%) ROA (%) Consensus Net Profit (MYR m) Source: Maybank KE 2014F 2015F 1,155.6 1,159.5 104.5 115.6 59.4 64.6 24.7 26.9 18.0 8.9 6.2 6.7 1.49 1.69 2011A 652.1 64.3 42.7 18.6 0.8 5.1 0.94 2012A 896.6 71.6 49.4 20.7 11.2 4.8 1.15 2013F 977.7 85.1 50.3 20.9 1.0 4.8 1.30 10.3 6.6 2.7 2.0 9.3 8.1 2.5 1.7 9.2 7.2 2.5 1.5 7.8 6.0 3.2 1.3 7.1 5.2 3.5 1.1 Cash 19.7 8.3 - 45.5 18.0 6.7 - 47.1 16.0 6.1 54.0 47.6 16.6 6.4 62.9 33.6 15.9 6.5 69.6 SEE APPENDIX I FOR IMPORTANT DISCLOSURES AND ANALYST CERTIFICATIONS Kimlun Corporation Berhad Company background Johor-based construction group. Kimlun Corporation Berhad (Kimlun), based out of Johor Bahru, is a medium-sized construction group which predominantly undertakes high-rise residential buildings projects. It is also one of only three key precast concrete suppliers in Malaysia and Singapore. Kimlun was established in 1977 and listed on Bursa Malaysia in Jun 2010. Two business segments: (i) Construction: Kimlun primarily undertakes main contractor jobs for the building of high-rise and landed residential properties for the private sector in Johor. The construction division is Kimlun’s biggest earnings contributor, accounted for 90% and 75% of group revenue and gross profit respectively in FY12, with decent gross margins of 8%. (ii) Manufacturing: Kimlun’s precast concrete products (i.e. tunnel linings, segmental box girders) are manufactured at its two plants (Johor and Sembilan) and mostly sold to external customers in Malaysia and Singapore. In FY12, the manufacturing division contributed 10% of the group’s total revenue and 25% of gross profit on a high gross profit margin of 24%. FY12: Revenue breakdown by segments (MYR867m) Construction 90% FY12: Gross profit breakdown by segments (MYR91m) Manufacturing : Precast concrete 10% Source: Company Construction 75% Manufacturing : Precast concrete 25% Source: Company Record high outstanding order book. Kimlun’s total outstanding order book has grown by 2.5x to MYR1.6b (as at Dec 2012) since its listing in Jun 2010, representing 1.8x of its FY12 billings. This was achieved on record-high job wins at both its construction and manufacturing divisions in 2012. Breakdown of total outstanding order book (Dec 2012: MYR1.6b) Construction 75% Manufacturing (precast concrete) 25% Source: Company 28 May 2013 Page 2 of 14 Kimlun Corporation Berhad Construction: Numerous medium-sized jobs Distinctive attributes. Unlike the big construction players (i.e. Gamuda, IJM Corp), Kimlun’s jobs are generally: (i) medium-sized property jobs worth less than MYR150m each, secured from wellestablished private property developers (i.e. SP Setia, IJM Land, Keck Seng). This reduces the risk of uncollectable receivables; (ii) fast-track jobs with an average turnaround time of 20 months, minimising the risk of cost overruns cause by changes in building material prices; and (iii) numerous jobs in hand (50-60 projects) at any point in time, reducing the risk of over-reliance on any one particular job. Order book at historical highs. Kimlun’s outstanding construction order book stood at MYR1.2b as at Dec 2012, or 1.5x FY12 construction revenue. We estimate that Kimlun’s outstanding construction order book has grown at a 2-year (FY11-12) CAGR of 29%, on the back of a high job replenishment rate in 2012 (+61% YoY). Construction: Outstanding orderbook (MYR1.2b as at Dec 2012) heavily skewed towards private sector Private sector (e.g. SP Setia, IJM Land, UM Land, Keck Seng) 90% Construction: Historical job wins (2012: +61% YoY) MYR m 1000 900 800 700 600 500 400 300 200 100 0 Public sector 10% 2012: +61% YoY 900 600 2007 Source: Company, Maybank KE 497 361 2008 2009 650 560 2010 2011 2012 Source: Company, Maybank KE Construction: Notable ongoing projects Award date Project Location Award value (MYRm) Client Duration (months) Completion May-12 Service aparment Shah Alam, Selangor 148.5 Esquire Corner 28 Sep-14 n.a. Mar-12 Service aparment Plentong, Johor 128.3 IJM Land n.a. n.a. Service aparment Nusajaya, Johor 114.7 SP Setia 23 Feb-14 n.a. Condominium Mar-12 Service aparment Plentong, Johor 96.7 UM Land n.a. n.a. Johor Bahru, Johor 68.0 UM Land 33 Dec-14 Sep-10 Service aparment Nusajaya, Johor 64.8 SP Setia 24 Sep-12 Aug-11 Dec-12 116 houses Pulai, Johor 54.4 Tanah Sutera 24 Aug-13 244 houses Tebrau, Johor 36.9 Keck Seng 18 n.a. Roadwork (Resort - Second Link) Sep-13 Gelang Patah, Johor 14.5 n.a. n.a. n.a. Source: Company, Maybank KE Minimal sub-contractor jobs. Besides the residential properties, Kimlun also has a track record of being a sub-contractor to other established construction players (i.e. WCT, MRCB) for other building and infrastructure jobs in Johor. These jobs include shopping malls (i.e. AEON, Carrefour), colleges (Marlborough), flyovers and bridges. 28 May 2013 Page 3 of 14 Kimlun Corporation Berhad Strength in Industrial Building System (IBS). Kimlun also stands out amongst the contractors in the property development sector for its adoption of the IBS construction method since 2009. In contrast to the conventional method, IBS is less labour intensive and has a faster completion time owing to the usage of precast concrete (i.e. wall panels, staircases). This benefits property developers, who often have to catch the property upcycle. More importantly, the Malaysian Government has mandated a higher IBS content for both public and private jobs by 2015, in a bid to reduce the reliance on foreign labour. In FY12, IBS jobs accounted for 20% of Kimlun’s construction revenue. We see more IBS job opportunities for Kimlun going forward, given that it is one of the very few full-fledged IBS contractors (from design, manufacturing at its plants to building) in Malaysia. Industrial Building System (IBS): Kimlun is a pioneer in