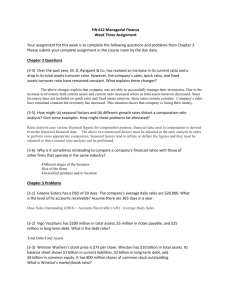

The Business Plan: Concepts, Theories, Models and Strategies

ENT 470/570 – 2009 – PRESUMMER - 04

The Business Plan for Executing Innovations:

Concepts, Theories, Models and Strategies

Ozzie Mascarenhas SJ, PhD.

May 13, 2009

From an academic point of view, a business plan is a roadmap, a statement of strategy, an operational model, a business forecast or some other conceptual label. From an entrepreneur’s viewpoint, a business plan is a selling document, a sales pitch you give to prospective venture capitalists and banks. A business plan does not sell a product or a service or a work environment, it sells an entire innovation project, the entire business venture or your new company. If you are really excited about and believe in your project or your new company, it should reflect in the business plan. Excitement, however, is not based on puffery or exaggeration. It is based on supporting evidence in the form of solid research and experience. The innovation, new product or service idea that you sell or form a company about should be real, credible, convincing, promising, attractive, demonstrable, and worth investing to your stakeholders. Hence, have a clear purpose, content, audience and expected outcome for your business plan. These will generate a sense of commitment, focus and realism to your document.

Why should you write a Business Plan?

A completed business plan is a guide that illustrates where you are, where you re going and how to get there (Charles J. Bodenstab). A business plan may tell you by the time you are done that this is not a profitable business. If you go into the business world without a path to walk down, without some sort of guidelines, you are in trouble (Geoff Walsh). The business plan could be the most useful and important document you, as an entrepreneur, ever put together. The plan keeps you thinking on target, keeps your creativity on track, and concentrates your power on reaching your goal (Megginson, Byrd, Scott and

Megginson 1994: 138).

A properly developed and written business plan serves as an effective communication tool to convey ideas, research findings and proposed plan to potential investors. The business plan is the basis for managing the new venture. It also serves as a measure to gauge progress and evaluate needed changes.

Gumpert (1997: 120-147) provides eight reasons for writing a good business plan:

1.

2.

It is a “sanity check” for you. Write your plan and run it through others for their response and reactions. Not all would agree with you and your plan. Nevertheless, agreements and disagreements will help you to focus better, sell yourself more credibly, and revise your assumptions and presuppositions.

To obtain Bank Financing: Getting bank finance is tough, and you will have to make a clear

3.

persuading case to your prospective bankers. Currently, (given the bank failures of the late 1980s and early 1990s), banks are under great scrutiny by federal regulators and, consequently, require entrepreneurs to include a business plan with any request for loan funds.

To obtain Investment Funds: A written plan endorses your belief and commitment to your business idea. Investors and the Securities Exchange Commission (SEC) want written business

4.

plans than mere oral presentations.

To arrange Strategic Alliances: Small and large companies need others and each other. Small companies need financial support and big companies need innovation. Besides obtaining funds, your business plan could ground joint research for developing your core product and competencies (front-end innovations) and joint marketing for bundling, promoting, retailing and servicing (backend innovations) your product.

1

5.

6.

7.

8.

To obtain large Contracts: Your major buyers will not contract with you until they are convinced that your product meets with quality standards, and that you will stay in business for at least three to five years. A formal written business plan should convince them about these concerns.

Today, big corporations are looking for long-term supplier chain management (SCM) relationships.

To attract key Employees: Best talent normally looks for stable large companies. Hence, as a small business, your business plan must be able to attract good executive, engineering and blue-collar worker talent to your fledgling company. Good executive and engineering talent, tired of convoluted bureaucracies of large corporations, are seeking personalized, ethical, and empowering morale and climate of small companies.

T complete Mergers and Acquisitions: If your business plan intends a merger, acquisition, divestiture, technical collaboration, cross-licensing, strategic alliance or a joint venture, then your prospective business partner would like to know more about you and your venture from your business plan.

To motivate and focus your Management Team: A written business plan with clear short-term and long-term goals and strategies will enable your executives, engineers, marketers and workers to stay focused, motivated and productive.

The Structure of your Business Plan

A business plan has usually three parts: a) A Summary Business Plan (< 5 pages) containing executive summary on all the key points of your full business and operational plan. b) The Full Business Plan (10-20 pages) covering topics 1-14 below, and c) The Operational Business Plan (25+ pages) covering materials, purchasing, product design, production, inventory, sizing, packaging, bundling, costing, pricing, distribution, promotion and advertising, business forecasts, cash flows, and profitability.

The length, depth, breadth and technicality of your business plan would depend upon several factors:

1.

Nature of your business (its size, growth, complexity, newness);

2.

The domain of your business (local, statewide, regional, national, international, global and online);

3.

Size of the bank loans needed;

4.

Size of investor commitment expected;

5.

Size of your collateral; what you bring to the table;

6.

Strategic business partners (mergers versus acquisitions versus joint ventures versus alliances);

7.

Your credibility and fame as a seasoned and successful entrepreneur;

8.

The nature of your innovation (radical versus incremental);

9.

The nature of your breakthrough idea (market versus technological breakthroughs);

10.

The nature, complexity, cultural diversity, rarity and cost of the skills required for your business;

11.

The nature of the target markets (old versus augmented versus new markets),

12.

The size, stability, volatility, potential and accessibility of your target markets;

13.

The risk, uncertainty and ambiguity of your products and target markets; and

14.

The legal implications of your products or services (e.g., safety, security, privacy, unions, patents, intellectual property, and OSHA, CAFÉ, EPA, USDA, SEC, CPSC or WTO regulatory requirements).

The Basic Content of a Business Plan

1.

