Micro Small & Medium Enterprises

advertisement

Micro Small & Medium

Enterprises

The Government of India passed in June

2006 an act regarding the Micro , Small ,

and Medium Enterprises . The Micro , Small

and Medium Enterprise Development Act

,2006 (MSMEDA )

The Act accomplishes many long -standing

goals of the government and stakeholders

in the MSME sector .

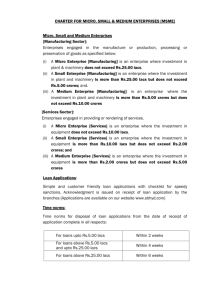

Definition of MSME

• The Act decisively defines the MSMEs

by the level of by Plant and Machinery

(P&M ) investment.

• The

categorization

also

makes

allowances for the inherently smaller

investments of Service enterprises.

• The new definition has expanded the P&M limits ; now

each enterprise level encompasses larger investments

than before . The new categorization is as follows :• Micro Manufacturing : P&M* Less than Rs 25 lacs

Micro Service

: Equipments* Less than Rs10 lacs

Small Manufacturing : Less than Rs 5 crore

Small Service

: Less than Rs 2 crore

Medium Manufacturing :

Less than Rs 10 crore

Medium Service :

Less than Rs 5 crore

*Original cost excluding Land and building and furniture,

fittings and such items, specifically excluded

Loans not exceeding Rs. 20.00 Lacs granted to Retail

Trade would henceforth be part of Small Service

Enterprise under MSME.

CLASSIFICATION OF MSME

WITHIN THE PRIORITY SECTOR

• The Micro and Small Enterprises (manufacturing and

service) will be Classified under Priority Sector.

• The Micro and Small (Service) enterprises shall

include Small Road and Water Transport Operator,

Small Business, Professional and Self-employed

Persons and all other service enterprises. Retail

Trade will not be classified under Micro and Small

enterprises (service sector).

• Small Road and Water Transport Operator (SRWTO),

Small Business, Professional and Self Employed

Persons (PSEP) will be classified as per the original

cost of equipments either under Micro or Small

Enterprises (service) sector instead of earlier

classification/ definition of 10 vehicles incase of

SRWTO and working capital and /or Term loan limits

incase of Small Business/Professional and Self

employed persons.

CLASSIFICATION OF MSME

WITHIN THE PRIORITY SECTOR

• If the following Storage Units, registered as SSI

Unit/Micro or Small Enterprises, the loans

granted to such units may be classified as Small

Enterprises Sector :

“Loans for construction

and

running

of

storage

facilities(warehouse,market yards, godowns and

silos), including Cold Storage Units designed to

store agriculture produce/ products, irrespective

of location”.

• Lending to Medium Enterprises will not be

included under Priority Sector.

Manufacturing Activities **

•

•

•

•

•

•

Medical Equipment and Ayurvedic Product

Composite unit of Bacon Processing and

Piggery Farm*

Tobacco Processing

Beedi/Cigarette manufacturing and other

tobacco Products

Extraction of Agave Spirit from Agave juice ;

(imported medicinal plant ) extraction of Agave

Manufacture of Bio-Fertilizer

* Piggery Farm without bacon processing as

this is a farming activity.

** The activity of “Bee-Keeping” being farming

allied activity.

1. DIRECT FINANACE:

i. All loans granted to Small Enterprises including

Micro Enterprises (both Manufacturing and

Services)

will be classified under Direct Finance

to Micro and Small Enterprises Sector.

ii. Khadi and Village Industries Sector (KVI):

All advances granted to units in the KVI sector, irrespective

of Sector their size of operation, location and amount of

original investment in Plant and Machinery, will be eligible

for consideration under the Sub Target (60 percent) of the

Small Enterprises segment within the Priority Sector.

INDIRECT FINANCE

1. Indirect Finance to the Small (manufacturing as well as service)

Enterprises sector will include credit to:i. Persons involved in assisting the decentralized sector in the

supply of inputs to and marketing of outputs of artisans, village

and cottage industries.

ii. Advances to cooperatives of producers in the decentralized sector

viz., artisans, village and cottage industries.

iii. Existing investments as on 31st March, 2007, made by banks in

special bonds issued by NABARD with the objective of financing

exclusively non-farm sector may be classified as Indirect fiancé to

Small Enterprise sector till the date of maturity of such bonds of

March 31, 2010, whichever is earlier. Investment in such special

bonds made subsequent to March 31, 2007 will, however, not be

eligible for such classification .

iv. Loans granted by banks to NBFCs for on lending to Small and

Micro enterprises (manufacturing as well as service).

