Syllabus - B. Korcan Ak

advertisement

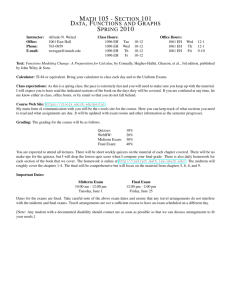

Introduction to Managerial Accounting – UGBA 102B Professor: B. Korcan Ak Email: korcan_ak@haas.berkeley.edu Office Hours: TuTh 1:00-­‐2:00pm or by appointment Office: F422 Tel: (510)705-­‐2259 Course Dates: May 27, 2014 to July 3, 2014 Lecture Time and Location: TuTh 10:30-­‐1:00pm C210-­‐Cheit GSI: TBA GSI Email: TBA GSI – Office Hours: TBA Discussion Time and Location: MW 10:30-­‐1:00pm C210-­‐

Cheit Course Description Catalog Description: The uses of accounting systems and their outputs in the process of management of an enterprise. Classification of costs and revenue on several bases for various uses; budgeting and standard cost accounting; analyses of relevant costs and other data for decision making. Managerial accounting includes a broad array of tools necessary to articulate, implement, monitor and refine an organization’s strategy. Managing the modern firm requires a significant amount of financial and non-­‐financial information about the firm’s products, processes, assets, and customers, as well as the external environment. This course explores the use of accounting information for internal planning, analysis, and decision-­‐making. This information is a key input to operational and strategic decisions: managing product-­‐line portfolios; setting prices; managing customers’ relations; translating strategy into a series of objectives, measures and targets; monitoring strategy implementation; and so on. Objective The main objective of this course is for students to develop a comprehensive framework to think about managerial accounting issues and understand their broader implications for the organization; so as to be able to make more informed (and, thus, “better”) decisions in an uncertain environment. The course is designed to equip students with the knowledge to understand, evaluate, and act upon the many financial and non-­‐financial reports used in managing modern firms. Along the way, students will discover that many companies have not provided their managers with useful information. These managers have to rely on information systems designed years ago for very different business processes and with very different technologies. The course takes a look at a number of pitfalls that these systems can induce and at the dangers in using these systems to make business decisions. It also investigates some modern ideas in how an organization’s information system should be designed. To develop such a framework, students will be required to become familiar with the mechanics of a number of management accounting tools, but ultimately the emphasis will be on obtaining a good grasp of the key conceptual issues. 1 Textbook (required) Managerial Accounting (14th Edition) by Ray H. Garrison, Eric W. Noreen and Peter C. Brewer Publisher: McGraw-­‐Hill Irwin ISBN13: 978-­‐0-­‐07-­‐811100 Grading Your grade will be determined in the following way: Final Grade = Max {Grade Based on Option1, Grade Based on Option2} Problem-­‐Sets Cases Quizzes Midterm Final Option 1 Option 2 20% 10% 10% 5% 15% 10% 25% 25% 30% 50% Letter grades will be awarded based on relative performance within the class (Haas Curve). •

Examinations o Quizzes There are 3 quizzes planned. The quizzes will consist of numerical problems. They will be closed book and will comprehensively cover all of the materials we have studied. Each quiz will consist of 2-­‐3 numerical questions. You are only required to answer one question. You can bring a calculator, however devices that can store data or transmit a wireless signal are not allowed. o Midterm The midterm will take place on June 17, 2014, Tuesday and will start at 10:40am. The midterm will include Chapters 2, 3, 4, 5, 6, and 7. The midterm will be closed book. You can bring a calculator, however devices that can store data or transmit a wireless signal are not allowed. 2 o Final The final will take place on July 3, 2014, Thursday and will start at 10:40am. The final will be comprehensive, covering all material we have studied. The final will be closed book. You can bring a calculator, however devices that can store data or transmit a wireless signal are not allowed. All the examinations are mandatory unless a student is excused, ahead of time, for a documented illness or University-­‐approved absence. There are no exceptions. Students who miss an exam and have not been previously excused will receive a score of zero. •

Assignments For accounting, there is really no other way to learn than to work through as many problems as possible yourself. For this reason the course has many problem-­‐sets and case assignments. These are a key element in ensuring you get the most out of this course. o Problem Sets (PS) Problem sets should be handed in to the GSI at sections. Homework will be graded based on effort, each question gets an equal weight, and there are a total of 20 questions assigned. You are encouraged to work together, but each student must write up and turn in the assignments individually. o Cases There are a total of 5 Cases; you need to submit a write-­‐up for each case at the beginning of each lecture. The cases will be based on material you have not seen previously. Given this, I am looking for effort and imaginative thing as opposed to the right answer. You are encouraged to work together, but each student must write up and turn in the assignments individually. 3 Academic Honesty Any cheating, copying or other academic dishonesty is strongly discouraged. The punishment for academic dishonesty is (minimum) a zero on the assignment or (for serious cases, such as cheating on a closed book examination) expulsion from the course with an ‘F’ grade. Berkeley-­‐Haas Defining Principles We will try to study the course in line with the defining principles of Haas which are: •