Malaysia According to the Construction Industry Development Board (CIDB)’s IBS Roadmap 2011-2015, the content of IBS components in every new government project is to be increased to no less than 70% with effect from 31st October 2008, save for certain exceptions. Meanwhile, the IBS content of private sector projects will increase to 50% by 2015. CIDB plans to roll out its strategy beginning with the KL City Hall, PJ City Council and Iskandar Regional Development Authority. Besides government-funded projects such as public apartments, schools and government buildings, the private sector has also begun to adopt Kimlun’s IBS to construct residential and commercial buildings within housing projects. Among the government’s initiatives in pushing for more affordable housing projects are “My First Home Scheme” and “PRIMA Home”. Since Kimlun began using the IBS building construction method in 2009, it has secured IBS projects with a total value of approximately MYR950m (as at Dec 2012). Installing precast wall panel Installing precast staircase Source: Shutterstock Source: Floorspan Source: Company, Maybank KE Rising number of non-Johor jobs. Since 2011, Kimlun has slowly moved into the Klang Valley. It has secured a total of MYR78m worth of housing jobs to date from repeat client Melati Ehsan. Though its nonJohor jobs account for a minimal of its construction order book, we see tremendous opportunities for Kimlun to grow this segment as it rides on its existing clients’ property projects in the Klang Valley. Lower margins. Kimlun’s construction gross profit margin has fallen over the years to 8% in FY12 (FY09-11: 11-12%) as it takes on more high-rise apartment jobs. These jobs generate lower margins compared to the construction of landed properties, as they require the engagement of other specialised subcontractors (i.e. mechanical and engineering, building of common facilities). Opportunities abound. We believe Kimlun’s jobs in FY13-15 will come from: (i) vast property development activity in Iskandar, propelled by rising foreign investments, RAPID and the proposed Johor BahruSingapore Rapid Transit System (operational in 2018); and (ii) nationwide convergence to the use of IBS by 2015. 28 May 2013 Page 4 of 14 Kimlun Corporation Berhad Manufacturing: An oligopolistic industry Oligopolistic structure. In Malaysia and Singapore, Kimlun is one of three active precast concrete producers, along with MTD-ACPI (Non Rated) and Singapore-based Hong Leong Asia (Non Rated). In Singapore, Kimlun participates in most of the available tenders and boasts a high hit rate of 70%. In Malaysia, it is the designated supplier for package 1 of the KV MRT Line 1 (Sg Buloh-Kajang)’s two packages. High margins. Given Kimlun’s bargaining power as one of the most preferred precast concrete suppliers, its manufacturing division generated high gross margins of 20-24% during FY10-12. This is on par with margins at the similarly oligopolistic cement industry, but much higher than those in the construction and steel industries. Rising plant utilisation rates. In Johor, Kimlun has two factories producing tunnel lining segments (utilisation rate: 90%) and is converting its steel factory into another tunnel lining factory in order to cater for the strong orders from Singapore. In Seremban, Kimlun has started operating a new segmental box girder plant (at end-2012) and tunnel lining segment plant (in May 2013). Overall utilisation at the Seremban plant is around 50% at the moment, but will reach the optimal rate as it ramps up after the trial run. Manufacturing: Details of plants in Johor Bahru and Seremban Capacity p.a. (in terms of sales) Johor Bahru MYR70-80m Seremban MYR100m Estimated utilisation rate (%) 70% (overall) - 90% (tunnel lining segment) 50% (overall) Catering markets and key products Singapore - tunnel lining - jacking pipes Malaysia (Johor, Klang Valley) - hollow core slabs Malaysia (KV MRT) - tunnel lining - segmental box girder Source: Company, Maybank KE Record high outstanding order book. Kimlun achieved a record high manufacturing outstanding order book of MYR400m as at Dec 2012 (+5.7x YoY), after it won the precast orders (segmental box girder and tunnel lining) for the Sg Buloh-Kajang MRT line in 2012 (total value: MYR272m). Its outstanding orderbook is also now more Malaysiacentric, with a Malaysia:Singapore split of 75:25 (10:90 in the past). Manufacturing: Outstanding orderbook (MYR400m as at Dec 2012) is Malaysia-centric Manufacturing: Historical replenishment rates (2012: +5.7x YoY) MYR m 350 2012: +5.7x YoY 300 250 Singapore 25% 200 Malaysia 75% 312 150 100 50 0 Source: Company, Maybank KE 28 May 2013 55 55 2010 2011 2012 Source: Company, Maybank KE Page 5 of 14 Kimlun Corporation Berhad Manufacturing: Ongoing sales order Award date Project Client Award value (MYRm) Duration (months) Completion Malaysia Feb-12 Segmental box girders for KV MRT MRT Corporation S/B 223.2 40 Mar-15 Jun-12 Tunnel lining for KV MRT MMC-Gamuda KVMRT S/B 48.5 24 Jun-14 Singapore (i) MRT downtown line - Package C929A Nishimastu Constrution, Japan 24.1 - - - Package C923A Shanghai Tunnel Engineering, China 27.9 - - - Package C917 & C918 ALPINE Bau GmbH, Austsria 16.3 - - - Package C935 Leighton-John Holland JV, Australia 10.6 - - (ii) NEWater - Infrastructure plan extension Penta Ocean Construction, Japan 16.3 - - - Precast jacking pipes Swee Hong Engineering, Singapore 7.7 - - Source: Company, Maybank KE Orders to normalise in FY13-14. We expect Kimlun’s new orders to come off significantly in FY13-14 vs FY12, as huge orders from the KV MRT Line 1 will not be repeated. We understand that the second of the two packages for the KV MRT Line 1 will likely be given to another supplier, as the MRT Corp seeks to manage its