isenberg school of management - California State University, San

advertisement

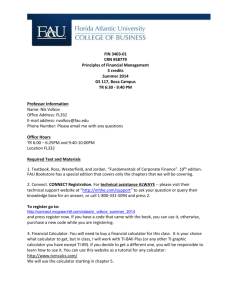

California State University, San Bernardino Course Policies and Schedule Finance 680 – Corporate Financial strategy Call #: Classes: Section T, Th 6:00 PM – 7:50 PM Office Hours: T, Th 4:50 PM – 5:50 PM or by appointment Winter 2016 Instructor: Taewon Yang Office: JB 427 Phone: 537-5784 e-mail: taewon@csusb.edu Please read carefully and save for further reference. 1. Course description: This course is intended to develop communication, problem solving, ethical reasoning, and information technical skills over case studies. These skills are obtained through team works. Each team has to analyze cases and take its stand to deal with given questions. 2. Pre-requirement: To take this course, MBA candidates had to finish or pass F602 (No Exception). 3. The Textbook: Case Studies in Finance by Robert F. Bruner, Six Edition, Irwin McGraw-Hill The New Corporate Finance: Where Theory Meets Practice by Donald H. Chew (ftp://139.182.185.210) 4. Assignments: Nine cases will be assigned during the quarter. Since one of the objectives of the course is clear communication, reports for analyses (4 -5 pages) must be neat, legible, on letter sized paper, stapled and on time. No late homework will be accepted. For the final term paper (5-10 pages), each team pick up a company where team members want to apply for internships or jobs. Then analyze industrial background, financial statements, costs of capitals and stock price (evaluation). At the end, post your suggestions to improve current financial status or company value. 5. Team Formation: Each team is composed of 3 or 4 members. Team formation is at your own will and risk. If a team has a conflict inside, it is strongly recommended to reform new team at your own will again. 6. Presentation: Each team is expected to present cases or summaries of articles (reading list) twice, at least, during the quarter. If a team is selected to be a presenter, the team should turn in its complete report and presentation format at least one day before D-day (presentation date). Each team’s presentation will be evaluated. 7. Exams & Quizzes: There will be a quiz every week (Lists of Chapters below). The quiz will be closed book and notes. There will be NO makeup quiz. In the event of an emergency you must notify me as soon as possible BEFORE the scheduled quiz. 8. Cheating: If MBA candidate is caught cheating on the quiz, he or she will be given a zero on the work in question. Furthermore copying others’ reports is considered to be a serious violation of ethics. No point and chance for making up will be given. It will result in failure of this course. 9. Grading Objections: All grading objections must be submitted in writing to the instructor within one week of the work in question being returned to the student. The nature of the discrepancy/complaint should be clearly stated in the write up. Objections made after one week will not be considered. 10. Grading: The grading of the course will be based on the percent (below). (However, it will be adjusted, depending on the class performance): Case Reports (50 for each report) Quizzes Presentation Class participation 450 = 50*9 180 = 20* 9 5 each time 2 each time A: A-: B+: B: 95 – 100% 90 – 94% 87- 89% 84 – 86% B-: C+: C: C-: D+: D: D-: 80 – 83% 77– 79% 74 –76% 70 - 73% 67- 69% 64 – 66% 60 – 63% Your score = total scores earned at reports + highest presentation score + 2*numbers of participation – penalty (report grading). Percent = Your score / (637). 11.Report Grading Each report must have a right format introduced in a class and respond to every question. And each report must include a time/work portion sheet with percentage, reflecting percent information (below). Introduction Working on Worksheets Answering to Each Question Conclusion Editing 5 30 10 3 2 For example, a member supposedly involved in writing an introduction and conclusion, he or she will receive 8 (=5+3). If two members involved in answering two question without working on worksheet (Excel), each will receive 10 (=(10*2)/2). If a member receives less than 10 in each time/work portion sheet, he/she will lose 10 points from his or her total score. 12.General Comments You are expected to read the material assigned before coming to each class. You are responsible for contributing to the learning process by participating in class discussions and asking questions or requesting clarifications. You are expected to present yourself as a professional in terms of ethics, conduct, attendance, etc. Any deviations from the class policy will be considered by the instructor only in case of documented medical emergencies or extreme personal problems. 13. Schedule: The approximate schedule follows. It is intended to give you an idea of where we are most likely to be at any point in the quarter. It may vary as we can cover some topics more slowly or more quickly than expected. Numb Quiz er 1 2 3 Topic Course Overview, Forming Teams Financial Statements and Market Efficiency 1. Case: Ethics in Finance 2. Articles: #2 - The Theory of Stock Market Efficiency 4 5 Yes #3 – Market Myths Team 1, 2, 3 Financial Analysis and Forecasting 1. Case 11. Deutsche Brauerei (Presentation) 2. Articles: (1) Corporate Earnings: Facts and Fiction, Written by Barunch Lev, Journal of Economic Perspectives, Vol. 17, 2003, p 27-50 Earnings Management and the long run market performance of IPO, Written by Toeh, Welch and Wong, Journal of Finance, 1998 , p1935-1974 6 Yes 7 8 9 Yes 10 11 Yes 12 13 Yes Yes 14 15 16 17 Yes Yes 3. Team 2,3,1 Capital Budgeting 1. Case20. Aurora Textile Company (Presentation) 2. Articles: # 6 – Financial Theory and Financial Strategy #9 -The EVA Financial System 3. Team 3,1,2 Stock Valuation 1. Case28. JetBlue (Presentation) 2. Articles: #20 - Initial Public Offering The determinants and survival of reverse mergers vs IPOs , Journal of Economics and Finance, 2008 (32), pp 176-194 3. Team 1,2,3 Cost of Capital – Case. 13 (lecture) 1. Case15. TeleTech Corporation (Presentation) 2. Articles: #22 - Are Bank Loans Different #13 - The Capital Structure Puzzle 3. Team 2,3,1 Capital Structure, Case 32. (lecture) 1. Case33. California Pizza Kitchen (Presentation) 2. Articles: #14 - On Financial Architecture: Leverage, Maturity and Priority #37 – The Motives and Methods of Corporate Restructuring 3. Team 3,1,2 M&A, Case. 41 (lecture) 1. Case43. Flinder Valves and Controls Inc (Presentation), 2. Articles: # 42 – Some New Evidence That Spinoffs Create Value Corporate Governance and Equity Prices, Written by Gompers, Ishii, and Metrick, Quarterly Journal of Economics Vol 25, p107-155 3. Team 1,2,3 Hedging 1. Case37. Baker Adhesives (Presentation) 2. Articles: #33 - Value at Risk: Uses and Abuses Corporate Ownership around the world, written by La Porta, Lopez-De-Silanes and Shleifer, Journal of Finance (1999), 471-517 3. Team 2,3,1 Leasing 18 1. Case 39: Primus Automation Division 2. Article 3. Team 3