Cover page: Name of the company, address, name of the president or contact person with phone,

Website and email details. The cover page should also include copyrights.

2

2.

Table of Contents: Provide Contents in brief, and Contents in details. Some bankers read portions of your business plan picking items from the Table of Contents.

3.

Executive Summary: This is the business plan in miniature. It should catch the excitement and essence of the business. This is the single most important section of your business plan because most of your target audience will start reading the summary first before digging into the Business Plan proper. Your executive summary has to keep potential investors, bankers or venture capitalists interested. If you lose them here, you lose them forever. It should rarely exceed two pages of bullets.

You may write this first before you start working on the business plan, or you may do it at the end.

In any case, this piece of the business plan should get your best attention, skills, drives and passion.

4.

The Company: What is your corporate identity? Provide your company’s history in brief, your start-ups, your current business strategy, management team, and a record of accomplishment of past products and successes (and failures). In describing your business strategy, tell the audience what you plan to do, but follow it carefully in the subsequent documents. Make your business strategy relevant, credible, doable, believable, and logically consistent. In this connection, analyze your past successes and problems as honestly and objectively as possible, with both its positive and negative aspects, describe your current status (e.g., its feasibility, viability, sales and earnings trends, your product and marketing mix, significant changes and profitability. Thirdly, outline your future goals, how they continue or depart from the past, why, and with what success. Describe your management team and how it is geared to realize your future goals.

5.

The Market: Who are your target market or potential buyers? How and why did you identify them?

What was your market scanning, market research, and market forecasting on this? What is your customer base, customer prospects, and how best can you reach them. What are your target market demographics and possible demographic shifts? Detail on the size, accessibility, stability, buying power, volatility of the target market. What will make the market believe and buy- in your product?

Is your market growing or shrinking, stagnant and stale? How do you plan to protect this market by suitable and ethical market entry barriers?

6.

The Product/Service: What are you selling? To whom? Why? How? When? Where? Through whom? How often? Describe your creation/innovation/invention/discovery product or service with its essential features and attributes, values, costs and benefits, quality and utility to the target markets.

How can your product fulfill unmet needs, wants and desires of your target customers? What convenience and saving (of time, money, energy, effort, anxiety, space and pace) does your product provide that your competition does not? Quantify your costs and benefits to the prospective customer.

7.

The Production Phase: Describe the essential ingredients, materials, components and parts required for the production of your product/service. Describe your suppliers, your purchasing strategies, your materials inventory, your in-process inventory and your finished goods inventories. Foresees problems and resolution of design, manufacturing, platform technology, patents and intellectual property, scale and scope economies, sizing, bundling, packaging, transportation logistics, costing and pricing, and other factory problems.

8.

Sales and Promotion: Detail on your marketing, advertising, promotion and distribution plan and strategies. In-house versus external marketing consultants. Detail your promotion tools such as price bundling, product bundling, price and product hybrid bundling, warranties, guarantees, discount pricing, rebates, credit, financing, product expansion and updates, and refund and recall policies. What are your plans for Web-marketing, Website designs, Web-auctioning, Webpersonalizing, and other modern Internet marketing strategies? What are your selling plans, costs and strategies? What are your retailing plans, costs and strategies? What are complaint handling and redress strategies? How will you motivate your distributors, retailers and sellers? How will your corporate advertising, PR, brand image building, product preannouncements, and brand community-building supplement and support your selling, retailing and distribution strategies?

9.

The Competition: Unless your product is absolutely new to the world, it will have competing brands, substitutes and surrogates. Examine and assess them. Who are your competitors, their products or services, their quality and brand equity, their price and rebate offerings, their price and product

3

bundling, their warranties and guarantees, and their credit and financing strategies? Be sure, you cover international and global competition if relevant. How would your establish sustainable competitive resource advantage (SCRA) against this competition? How would you establish your sustainable competitive quality advantage (SCQA) against this competition? How would you establish your sustainable competitive marketing advantage (SCMA) against this competition?

10.

Finances: What are your costing, pricing, break-even and mark-up plans? What are your premium, penetration and competitive pricing strategies? Based on your business forecasts, project your cash flows, cash outflows, cash inflows, net cash flows, for the first, second, third, fourth and fifth years.

Study your cost of goods sold (CGS), selling and administrative costs (SAE), capital expenditures, interest expenses, owning versus leasing versus renting expenses, depreciation, wage payrolls, taxes, gross margins, contribution margins, net earnings, retained earnings and dividends. Hence, also project ROQ, ROS, ROM, ROE, ROI, ROA, and EPS, P/E, and TSR if publicly traded.

11.

Concluding Remarks: Summarizes your strengths and weaknesses, threats and opportunities, unique features and attributes, great values and benefits to make a final and brilliant pitch to your reader audience.

12.

Appendices: This is the place for executive and team résumés, product literature, patent literature, endorsement letters from suppliers and customers, and the like.

Table 4.1 summarizes the content of a business plan and the relevant questions you should ask under each item.

Before you write a Business Plan:

Before embarking on any business project, it is critical that you ask the right questions and explore focused answers on several key issues. For instance, examine your current financial position by answering some simple questions (Blaney 2002:57): a) Where are you now? Do you have the money to start this business? Do you need to borrow from banks? Do you want to attract venture or angel capitalists to your project? What is your current business status: Are you insolvent: that is, can you pay all your bills and debts when they are due?

Do you have sufficient cash for the immediate near future? Will the banks (assuming you have bank borrowing capacity such as overdraft) bail you out? b) How did you get here? What brought you to your current business status? Do you have in the immediate any negative net cash flows? What was your business performance record of accomplishment with immediately past innovations and new product introductions? c) Where are you going from here? What are your longer-term cash, sales, profit and loss, balance and security forecasts? How did you forecast? How objectively and realistically did you forecast?