supplier risk. For FY13-14, we expect that new orders at Kimlun’s manufacturing division will be somewhere around its historical average of MYR55m (FY10-11), underpinned by continuous demand from Singapore owing to: (i) the expansion of the MRT network (the Singapore government plans to double its rail network from 178km currently to around 360km by 2030); (ii) the power cable tunnel project comprising two underground cable tunnels with a total length of 35km (construction is expected to complete by 2017; main contractors were appointed at end2012). Another big jump in 2015? We believe Kimlun will see another big jump in new orders in 2015, as the KV MRT Line 2 (Sg Buloh-Serdang) is expected to see construction commencing in 2015 and ending in 2018. Malayisa: Proposed Klang Valley MRT lines Total length (km) Underground Elevated Construction year Line 1 Sg Buloh - Kajang Line 2 Sg Buloh - Serdang Line 3 Circle line 51 10 41 2012 - 2015 56 11 45 2015 - 2018 n.a. n.a. n.a. 2018 - 2021 Source: Gamuda, Maybank KE Singapore: Proposed extension of MRT network Existing Total length (km) 178 ---------------------------------- To be built ----------------------------------Thomson Eastern Jurong Cross Others line Region Region Island Line Line Line 30 21 20 50 61 Completion year 2019 - 2020 2020 Source: Land Transport Authority of Singapore, Maybank KE 28 May 2013 2025 2030 2014 - 2030 Page 6 of 14 Kimlun Corporation Berhad Property: An earnings booster from 2014 Maiden property project. Kimlun’s maiden property development project, 51%-owned Hyve Soho Suites, is situated in Cyberjaya’s Central Business District (CBD) and has an estimated total GDV of MYR240m. Out of the two towers planned, Tower A was launched in Feb 2013 and has already secured a booking rate of 80% (SPA not signed) to date, at an average ASP of MYR535psf. In view of the good demand, the official launch of Tower B will likely take place in 2H13 at a higher ASP of MYR570psf. As it is now at the earthworks stage, we think billings will only commence in FY14 onwards. Upcoming property developments. Other landbanks that will be developed over the next few years include: (i) a 43-acre piece of land in Nilai earmarked for industrial development (i.e. industrial buildings and factories); and (ii) a 5-acre plot of land in North Medini, Iskandar, slated for mixed development (serviced apartments, offices and retail space). Property: Details of landbanks and planned projects Location Land size (acres) 5.0 Nilai, Seremban 42.7 North Medini, Iskandar 5.3 Cyberjaya, Selangor Planned developments Date launched Mixed developments (i.e. SOHO, offices) Target GDV (MYR) 240 Kimlun's interest Jan 2013 51% Industrial buildings and factories n.a. Pending 100% Mixed developments (i.e. serviced apartment, offices, retail) with permitted GFA of 926,688 sqft n.a. Pending 100% Source: Company, Maybank KE Earnings outlook Construction: Flattish new wins. For the construction division, we have assumed job wins of MYR800m/MYR850m/MYR900m for FY1315 respectively. At a job win rate of around MYR850m p.a., Kimlun’s manpower is already stretched and management will be more selective on jobs, preferring high-margin infrastructure jobs (+5ppts vs construction of residential properties). YTD, Kimlun has secured construction jobs worth MYR200m (or 25% of our assumed MYR800m for FY13). Manufacturing: Lower new orders. As for the manufacturing division, we have assumed its new orders to come off significantly to MYR70m p.a. during FY13-14 (FY12: estimated at MYR312m) as we do not expect repeat orders from the KV MRT line 1. However, our new order assumption of MYR300m in FY15 is based on our expectation of orders from the KV MRT line 2 (construction to commence in 2015). Kimlun: Maybank KE's assumptions FYE Dec (MYR m) 2012A 2013F 2014F 2015F 1,211.7 870.0 920.0 1,200.0 Construction 900.0 800.0 850.0 900.0 Manufacturing 311.7 70.0 70.0 300.0 1,600.0 1,480.5 1,289.3 1,396.6 1,200.0 1,180.0 1,050.5 1,042.7 400.0 300.5 238.8 354.0 Total new wins Total outstanding orderbook Construction Manufacturing Source: Company, Maybank KE 28 May 2013 Page 7 of 14 Kimlun Corporation Berhad Earnings step-up in FY14-15. We project a flattish net profit growth in FY13 on a flattish EBIT margin of 7% owing to: (i) the sunk costs and depreciation of its new plant at Seremban; and (ii) initial construction cost at its Cyberjaya property project. As for FY14 and FY15, we expect net profit step-up of 18% and 9% respectively, driven by: (i) billings from its property development; and (ii) a better EBIT margin of 8% (+1.5ppts from FY13). Kimlun: Maybank KE’s net profit and gross profit margin forecasts MYR m 70 Net profit (MYR m): LHS EBIT margin (%): RHS 9.5% 9.0% 60 8.4% 50 40 8.0% 7.6% 7.2% 7.3% 7.5% 30 7.0% 20 6.5% 10 0 8.5% 49 50 59 65 2012A 2013F 2014F 2015F 6.0% 5.5% Source: Company, Maybank KE Decent dividend yield. We think FY13 net dividends will be capped at 4.8sen/shr (flattish YoY), as cash will be utilised for the expansion of the manufacturing plant (purchase of machinery) and construction of its maiden property projects. However, we project a higher dividend payout of 25% in FY14-15 (FY12: 23%), translating into net dividend yield of 3.2% and 3.5% in FY14 and FY15 respectively. Key risks. Key risks to our earnings forecasts include: (i) rising raw material prices which will affect margins; (ii) an unexpected downturn in the property markets in Johor and the Klang Valley; and (iii) a delay/ slowdown in infrastructure works, especially in the Klang Valley (i.e. KV MRT) and Singapore (i.e. MRT, power cable tunnel). Shareholders and management 50% family-owned, 17% institutions. Pang family, collectively holds approximately 50% stake in Kimlun, while the institutional funds hold another 17% (local: 13%, foreign: 4%). Hence, Kimlun’s free float is approximately 33% of the total shareholding. Founded by Mr Pang. Kimlun’s driving force is Mr Pang Tin @ Pang Yon Tin (Executive Chairman, age: 66), who has more than 30 years of experience in various industries (i.e. construction, quarrying, manufacturing, property development, property investment and hotel management). The other Pang family member holding the top management role is Mr Pang Tin @ Pang Yon Tin’s son, Mr Pang Khang Hau (Executive Director, age: 32). Professionally-run. Today’s Kimlun is very much run by the professionals with top management from various construction/finance backgrounds, i.e. Mr Sim Tian Liang (CEO, age: 59), Mr Chin Lian Hing (Executive Director, age: 49) and Ms Yam Tai Fong (CFO, age: 46). 