here

advertisement

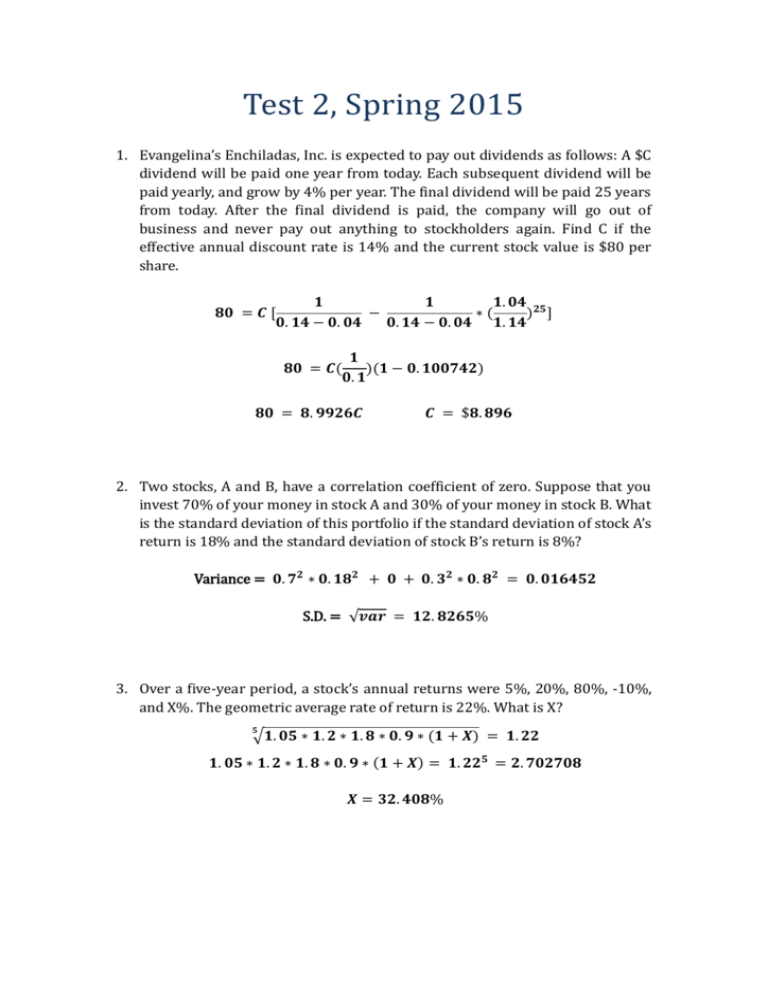

Test 2, Spring 2015 1. Evangelina’s Enchiladas, Inc. is expected to pay out dividends as follows: A $C dividend will be paid one year from today. Each subsequent dividend will be paid yearly, and grow by 4% per year. The final dividend will be paid 25 years from today. After the final dividend is paid, the company will go out of business and never pay out anything to stockholders again. Find C if the effective annual discount rate is 14% and the current stock value is $80 per share. 𝟏 𝟏 𝟏. 𝟎𝟒 𝟐𝟓 − ∗( ) ] 𝟎. 𝟏𝟒 − 𝟎. 𝟎𝟒 𝟎. 𝟏𝟒 − 𝟎. 𝟎𝟒 𝟏. 𝟏𝟒 𝟖𝟎 = 𝑪 [ 𝟖𝟎 = 𝑪( 𝟏 )(𝟏 − 𝟎. 𝟏𝟎𝟎𝟕𝟒𝟐) 𝟎. 𝟏 𝟖𝟎 = 𝟖. 𝟗𝟗𝟐𝟔𝑪 𝑪 = $𝟖. 𝟖𝟗𝟔 2. Two stocks, A and B, have a correlation coefficient of zero. Suppose that you invest 70% of your money in stock A and 30% of your money in stock B. What is the standard deviation of this portfolio if the standard deviation of stock A’s return is 18% and the standard deviation of stock B’s return is 8%? Variance = 𝟎. 𝟕𝟐 ∗ 𝟎. 𝟏𝟖𝟐 + 𝟎 + 𝟎. 𝟑𝟐 ∗ 𝟎. 𝟖𝟐 = 𝟎. 𝟎𝟏𝟔𝟒𝟓𝟐 S.D. = √𝒗𝒂𝒓 = 𝟏𝟐. 𝟖𝟐𝟔𝟓% 3. Over a five-year period, a stock’s annual returns were 5%, 20%, 80%, -10%, and X%. The geometric average rate of return is 22%. What is X? 𝟓 √𝟏. 𝟎𝟓 ∗ 𝟏. 𝟐 ∗ 𝟏. 𝟖 ∗ 𝟎. 𝟗 ∗ (𝟏 + 𝑿) = 𝟏. 𝟐𝟐 𝟏. 𝟎𝟓 ∗ 𝟏. 𝟐 ∗ 𝟏. 𝟖 ∗ 𝟎. 𝟗 ∗ (𝟏 + 𝑿) = 𝟏. 𝟐𝟐𝟓 = 𝟐. 𝟕𝟎𝟐𝟕𝟎𝟖 𝑿 = 𝟑𝟐. 𝟒𝟎𝟖% 4. Gregory is thinking about investing in the Throny Point Toothbrush Company. If he decides to invest $80,000 today, he will receive $8,000 every six months, starting six months from today. His effective annual discount rate is 19%. What is the annual internal rate of return for this investment? $𝟖𝟎, 𝟎𝟎𝟎 = $𝟖, 𝟎𝟎𝟎 𝑰𝑹𝑹(𝟔 − 𝒎𝒐𝒏𝒕𝒉) 𝑰𝑹𝑹(𝟔 − 𝒎𝒐𝒏𝒕𝒉) = 𝟎. 𝟏 𝑰𝑹𝑹(𝒂𝒏𝒏𝒖𝒂𝒍) = 𝟏. 