Presumably based on your forecasts, how and why did you set your targets? d) How do you know now that you will reach there (your targets)? How would you know that you have reached there? What are your metrics to gauge your performance? If you do not reach your forecasted targets, what is your risk? What is the impact of such a risk on your profits and financial performance ratios?

If you are in a cash crisis (first question), then you should not worry about the past (second question) or about your future (third and fourth questions). Your business plan should address all four questions: with sales, CGS, receivables, payables, inventory, cash, cash cycle, cash flows, cash flow forecasts, cash flow statements, cash flow management, cash budgeting, harvesting cash, and anything about cash that will help you answer the first and the third questions and get you out of a cash crisis. The single most

4

important tool for building new companies or saving dying ones is the deft management of cash flow

(Wexler 2002).

Often, new products turn out to be cash traps . Bruce Henderson, the founder of the Boston

Consulting Group, warned managers over three decades ago: “The majority of products in most companies are cash traps. They will absorb more money forever than they will generate.” Most new products (almost 5 to 9 out of ten products) do not generate enough cash or enough financial returns despite massive investments in them. For instance, Apple Computer stopped making the striking G4

Cube less than a year after its launch in July 2000 as the company was losing too much cash on the investment. Proctor & Gamble in 2002 made half of its sales and even a bigger share in profits from just

12 of its new 250-odd products of that year (Andrew and Sirkin 2003: 77). Creativity and innovation are not enough. There is a big difference between being innovative and an innovative enterprise: the former generates many ideas; the latter generates much cash (Levitt 1963). A failing company needs innovations that turn into good markets and good markets that turn into good cash and financial returns – this is the innovation-to-cash chain (Andrew and Sirkin 2003: 78).

The Fundamental Finance Principle

A key question we ask before any business decision or undertaking is: Will the decision create value for the firm’s owners? The fundamental finance principle responds to this question stating: A business proposal (e.g., new investment, acquisition, merger, a restructuring plan) will raise the firm’s value only if the present value of the future stream of net cash benefits the proposal expects to generate exceeds the initial cash outlays required to carry out the proposal (Hawawini and Viallet 2002: 5).

The present value of the future stream of net cash benefits the proposal expects to generate is the amount of dollars that makes the firm’s owners indifferent between receiving that sum today and getting the expected future cash-flow stream. For example, if the firm’s shareholders are indifferent between receiving cash dividend of $100,000 today and getting expected cash dividend of $110,000 next year, then $100,000 is the present value of $110,000 expected next year. That is, the shareholders expect to receive a return of 10 percent from the project, which is called the discount rate (the rate at which the future cash flow must be discounted in order to find its present value). A proposal’s appropriate discount rate is the cost of financing the proposal. By the fundamental finance principle, a project is undertaken if its net present value (NPV) is positive (i.e. it creates value for the firm’s owners), and is rejected if its

NPV is negative (since it destroys value for the firm’s owners). This is called the

Net Present Value Rule .

Only Cash Matters

The fundamental finance principle requires that the initial investment needed to undertake a proposal, as well as the stream of net future benefits it expects to generate, be measured in cash . Only cash matters to the investors, whether they are shareholders (providing equity capital ) or debt-holders (leveraging debt capital ) because all they have invested is cash in the firm and are expecting cash returns in the future.

[Note that the cash benefits of a project are not the same as the project’s net profits – the latter are accounting measures of benefits, not of cash returns].

In 1993, Dell experienced a serious liquidity problem. Dell’s rapid growth coupled with poor working capital management was rapidly stifling their ability to grow in the future. In order to remedy the problem, Dell institutionalized a working capital program that focused on cash flow and a more efficient cash management process. Today, working capital management is part of the Dell fabric and

DNA for growth (Hartman 2004: 150).

5

How to use cash is the biggest issue in an ongoing restructuring plan. Debt and cash are two top priorities in troubled organizations, especially those that have no choice but restructure. Some corporations use cash to buy back their own stock, especially if there is no other better investment opportunity. Others pay dividends giving cash back to shareholders and assuring them that they can think of no better investment for their money. If you restructure your balance sheet to reduce your debt in profitable times, you prepare yourself for times you will need to raise the debt. Excessive debt creates unremitting pressure from financial and trade creditors. Financial creditors harass management about delayed interest payments, violated debt covenants, sinking fund obligations and early repayment schedules, and may even threaten to deny the company further credit. Trade creditors warn the struggling company about overdue balances and may threaten to withhold further shipments. Controlling your cash and cash flows are very important in satisfying both your financial and trade creditors (Pate and Platt

2002: 92-3).

We can view a satisfied customer as an economic asset that yields predictable future cash flows

(Fornell 2002: 41). Satisfied customers are more loyal and increase their level of purchasing over time

(Anderson and Sullivan 1993; Reichheld 1996), are more receptive to cross-selling efforts (Fornell 1992), are less likely to switch to competing brands despite their alluring lower prices (Fornell et al. 1996), and generate positive word-of-mouth patronization (Anderson 1996). All these factors contribute to steady and enhanced future cash flows that ensure higher shareholder value.

Some Basic Terms and Definitions of Cash Flow Management

Cash Flow Management:

In order to appreciate fully the critical importance of cash and cash flows to any business, we first define some major terms involved such as cash, cash flow, cash flow management, cash flow time line, operating cycle, cash cycle, cash flow management measures and cash flow statements. Most of these terms follow generally accepted accounting principles (GAAP).

Cash: Definition and Measurement

Most familiar to us as the term “cash” is, it is a surprisingly imprecise concept. From a banker’s viewpoint, cash is money or any medium of exchange that a bank accepts at face value . Cash includes currency, coin, and funds on deposit that are available for immediate withdrawal without restriction. Cash is the first current asset listed on the balance sheet of most companies. A balance sheet lists all assets in relation to their degree of liquidity. Cash obviously tops the list in the balance sheet as being the most liquid monetary asset of the firm. The cash account on the balance sheet is the amount of liquid assets available for the company’s day-to-day uses.