28 May 2013 Page 8 of 14 Kimlun Corporation Berhad Valuation Target PER: 10x FY14. We peg Kimlun at 10x FY14 PER, higher than its historical mean of 7x, as we think the stock deserves a higher valuation for its exposure to: (i) the less cyclical property development market in Iskandar Malaysia (vs government-led infrastructure projects); and (ii) the oligopolistic precast concrete sector, where it should command a scarcity premium valuation similar to that of the cement sector. Consequently, we derive a TP of MYR2.50 for Kimlun, representing an upside of 30%. There are no direct comparables for Kimlun in Malaysia, except MTDACPI, which has a precast manufacturing business. Kimlun: Historical rolling forward PER x 11 10 9 +1 SD : 8.3x 8 Mean : 7.2x 7 6 -1 SD: 6.1x 5 4 Source: Bloomberg, Maybank KE Construction Sector – Peer Valuation Summary Stock Rec Shr px 27 May Mkt cap TP PER (x) PER (x) PER (x) P/B (x) P/B (x) ROE (%) ROE (%) Net yield (MYR) (MYRm) (MYR) CY12A CY13E CY14E CY12A CY13E CY12A CY13E CY13E Construction Gamuda IJM Corp WCT Eversendai HSL Average Buy Buy Buy Buy Buy 4.87 5.75 2.64 1.42 1.96 10,744.8 8,004.2 2,883.4 1,099.1 1,086.1 5.30 6.10 3.00 1.70 2.30 19.3 17.2 7.2 9.5 12.0 13.0 18.4 15.6 14.5 9.3 11.1 13.8 15.4 13.8 13.6 8.5 10.3 12.3 2.4 1.4 1.4 0.7 2.3 1.6 2.3 1.3 1.3 0.7 1.9 1.5 12.7 8.2 9.2 14.7 18.9 12.7 12.5 8.5 9.7 13.6 17.6 12.4 2.7 2.1 2.5 2.9 2.0 2.4 Cement LMC Tasek Average Buy NR 10.98 16.00 9,329.7 1,938.3 9.60 NR 28.2 22.1 25.1 25.0 20.3 22.6 23.9 19.8 21.8 2.9 2.0 2.5 3.0 n.a. 3.0 10.6 9.9 10.3 12.0 9.0 10.5 4.0 3.8 3.9 81.1 459.3 NR 2.50 n.m. 9.2 n.a. 9.1 n.a. 7.7 0.5 1.7 n.a. 1.5 n.m. 18.0 n.a. 16.0 n.a. 2.5 Construction-cum-Precast concrete MTD ACPI NR 0.35 Kimlun Buy 1.91 Source: Maybank KE 28 May 2013 Page 9 of 14 Kimlun Corporation Berhad INCOME STATEMENT (MYR m) BALANCE SHEET (MYR m) FY Dec 2012A 2013F 2014F 2015F Revenue EBITDA Depreciation & Amortisation Operating Profit (EBIT) Interest (Exp)/Inc Associates One-offs Pre-Tax Profit Tax Minority Interest Net Profit Recurring Net Profit 896.6 71.6 (6.7) 64.9 (5.1) 0.0 0.0 60.7 (11.3) 0.0 49.4 49.4 977.7 85.1 (14.1) 71.0 (8.0) 0.0 0.0 63.7 (13.4) 0.0 50.3 50.3 1,155.6 104.5 (16.4) 88.2 (8.6) 0.0 0.0 80.1 (16.8) (3.9) 59.4 59.4 1,159.5 115.6 (18.4) 97.2 (8.6) 0.0 0.0 89.2 (18.7) (5.9) 64.6 64.6 37.5 11.5 10.0 15.7 15.7 18.7 9.1 18.8 9.3 1.9 1.9 21.0 18.2 22.9 24.2 18.0 18.0 21.0 0.3 10.6 10.3 8.9 8.9 21.0 FY Dec 2012A 2013F 2014F 2015F FY Dec Profit before taxation Depreciation Net interest receipts/(payments) Working capital change Cash tax paid Others (incl'd exceptional items) Cash flow from operations Capex Disposal/(purchase) Others Cash flow from investing Debt raised/(repaid) Equity raised/(repaid) Dividends (paid) Interest payments Others Cash flow from financing Change in cash 60.7 8.6 4.2 (111.0) (17.2) (1.3) (56.0) (75.7) 0.5 (0.4) (75.6) 81.8 17.6 (7.5) (4.2) (0.4) 87.3 (44.3) 63.7 16.2 7.3 (35.4) (13.4) (2.1) 36.3 (40.0) 0.0 0.0 (40.0) 30.0 0.0 (11.5) (7.3) 0.0 11.1 7.4 80.1 18.8 8.1 (57.5) (16.8) (2.5) 30.2 (30.0) 0.0 0.0 (30.0) 0.0 0.0 (14.8) (8.1) 0.0 (22.9) (22.7) 89.2 20.8 8.0 (8.8) (18.7) (2.5) 88.0 (30.0) 0.0 0.0 (30.0) 0.0 0.0 (16.2) (8.0) 0.0 (24.2) 33.9 EBITDA Margin % Op. Profit Margin % Net Profit Margin % ROE % ROA % Net Margin Ex. El % Dividend Cover (x) Interest Cover (x) Asset Turnover (x) Asset/Debt (x) Debtors Turn (days) Creditors Turn (days) Inventory Turn (days) Net Gearing % Debt/ EBITDA (x) Debt/ Market Cap (x) Revenue Growth % EBITDA Growth (%) EBIT Growth (%) Net Profit Growth (%) Recurring Net Profit Growth (%) Tax Rate % CASH FLOW (MYR m) FY Dec 2012A 2013F 2014F 2015F Fixed Assets Other LT Assets Cash/ST Investments Other Current Assets Total Assets 128.6 0.1 44.7 559.7 733.1 152.4 0.1 52.2 623.0 827.7 163.6 0.1 29.4 739.4 932.6 172.8 0.1 63.3 751.9 988.1 ST Debt Other Current Liabilities LT Debt Other LT Liabilities Minority Interest Shareholders' Equity Total Liabilities-Capital 103.8 286.8 66.1 1.2 0.3 274.9 733.1 133.8 312.6 66.1 1.2 0.3 313.7 827.7 133.8 369.0 66.1 1.2 4.3 358.2 932.6 133.8 370.3 66.1 1.2 10.1 406.7 988.1 Share Capital (m) Gross Debt/(Cash) Net Debt/(Cash) Working Capital 238.3 169.8 125.1 60.4 240.5 199.8 147.7 67.9 240.5 199.8 170.4 82.4 240.5 199.8 136.5 85.1 2012A 2013F 2014F 2015F 8.0 7.2 5.5 18.0 6.7 5.5 4.3 9.7 1.2 4.3 125.1 109.6 9.0 45.5 1.7 0.3 8.7 7.3 5.1 16.0 6.1 5.1 4.4 6.3 1.2 4.1 125.1 109.6 9.0 47.1 1.7 0.3 9.0 7.6 5.1 16.6 6.4 5.1 4.0 6.9 1.2 4.7 125.1 109.6 9.0 47.6 1.6 0.4 10.0 8.4 5.6 15.9 6.5 5.6 4.0 7.5 1.2 4.9 125.1 109.6 9.0 33.6 1.2 0.3 RATES & RATIOS Source: Company, Maybank KE 28 May 2013 Page 10 of 14 Kimlun Corporation Berhad RESEARCH OFFICES REGIONAL P K BASU Regional Head, Research & Economics (65) 6432 1821 pk.basu@maybank-ke.com.sg WONG Chew Hann, CA Acting Regional Head of Institutional Research (603) 2297 8686 wchewh@maybank-ib.com ONG Seng Yeow Regional Products & Planning (65) 6432 1453 