charter for small & medium enterprises

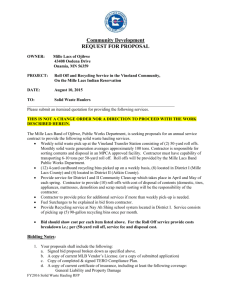

advertisement

CHARTER FOR MICRO, SMALL & MEDIUM ENTERPRISES [MSME] Micro, Small and Medium Enterprises [Manufacturing Sector]: Enterprises engaged in the manufacture or production, processing or preservation of goods as specified below: (i) A Micro Enterprise [Manufacturing] is an enterprise where investment in plant & machinery does not exceed Rs.25.00 lacs. (ii) A Small Enterprise [Manufacturing] is an enterprise where the investment in plant and machinery is more than Rs.25.00 lacs but does not exceed Rs.5.00 crores; and. (iii) A Medium Enterprise [Manufacturing] is an enterprise where the investment in plant and machinery is more than Rs.5.00 crores but does not exceed Rs.10.00 crores [Services Sector]: Enterprises engaged in providing or rendering of services. (i) A Micro Enterprise [Services] is an enterprise where the investment in equipment does not exceed Rs.10.00 lacs. (ii) A Small Enterprise [Services] is an enterprise where the investment in equipment is more than Rs.10.00 lacs but does not exceed Rs.2.00 crores; and (iii) A Medium Enterprise [Services] is an enterprise where the investment in equipment is more than Rs.2.00 crores but does not exceed Rs.5.00 crores Loan Applications: Simple and customer friendly loan applications with checklist for speedy sanctions. Acknowledgment is issued on receipt of loan application by the branches [Applications are available on our website www.sbhyd.com] Time norms: Time norms for disposal of loan applications from the date of receipt of application complete in all respects: For loans upto Rs.5.00 lacs Within 2 weeks For loans above Rs.5.00 lacs and upto Rs.25.00 lacs Within 4 weeks For loans above Rs.25.00 lacs Within 6 weeks 2 Margin requirements: Upto Rs.25,000 Nil Above Rs.25,000 15% - 25% as determined by Bank Competitive Interest Rates: For working capital Upto Rs.50,000/Above Rs.50,000/- upto Rs.2.00 lacs Above Rs.2 lacs & upto Rs.5 lacs Above Rs.5 lacs & upto Rs.25 lacs Above Rs.25.00 lacs [as per credit rating] SB1 – SB2 SB3 – SB5 SB6 – SB7 SB8 – SB9 SB10 – SB16 : : : : 1.75% below BPLR 1.25% below BPLR 0.50% below BPLR BPLR : : : : : 0.50% below BPLR BPLR 0.50% above BPLR 1.00% above BPLR 2.00% above BPLR Term loans are priced 0.50% above working capital rates Collateral Security: a. b. No Collateral Security for Micro & Small Enterprises for loans upto Rs.5.00 lacs, provided the loan is eligible / covered under Credit Guarantee Scheme of CGTMSE. Collateral security may be waived for Micro & Small Enterprises for loans over Rs.5.00 lacs and upto Rs.50.00 lacs based on good track record and financial position of the unit provided the loan is eligible / covered under Credit Guarantee Scheme of CGTMSE. Working Capital Limit: Minimum 20% of projected annual sales turnover upto limits of Rs.500 lacs [i.e. 20% of projected turnover] and Projected balance sheet method for limits above Rs.500 lacs for MSME units. Adhoc Limit Facility: 10% of the limit or Rs.10 lacs whichever is lower to meet the contingencies. Renewal of Working Capital Account: Once in 2 years. Need based enhancements will be considered as and when required. 