The economic definition of cash includes currency, money orders, certified checks, cashier’s checks, personal checks and bank drafts, checking account deposits at commercial banks, and un-deposited checks. Financial managers use the term cash also to include short-term marketable securities. Shortterm marketable securities are short-term investments with a maturity not exceeding one year.

One property of liquidity is divisibility , that is, how easily an asset can be divided into parts (Ross,

Westerfield and Jaffe 2002: 771). The economic definition of cash is based on liquidity: currency, checking accounts at commercial banks and un-deposited checks are highly divisible into small units and usable to pay bills. As the most liquid of all assets, cash is also the medium of exchange for assets and liabilities. It serves as a basis for measuring the value of all assets and liabilities.

Cash Equivalents

6

The balance sheet term “cash or cash equivalents” reflects the amount of money or the currency the firm has on hand or in bank accounts. Cash equivalents are short-term and highly liquid investments readily convertible into known amounts of cash and close enough to maturity. Typical cash equivalents are short-term marketable securities such as short-term U. S. Treasury bills issued by the government, certificates of deposit issued by the banks, commercial paper issued by corporations with good credit ratings, shares in money market funds , and repurchase agreements . The balance sheet item “cash” usually includes cash and cash equivalents. Net working capital includes both cash and cash equivalents.

Cash equivalents are highly liquid; that is, one can easily sell or convert them to cash with minimal change in value.

How is cash amount measured? If cash consists exclusively in US dollars, the balance sheet account reflects the historical amount of net dollar units arising from past transactions. Since cash is very liquid, this historical amount of net dollar units is identical to the current market value of the cash.

If a firm is multinational, and some cash is in foreign currencies, then the foreign currency units must be translated into U. S. dollar equivalents. For some monetary assets like cash, accounts receivable and notes receivable, the current rate of foreign exchange (in effect at the balance sheet date, and not the historical rate of exchange that was in effect at the time of the foreign currency cash inflow) is used to translate foreign currency into U. S. dollars. Some currency conversions involve conversion commissions or exchange fees. Thus, this foreign portion of the cash account is carried at its current market price, irrespective of whether it is higher or lower than the historical rate. Thus, for foreign accounts, the GAAP measurement convention for cash is market price rather than historical cost (Revsine, Collins and

Johnson 1999: 109-110).

There are two primary reasons for holding cash:

1.

For transactions such as disbursements and collections. Disbursements of cash are cash outflows and include the payment of wages and salaries, rents, utilities, shipping, trade debts, taxes, and dividends. Collections of cash are cash inflows and occur from selling products and services, sales of fixed assets, income from investments, royalties from patents and licenses, and new financing.

2.

For Compensating balances: minimum cash balances are held in commercial banks to compensate for banking services provided by them.

Since minimal compensating balances must be maintained in order to obtain banking services and not for transactions, the cash of most firms can be thought of as consisting only cash holdings for transaction balances. The cost of holding cash is the opportunity cost of lost interest. To determine the optimal cash balance, the firm must weigh the benefits of holding cash against opportunity costs of lost interest and cash-shortage. Many firms hold very large balances of cash and cash equivalents. For instance, in 1997, the largest cash balances included those of Ford ($18.5 billions), General Motors ($10.1 billions),

Microsoft ($9.1 billions), Intel ($8.5 billions) and IBM ($6.5 billions). The reasons firms hold large balances of cash and cash equivalents include precautionary needs such as a recession, large anticipated spending on dividends, stock repurchases, privatization, stock options, or capital investment.

Understanding Financial Statements

Financial Statements are formal documents issued by firms to provide financial information about their business and financial transactions. Regulatory authorities (e.g., GAAP, SEC) and stock markets, in which their shares are traded, require such financial statements at least annually. Two primary financial statements include: a balance sheet and an income statement (the latter is also called the profit and loss

7

statement or P&L account). In some cases, regulatory authorities also require a third protocol: a statement of cash flows, which provides information about the cash transactions between the firm and its outside world. Financial statements are mostly meant for the investors who are the primary users of such statements. Hence, these statements must use terms and expressions that are commonly employed in financial accounting and must conform to general standards and rules, which in the USA are known as generally accepted accounting principles (GAAP).

The fundamental objective of a balance sheet is to indicate the value of the net or cumulative investment made by the firm’s owners (investors or shareholders) in their firm at a specific date, generally at the end of the accounting period. The balance sheet informs what shareholders collectively own and what they owe at the date the statement is made.

The fundamental objective of the income statement is to measure the net profit (or loss) generated by the firm’s activities during a specific period called the accounting period (or the fiscal year). The income statement informs the investors about the firm’s activities that resulted in increases (or decreases) in the value of the owners’ investment during a given accounting period. That is, the income statement or the net profit or loss statement is a measure of the change in the value of the owners’ investment in their firm during a given accounting period. Table 4.2

presents a sample of Projected Income (Profit & Loss)

Statements 2007-2010. Table 4.3

is a sample of Cash Flow Projections 2007-2010, and Table 4.4

describes a typical Pro-forma Balance Sheet.

Further, accountants who prepare the financial statements generally provide “ notes ” that provide additional information about the statements, such as their nature and the way they have been valued.

Also, firms prepare two sets of statements, one for financial reporting purposes and one for tax purposes.

Only the first set of statements (i.e., the balance sheet, the income statement, and the statement of cash flows) is public. These statements are found in the annual report that the firms publish every year.

