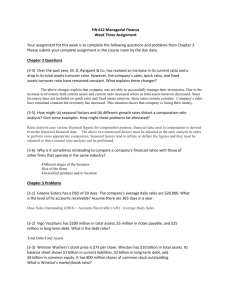

Abercrombie and Fitch - Fisher College of Business

advertisement