Question the Status Quo •

Confidence without Attitude •

Students Always •

Beyond Yourself For more information on the Berkeley-­‐Haas defining principles please visit http://www.haas.berkeley.edu/strategicplan/culture/ Feedback I encourage you to provide feedback on class topics, content, and cases. I appreciate any concerns, questions, or opinions regarding the course. Participants’ feedback is critical to the improvement of the course over time. Instructor Bio B. Korcan AK is a PhD candidate in Accounting at the Haas School of Business at the University of California, Berkeley. He gained his Bachelor’s in Management Engineering from Istanbul Technical University in 2009. His research interests include: Measurement of Financial Distress, Implications of Financial Distress on Firm Performance, Financial Statement Analysis and Valuation, and Sports Finance.

4 Schedule: Week Date Topic Assignments 27-­‐May L Introduction, Chapter 2 -­‐ Managerial Accounting and Cost Concepts 1 28-­‐May D Practice Problems for Chapter 2: E2-­‐2, E2-­‐6, P2-­‐18 Case-­‐1: Case 3-­‐29 29-­‐May L Chapter 3, Job-­‐Order Costing, Case 3-­‐29 2-­‐Jun D Discussion of PS-­‐1, and Practice Problems for Chapter 3: E3-­‐6, E3-­‐12, P3-­‐22 2 3 4-­‐Jun D Discussion of QUIZ-­‐1, and Practice Problems for Chapter 4: E4-­‐7, P4-­‐13 5-­‐Jun L Chapter 5, Cost-­‐Volume-­‐Profit Relationships, Case 5-­‐32 Case-­‐2: Case 5-­‐32 9-­‐Jun D Discussion of PS-­‐2, and Practice Problems for Chapter 5: E5-­‐11, P5-­‐24 PS-­‐2: E4-­‐11, P4-­‐17, E5-­‐16, P5-­‐29 10-­‐Jun L Chapter 6, Variable-­‐Costing and Segment Reporting, QUIZ -­‐ 2 11-­‐Jun D Discussion of QUIZ-­‐2, and Practice Problems for Chapter 6: E6-­‐12, P6-­‐21 16-­‐Jun D Review Section 18-­‐Jun D Midterm Review, Discussion of PS-­‐3 Case-­‐4: P8-­‐29 PS-­‐3: E8-­‐13, E8-­‐14, P8-­‐20 24-­‐Jun L Chapter 9, Flexible Budgets, Chapter-­‐10, Standard Costs and Variances QUIZ -­‐ 3 25-­‐Jun D Discussion of QUIZ-­‐3, and Practice Problems for Chapters 9-­‐10: E9-­‐16, P9-­‐24, P10-­‐15 26-­‐Jun L Chapter 11, Performance Measurement -­‐L01, L02, L03, L05 -­‐ Case -­‐ 11A-­‐7 30-­‐Jun D Discussion of PS-­‐5, and Practice Problems for Chapter 11: E11-­‐7, P11A-­‐6 Case-­‐5: Case 11A-­‐7 PS-­‐4: E9-­‐15, P9-­‐21, P10-­‐11, P11-­‐14, P11A-­‐5 1-­‐Jul L Chapter 12, Differential Analysis: Decision Making 2-­‐Jul D Review Section 3-­‐Jul L FINAL Bold Lettering – Lectures Italic Lettering – Discussion Sections Case-­‐3: P7-­‐20 17-­‐Jun L MIDTERM 23-­‐Jun D Discussion of PS-­‐4, and Practice Problems for Chapters 7-­‐8: E7-­‐9, P7-­‐18, E8-­‐14, P8-­‐27 6 PS-­‐3: E6-­‐14, P6-­‐22, E7-­‐13, P7-­‐17 19-­‐Jun L Chapter 8, Profit Planning, Case 8-­‐29 5 PS-­‐1: E2-­‐7, P2-­‐14, E3-­‐10, P3-­‐24 3-­‐Jun L Chapter 4, Process Costing, QUIZ -­‐ 1 12-­‐Jun L Chapter 7, Activity-­‐Based Costing, P7-­‐20 4 5

![[#DASH-191] Replace JERSEY REST implementation by](http://s3.studylib.net/store/data/005918124_1-33fb89a22bdf4f7dbd73c3e1307d9f50-300x300.png)