CALCULATION OF INVESTMENT

FOR PLANT & MACHINERY

• In case of MSME advances, if the branches are unable

to assess original investment criteria, a certificate with

regard to investment in plant and machinery / equipment

should be obtained from a Chartered Accountant.

• In calculating the value of plant and machinery for

the purpose of calculating investment limit, the

original price thereof, irrespective of whether the plant

and machinery are new or second hand shall be taken

into account. In case the Branch is unable to assess the

original investment criteria, a certificate with regard to

investment in plant/machinery/equipment etc. would be

obtained from a Chartered Accountant.

• The investment in establishing of wind mill/s to

generate electricity for captive consumption or partly

for captive consumption and remaining power to sell

to Electricity Boards/others are to be included in the

investment in plant and machinery.

Processing of Loan Application

•

•

•

Application Format:

Revised Simplified Loan Application Form prescribed

by IBA alongwih check list and undertaking of the

applicant, will be applicable for Micro and Small

Enterprises (MSEs)

For loan beyond Rs.25Lacs, branches may obtain

additional information from the borrower, as deemed

necessary, as incorporated in the checklist enclosed to

the loan application form.

Loan Application Form (ADV-Comm) and Checklist

enclosed will be applicable for Medium Enterprises

only.

Processing of Loan Application

• Fair Practice Code for Lenders Liabilities

• Before handing over the Application Forms to applicant,

the modification / addition as applicable under guidelines

on Fair Practice Code for Lender’s Liabilities will be

complied as under:

(a) Information regarding Processing Fee, Service

Charges, and Refund etc. will be annexed as a part of

application form.

(b) An undertaking to be obtained from the prospective

borrower while accepting application that he has been

briefed about and convinced about the charges, bank

will levy on pre/post sanction of the loan.

Processing of Loan Application

Issue of Acknowledgement of Loan

Applications :

Each

branch

will

issue

an

acknowledgement for loan applications

received from the borrowers towards

financing under this sector and maintain

the record of the same.

Processing of Loan Application

•

Disposal of Applications:

In case of Loans up to Rs.25000/- :

Within 2 weeks

In case of Loans above Rs.25000/- :

Within 4 Weeks

(Provided the loan applications are

complete

in

all

respects

and

accompanied by a 'check list' enclosed

to the application form)

Processing of Loan Application

• Register of Receipt/Sanction/Rejection of Applications:

a. A register should be maintained at branch wherein the

date of receipt, sanction / disbursement ,rejection with

reasons , should be recorded. The register should be

made available to facilitate verification by the Bank’s

officials including Zonal Manager during visit to the

branch.

b.Branch Manager may reject application (except in

respect of SC/ST). In the case of proposals from SC/ST,

rejection should be done at a level higher than Branch

Manager.

c.The reason for rejection will be communicated to the

borrower in line with stipulation mentioned in the Fair

Practice Lenders Code.

Processing of Loan Application

• Photographs of Borrowers

While there is no objection to take photographs

of the borrowers, for

the purpose of

identification, branches themselves should make

arrangements for the photographs and also bear

the cost of photographs of borrowers falling in

the category of Weaker Sections. It should also

be ensured that the procedure does not involve

any delay in loan disbursement.

TYPES OF CREDIT FACILITIES

• The Bank may provide all types of funded and

non funded facilities to the borrower under this

sector viz, Term Loan, Cash Credit, Letter of

Credit, Bank guarantee, etc.

• A Composite Loan with maximum limit upto

Rs.1.00 crore may be considered by bank to

enable the Micro and Small Enterprises {both for

manufacturing and service sector} to avail of

their working capital and Term loan requirement

through Single Window.

MARGIN

(A) FUNDED

Upto Rs.25000

Above Rs.25000

1.

2.

3.

