Direct Write-Off Method: Use the actual amount of debt from customer

advertisement

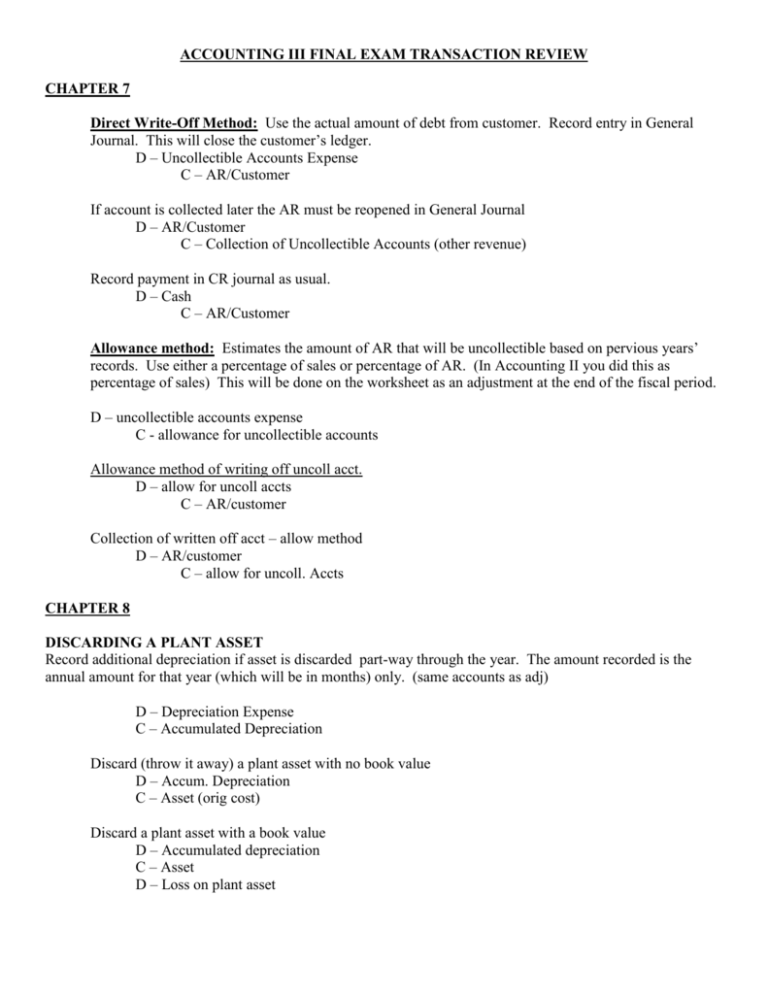

ACCOUNTING III FINAL EXAM TRANSACTION REVIEW CHAPTER 7 Direct Write-Off Method: Use the actual amount of debt from customer. Record entry in General Journal. This will close the customer’s ledger. D – Uncollectible Accounts Expense C – AR/Customer If account is collected later the AR must be reopened in General Journal D – AR/Customer C – Collection of Uncollectible Accounts (other revenue) Record payment in CR journal as usual. D – Cash C – AR/Customer Allowance method: Estimates the amount of AR that will be uncollectible based on pervious years’ records. Use either a percentage of sales or percentage of AR. (In Accounting II you did this as percentage of sales) This will be done on the worksheet as an adjustment at the end of the fiscal period. D – uncollectible accounts expense C - allowance for uncollectible accounts Allowance method of writing off uncoll acct. D – allow for uncoll accts C – AR/customer Collection of written off acct – allow method D – AR/customer C – allow for uncoll. Accts CHAPTER 8 DISCARDING A PLANT ASSET Record additional depreciation if asset is discarded part-way through the year. The amount recorded is the annual amount for that year (which will be in months) only. (same accounts as adj) D – Depreciation Expense C – Accumulated Depreciation Discard (throw it away) a plant asset with no book value D – Accum. Depreciation C – Asset (orig cost) Discard a plant asset with a book value D – Accumulated depreciation C – Asset D – Loss on plant asset SELLING A PLANT ASSET *Record additional depreciation if asset is sold part-way through the year. The amount recorded is the annual amount for that year (which will be in months) only. (same accounts as adj) D – Depreciation Expense C – Accumulated Depreciation Sell a plant asset for book value: *Record additional depreciation if needed in General Record in CR journal D – cash received D – accumulated depreciation C – Asset (original cost) Sell a plant asset for more than book value: *Record additional depreciation if needed in General Record in CR journal D – cash received D – accumulated depreciation C – Asset (original cost) C – Gain on Plant Asset (cash - book value) Sell a plant asset for less than book value *Record additional depreciation if needed in General Record in CR journal D – cash received D – accumulated depreciation D – Loss on plant asset (cash – book value) C – Asset (original cost) TRADING A PLANT ASSET Buying a new asset and use the value of the old asset as part of the payment D – New asset (orig cost of new asset) D – Accumulated Depreciation (of old asset) C – Asset (orig cost of old asset) C – Cash (amount of cash paid) LAND AND BUILDING. Land is considered a permanent plant asset that does not depreciate. There is no useful life or accumulated depreciation recorded for land. If there is a building on the land the land is usually sold with the building. The building may depreciate or appreciate. D – Accum Dep – Building C – Land (orig cost) C – Building (orig cost) C – Gain on Plant Asset or D – Loss of Plant Asset CHAPTER 9 When a note is issued, use only the principal (original amount of loan) amount in the journal. D – Cash C – Notes Payable A note is paid on it’s maturity date. Interest is also paid. D – Notes Payable D – Interest Expense C – Cash CHAPTER 10 Accepting a notes receivable – amount is taken out of AR and put into NR D – notes receivable C – accounts receivable Receive cash for a note receivable D – cash C – notes receivable C – Interest Income (this is a revenue account) If a customer does not pay, the note is a “dishonored note”. The amount of the note is taken out of notes receivable and put back into accounts receivable. D – accounts receivable/customer C – notes receivable C – interest income If a customer does eventually pay a dishonored note, the business will record a transaction in the cash receipts journal charging additional interest from the date of the note to the date of payment. D – cash C – accounts receivable C – interest income CHAPTER 11 1. Receive $ for stock issued D – Cash C – Capital Stock (common, preferred or both) 2. Paid $ for organizational costs D – organizational costs (intangible asset) C – cash (originally paid by owner, but being reimbursed) 3. Receive a subscription for stock (not yet paid for) D – Subscriptions Receivable C – Stock subscribed (common/preferred) 4. Receive $ for stock subscription D – Cash C – Subscriptions Receivable 5. Issue stock certificate – stock is paid in full D – Stock subscribed (common, preferred) C – Capital Stock (common, preferred) (Capital Stock represents ownership, Equity) 6. Declare dividends (not yet paid) D – Dividends (common, preferred – St. Equity account) C – Dividends Payable (liability) 8. Pay $ for dividends previously declared D – dividends payable C – Cash CHAPTER 12 Transactions – selling stock to investors: 1. Issue preferred stock at par value D – Cash C – Capital Stock – preferred 2. Issue preferred stock for more than par value D – Cash C – Capital Stock – preferred C – Paid-in capital in excess of par/stated value (increase OE) 3. Issue preferred stock for less than par value D – Cash D – Discount on sale of capital stock (decrease OE) C – Capital Stock preferred 4. Issue preferred stock for asset other than cash D – Asset (equipment, furniture, land, building, etc.) C – Capital Stock preferred 5. Issue common stock with no par value (record amount paid by investor) D – Cash C – Capital Stock – common 6. Issue common stock for less than stated value D – Cash D – Discount on sale of capital stock (decrease OE) C – Capital stock – common 7. Issue common stock for more than stated value D – Cash C – Capital stock common C – Paid-in capital in excess of par/stated value (increase OE) Treasury Stock Transactions 8. Pay cash for shares of previously issued stock. Record amount paid to reacquire stock. Corp is buying stock back from stockholder. D – Treasury Stock C – Cash 9. Sell Treasury Stock for original cost D – Cash C – Treasury Stock 10. Sell Treasury Stock for more than original cost D – Cash C – Treasury Stock C – Paid-in Capital from sale of treasury stock (increase OE) 11. Sell Treasury Stock for less than original cost D – Cash D – Paid-in Capital from sale of treasury stock (decrease OE) C – Treasury Stock Bonds Transactions: 12. Issue a bond at par value D – Cash C – Bonds Payable The corporation pays interest to bond trustee (bank/dealer). 13. The trustee pays interest to the bondholder D – Interest Expense C – Cash Corporation puts money away to pay for bond, saving for when it is due. 14. Pay cash to bond trustee for deposit to bond sinking fund. D – Bond Sinking Fund C – Cash 15. Pay cash to trustee for bond sinking fund and record interest earned. Interest earned reduces the deposit that must be made in that year. D – Bond Sinking Fund C – Cash C – Interest Income 16. Bond was retired using the bond sinking fund D – Bonds Payable C – Bond Sinking Fund CHAPTER 13 a) Accrued Interest Income – revenue earned but not yet received (ch10, 299) D – Interest Receivable C – Interest Income b) Uncollectible Accounts Expense – estimated amount of AR not paid by customers, usually a percentage of sales (Ch7, 205) D – Uncollectible accounts expense C – Allowance for Uncoll Accts c) Merchandise Inventory (for each department) if Merchandise is decreasing (Ch4, 105) D – Income Summary C – Merchandise Inventory Merchandise Inventory if Merchandise is increasing (Ch4, 105) D – Merchandise Inventory C – Income Summary d) Supplies: adjust for amount of supplies used (Ch4, 106) D – Supplies Expense C – Supplies e) Prepaid Insurance: adjust for amount of insurance used (Ch4, 106) D – Insurance Expense C – Prepaid Insurance f) Prepaid Interest: interest paid but not yet owed (Chapter 9) D – Prepaid Interest C – Interest Expense g) Depreciation: Adjust for the amount of annual depreciation incurred for the fiscal period. (Ch8 232) D – Depreciation Expense C – Accumulated Depreciation h) Organizational expenses: adjust for the amount written off for the fiscal period (Ch13, 371) D – Organization Expense C – Organization Cost i) Accrued Interest: Interest is owed but not yet paid (Ch9, 272) D – Interest Expense C – Interest Payable j) Accrued Salaries: Salaries were earned by employees but not yet paid (Ch9, 274) D – Salary Expense C – Salaries Payable k) Accrued Payroll Taxes: Employer taxes owed but not yet paid (Ch9, 276) D – Payroll Tax Expense C – Tax Payable (SS, Medicare, Unemployment) l) Federal Income Tax: Subtract actual amount owed from amount already paid. The difference is the adjustment (Ch13, 371-372) D – Federal Income Tax Expense C – Federal Income Tax Payable