Operating Assets

advertisement

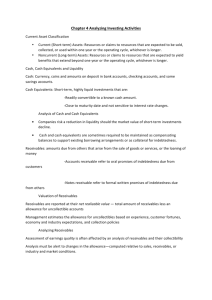

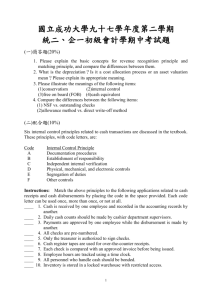

Module 6 Reporting and Analyzing Operating Assets Accounts Receivable Offer sales on credit as a customer service that increases sales & build relationships If interest is charged, then can earn income BUT, increases risk and results in bad debt expense Aging Analysis Example GAAP requires companies to disclose the amount of the allowance for uncollectible accounts, either on the face of the balance sheet or in the notes. Bad Debt Expense Bad Debt Expense is equal to the needed increase in the allowance for uncollectible accounts. In our previous example, if the current balance of $2,200 existed in the allowance for uncollectible accounts, the company would record a bad debt expense of $700 and increase the allowance to $2,900. Write-off of Uncollectible Accounts The write-off of an uncollectible account does not affect income. The amount written-off is reflected as a reduction of the account receivable balance and the allowance for uncollectible accounts: NOTE: For income tax purposes, only the direct write-off of accounts may be deducted as bad debts expense. Receivables Turnover Rate and Days Sales in Receivables The accounts receivables turnover (ART) rate is defined as The accounts receivable turnover rate reveals how many times receivables have turned (been collected) during the period. More turns indicate that receivables are being collected quickly. A companion ratio is the Average Collection Period: Example Suppose that sales are $1,000 average accounts receivable are $200. Then: Accounts Receivable Turnover = $1,000/200 = 5 Average Collection Period = 200/ (1,000/365) = 200/2.73957 = 73 days or 365 days / 5 turns = 73 Average collection Period for Selected Industries Inventories Very Expensive. Costs of holding: space, insurance, counts Inventories deteriorate and/or become obsolete No returns for investment Mistakes are hidden in inventories In concept: Only need one of each item to show to customers or use plus a way to make or purchase another quickly Inventory Costing Methods First-In. First-Out (FIFO). Costs of the first units purchased are the first in cost of goods sold. Last-In, First-Out (LIFO). Costs of the last units purchased are the first in cost of goods sold. Average cost. Computes COGS and ending inventories as the weighted average of costs. NOTES: During inflation, LIFO results in the lowest taxable income If LIFO, then must disclose FIFO are LIFO reserve LIFO not allowed in IFRS, many companies are dropping LIFO Lower of Cost or Market Companies must write down the carrying amount of inventories on the balance sheet if the reported cost exceeds market value (replacement costs in US and NRV in IFRS). This process is called reporting inventories at the lower of cost or market and creates the following financial statement effects: Inventory book value is written down to current market value; reducing inventory and total assets. Inventory write-down is reflected in cost of goods sold on the income statement. Inventory Turnover Rates for Selected Companies Property, Plant, & Equipment Use of PPE generates revenues Consider with ownership: Control quality and usage Fixed expenses: depreciation, maintenance, insurance, property taxes Business volume fluctuation Risk of technology change Depreciation Methods All depreciation methods have the following general formula: Depreciation Methods: 1. 2. Straight-line method Accelerated Methods (Double-decliningbalance method) Straight-line Depreciation Example For the straight-line method, we use our illustrative asset to assign the following amounts to the depreciation formula: Double-declining-balance method Double-declining-balance method. For the doubledeclining-balance (DDB) method, we use our illustrative asset to assign the following amounts to the depreciation formula: Double-declining-balance method The asset is reported on the balance sheet as follows: In the second year, $24,000 ($60,000 40%) of depreciation expense is recorded in the income statement and the NBV of the asset on the balance sheet follows: Tax Issues MACRS Depreciation: DDB Asset Life: 3, 5, 7, 10, 15, 30 Assumes the asset purchased/disposed half way through period, then determines the DDB rates for each life asset Sales and Trades: Taxable gains/losses occur on a sale On like kind trades: flows to next asset SO, trade your like-kind gains, sell your losses Asset Impairments Impairment of plant assets other than goodwill is determined by comparing the sum of the expected future (undiscounted) cash flows generated by the asset with its net book value. Companies must recognize a loss if the asset is deemed to be impaired. (Impairment not recognized for tax purposes until sold. Loss may be reversed for IFRS.) Analysis PPE Turnover: analysis of the productivity of long-term assets Lowe’s: 48,815/(22,089+22,499))/2 = 2.19 Home Depot: 67,997/(25,060+25,550)/2= 2.69 Home Depot earns $2.69 for each dollar of fixed assets. Analysis of Useful life and Percent Used Up Estimated useful life = Percent used up =