Tables 4.5

and 4 .6

present financial statements, the balance sheet and income statement, of a fictitious

XYZ Manufacturing Corporation for the fiscal year ending on June 30 of 2003 and of 2002.

Owners’ Equity, Assets and Liabilities

As stated earlier, the main purpose of a balance sheet is to provide an estimate of the cumulative investment made by the firm’s shareholders at a given point in time. This investment is known as owners’ equity . Other terms used for owners’ equity include shareholders’ equity, shareholders’ funds, and bookvalue of equity, net worth, and net asset value. Owners’ equity is the difference, at a particular date, between what a firm’s shareholders collectively own, called assets (such as cash, cash equivalents, inventories, receivables, equipment, buildings), and what they owe, called liabilities (such as short term debts and long term debts owed to banks, bondholders and suppliers). That is, according to the fundamental accounting principle of balance sheets:

Owners’ Equity = Total Assets – Total Liabilities, or, Total Assets = Total Liabilities + Owners’ Equity.

The balance sheet in Table 4.5

verifies this equation for two consecutive years of reporting, 2002 and

2003, as shown in Exhibit 4.1

.

8

XYZ’s

Accounting period

Ending June 30,

2002

Exhibit 4.1: Verifying the Fundamental Accounting Principle at XYZ

Total Assets

$2,992,500

Total Liabilities

Owners’ Equity

Total Liabilities +

Owners’ Equity

$1,855,000 $1,137,500 $2,992,500

Ending June 30,

2003

$3,675,000 $2,310,000 $1,365,000 $3,675,000

That is, a firm’s total assets must have the same value as the sum of its liabilities and owners’ equity.

Owners’ equity is a residual value – that is, it is equal to whatever dollar amounts are left after deducting all the firm’s liabilities from its total amount of assets. If total liabilities far exceed total assets, owners’ equity is negative and the firm is technically bankrupt.

Fixed Assets and Depreciation Methods

Fixed assets or non-current assets, also called capital assets, are assets that are expected to produce economic benefits for more than a year. Fixed assets are of two types: tangible assets (e.g., land, buildings, machines, and furniture, collectively called property, plant and equipment ) and intangible assets (e.g., patents, trademarks, copyrights, intellectual property, long-term relationships, brand community, brand equity and corporate goodwill).

Tangible assets are generally reported at their historical cost , that is, the price the firm paid for them when they were bought. As time passes, the value of the fixed assets (except land) is expected to decrease during their expected useful life. This periodic (usually, annual) and systematic value-reduction process is called depreciation , and noted in the balance sheet as depreciation charges or simply, depreciation. Two common methods of depreciation used are a) straight line depreciation method (assets are depreciated by an equal amount each year of the expected lifetime of the asset), and b) accelerated depreciation method (depreciation charges are higher in the earlier years of the asset’s life and lower in the later years. The total amount that is depreciated is the same regardless of the depreciation method used.

The value at which a fixed asset is reported in the balance sheet is its net book value . If the firm uses historical value or acquisition cost principle to value its fixed assets, then the net book value of the fixed asset is equal to its acquisition price minus the accumulated depreciation since the asset was bought. If the firm uses replacement cost principle to value its fixed assets, then the net book value of the fixed asset is equal to the price the firm must pay at the date of the balance sheet to replace that asset minus the amount of accumulated depreciation. Exhibit 4.2

illustrates the net book value under various depreciation methods.

In Exhibit 4.2

, we assume that an asset bought at an acquisition price or historical cost of $600 has a useful life of three years and its replacement cost the year it was bought is $750. Under the straight-line method for depreciation, we depreciate the asset each year by $200. Under accelerated method of depreciation, we depreciate the asset by 50% ($300) the first year, one-third the cost ($200) the second year, and one-sixth ($100) the third year. In Exhibit 4.2

, we assume the straight-line method for depreciating the replacement cost of $750, and hence, each year the depreciation amount is $250. Under each method, the net book value is acquisition cost (gross value) minus the accumulated depreciation.

Exhibit 4.2

illustrates that a fixed asset value reported in the balance sheet can have a different net book value depending upon the historical or replacement cost principle and the method of depreciation used. In comparing the financial performance of firms, therefore, one must check (from the “notes”) the cost

9

principle and depreciation method used. Very few firms in the USA use the replacement cost principle; it is common, however, in the Netherlands (Hawawini and Viallet 2002: 44-47).

Depreciation is a component in cash flow adjustments (CFA). CFA = Depreciation + Net cash +

Proceeds from asset sales or divestitures – Capital replacement expenditures - Investment in growth capital expenditures [see Exhibit 4.3

].

Exhibit 4.2: Net Book Value under Various Depreciation Methods

Value Item

Year of Reckoning

Straight-Line Method Accelerated Method Replacement Cost &

Straight-Line Method

Year 1 Year 2 Year 3 Year 1 Year 2 Year 3 Year 1 Year 2 Year 3

Gross Value

(Acquisition cost)

Annual Depreciation

Charge

Accumulated

Depreciation

Net Book Value

$600

$200

$200

$600

$200

$400

$600

$200

$600

$600

$300

$300

$600

$200

$500

$600

$100

$600

$600

$250

$250

$600

$250

$500

$600

$250

$750

$400 $200 $0 $300 $100 $0 $350 $100 -$150

Current Assets, Current Liabilities and Working Capital Management

Assets are divided into two categories: current assets and fixed (non-current) assets. A typical balance sheet lists its assets in decreasing order of their accounting liquidity

– where liquidity is measured by the ease and speed at which you can convert assets into cash at a fair price. Thus, cash, which is the most liquid of assets, is listed first. Land and building, the least liquid of assets, are listed last.

Analogously, liabilities are listed in increasing order of maturity , where maturity is a measure of the time before the liability is due. Thus, short-term liabilities are listed first and long-term liabilities are listed last. Liabilities are also divided into two categories: current liabilities and non-current liabilities.

