Final Test

advertisement

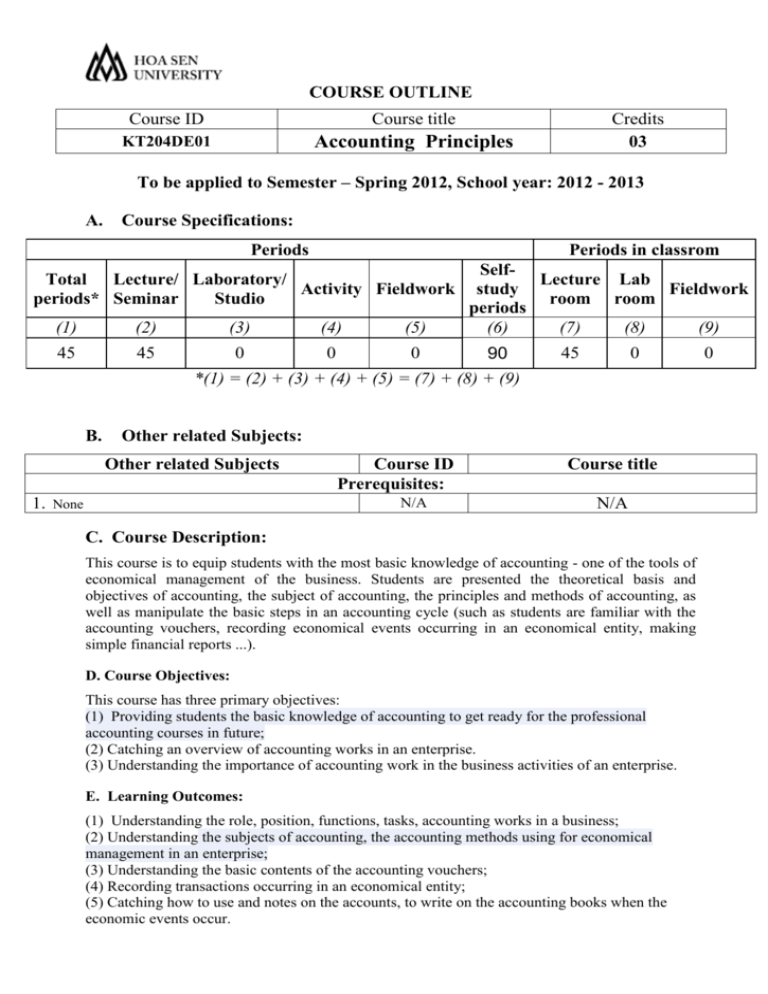

COURSE OUTLINE Course ID Course title KT204DE01 Accounting Principles Credits 03 To be applied to Semester – Spring 2012, School year: 2012 - 2013 A. Course Specifications: Periods Periods in classrom Total Lecture/ Laboratory/ Activity Fieldwork periods* Seminar Studio (1) (2) (3) (4) (5) 45 45 0 0 0 SelfLecture Lab study Fieldwork room room periods (6) (7) (8) (9) 90 45 0 *(1) = (2) + (3) + (4) + (5) = (7) + (8) + (9) B. Other related Subjects: Other related Subjects 1. Course ID Prerequisites: N/A None Course title N/A C. Course Description: This course is to equip students with the most basic knowledge of accounting - one of the tools of economical management of the business. Students are presented the theoretical basis and objectives of accounting, the subject of accounting, the principles and methods of accounting, as well as manipulate the basic steps in an accounting cycle (such as students are familiar with the accounting vouchers, recording economical events occurring in an economical entity, making simple financial reports ...). D. Course Objectives: This course has three primary objectives: (1) Providing students the basic knowledge of accounting to get ready for the professional accounting courses in future; (2) Catching an overview of accounting works in an enterprise. (3) Understanding the importance of accounting work in the business activities of an enterprise. E. Learning Outcomes: (1) Understanding the role, position, functions, tasks, accounting works in a business; (2) Understanding the subjects of accounting, the accounting methods using for economical management in an enterprise; (3) Understanding the basic contents of the accounting vouchers; (4) Recording transactions occurring in an economical entity; (5) Catching how to use and notes on the accounts, to write on the accounting books when the economic events occur. 0 F. Instructional Modes: Students are expected to attend all classes. You should come to class prepared, which means you should have read the assigned material, attempted the exercises, and bring your textbook, paper, and calculator. The class period is your opportunity to ask questions about any of the material you have read or problems you have attempted to work. Quizzes and in-class activities cannot be “made up” at a later time. G. Textbooks and teaching aids: Text book: Accounting, sixth edition – Horngren, Harrison, Bamber - newest edition: Chapter 1 to Chapter 8. Reference book: Intermediate Accounting, fourth edition – Spiceland, Sepe, Tomassini - newest edition. H. Assessment Methods (Requirements for Completion of the Course): Final Examination – 90’ Mid-Term Examination – 60’ Individual Project, Homework 50% 30% 20% Subordinate semester: test will be take place in class. Academic Integrity Academic integrity is a fundamental value that affects the quality of teaching, learning, and research at a university. To ensure the maintenance of academic integrity at Hoa Sen University, students are required to: Work