Solution

advertisement

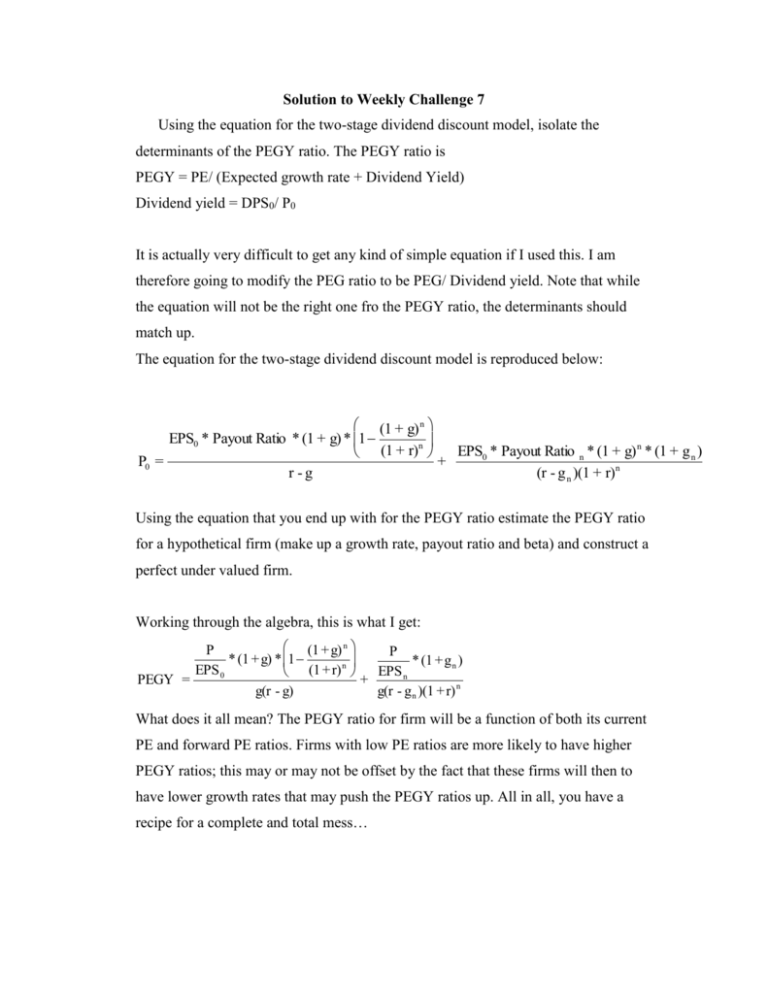

Solution to Weekly Challenge 7 Using the equation for the two-stage dividend discount model, isolate the determinants of the PEGY ratio. The PEGY ratio is PEGY = PE/ (Expected growth rate + Dividend Yield) Dividend yield = DPS0/ P0 It is actually very difficult to get any kind of simple equation if I used this. I am therefore going to modify the PEG ratio to be PEG/ Dividend yield. Note that while the equation will not be the right one fro the PEGY ratio, the determinants should match up. The equation for the two-stage dividend discount model is reproduced below: (1 + g) n EPS0 * Payout Ratio * (1 + g) * 1 n n (1 + r) EPS0 * Payout Ratio n * (1 + g) * (1 + g n ) P0 = + r -g (r - g n )(1 + r)n Using the equation that you end up with for the PEGY ratio estimate the PEGY ratio for a hypothetical firm (make up a growth rate, payout ratio and beta) and construct a perfect under valued firm. Working through the algebra, this is what I get: (1 + g) n P P * (1 + g) * 1 * (1 + g n ) n EPS 0 (1 + r) EPS n PEGY = + g(r - g) g(r - g n )(1 + r) n What does it all mean? The PEGY ratio for firm will be a function of both its current PE and forward PE ratios. Firms with low PE ratios are more likely to have higher PEGY ratios; this may or may not be offset by the fact that these firms will then to have lower growth rates that may push the PEGY ratios up. All in all, you have a recipe for a complete and total mess… P.S: To get this solution write out the payout ratio as DPSn/EPSn and divide both sides of the equation by the dividend yield (DPS0/P0