Rainfall Deficiency

A Note on Rainfall Insurance

Rationale of Weather Insurance:

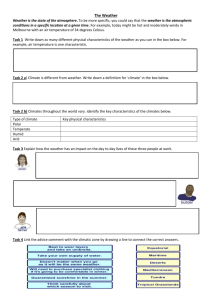

Agriculture is still the dominant sector in India, contributing around 24 per cent of GDP and providing employment to two-third of its population. However, Indian agriculture is extremely prone to unfavorable weather conditions like deficit/ excess rainfall (mostly dependent upon monsoons), variations in temperature, etc.

The phenomenon of unpredictable rainfall in India remains an unresolved issue. As early as in 1976 the National Commission on Agriculture (1976) had estimated that rainfall variations accounted for 50% of the variability in agricultural yields, being as high as

90% for cotton and groundnut, 47% for wheat and 45% for barley and jowar.

Weather Insurance is an insurance cover against crop losses incurred due to unfavorable weather conditions such as deficit/excess/untimely rainfall, variations in temperature, etc.

Weather insurance product is designed on the basis of location’s agricultural and climatic properties and productivity levels over the last several years.

The existing crop insurance scheme is of the multi-peril insurance type. It provides coverage against most of the exogenous losses that occur during the production stage. However the scheme is marred by several shortcomings like its supply-driven nature, non-transparent loss assessments, long settlement periods, forced enrollments etc.

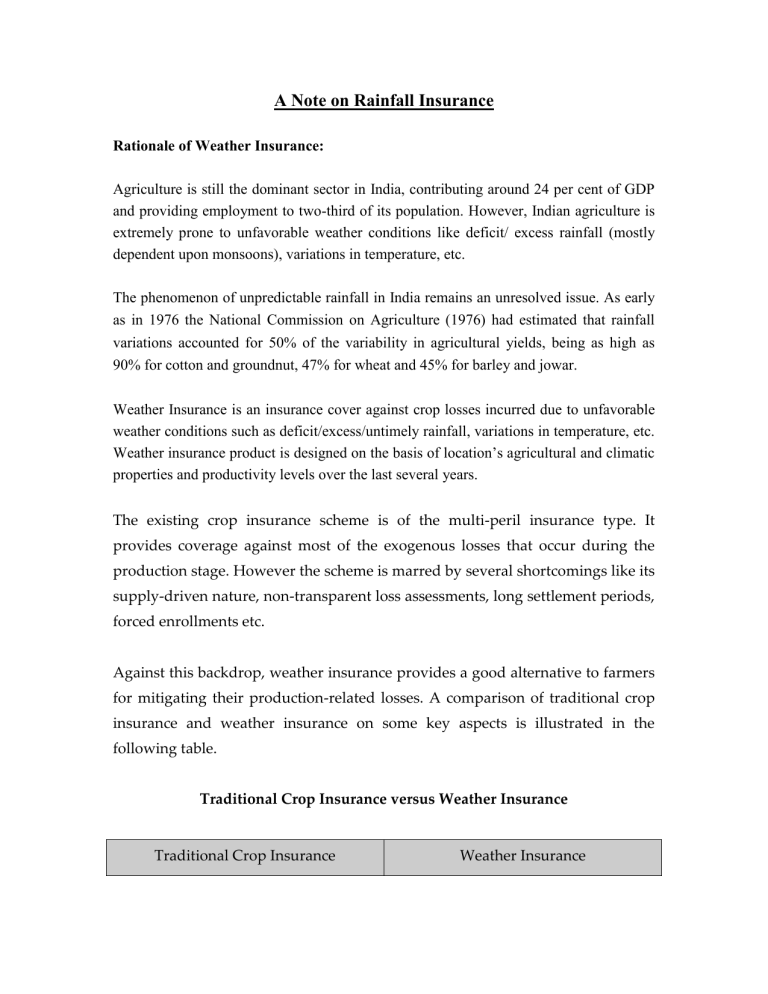

Against this backdrop, weather insurance provides a good alternative to farmers for mitigating their production-related losses. A comparison of traditional crop insurance and weather insurance on some key aspects is illustrated in the following table.

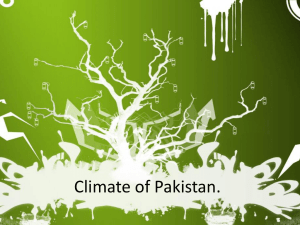

Traditional Crop Insurance versus Weather Insurance

Traditional Crop Insurance Weather Insurance

Coverage is effective largely for extreme loss situations – e.g. droughts transparent

Large delays in claim settlements

Coverage for deviation in weather parameters from their optimum values

Calculation of weather index is transparent and objective

Claim settlements are quick and easy

High administration costs Low administration costs

Assessment of Pilot Weather Insurance:

The weather insurance product was first piloted in Mahboobnagar and Anantapur districts of Andhra Pradesh in 2003 and again in 2004 with the help of BASIX. In 2003, the weather insurance was sold to 230 small, medium and large farmers (154 groundnut farmers and 76 castor farmers), mostly the members of borewell users associations and covering 450 acres of sown land. A total premium of Rs. 1 lakh was collected from the farmers in 2003. In 2004, the insurance was sold to 427 farmers covering 670 acres of crop and insuring a total sum of around Rs. 4,020,000. The premium collected in 2003 was Rs. 1.5 lakhs. In 2003, farmers were still indemnified due to delay in rainfall that affected the time of sowing despite being normal rainfall levels in Mahboobnagar. In

2004, all 305 reported claims were settled with Rs. 4.5 lakhs. The claim settlement was done within 15 days of completion of the policy period in contrast to the long settlement period of 12-18 months for the conventional Crop Insurance.