ongsengyeow@maybank-ke.com.sg MALAYSIA WONG Chew Hann, CA Head of Research (603) 2297 8686 wchewh@maybank-ib.com Strategy Construction & Infrastructure Desmond CH’NG, ACA (603) 2297 8680 desmond.chng@maybank-ib.com Banking - Regional LIAW Thong Jung (603) 2297 8688 tjliaw@maybank-ib.com Oil & Gas Automotive Shipping ONG Chee Ting, CA (603) 2297 8678 ct.ong@maybank-ib.com Plantations- Regional Mohshin AZIZ (603) 2297 8692 mohshin.aziz@maybank-ib.com Aviation Petrochem YIN Shao Yang, CPA (603) 2297 8916 samuel.y@maybank-ib.com Gaming – Regional Media TAN CHI WEI, CFA (603) 2297 8690 chiwei.t@maybank-ib.com Power Telcos WONG Wei Sum, CFA (603) 2297 8679 weisum@maybank-ib.com Property & REITs LEE Yen Ling (603) 2297 8691 lee.yl@maybank-ib.com Building Materials Manufacturing Technology LEE Cheng Hooi Head of Retail chenghooi.lee@maybank-ib.com Technicals HONG KONG / CHINA Todd MARTIN Head of Research (852) 2268 0638 toddmartin@kimeng.com.hk Banking & Finance Ivan CHEUNG, CFA (852) 2268 0634 ivancheung@kimeng.com.hk HK Property Industrial Jacqueline KO, CFA (852) 2268 0633 jacquelineko@kimeng.com.hk Consumer Andy POON (852) 2268 0645 andypoon@kimeng.com.hk Telecom & equipment Alex YEUNG (852) 2268 0636 alexyeung@kimeng.com.hk Industrial Karen KWAN (852) 2268 0640 karenkwan@kimeng.com.hk China Property Jeremy TAN (852) 2268 0635 jeremytan@kimeng.com.hk Gaming Warren LAU (852) 2268 0644 warrenlau@kimeng.com.hk Technology – Regional Lisa YANG (852) 2268 0647 lisayang@kimeng.com.hk Technology – Regional INDIA Jigar SHAH Head of Research (91) 22 6623 2601 jigar@maybank-ke.co.in Oil & Gas Automobile Cement Anubhav GUPTA (91) 22 6623 2605 anubhav@maybank-ke.co.in Metal & Mining Capital goods Property Urmil SHAH (91) 22 6623 2606 urmil@maybank-ke.co.in Technology Media Varun VARMA (91) 226623 2611 varun@maybank-ke.co.in Banking 28 May 2013 ECONOMICS Suhaimi ILIAS Chief Economist Singapore | Malaysia (603) 2297 8682 suhaimi_ilias@maybank-ib.com JUNIMAN Chief Economist, BII Indonesia (62) 21 29228888 ext 29682 Juniman@bankbii.com Luz LORENZO Philippines (63) 2 849 8836 luz_lorenzo@maybank-atrke.com Tim LEELAHAPHAN Thailand (662) 658 1420 tim.l@maybank-ke.co.th Josua PARDEDE Economist / Industry Analyst, BII Indonesia (62) 21 29228888 ext 29695 JPardede@bankbii.com SINGAPORE Gregory YAP Head of Research (65) 6432 1450 gyap@maybank-ke.com.sg Technology & Manufacturing Telcos - Regional Wilson LIEW (65) 6432 1454 wilsonliew@maybank-ke.com.sg Property & REITs James KOH (65) 6432 1431 jameskoh@maybank-ke.com.sg Logistics Resources Consumer Small & Mid Caps YEAK Chee Keong, CFA (65) 6432 1460 yeakcheekeong@maybank-ke.com.sg Offshore & Marine Alison FOK (65) 6432 1447 alisonfok@maybank-ke.com.sg Services S-chips ONG Kian Lin (65) 6432 1470 ongkianlin@maybank-ke.com.sg REITs / Property Wei Bin (65) 6432 1455 weibin@maybank-ke.com.sg S-chips Small & Mid Caps INDONESIA Katarina SETIAWAN Head of Research (62) 21 2557 1125 katarina.setiawan@maybank-ke.co.id Consumer Strategy Telcos Lucky ARIESANDI, CFA (62) 21 2557 1127 lucky.ariesandi@maybank-ke.co.id Base metals Mining Oil & Gas Wholesale Rahmi MARINA (62) 21 2557 1128 rahmi.marina@maybank-ke.co.id Banking Multifinance Pandu ANUGRAH (62) 21 2557 1137 pandu.anugrah@maybank-ke.co.id Automotive Heavy equipment Plantation Toll road Adi N. WICAKSONO (62) 21 2557 1128 adi.wicaksono@maybank-ke.co.id Generalist Anthony YUNUS (62) 21 2557 1139 anthony.yunus@maybank-ke.co.id Cement Infrastructure Property Arwani PRANADJAYA (62) 21 2557 1129 arwani.pranadjaya@maybank-ke.co.id Technicals PHILIPPINES Luz LORENZO Head of Research (63) 2 849 8836 luz_lorenzo@maybank-atrke.com Strategy Laura DY-LIACCO (63) 2 849 8840 laura_dyliacco@maybank-atrke.com Utilities Conglomerates Telcos Lovell SARREAL (63) 2 849 8841 lovell_sarreal@maybank-atrke.com Consumer Media Cement Luz LORENZO / Mark RACE (63) 2 849 8844 mark_race@maybank-atrke.com Conglomerates Property Ports/ Logistics Gaming Katherine TAN (63) 2 849 8843 kat_tan@maybank-atrke.com Banks Construction Ramon ADVIENTO (63) 2 849 8845 ramon_adviento@maybank-atrke.com Mining THAILAND Sukit UDOMSIRIKUL Head of Research (66) 2658 6300 ext 5090 Sukit.u@maybank-ke.co.th Maria LAPIZ Head of Institutional Research Dir (66) 2257 0250 | (66) 2658 6300 ext 1399 Maria.L@maybank-ke.co.th Consumer/ Big Caps Andrew STOTZ Strategist (66) 2658 6300 ext 5091 Andrew@maybank-ke.co.th Mayuree CHOWVIKRAN (66) 2658 6300 ext 1440 mayuree.c@maybank-ke.co.th Strategy Suttatip PEERASUB (66) 2658 6300 ext 1430 suttatip.p@maybank-ke.co.th Media Commerce Sutthichai KUMWORACHAI (66) 2658 6300 ext 1400 sutthichai.k@maybank-ke.co.th Energy Petrochem Termporn TANTIVIVAT (66) 2658 6300 ext 1520 termporn.t@maybank-ke.co.th Property Woraphon WIROONSRI (66) 2658 6300 ext 1560 woraphon.w@maybank-ke.co.th Banking & Finance Jaroonpan WATTANAWONG (66) 2658 6300 ext 1404 jaroonpan.w@maybank-ke.co.th Transportation Small cap. Chatchai JINDARAT (66) 2658 6300 ext 1401 chatchai.j@maybank-ke.co.th Electronics Pongrat RATANATAVANANANDA (66) 2658 6300 ext 1398 pongrat.R@maybank-ke.co.th Services/ Small Caps VIETNAM Michael KOKALARI, CFA Head of Research (84) 838 38 66 47 michael.kokalari@maybank-kimeng.com.vn Strategy Nguyen Thi Ngan Tuyen (84) 844 55 58 88 x 8081 tuyen.nguyen@maybank-kimeng.com.vn Food and Beverage Oil and Gas Ngo Bich Van (84) 844 55 58 88 x 8084 van.ngo@maybank-kimeng.com.vn Banking Trinh Thi Ngoc Diep (84) 844 55 58 88 x 8242 diep.trinh@maybank-kimeng.com.vn Technology Utilities Construction Dang Thi Kim Thoa (84) 844 55 58 88 x 8083 thoa.dang@maybank-kimeng.com.vn Consumer Nguyen Trung Hoa +84 844 55 58 88 x 8088 hoa.nguyen@maybank-kimeng.com.vn Steel Sugar Resources Page 11 of 14 Kimlun Corporation Berhad APPENDIX I: TERMS FOR PROVISION OF REPORT, DISCLAIMERS