𝟏𝟐 – 𝟏 = 𝟐𝟏% 5. An asset has a known distribution of rates of return. With 25% probability, the asset will have a 5% rate of return. With 75% probability, the asset will have a 15% rate of return. What is the standard deviation of this known distribution? 𝑾𝒆𝒊𝒈𝒉𝒕𝒆𝒅 𝒂𝒗𝒆𝒓𝒂𝒈𝒆 = 𝟎. 𝟐𝟓 ∗ 𝟓% + 𝟎. 𝟕𝟓 ∗ 𝟏𝟓% = 𝟏𝟐. 𝟓% 𝑽𝒂𝒓 = 𝟎. 𝟐𝟓 ∗ (𝟎. 𝟎𝟓 − 𝟎. 𝟏𝟐𝟓)𝟐 + 𝟎. 𝟕𝟓 ∗ (𝟎. 𝟏𝟓 − 𝟎. 𝟏𝟐𝟓)𝟐 = 𝟎. 𝟎𝟎𝟏𝟖𝟕𝟓 𝑺. 𝑫. = √𝟎. 𝟎𝟎𝟏𝟖𝟕𝟓 = 𝟒. 𝟑𝟑% Free Response Part 6. (8 points) Down South Silly Spoon, Inc. specializes in the production of silly spoons. In anticipation of a rush of silly spoon purchases, the executives decide to sell bonds to help fund additional spoon production. Bonds today sell today for $60 each, but the face value of the bond is $45. A 20% coupon of the face value is promised twice: Once year from today and two years from today. The bond also matures two years from today. What is the yield to maturity, expressed as an effective annual interest rate? 𝟔𝟎 = 𝟒𝟓 ∗ 𝟎. 𝟐 𝟒𝟓 ∗ 𝟏. 𝟐 + 𝟏+𝒓 (𝟏 + 𝒓)𝟐 𝟔𝟎(𝟏 + 𝒓)𝟐 = 𝟗(𝟏 + 𝒓) + 𝟓𝟒; 𝟔𝟎𝑿𝟐 − 𝟗𝑿 − 𝟓𝟒 = 𝟎 Quadratic Formula: X = Let X = 1+r 𝟐𝟎𝑿𝟐 − 𝟑𝑿 − 𝟏𝟖 = 𝟎 3±√3∗3−4∗20∗(−18) 2∗20 = 3±38.0657 40 =1.0266433 Notice: we have ignored the negative value. 1.0266433 = 1+r r = 2.664% 7. (5 points) Away for the Day Airlines, Inc. has just paid out its annual dividend today of $3 per share earlier today. The annual dividend will grow by 20% next year, and an additional 30% the year after. This will be followed by 5% annual growth in the annual dividend every year after that forever. What will the price of the stock be 3 years from today if the effective annual interest rate is 10%? (Note: Provide the price AFTER the dividend has been paid.) Dividend in year 4 = 3*1.2*1.3*𝟏. 𝟎𝟓𝟐 = 𝟓. 𝟏𝟓𝟗𝟕 Future value 3 years later = 𝟓.𝟏𝟓𝟗𝟕 𝟎.𝟏−𝟎.𝟎𝟓 = $𝟏𝟎𝟑. 𝟏𝟗𝟒