Review

advertisement

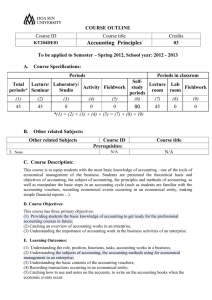

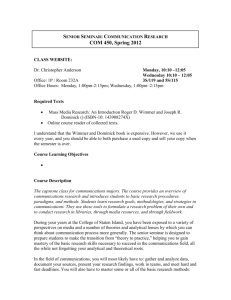

COURSE OUTLINE Course ID Course title Credits TC201DE02 Introduction to Banking and Finance 03 To be applied to Semester – Spring 2012, School year: 2012 - 2013 A. Course Specifications: Periods Periods in classrom Total Lecture/ Laboratory/ Activity Fieldwork periods* Seminar Studio SelfLecture Lab study Fieldwork room room periods (1) (2) (3) (4) (5) (6) (7) (8) (9) 45 45 0 0 0 90 45 0 0 *(1) = (2) + (3) + (4) + (5) = (7) + (8) + (9) B. Other related Subjects: Other related Subjects Course ID Course title Prerequisites: 1. C. Course Description: This course is designed to provide students the most basic knowledge of: the corporate finance, financial markets, financial intermediums; monetary problems, loan, and inflation; the bank systems; content of the government’s budget policy, the government’s monetary policy and the government’s financial policy. D. Course Objectives: Describe the most basic knowledge of financial field such as corporate finance, financial markets, financial intermediums and another investment tools as well as money, loan, inflation… Students can understand and explain why the Government determine such policy. To help students to understand and practice in making investment decisions. E. Learning Outcomes: After completion of this course, students can: 1. Describe the basic building blocks of finance. 2. Describe and make the different types of financial decisions such as on stock market, gold market even on real estate market… 3. Explain why and how the government make deferent decision on financial market in general. 4. Create financial solutions to overcome inflation, economic recession, unemployment… F. Instructional Modes: 1. Theory work will be carried out in group-discussion plus individual study. All students will make extensive analysis of specific real case studies to obtain practical understanding of the issues and how to resolve them. 2. Lectures, discussion, exercises (in class or at home). G. Textbooks and teaching aids: Text book: - The Economics of Money, Banking, and Financial Markets, Frederic S. Mishkin. – Banking and money, Nguyen Minh Kieu, The Statistic Publishing House, 2009. Reference book: The beginner‘ s on finance and money, Su Dinh Thanh, The Statistic Publishing House, 2009. – Foundations of Financial Markets and Instititions, Frank J. Fabozzi. - H. Assessment Methods (Requirements for Completion of the Course): Final Examination – 90’ 50% Mid-Term Examination – 60’ 30% Individual Project, Homework 20% Subordinate semester: test will be take place in class. Academic Integrity Academic integrity is a fundamental value that affects the quality of teaching, learning, and research at a university. To ensure the maintenance of academic integrity at Hoa Sen University, students are required to: Work independently on individual assignments Collaborating on individual assignments is considered cheating. Avoid plagiarism Plagiarism is an act of fraud that involves the use of ideas or words of another person without proper attribution. Students will be accused of plagiarism if they: i. Copy in their work one or more sentences from another person without proper citation. ii. Rephrase, paraphrase, or translate another person’s ideas or words without proper attribution. iii. Reuse their own assignments, in whole or in part, and submit them for another class. Work responsibly within a working group In cooperative group assignments, all students are required to stay on task and contribute equally to the projects. Group reports should clearly state the contribution of each group member. Any acts of academic dishonesty will result in a grade of zero for the task at hand and/or immediate failure of the course, depending on the seriousness of the fraud. Please consult Hoa Sen University’s Policy on Plagiarism at http://thuvien.hoasen.edu.vn/chinh-sachphong-tranh-dao-van. To ensure the maintenance of academic integrity, the university asks that students report cases of academic dishonesty to the teacher and/or the Dean. The names of those students will be kept anonymous. I .Teaching Staff: No. Professor’s name Email, Phone number, Office location Office hours Position 1 Tran Linh Dang Dang.tranlinh@hoasen.edu.vn CS2 GV CH 2 Dang Thi Thu Hang Hang.dangthithu@hoasen.edu.vn GV CH 3 Guest Speaker J. Outline of Topics to be covered (Learning Schedule): Main semester: Once per week; Subordinate semester: Twice per week. Week Lectures 1 The overview of finance 2 The overview of money 3 Supply - demand of money & inflation 4 Supply - demand of money & inflation 5 Lending 6 Corporate finance 7 Financial market 8 Mid – Term Test + continue teaching Text book 9 The national financial policy 10 Public finance and budget policy 11 Public finance and budget policy 12 Bank system in the economy 13 The central bank and the national monetary policy 14 The central bank and the national monetary policy 15 Review Notice: Subject is designed with the participant of guest speaker who will share reality from experience or students will be attended the seminar during the subjects