Minimum Margin

NIL

25%

20% (Under Turnover

Method)

20-25%

NIL

Margin on Book Debts

Exports Bills backed by L/C

confirmed by First Class Bank

(B)

NON-FUNDED

Letter of Credit (DP)

5%

Letter of Credit (DA)

10%

Bank Guarantee

20%

Margin in case of Non Funded facility can be reduced upto 5% by the

GM(PSC) at HO and

below 5% by the Chairman and Managing Director or Executive

Director(in absence of C&MD).

Security Aspects

1. No collateral or third party Guarantee for advances up to

Rs.5.00 Lacs.

2. In case of good track record of the borrower, Collateral

Security and or third party guarantee may be waived beyond

Rs. 5.00 Lacs but up to Rs.100.00 Lacs, where guarantee

cover of 75% upto Rs.50.00 lacs and 50% thereafter, of the

amount of default is available from CGTMSE. The Guarantee

Coverage has increased to 85% of credit facility upto Rs.5

Lacs sanctioned to Micro Enterprises w.e.f. 02.01.2009.

Women Entrepreneurs/ units located in North East Region,

including Sikkim (Other than Micro enterprises) will be eligible

for coverage of 80% upto Rs.50.00 lacs instead of 75% in

other cases.

The CGTMSE Commission/ Annual fee will be borne by the

Borrower.

Security Aspects

•

•

•

•

In case of Loan up to Rs.25000.00, minimum asset coverage

ratio would be 1:1. However, in case of

schematic

lending/specified scheme, the guidelines as applicable will be

complied with.

In case of Loan above 25000, a minimum asset coverage ratio

must be 1.1:1 (excluding Margin stipulated).

In case of loan accounts not covered under CGTMSE scheme

i.e. above Rs.100 lac, it may be explored as far as practicable

that the credit facilities/loans extended, are supported by

collaterals in the form of liquid securities or fixed assets,

immovable properties, based on the credit risks perception of

the borrower. However, availability of collateral security shall

not be the mere criterion for arriving at credit decision.

Collateral security shall not be insisted upon in those cases

where the RBI directives specifically advised the banks not to

insist on obtaining collateral security /third party guarantee.

Risk Rating

• Exposure-wise rating modules for SMEs are

as follows :Credit Exposure

Up to Rs.10.00 Lacs

(Existing & New Units )

Above Rs.10.00 Lacs up

to Rs.1.00 Cr :Existing Unit

New Unit

Above Rs.1.00 Cr to less

than Rs.5.00 Cr :Existing Unit

New Unit

Rating Module

CRG-1

Rs.5.00 Cr & above

(Existing & New Units)

Risk

Assessment

Module

(RAM –CRISIL)

CRG-2

CRG-4

CRG-7A

CRG-7B

In case RAM module is

not operationalised :Existing Unit

CRG-7A

New Unit

CRG-7B

Methodology for calculation of

Bank Finance

Working Capital Finance:

• Working capital credit limits to Micro, Small and Medium

Enterprises in individual cases up to Rs.5.00 Crore

(Manufacturing sector) and upto Rs.2.00 Crore (Service sector)

will be computed as per existing guidelines on the basis of

minimum 20% of projected annual turnover. However in case

of borrower applying for working capital limit higher or lower

than the working capital computed on the basis of turnover

method shall be assessed as per actual requirement.

• ii) For assessment of the working capital requirement for

borrowers falling within the band of above Rs.5.00 crores and

below Rs.10.00Crore (Manufacturing Sector) and above Rs.2.00

Crore and below Rs.10.00 Crore (Service Sector) the traditional

method of computing MPBF as per second method of lending

will continue. If any of the borrower falling in this band intends

to shift to cash budget system, the same may be accepted.

Methodology for calculation of

Bank Finance

Working Capital Finance:

• For borrowers having working capital limit of

Rs.10.00 crores and above, Cash Budget

System will be applicable.. However, if a

borrower is desirous to continue with the existing

MPBF system the Bank may accept the request.

If any of the borrowers falling in this band

intends to shift to cash budget system, the same

may be accepted.

Methodology for calculation of

Bank Finance

• Drawing Power :

• Book Debts upto Six Months may be treated as

Current Asset, for the purpose of computation of

permissible bank finance and drawing power

calculation. All Book Debts more than 180 days

are to be treated as Non-Current Assets. As

regards age of the book debts, a certificate

preferably from a Chartered Accountant to be

obtained.