AND DISCLOSURES DISCLAIMERS This research report is prepared for general circulation and for information purposes only and under no circumstances should it be considered or intended as an offer to sell or a solicitation of an offer to buy the securities referred to herein. Investors should note that values of such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Opinions or recommendations contained herein are in form of technical ratings and fundamental ratings. Technical ratings may differ from fundamental ratings as technical valuations apply different methodologies and are purely based on price and volume-related information extracted from the relevant jurisdiction’s stock exchange in the equity analysis. Accordingly, investors’ returns may be less than the original sum invested. Past performance is not necessarily a guide to future performance. This report is not intended to provide personal investment advice and does not take into account the specific investment objectives, the financial situation and the particular needs of persons who may receive or read this report. Investors should therefore seek financial, legal and other advice regarding the appropriateness of investing in any securities or the investment strategies discussed or recommended in this report. The information contained herein has been obtained from sources believed to be reliable but such sources have not been independently verified by Maybank Investment Bank Berhad, its subsidiary and affiliates (collectively, “MKE”) and consequently no representation is made as to the accuracy or completeness of this report by MKE and it should not be relied upon as such. Accordingly, MKE and its officers, directors, associates, connected parties and/or employees (collectively, “Representatives”) shall not be liable for any direct, indirect or consequential losses or damages that may arise from the use or reliance of this report. Any information, opinions or recommendations contained herein are subject to change at any time, without prior notice. This report may contain forward looking statements which are often but not always identified by the use of words such as “anticipate”, “believe”, “estimate”, “intend”, “plan”, “expect”, “forecast”, “predict” and “project” and statements that an event or result “may”, “will”, “can”, “should”, “could” or “might” occur or be achieved and other similar expressions. Such forward looking statements are based on assumptions made and information currently available to us and are subject to certain risks and uncertainties that could cause the actual results to differ materially from those expressed in any forward looking statements. Readers are cautioned not to place undue relevance on these forward-looking statements. MKE expressly disclaims any obligation to update or revise any such forward looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events. MKE and its officers, directors and employees, including persons involved in the preparation or issuance of this report, may, to the extent permitted by law, from time to time participate or invest in financing transactions with the issuer(s) of the securities mentioned in this report, perform services for or solicit business from such issuers, and/or have a position or holding, or other material interest, or effect transactions, in such securities or options thereon, or other investments related thereto. In addition, it may make markets in the securities mentioned in the material presented in this report. MKE may, to the extent permitted by law, act upon or use the information presented herein, or the research or analysis on which they are based, before the material is published. One or more directors, officers and/or employees of MKE may be a director of the issuers of the securities mentioned in this report. This report is prepared for the use of MKE’s clients and may not be reproduced, altered in any way, transmitted to, copied or distributed to any other party in whole or in part in any form or manner without the prior express written consent of MKE and MKE and its Representatives accepts no liability whatsoever for the actions of third parties in this respect. This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. This report is for distribution only under such circumstances as may be permitted by applicable law. The securities described herein may not be eligible for sale in all jurisdictions or to certain categories of investors. Without prejudice to the foregoing, the reader is to note that additional disclaimers, warnings or qualifications may apply based on geographical location of the person or entity receiving this report. Malaysia Opinions or recommendations contained herein are in the form of technical ratings and fundamental ratings. Technical ratings may differ from fundamental ratings as technical valuations apply different methodologies and are purely based on price and volume-related information extracted from Bursa Malaysia Securities Berhad in the equity analysis. Singapore This report has been produced as of the date hereof and the information herein may be subject to change. Maybank Kim Eng Research Pte. Ltd. (“Maybank KERPL”) in Singapore has no obligation to update such information for any recipient. For distribution in Singapore, recipients of this report are to contact Maybank KERPL in Singapore in respect of any matters arising from, or in connection with, this report. If the recipient of this report is not an accredited investor, expert investor or institutional investor (as defined under Section 4A of the Singapore Securities and Futures Act), Maybank KERPL shall be legally liable for the contents of this report, with such liability being limited to the extent (if any) as permitted by law. Thailand