Initiative by Sajjata Sangh:

Sajjata Sangh, a network of NGOs promoted by Development Support Centre (DSC), had instituted a research study on providing a cushion to the farmers against crop losses on account of weather vagaries by providing Rainfall Insurance cover to the farmers. For this the services of Cardinal Edge Management Services (P) Ltd (CEMS), New Delhi was hired to carry out the study in collaboration with Agriculture Insurance Company (AIC) in Jamnagar and Surendranagar districts of Gujarat.

Special emphasis was laid on ensuring quick and easier claim-settlements.

The players involved in designing Insurance package and its implementation are as follows:

2

3

1

S.

No.

Name of the organisation

Sajjata Sangh

Cardinal Edge

Management

Services (P) Ltd

(CEMS)

Agriculture

Insurance Company

Assigned Role

1.

Exploring the scope of rainfall insurance by instituting a research study by hiring the services of

CEMS.

2.

Coordinating with CEMS for Studying, analyzing, and estimating (wherever required through heuristics) the nature and extent of production losses caused by the key weather perils and procuring weather-related and other necessary data from relevant agencies and cleaning the data for further processing.

3.

Approval of the insurance package designed as per the findings of the Research Study in consultation with its partner organisations.

4.

Coordinating with AIC and SAVA for popularizing the insurance package and selling it to target clients.

5.

Coordinating with AIC and SAVA for ensuring robust settlement of insurance claim to the farmers

6.

Undertaking documentation of the experiences of farmers and its dissemination to other partner organisations in the network.

1.

Developing a customized insurance product covering all insurable weather perils/events

2.

Facilitating negotiations with insurance companies for underwriting the structured solutions at an affordable price

3.

Imparting product education and process training to the staff of different member organizations of Sajjata Sangh.

1.

Negotiating with CEMS for underwriting the structured solutions at an affordable price.

2.

Granting technical approval to the insurance product.

3.

Imparting product education and process training to the

(AIC) staff of different member organizations of Sajjata

Sangh.

4.

Ensuring robust settlement of insurance claim to the farmers.

4 SAVA

1.

Coordinating with Sajjata Sangh and CEMS for facilitating and providing required field related information for the Research Study.

2.

Holding promotional workshops and campaigns in collaboration with Sajjata Sangh and AIC to generate farmers’ interests into buying the recommended insurance package.

3.

Deposit the application format duly filled by the farmers along with the premium amount to AIC.

4.

Overseeing robust settlement of insurance claim to the farmers.

Based on the comprehensive study, the rainfall insurance package for groundnut was designed that provided cover against the following weather perils.

Absence of Pre-sowing Rainfall

The purpose of the cover is to compensate the groundnut growers for lack of critical rainfall required for sowing. The critical value required for sowing has been fixed as minimum 50 mm of rainfall over any three consecutive days (preceding day onwards) during the period 20 th June to 15 th July.

Rainfall Deficiency

The deficiency of rainfall over the normal crop cycle can manifest itself in two forms: a) Deficiency in absolute volume of rainfall b) Long drought spell due to erratic distribution

For groundnut, the volume-based covers are based on an absolute volume of rainfall required during a particular phase of crop cycle.

The purpose of the distribution cover is to compensate the groundnut farmers for losses arising due to drought spells during the normal crop cycle. A drought spell is defined as the total absence of rainfall for more than twenty-five (25) consecutive days.

Product summary (Per acre)

Stage

Presowing

Distribution Rainfall

Volume Rainfall

Combined Cover

Sum Assured

500

1500

3000

5000

Premium %

14.60

13.00

15.21

14.5

Premium

73

195

456

724

Encouraged by the positive response evoked among the farmers, AIC set up a temporary mobile weather station on Khambalia- Porbandar highway to keep track of the amount and timings of rainfall in the district, thereby, ensuring the full-scale reliability of the recoding of actual rainfall data in the region. This move was aimed at facilitating the farmers to settle their insurance claims timely and in the vicinity of their villages.

Based on the recommendations, 35 farmers have been insured (covering 39 acres of land) against the crop losses on account of uncertain weather perils like inadequate and untimely rainfall. Since Jamnagar happens to be the drought-prone and semi-arid region, the farmers based on their previous experiences decided against purchasing insurance cover for excess rainfall. However, in lieu of the unprecedented rainfall this year, the farmers could not claim for inadequate and untimely rainfall. Also based on farmers’ experiences, Sajjata Sangh is negotiating with AIC on the possibility of scaling down the existing premium rates. The experiences of the current year would be extremely crucial in creating wider acceptability of our maiden initiative of Rainfall insurance cover.

Sajjata Sangh plans to expand the weather insurance in drought-prone areas of Surendra

Nagar, Rajkot and Amreli districts of Gujarat covering around 600 farmers. For this,

Sajjata Sangh will approach AIC to develop appropriate insurance package for other districts.