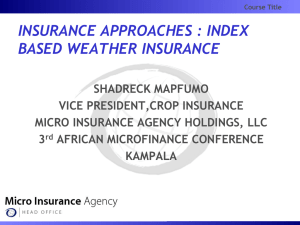

Weather Insurance in India

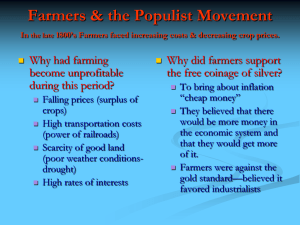

advertisement

Fair Weather Network – How emerged? (1994 – 2010) AKRSP BCD ABC SADGURU DSC VRTI EFG SS HIJ BAIF KLM Coverage Coverage of SS 31 Partners, 7660 villages, 18 Districts Networking with NGOs Cooperation Coordination Collaboration •Crop Specific Workshops •Exposure visits •Congregations and Conventions •Trainings & capacity building program •Market linkages, •Publication and Dissemination of best practice •Product Enhancement •Cost reduction •Risk Management •Value Addition Strategy for Agriculture Development "Promotion of Rainfall Insurance in Gujarat" Typology of Key Risks in Agriculture CAUSE TYPE OF RISKS Weather Hail, frost, drought, flood, wind, fire, snow, ice etc. Market Variability in Domestic & Intl. Prices, Changes in Quality Standards & Consumer Preferences Sanitary Outbreak of Pests & Diseases Storage Infestation of pests and insects, Deterioration in Quality Man-made Financial Crisis, Wars, Collapse of Legal or Institutional Structures Nature of Crop Losses 100% 80% 10% 20% includes storms, earthquakes, disease, pests, wild animals etc. 60% 40% 70% 20% 0% Cause of Loss Deficient Rainfall Excess Rainfall Others More than 90% of crop losses result from improper rainfall Source: Data Compiled by GIC’s Crop Insurance Cell Rainfall pattern in Gujarat • Average Rainfall of Gujarat is 700 mm which varies from 200 mm to 2000 mm in the state. • Due to agro-climatic diversity, there are extreme climatic conditions in Gujarat. • Once in every 3 year, there is drought in Gujarat. (declared in the years 1985, 86, 87, 98, 99, 2000, 01, 02 and 03. Weather Insurance Overview • Weather Insurance – Contracts for providing risk coverage against adverse weather events – Indemnification for losses due to unfavorable weather • Examples of Adverse Weather Event – More than 150 mm rainfall in a Day – Drought Spell of more than 30 Days – Winds Exceeding 30 kmph • More Complex Weather Events can be Covered Weather Insurance in India • Year 2003 – piloted by BASIX with ICICI Lombard General Insurance Company in the Andhra Pradesh State of India. • Year 2004 – Piloted by AIC in three states • Year ‘2008’ marked 5 years of Weather Insurance in India • Hon. Finance Minister allocated subsidy for Weather Insurance to the tune of INR 1 billion and 500 million in annual budgets of 2006-07 & 2007-08 respectively Weather Insurance in Gujarat • Year 2005 – Piloted by SEWA in three districts of Gujarat • Year 2006 – piloted with Study by Sajjata Sangh Weather Insurance: Our Goal • To enhance farmers’ risk management capacity and protection levels, – particularly those of small and marginal farmers – for dealing with exogenous risks – through the provision of a context-driven and well-analysed Weather Insurance Product – complemented by appropriate infrastructure and value-added support services • To inculcate clarity and critical understanding in the grassroots partner NGOs of Sajjata Sangh about key aspects of a Weather Insurance initiative • Empower partner NGOs to propose suitable initiatives for risk management in agricultural production in association with the farming communities being served by them Experience of Earlier Pilots • Sajjata Sangh initiated a research study in 2006 for – Study of rainfall risks & development of a customized weather insurance product for groundnut in Jamnagar • In 2006 itself, 35 farmers were covered under the operational area of SAVA (partner NGO) for – Sowing rain deficiency, Insufficient rainfall volume and Poor rainfall distribution • In 2007, 110 farmers bought customized product, thereby, insuring 180 acres of land. • In 