Owners’ equity is listed last, as it does not have to be repaid because it represents the owners’ investment in the firm.

Assets and liabilities are usually assessed and recorded according to the conservatism principle , which states: when in doubt, report assets and liabilities at a value whereby you would be least likely to overstate assets or understate liabilities. The recent legislation, the Sarbanes-Oxley Act of 2002 , reaffirms the conservatism principle (see Chapter One ).

Current assets are cash and other assets that the company expects to convert to cash within a year.

Usually, current assets include four major items: cash, marketable securities, accounts receivable, and inventories.

Prepaid expenses recorded on a balance sheet (e.g., prepaid rent, prepaid lease, prepaid payroll, prepaid taxes) are payments made by the firm for goods and services it will receive after the date of the balance sheet. A typical example is prepaid insurance, a payment for an insurance policy that will provide protection for a period of time that extends beyond the date of the balance sheet. A typical income statement records prepaid expenses by a key accounting principle, called the matching principle .

This principle states that expenses are recognized (in the income statement) not when they are paid but during the period when they are consumed or when they effectively contribute to the firm’s revenues.

10

That is, expenses prepaid by the firm must be carried in its balance sheet as an asset until they become a recognized expense in its (future) income statement. For instance, in Table 4.5

, the prepaid rent of $5,000 for June 30, 2003 represents the rent for the year 2004 and thereafter. Often, these items are declared as prepaid expenses for tax purposes.

Current liabilities are short-term debts or obligations that the company must clear with cash within a year. Normally, current liabilities list four major items: accounts payable, notes payable to the banks

(also called short-term debt), accrued wages and other expenses payable and accrued taxes payable. See

Table 4.5

. Short-term debts include overdrafts, drawings on lines of credit, short-term promissory notes, and portion of long-term debt due within a year of accounting.

Working capital is current assets minus current liabilities. For XYZ it was 1,592,500 - 595,000 =

$997,500 for 2002 and 2,100,000 – 1,050,000 = $1,050,000 for 2003, an improvement of $52,500

(5.26%) over 2002. Thus, other things being equal, a significant increase of working capital for 2003 over 2002 indicates that XYZ is a healthy company in relation to cash flows and cash flow management.

Working Capital Management is improving working capital.

Fundamentally, managing working capital is a way to increase returns to the company; it allows one to increase cash flow used for investment (Hartman 2004: 149). Opportunities for working capital improvement differ across industries, but they typically involve controlling key business processes such as inventory, accounts payable and accounts receivable. Increasing working capital, however, is not an end in itself. Some companies that insist on JIT (e.g., Dell), payment on consignment (i.e., Wal-Mart pays its retailers only when their products are sold and cash is realized) and cross-docking inventory systems (e.g. Wal-Mart), may even show negative working capital, and still would have grown significantly.

Cash Flows: Positive and Negative

Cash flow represents the available cash to pay current expenses. Cash flow is a value equal to income after taxes plus non-cash expenses. In capital budgeting decisions, the usual non-cash expense is depreciation. The management of working capital deals mainly with cash, receivables, payables, and inventories. A positive cash flow meets all current expenses. A negative cash flow implies more expenses than revenues; it forces short-term borrowing to meet your current expenses. Positive cash flows are not profits, just as negative cash flows are not losses. A positive cash flow is just cash after paying the costs (but not after depreciation). A negative cash flow is like bleeding; it is borrowing from

Paul to pay Peter.

Mere growth in sales does not assure a steady cash flow, as much of the sales could be tied in credit.

That is, sales may generate accounts receivables in the short run but no immediate cash to meet maturing obligations. Similarly, a high growth in sales with low profits can also create a cash crunch, especially if assets have simultaneously grown to generate the high sales growth. For instance, the sales in a given year might have doubled from $100,000 to $200,000, but if net profits are low (say 5% of sales, that is,

$200,000 x 0.05 = $10,000), and if assets have grown from $50,000 to $75,000 during the same year, then the net profits of $10,000 are inadequate to finance the additional assets of $25,000 unless one borrows the required amount ($15,000) from banks, suppliers or stockholders. In general, profits alone are inadequate to finance significant growth, and in which case, a comprehensive financing plan or forecasting must be developed. A cash budget is an important component of a comprehensive financing plan.

A cash budget is a series of monthly or quarterly budgets that indicate cash receipts, cash payments, and the borrowing requirements for meeting capital expenditures. It is normally constructed from the pro forma income statement and other supportive schedules.

11

Cash outflows and inflows are not perfectly synchronized or certain, and some level of cash holdings is necessary to serve as a buffer. Figure 4.1

sketches various cash inflow and cash outflow items to create short-term net cash flows. If the firm maintains too small a cash balance, it may run out of cash for necessary transactions, and then, the firm must sell marketable securities or borrow, and both transactions involve trading costs.

Notice that XYZ’s cash balance remained constant at $175,000 during 2002 and 2003 (see Table 4.5

), even though cash flow from operations (that is, net income plus depreciation, the two major items that finally affect cash) was (259,000 + 105,000) = $364,000 (see Table 4.6

under the year 2003). Its cash remained the same simply because the sources of cash were equal to the uses of cash for the year 2003 as is demonstrated in Table 4.7. For instance, XYZ derived a major source of cash from net profits

($259,000) and depreciation ($105,000) for 2003, totaling to $364,000.

Another source of cash was increase in accounts payable by $87,500 – this is same as increased borrowing from suppliers. The notes payable increased by $350,000 from 2002 to 2003 – this represents increase in borrowing from the banks. Small amounts of cash were sourced, $8,750 in each case, from wages (i.e., withholding wages or benefits from the employees) and taxes payable (in effect, this is borrowing from the IRS). Thus, total sources of cash inflows for 2003 amounted to $819,000.