3 Stock statements: To be submitted at quarterly intervals. Simplified and Hassle Free Loan Products: i) ii) iii) iv) v) vi) vii) viii) ix) x) xi) xii) xiii) xiv) xv) xvi) General: a) Working Capital [Fund based / Non-fund based] b) Term Loans [MTL / CTL] SME-Credit Plus: 20% of the working capital limits, Max. Rs.25 lacs for Micro & Small Enterprises and Rs.50 lacs for Medium Enterprises to meet contingencies. Mortgage Loan: Against Mortgage of tangible collateral security upto Rs.10.00 lacs for Micro Enterprises, Rs.1.50 crores to Small Enterprises and Rs.3.00 crores to Medium Enterprises for working capital and term loan requirements. Laghu Udyami Credit Card [LUCC]: Upto Rs.10 lacs towards working capital for units having satisfactory conduct of borrowal accounts for atleast 1 year. No submission of periodic stock statements / financial statements. Artisan Credit Card [ACC]: To meet the credit requirements of Artisans. Max. Loan amount Rs.2 lacs. Swarojgar Credit Card [SCC]: Upto Rs.25000/- for self-employed persons. SME – Smart Score: For quick sanction of Loans from Rs.5 lacs to Rs.25 lacs, based on simplified scoring model. General Purpose Term Loan [GPTL]: Pre-approved limit for multi-purpose needs. Max. Rs.250 lacs for manufacturing enterprises, Rs.100 lacs for service enterprises. SME – Car Loans: Car loans to the promoters / partners of SME units and their family members without any collateral security. Doctor Plus: To provide financial assistance to Medical Practitioners upto a maximum limit of Rs.5 crores Tourism Fin: Financial assistance for Tourism related activities. Rice Mill Plus Scheme: To provide financial assistance to Rice Millers for acquisition of machinery / construction of mill / working capital requirements. Dall Mill Plus Scheme: To provide financial assistance to Dall Millers for acquisition of machinery / construction of mill / working capital requirements. Cotton Ginning Plus Scheme: To provide financial assistance to Cotton Ginning Millers for acquisition of machinery / construction of mill / working capital requirements. Construction Equipment Loan: Line of credit facility for financing construction equipment / machinery upto Rs.5 crores. Scheme for Financing Commission Agents dealing in agriculture produce. Maximum loan amount Rs.25 lacs 4 xvii) Transport Operator Scheme: To finance transport operators for purchase of commercial vehicles upto Rs.3 crores. xviii) MSME Liquid Gold Scheme: To provide an easy loan facility to meet urgent business needs against pledge of gold ornaments. Minimum Rs.25000/Maximum Rs.25.00 lacs. Special Schemes: Joint financing / co-financing of SMEs with A.P.State Finance Corporation. Scheme for Technology upgradation / establishment / modernisation / expansion of Food Processing industries Scheme for financing Handloom Weaver groups Scheme for advances against Ware-house receipts of National Bulk Handling Corporation Ltd. [NBHCL] to processors / traders Special Schemes for Women Enterpreneurs: Stree Shakti Scheme: Interest rebate of 0.50% & Margin reduction by 5%. Specialised MSME Branches: 11 specialised MSME branches to give focused attention to MSME units: Cherlapalli [R.R.District–A.P], Balanagar [Hyderabad–A.P], Vijayawada [A.P], Warangal [A.P], Vizag [A.P], Rampur [Karimnagar–A.P], I.E.Medchal [A.P], Mancherial [A.P], Khammam [A.P], Miryalguda [A.P], Dubba [Nizamabad–A.P]. Specialised MSME Divisions at potential branches across the country Debt restructuring facility to all the eligible / potentially viable MSME - Units Technical Consultancy Dept. at Head Office offers the following services: – – – – – Techno-economic feasibility study Project validation / appraisal Stock Audit Turn around Management Merchant Banking Appraisal for Public issue projects. Entrepreneurship Development Programmes [EDPs]: Bank conducts/sponsors EDPs of general/skill enhancement programmes. MSME Care Centres established at all Zonal Offices and Head Office. Details of these care centres are available on banks website. 5 For further details contact your nearest Branch or Call Helpline: 1800 – 4254055 Visit us at : www.sbhyd.com e-mail : mysbh@sbhyd.co.in SMS : Send ‘SME’ to 9000 222 444