2008, in Jamnagar and Amreli 350 farmers covering 427 acres of land were insured Immediate benefits to farmers • Year 2006, The farmers got the claim of Rs 1010 against premium of Rs. 730 • Year 2008, In Jamnagar, out of total 203 farmers, 158 farmers have received claim of Rs. 500 per acre for sowing and 45 farmers have received Rs. 713 per acre for volume in deficit rainfall. In Amreli District, total 35 farmers have received Rs. 465/- per acre of claim under cotton crop for excessive rainfall against premium of Rs.750/- . • Year 2009, 1353 farmers out of total 1377 farmers have received claim ranging from 80 to 2800 for sowing & germination failure (excessive rainfall ), deficient rainfall and rainfall distribution. Replication Particular Kharif 08 Kharif 09 Kharif -10 (proposed) Partners involved 4 8 12 Districts/ Taluka covered 2/5 8/25 11/35 Product Developed 4 Cotton, GN 19 Cotton, GN, Maize Cotton, GN, Maize, paddy, castor Ref Weather station 2 IMD (>60 km) 25 GSDMA (<25 km) 6 AWS GSDMA, AWS Farmers covered 307 1377 15000 Small & marginal farmers 11% 59% 60% Women Farmer covered 2% 9% 15% Acre of land covered 357 1747 --- Total Sum insured Rs. 1.6 million Rs. 12.2 million --- Total premium collection Rs.1,83,274 Rs. 17,92,107 --- Claim received 1,27,360 17,98,000 --- Participatory Process Sr.No Process A Product Design 1 Product review through experience sharing workshop 2 Orientation on different products 3 Selection of design Options through a Questionnaire-based exercise 4 5 6 Collection of 15 year rainfall data Sharing draft product with farmers Dialogue with Insurer for required changes 7 8 Acceptance on draft Term sheets Finalization on product/term sheet Stack holders PRODUCT DESIGNER, INSURANCE COMPANY, PARTNER NGOS, CBOS, FARMERS, METEREOL OGICAL STATION, Contd. B Awareness Campaign Launch programme, Village Rally, Night meetings, Vedio Shaw, Resource group training etc. C Premium collection & submission D Post sale services (sharing rainfall data, policy document etc) E Claim settlement and declaration OXFAM, NABARD NGOs, CBOs, AIC, BANK, PANCHAYAT AIC, NGOs, CBOs, FARMERS, WEATHER STATION AIC, BANK, FARMERS Challenges High premium rate • Due to the demand-driven product development and intensive test-marketing, premiums for the targeted crops have come in the range of 12%-15% of the sum assured • Sum assured has been an intermediate value between the cost of production and farmgate value depending on influencing parameters of weather insurance • 7.5% to 9% premium is a reasonable benchmark value for farmers taking into account the escalation in costs of other agricultural inputs • No further scope for reducing the premiums by altering the weather insurance parameters. Any downward revision to severely undermine protection level and credibility of weather insurance Reference Weather Stations • Single most important aspect determining the effectiveness and credibility of Weather Insurance (from earlier pilots & other research studies) • Reduces basis risk which is one of the two biggest limitations of Weather Insurance • Third-party portable automatic weather stations authorized by Agriculture Insurance Company of India – the insurer for the proposed pilot • Ensures high resolution, timely weather data which can be regularly shared with the insured farmer clients Other challenges • Large basis risk inherent in rainfall index • Rainfall insurance concept • Time of premium collection Opportunity for scale up • Promoting weather insurance together with crop insurance by the state Government. • Designing farmer centric insurance products for more crops and more blocks of the state. • Interest shown by NABARD Climate change??? Disasters ??