independently on individual assignments Collaborating on individual assignments is considered cheating. Avoid plagiarism Plagiarism is an act of fraud that involves the use of ideas or words of another person without proper attribution. Students will be accused of plagiarism if they: i. Copy in their work one or more sentences from another person without proper citation. ii. Rephrase, paraphrase, or translate another person’s ideas or words without proper attribution. iii. Reuse their own assignments, in whole or in part, and submit them for another class. Work responsibly within a working group In cooperative group assignments, all students are required to stay on task and contribute equally to the projects. Group reports should clearly state the contribution of each group member. Any acts of academic dishonesty will result in a grade of zero for the task at hand and/or immediate failure of the course, depending on the seriousness of the fraud. Please consult Hoa Sen University’s Policy on Plagiarism at http://thuvien.hoasen.edu.vn/chinh-sachphong-tranh-dao-van. To ensure the maintenance of academic integrity, the university asks that students report cases of academic dishonesty to the teacher and/or the Dean. The names of those students will be kept anonymous. I .Teaching Staff: No. 1 2 Professor’s name Email, Phone number, Office location Office hours Position Hồ sỹ tuy Đức duc.hosytuy@hoasen.edu.vn CS2 GV CH Nguyễn Thanh Nam nam.nguyenthanh@hoasen.edu.vn J. Outline of Topics to be covered (Learning Schedule): Main semester: Once per week; Subordinate semester: Twice per week. Week Lectures Text book (session ) 1 2 3 4 5 6 7 8 9 10 11 12 13 Accounting and the Business Environment - Regulating Accounting. - Types of Business Organizations - Accounting Business Transactions Recording Business Transactions - The account, the Ledger, and the Journal - Double-Entry Accounting - The T account Recording Business Transactions The Balance Sheet - Classification: - Assets - Liabilities - Shareholders’ Equity Solving Problems Chapter 1 Chapter 2 Chapter 2 The Adjusting Process - Financial Statements and Adjusting Entries - The Adjusted Trial Balance - Ethical Issues in Accrual Accounting Completing the Accounting Cycle - Completing the Accounting Cycle - Classifying Assets & Liabilities - Accounting Ratio Solving problems & Review for Mid-term Test Mid-term Test + Continue teaching Merchandising Operations - Perpetual System - Periodic System - Sales Revenues, Cost of Good Sold, Gross Profit Merchandise Inventory - FIFO method - LIFO method - Average-Cost method - Comparison the methods Future Value of Cash & Solving problems Internal Control & Cash - Internal Control - Bank reconciliation - Petty Cash Internal Control & Cash - Bank reconciliation Chapter 3 Chapter 4 Chapter 5 Chapter 6 Chapter 7 Chapter 8 Chapter 8 GV CH 14 15 - Petty Cash Solving Problems Final Test Comprehensive Notice: Subject is designed with the participant of guest speaker who will share reality from experience or students will be attended the seminar during the subjects