Methodology for calculation of

Bank Finance

• Term Loan Finance:

The technical feasibility and economic, financial,

commercial viability, managerial competence,

environment viability and bank-ability of the

proposal with reference to risk will be assessed.

• Debt Equity Ratio

In case of term loan, Debt Equity Ratio (DER)

should not normally be above 3:1.However, in

case of capital intensive industries, the same

may be considered upto 5.00:1.

Methodology for calculation of

Bank Finance

• DSCR/Average DSCR

In case of Term Loan, minimum Average

DSCR of 1.30:1 will be considered as

reasonable requirement for any new

project/expansion project.

• Other Benchmarks

Other benchmark financial ratios like

Current Ratios, Tenure etc. will be in line

with the Bank’s domestic lending policy.

Mode of Disbursement of Loan

• The disbursement of the loan amount for

Plant and Machinery, Equipment and other

fixed assets will be made in favour of the

supplier through Demand Draft/Banker

Cheque. Branches will continue to ensure

the

end

use

verification

on

monthly/quarterly basis.

Repayment Schedule

• Repayment schedule should be fixed taking into

account the sustenance requirements, surplus

generating capacity, the break-even point, the

life of the asset, etc., and not in an “ad hoc”

manner.

• Moratorium period depending on requirement of

the project will be considered.

• Moratorium period may be extended by further

six months where project implementation has

been delayed for reasons whatsoever beyond

control of the borrower.

• COMPOSITE TERM LOANS

A composite loan with maximum limit upto

Rs.1.00 crore may be considered by bank to

enable the Micro and Small Enterprises (both

for manufacturing and service sector) to avail

of their working capital and Term loan

requirement through Single Window.

• NON-FUNDED LIMIT :

The non-fund limit may be sanctioned as per

need based requirements of the borrower within

the ambit of the bank’s guidelines in this regard.

The proposals for non-fund facilities should be

dealt with same diligence as in case of funded

limits.

REVIEW OF SME PORTFOLIO:

• At the Zonal office level, Chief Manager (Credit)/ Senior Manager

identified as nodal officers will act as coordinating officer to monitor

the functioning, review and the progress in SME financing and to

coordinate with other banks/financial institutions and the State

Government removing bottlenecks, if any, to ensure smooth flow of

credit to the sector.

• SME financing branches (erstwhile SSIFBs) have be permitted to

finance Medium Enterprises also. Further, bank may explore the

possibility of opening more branches to cater the specialized

requirement to this segment.

• The Zonal office will give due importance for financing in the

identified special credit delivery branches and branches situated

near to clusters.

• Review of progress on MSME lending will be placed before the

Board on quarterly basis.

DEBT RESTRUCTURING

• The Bank’s policy of Debt Structuring

Policy will be applicable for SME as per

Instruction

Circular

No.10285

/CPRMD/2008-09 dated 19.12.2008 will

be applicable

, in respect of debt

restructuring of SMEs.

ADHOC WORKING CAPITAL

DEMAND LOAN :

(a) Under stimulus package, the need based Adhoc

Working Capital Demand Loans maximum up to 20% of

the existing fund based limits in respect of units having

overall fund based credit facility up to Rs.10.00 Crore

may be given, which will be repayable in one year with a

provision of maximum period of six months during which

interest will have to be serviced.

(b) In this regard borrower may avail only one of the

under noted facilities at a time:

• i) Adhoc Facility

• ii) Adhoc Working Capital Demand Loan

EXCESS DRAWING

• Besides Adhoc Facility / Adhoc

Working Capital Demand Loan, excess

drawing may be allowed in terms of

provisions contained in the Bank’s

Discretionary

Authority

(Lending

Power)/ Lending Policy, on merits ,

considering exigencies of the case.

OPERATIONAL GUIDELINES

FOR ADHOC FACILITIES FOR

MSME BORROWERS

• As per extant MSME Policy, Discretionary

Authority for Adhoc sanction to MSME

Borrowers have been provided from Scale-II

onwards, which has to be extended within

20% of 20% of sanctioned limits or the

prescribed amount under Discretionary

Authority in case of AB-1 and AB-2 rated

Accounts and 10% of sanctioned limit or the

prescribed amount under each scale,

whichever is less in case of accounts with

Risk Grading with AB-3 to AB-7 .