The disclosure of the survey result of the Thai Institute of Directors Association (“IOD”) regarding corporate governance is made pursuant to the policy of the Office of the Securities and Exchange Commission. The survey of the IOD is based on the information of a company listed on the Stock Exchange of Thailand and the market for Alternative Investment disclosed to the public and able to be accessed by a general public investor. The result, therefore, is from the perspective of a third party. It is not an evaluation of operation and is not based on inside information.The survey result is as of the date appearing in the Corporate Governance Report of Thai Listed Companies. As a result, the survey may be changed after that date. Maybank Kim Eng Securities (Thailand) Public Company Limited (“MBKET”) does not confirm nor certify the accuracy of such survey result. Except as specifically permitted, no part of this presentation may be reproduced or distributed in any manner without the prior written permission of MBKET. MBKET accepts no liability whatsoever for the actions of third parties in this respect. US This research report prepared by MKE is distributed in the United States (“US”) to Major US Institutional Investors (as defined in Rule 15a-6 under the Securities Exchange Act of 1934, as amended) only by Maybank Kim Eng Securities USA Inc (“Maybank KESUSA”), a broker-dealer registered in the US (registered under Section 15 of the Securities Exchange Act of 1934, as amended). All responsibility for the distribution of this report by Maybank KESUSA in the US shall be borne by Maybank KESUSA. All resulting transactions by a US person or entity should be effected through a registered broker-dealer in the US. This report is not directed at you if MKE is prohibited or restricted by any legislation or regulation in any jurisdiction from making it available to you. You should satisfy yourself before reading it that Maybank KESUSA is permitted to provide research material concerning investments to you under relevant legislation and regulations. UK This document is being distributed by Maybank Kim Eng Securities (London) Ltd (“Maybank KESL”) which is authorized and regulated, by the Financial Services Authority and is for Informational Purposes only. This document is not intended for distribution to anyone defined as a Retail Client under the Financial Services and Markets Act 2000 within the UK. Any inclusion of a third party link is for the recipients convenience only, and that the firm does not take any responsibility for its comments or accuracy, and that access to such links is at the individuals own risk. Nothing in this report should be considered as constituting legal, accounting or tax advice, and that for accurate guidance recipients should consult with their own independent tax advisers. 28 May 2013 Page 12 of 14 Kimlun Corporation Berhad DISCLOSURES Legal Entities Disclosures Malaysia: This report is issued and distributed in Malaysia by Maybank Investment Bank Berhad (15938-H) which is a Participating Organization of Bursa Malaysia Berhad and a holder of Capital Markets and Services License issued by the Securities Commission in Malaysia. Singapore: This material is issued and distributed in Singapore by Maybank KERPL (Co. Reg No 197201256N) which is regulated by the Monetary Authority of Singapore. Indonesia: PT Kim Eng Securities (“PTKES”) (Reg. No. KEP-251/PM/1992) is a member of the Indonesia Stock Exchange and is regulated by the BAPEPAM LK. Thailand: MBKET (Reg. No.0107545000314) is a member of the Stock Exchange of Thailand and is regulated by the Ministry of Finance and the Securities and Exchange Commission.Philippines:MATRKES (Reg. No.01-2004-00019) is a member of the Philippines Stock Exchange and is regulated by the Securities and Exchange Commission. Vietnam: Kim Eng Vietnam Securities Company (“KEVS”) (License Number: 71/UBCK-GP) is licensed under the StateSecuritiesCommission of Vietnam.Hong Kong: KESHK (Central Entity No AAD284) is regulated by the Securities and Futures Commission. India: Kim Eng Securities India Private Limited (“KESI”) is a participant of the National Stock Exchange of India Limited (Reg No: INF/INB 231452435) and the Bombay Stock Exchange (Reg. No. INF/INB 011452431) and is regulated by Securities and Exchange Board of India. KESI is also registered with SEBI as Category 1 Merchant Banker (Reg. No. INM 000011708) US: Maybank KESUSA is a member of/ and is authorized and regulated by the FINRA – Broker ID 27861. UK: Maybank KESL (Reg No 2377538) is authorized and regulated by the Financial Services Authority. Disclosure of Interest Malaysia: MKE and its Representatives may from time to time have positions or be materially interested in the securities referred to herein and may further act as market maker or may have assumed an underwriting commitment or deal with such securities and may also perform or seek to perform investment banking services, advisory and other services for or relating to those companies. Singapore: As of 28 May 2013, Maybank KERPL and the covering analyst do not have any interest in any companies recommended in this research report. Thailand: MBKET may have a business relationship with or may possibly be an issuer of derivative warrants on the securities /companies mentioned in the research report. Therefore, Investors should exercise their own judgment before making any investment decisions. MBKET, its associates, directors, connected parties and/or employees may from time to time have interests and/or underwriting commitments in the securities mentioned in this report. Hong Kong: KESHK may have financial interests in relation to an issuer or a new listing applicant referred to as defined by the requirements under