This increase in cash was spent on machinery and plant ($245,000), on dividends ($31,500), on prepayments and deferred charges ($35,000), on additional inventory of $345,000, in additional accounts receivable of $140,000 (this is equivalent to lending customers or granting credit), in purchasing $17,500 worth of marketable securities, and prepaying rent of $5,000 – totaling uses of cash (outflows) to

$819,000.

Hence, the sources of cash (inflows) were exactly used by uses of cash (outflows), with no net cash increase from 2002 to 2003. This case illustrates the difference between a firm’s cash position on the balance sheet and cash flows from operations. We will resume discussion on cash flows when we derive cash flow statements of XYZ Inc.

Cash Flow Management

Cash flow management relates primarily to short-term financial decisions than to long-term ones, the latter being capital budgeting, dividend policy or capital structure. Short-term finance is an analysis of decisions that affect current assets and current liabilities, and their impact on the firm is normally felt within the year. The term, net working capital (current assets – current liabilities) is often associated with short-term financial decision-making. Short-term finance involves cash inflows and cash outflows within a year or less (e.g., ordering raw materials, paying in cash, goods are produced and sold, and salesrevenues are received in cash within a year). That is, cash flows management relates to short-term liquidity : an organization’s ability to meet current payments as they become due. Long-term financing relates to purchases, use, and revenue streams that roll over many years: e.g., a costly machinery or technology license bought this year, paid in five annual equal installments, and used for production that will increase cost savings over the next five years that, in turn, will more than cover the cost of the machine or technology license. Long-term financing relates to long-term solvency – that is, an organization’s ability to generate enough cash to repay long-term debts as they mature.

Cash flow management refers to valuable accounting information that includes product-cost data (i.e., how much labor, material and overhead are used in each product line and each product unit), break-even data (on fixed and variable cost), and a variance analysis that looks for efficiencies and inefficiencies by

12

comparing actual costs against industry standards. Cash flow management also includes a cash budget: this describes the expected inflows and outflows of cash that is used for wages, supplier outlays, and receipts from customers, bond and interest payments, dividends and the like. Conversely, a recovering company has to concentrate more intensely than ever on managing its cash flow and working capital.

Because in almost all turnarounds a cash crunch is well nigh inescapable, dealing with it becomes very critical for the turnaround. Cash can come from only two sources:

Internal sources: (e.g., cash equivalents, accounts receivables, acceleration of receivables, turning receivables into cash, forgiveness, conversion or extended terms for payables, inventory management, converting inventory to cash, asset restructuring, selling fixed assets, divestitures, and converting assets to leases).

External sources (e.g., banks, asset lenders, trust receipts, field warehousing, intermediate debt financing, venture capital, public issues, mergers, sellouts, and using loss carry-forward).

For an effective business turnaround, each item of the internal and external sources must be managed efficiently, effectively and quickly, and without much damage done to any stakeholders such as the suppliers, banks, retailers, distributors, employees and the customers.

Cash Forecast : Running out of cash is not an abstraction. Any day checks could bounce, receivables can become bad debts, and short-term payables may be due. Hence, daily cash projections, if possible, are best. Weekly projections are the next best choice. Biweekly projections are an absolute requirement

(Whitney 1999: 36). Difficult as it may seem, the turnaround leaders would have to make their cash projections, preferably short-term rollout cash forecast of at least 120 days, during the first week or ten days of their term. Since a cash projection is a reflection of countless operating decisions, there could be errors in one’s projections, but some information is better than no information at all (Whitney 1999: 37).

The first element of a successful turnaround plan is accurate cash forecast based upon receipts and disbursements. Good cash management works by actively managing and deciding about each of the line items of your weekly, or even daily, receipts and disbursements. This will bring costs in line with declining revenues. Most companies plan on a five-year forecast. However, if your long-range projections indicate the company will run out of cash within nine months, change your planning horizon to months, or even weeks or days if the crisis becomes near-fatal (Alix and Ramaekers 1995).

Cash flow is not depreciation added to the bottom line of an income statement. Nor is it looking at the balance of cash in the bank and developing a picture of how much cash will be there next month based on net income this month. Forecasting cash is an important ingredient of cash flow management.

Seventy percent of companies with revenues exceeding $50 million forecast cash. That percentage declines as companies become smaller, to the point where only 25% of companies with revenues of $10 million or less forecast cash (Kort 1999).

An income statement is not a good barometer of a company’s financial well-being, even though an income statement budget for the next year may set goals for revenue and profitability by providing benchmark for performance. Moreover, managers or accountants can manipulate the numbers on an income statement to obtain figures that please banks and security analysts. In such cases, earnings report the desires of management rather than the underlying financial performance of the company.

Income statements and budgets do not provide management with information on issues that affect cash flows, such as the collection of receivables or the adequacy of cash flows to cover debt payments or equipment purchases. These issues often translate into dramatic differences between profits and cash

13

flows. Managing a company by looking at past profitability (as judged from an income statement) is reactive. Managers must be proactive if they want to look at what lies ahead. One critical item that can help them in this regard is cash forecast. Figure 4.1

includes most of the major cash inflow and cash outflow items where a good controller could do the cash forecast for each year.

Studies have shown that cash flows from operations are a better predictor of financial well-being than income statements because it is much harder to manipulate cash flows. When comparing healthy companies to those involved in a turnaround, financially sound companies tend to have the ratio of net income (excluding depreciation) to cash flows from operations as 1/1 over a period of five years and more. Companies in financial trouble have such ratios also well exceeding one over one owing to fraudulent overstatement of income. For example, one company reported net income over a five-year period of several million dollars. Yet, cash flow during that period was less than $9,000, and the resulting ratio of net income (excluding depreciation)/cash flows from operations was 293 over a five-year period.

