FIN 612 Managerial Finance Week Three Assignment Your

advertisement

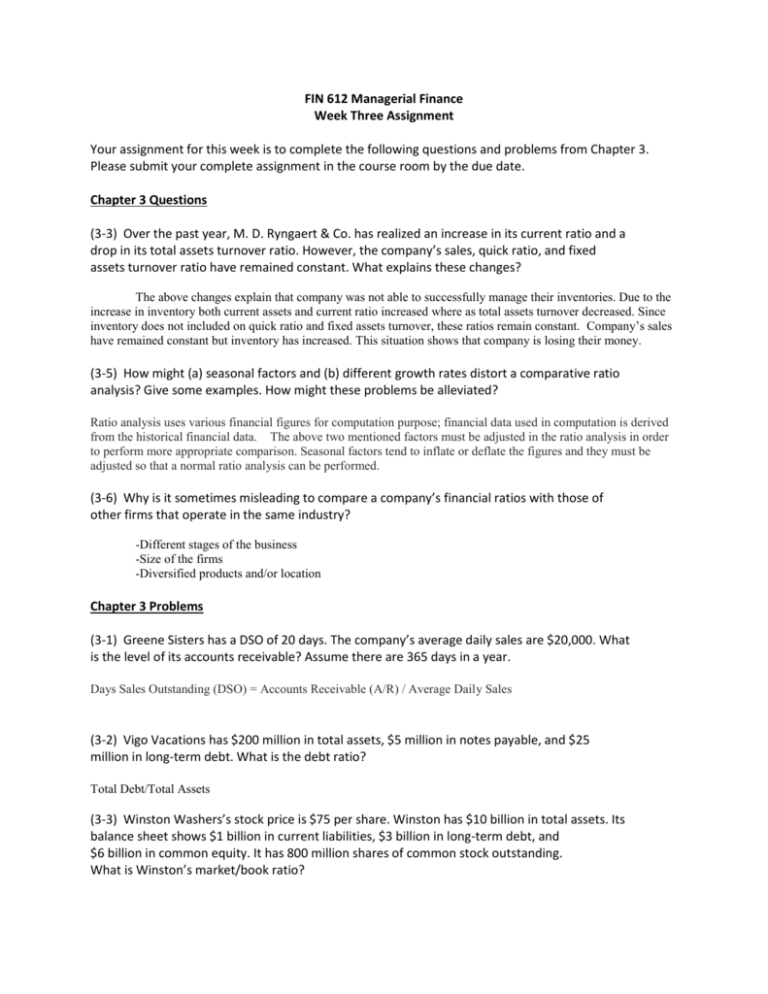

FIN 612 Managerial Finance Week Three Assignment Your assignment for this week is to complete the following questions and problems from Chapter 3. Please submit your complete assignment in the course room by the due date. Chapter 3 Questions (3-3) Over the past year, M. D. Ryngaert & Co. has realized an increase in its current ratio and a drop in its total assets turnover ratio. However, the company’s sales, quick ratio, and fixed assets turnover ratio have remained constant. What explains these changes? The above changes explain that company was not able to successfully manage their inventories. Due to the increase in inventory both current assets and current ratio increased where as total assets turnover decreased. Since inventory does not included on quick ratio and fixed assets turnover, these ratios remain constant. Company’s sales have remained constant but inventory has increased. This situation shows that company is losing their money. (3-5) How might (a) seasonal factors and (b) different growth rates distort a comparative ratio analysis? Give some examples. How might these problems be alleviated? Ratio analysis uses various financial figures for computation purpose; financial data used in computation is derived from the historical financial data. The above two mentioned factors must be adjusted in the ratio analysis in order to perform more appropriate comparison. Seasonal factors tend to inflate or deflate the figures and they must be adjusted so that a normal ratio analysis can be performed. (3-6) Why is it sometimes misleading to compare a company’s financial ratios with those of other firms that operate in the same industry? -Different stages of the business -Size of the firms -Diversified products and/or location Chapter 3 Problems (3-1) Greene Sisters has a DSO of 20 days. The company’s average daily sales are $20,000. What is the level of its accounts receivable? Assume there are 365 days in a year. Days Sales Outstanding (DSO) = Accounts Receivable (A/R) / Average Daily Sales (3-2) Vigo Vacations has $200 million in total assets, $5 million in notes payable, and $25 million in long-term debt. What is the debt ratio? Total Debt/Total Assets (3-3) Winston Washers’s stock price is $75 per share. Winston has $10 billion in total assets. Its balance sheet shows $1 billion in current liabilities, $3 billion in long-term debt, and $6 billion in common equity. It has 800 million shares of common stock outstanding. What is Winston’s market/book ratio? winstons market cap = 75 * 800 million Book Value = Assets - Liabilities mkt/book ratio = $60b/$6b (3-7) Ace Industries has current assets equal to $3 million. The company’s current ratio is 1.5, and its quick ratio is 1.0. What is the firm’s level of current liabilities? What is the firm’s level of inventories? Current assets = 3 million/ current liabilities of 2 million = 1.5 current ratio. The quick ratio is current assets = 3 million - 1 million inventory / current liabilities of 2 million equal a quick ratio of 1. (3-11) Complete the balance sheet and sales information in the table that follows for J. White Industries using the following financial data: Total assets turnover: 1.5 Gross profit margin on sales: (Sales – Cost of goods sold)/Sales = 25% Total liabilities-to-assets ratio: 40% Quick ratio: 0.80 Days sales outstanding (based on 365-day year): 36.5 days Inventory turnover ratio: 3.75 Partial Income Statement Information Sales __600,000___ Cost of goods sold ___450,000____ Balance Sheet Cash 28,000 Accounts payable Accounts receivable 60,000 Long-term debt Inventories 160,000 Common stock Fixed assets 152,000 Retained earnings Total assets $400,000 Total liabilities and equity 110,000 50,000 140,000 100,000 (3-13) Data for Lozano Chip Company and its industry averages follow. a. Calculate the indicated ratios for Lozano. b. Construct the extended Du Pont equation for both Lozano and the industry. c. Outline Lozano’s strengths and weaknesses as revealed by your analysis. Lozano Chip Company: Balance Sheet as of December 31, 2013 (Thousands of Dollars) Cash Receivables Inventories Total current assets Net fixed assets $ 225,000 1,575,000 1,125,000 $2,950,000 1,350,000 __________ Accounts payable $ 601,866 Notes payable 326,634 Other current liabilities 525,000 Total current liabilities $1,453,500 Long-term debt 1,068,750 Common equity 1,752,750 Total assets $4,275,000 Total liabilities and equity $4,275,000 Lozano Chip Company: Income Statement for Year Ended December 31, 2013 (Thousands of Dollars) Sales Cost of goods sold Selling, general, and administrative expenses Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Federal and state income taxes (40%) Net income Ratio Current assets/Current liabilities Days sales outstanding (365-day year) COGS/Inventory Sales/Fixed assets Sales/Total assets Net income/Sales Net income/Total assets Net income/Common equity Total debt/Total assets Total liabilities/Total assets (b) ROE = PM x TATO x EM $ 7,500,000 6,375,000 825,000 $ 300,000 111,631 $ 188,369 75,348 $ 113,022 Lozano _____2.03__ ____76.65____ ___5.67_____ ____5.55______ ____1.75______ ____1.5%______ ___2.64%_______ _____6.44%_____ ____34%______ _____59%_____ Industry Average 2.0 35.0 days 6.7 12.1 3.0 1.2% 3.6% 9.0% 30.0% 60.0%