Paragraph 16.5(a) of the Hong Kong Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission. As of 28 May 2013, KESHK and the authoring analyst do not have any interest in any companies recommended in this research report. MKE may have, within the last three years, served as manager or co-manager of a public offering of securities for, or currently may make a primary market in issues of, any or all of the entities mentioned in this report or may be providing, or have provided within the previous 12 months, significant advice or investment services in relation to the investment concerned or a related investment. OTHERS Analyst Certification of Independence The views expressed in this research report accurately reflect the analyst’s personal views about any and all of the subject securities or issuers; and no part of the research analyst’s compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in the report. Reminder Structured securities are complex instruments, typically involve a high degree of risk and are intended for sale only to sophisticated investors who are capable of understanding and assuming the risks involved. The market value of any structured security may be affected by changes in economic, financial and political factors (including, but not limited to, spot and forward interest and exchange rates), time to maturity, market conditions and volatility and the credit quality of any issuer or reference issuer. Any investor interested in purchasing a structured product should conduct its own analysis of the product and consult with its own professional advisers as to the risks involved in making such a purchase. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior consent of MKE. Definition of Ratings Maybank Kim Eng Research uses the following rating system: BUY Total return is expected to be above 10% in the next 12 months (excluding dividends) HOLD SELL Total return is expected to be between -10% to +10% in the next 12 months (excluding dividends) Total return is expected to be below -10% in the next 12 months (excluding dividends) Applicability of Ratings The respective analyst maintains a coverage universe of stocks, the list of which may be adjusted according to needs. Investment ratings are only applicable to the stocks which form part of the coverage universe. Reports on companies which are not part of the coverage do not carry investment ratings as we do not actively follow developments in these companies. Some common terms abbreviated in this report (where they appear): Adex = Advertising Expenditure BV = Book Value CAGR = Compounded Annual Growth Rate Capex = Capital Expenditure CY = Calendar Year DCF = Discounted Cashflow DPS = Dividend Per Share EBIT = Earnings Before Interest And Tax EBITDA = EBIT, Depreciation And Amortisation EPS = Earnings Per Share EV = Enterprise Value 28 May 2013 FCF = Free Cashflow FV = Fair Value FY = Financial Year FYE = Financial Year End MoM = Month-On-Month NAV = Net Asset Value NTA = Net Tangible Asset P = Price P.A. = Per Annum PAT = Profit After Tax PBT = Profit Before Tax PE = Price Earnings PEG = PE Ratio To Growth PER = PE Ratio QoQ = Quarter-On-Quarter ROA = Return On Asset ROE = Return On Equity ROSF = Return On Shareholders’ Funds WACC = Weighted Average Cost Of Capital YoY = Year-On-Year YTD = Year-To-Date Page 13 of 14 Kimlun Corporation Berhad Malaysia Maybank Investment Bank Berhad (A Participating Organisation of Bursa Malaysia Securities Berhad) 33rd Floor, Menara Maybank, 100 Jalan Tun Perak, 50050 Kuala Lumpur Tel: (603) 2059 1888; Fax: (603) 2078 4194 Stockbroking Business: Level 8, Tower C, Dataran Maybank, No.1, Jalan Maarof 59000 Kuala Lumpur Tel: (603) 2297 8888 Fax: (603) 2282 5136 Singapore Maybank Kim Eng Securities Pte Ltd Maybank Kim Eng Research Pte Ltd 9 Temasek Boulevard #39-00 Suntec Tower 2 Singapore 038989 Hong Kong Kim Eng Securities (HK) Ltd Level 30, Three Pacific Place, 1 Queen’s Road East, Hong Kong Tel: (852) 2268 0800 Fax: (852) 2877 0104 Philippines Maybank ATR Kim Eng Securities Inc. 17/F, Tower One & Exchange Plaza Ayala Triangle, Ayala Avenue Makati City, Philippines 1200 Tel: (63) 2 849 8888 Fax: (63) 2 848 5738 Thailand Maybank Kim Eng Securities (Thailand) Public Company Limited 999/9 The Offices at Central World, 20th - 21st Floor, Rama 1 Road Pathumwan, Bangkok 10330, Thailand Tel: (66) 2 658 6817 (sales) Tel: (66) 2 658 6801 (research) South Asia Sales Trading Connie TAN connie@maybank-ke.com.sg Tel: (65) 6333 5775 US Toll Free: 1 866 406 7447 Maybank Kim Eng Securities (London) Ltd 6/F, 20 St. Dunstan’s Hill London EC3R 8HY, UK Tel: (44) 20 7621 9298 Dealers’ Tel: (44) 20 7626 2828 Fax: (44) 20 7283 6674 Tel: (65) 6336 9090 Fax: (65) 6339 6003 London Indonesia PT Kim Eng Securities Plaza Bapindo Citibank Tower 17th Floor Jl Jend. Sudirman Kav. 54-55 Jakarta 12190, Indonesia Vietnam In association with Kim Eng Vietnam Securities Company 1st Floor, 255 Tran Hung Dao St. District 1 Ho Chi Minh City, Vietnam Tel : (84) 838 38 66 36 Fax : (84) 838 38 66 39 Maybank Kim Eng Securities USA Inc 777 Third Avenue, 21st Floor New York, NY 10017, U.S.A. Tel: (212) 688 8886 Fax: (212) 688 3500 Tel: (62) 21 2557 1188 Fax: (62) 21 2557 1189 New York India Kim Eng Securities India Pvt Ltd 2nd Floor, The International 16, Maharishi Karve Road, Churchgate Station, Mumbai City - 400 020, India Tel: (91).22.6623.2600 Fax: (91).22.6623.2604 Saudi Arabia In association with Anfaal Capital Villa 47, Tujjar Jeddah Prince Mohammed bin Abdulaziz Street P.O. Box 126575 Jeddah 21352 Tel: (966) 2 6068686 Fax: (966) 26068787 North Asia Sales Trading Eddie LAU eddielau@kimeng.com.hk Tel: (852) 2268 0800 US Toll Free: 1 866 598 2267 www.maybank-ke.com | www.kimengresearch.com.sg 28 May 2013 Page 14 of 14