The company was in serious trouble. No one at the company, however, noticed this because they focused attention on net income as an indicator of financial health.

Measures of Operating Cash Flows

In a business turnaround situation, most cash flow metrics are sensitive to what the lenders or creditors, secured or unsecured, can claim from a company’s net cash flows. Secured lenders’ claims on cash flows precede those of federal taxes (Tax-Trust funds and payroll taxes), state taxes (income taxes and UIA [Unemployed Insurance Agency] taxes) and equity investors. Thus, the critical question is what the lenders are entitled from a company’s net cash flow, and what the company can legitimately deduct from its revenuers before paying its lenders.

Each operating cash flow formula must adjust for: a) depreciation tax shields, b) loan amortization tax shields, c) interest expense tax shields, d) federal corporate tax rates, e) state corporate tax rates and f) net operating losses (NOL) carry forward tax shields. Additionally, operating cash flows should reflect CFA

= Cash flow adjustments = Depreciation + Net cash + Proceeds from asset sales or divestitures – Capital replacement expenditures - Investment in growth capital expenditures for a given year. Exhibit 4.3

lists some of the common Alternative Discounted Cash Flow Valuation Methods .

EBITDA

(earnings before interest, taxes, depreciation and amortization)

–

is one useful but crude measure of pre-interest, pretax, pre-depreciation and pre-amortization cash flow. It is a crude measure of cash flow because although it is calculated before two key non-cash expenses, depreciations and amortization, it does not adjust for other non-cash items such as changes in working capital accounts.

EBITDA differs from the cash flow from operations found on the Statement of Cash Flows if you ignore payment for taxes or interest. EBITDA also differs from free cash flow, as it does not recognize the cash requirements for replacing capital assets.

EBITDA is different of operating cash flows since, for instance, uncollected receivables belong to revenues and therefore to EBITDA but not to operating cash flows. Similarly, cash paid to purchase inventory, which remains on hand if unused, would not reduce EBITDA but will reduce operating cash flow.

EBITDA, however, is most useful when evaluating a company’s true ability to earn profits, a factor that is critical for acquirers in acquisition decisions. But, EBITDA is not an accurate measure of debt-service capacity unless the creditors are actually willing to accept accounts receivable or inventory as payment of interest and principal on a loan (Mulford and Comisky 2005: 12).

14

EBITDAR: A popular variation of EBITDA that is EBITDA measured before rent (lease) expense.

Exhibit 4.3: Comparison of Alternative Discounted Cash Flow Valuation Methods

Valuation Method Calculation of Cash Flows

Adjusted Present Value

(APV)

Capital Cash Flow

(CCF): a) Net Income Version b) EBIT Version c) EBITDA Version

(R – C – D) x (1 – T) + CFA + I x T + N x T

{EBIAT} {Interest tax shield} {NOL tax shield}

(R – C - D – I) x (1 – T) + N x T + CFA + I

{Net income}

(R – C – D) - (R – C – D – I – N) x T + CFA

{EBIT} {Taxes payable}

(R – C) - (R – C – D – I – N) x T + CFA - D

{EBITDA} {Taxes payable}

Weighted Average Cost of Capital (WACC)

(R – C – D) x (1 – T) + N x T + CFA

{EBIAT} {NOL tax shield}

Where:

A = Amortization of long-term loans; C = Cost of goods sold (CGS) + Selling, general and administrative

(SGA) expenses; D = Depreciation; I = Interest expense on debt; N = Taxable income shielded by net operating loss (NOL) carry-forwards; R = Revenues, and T = Marginal corporate tax rate.

CFA = Cash flow adjustments = Depreciation + Net cash + Proceeds from asset sales or divestitures – Capital replacement expenditures - Investment in growth capital expenditures.

Deterioration of Receivables and Acceleration of Payables

Two of the most troublesome problems in the crisis stage of a turnaround are deterioration of receivables and acceleration of payables. Slowing of collections can come about because of slowing sales, billing errors, extended credit granted in desperation, sloppy collection procedures, and some customers, recognizing that the company is desperate, may not pay or just deliberately delay payments.

Acceleration of payables will occur because vendors recognize the company’s plight and may refuse to ship other than on cash on delivery (COD) terms, unless the account is paid current. Often, in troubled companies there could be inadequate purchase controls (e.g., the purchase order system could have been circumvented), in which case there could be grossly understated payables, creating those unpleasant surprises of receiving unexpected invoices for unauthorized expenditures.

Current computer software can empower the turnaround managers to run infinite variations of cash projections as well as balance sheets and operating statements. By manipulating relevant variables, turnaround managers can quickly assess what would happen if collections are slowed or if payables are accelerated, or if both events occur simultaneously. The turnaround managers can alter the variables by any increment that deem useful to them in order to derive a wider picture of cash projections under wider

15

range of situations and assumptions. For an illustration, see how Arthur Andersen & Company does cash flow projections using Lotus 123 software (Whitney 1999: 38-49).

Two cardinal assumptions or rules in the early turnaround stages of projecting receivables or payables are (Whitney 1999: 37):

1.

The company cash flow situation is worse than it seems.

2.

The cash flow situation will deteriorate. bad news even though they may not reduce the shock of deteriorating receivables and accelerating payables.

From hindsight, these are realistic assumptions even though pessimistic. They help you face up the

Cash Flow Time Line

Short-term finance is concerned with the firm’s short-run operating activities. For a typical manufacturing firm, such as XYZ Inc., the short-term activities consist of a sequence of events and decisions such as those outlined in Table 4.8.

Current liabilities are short-term obligations that the company must meet with cash within a year or within the operating cycle, whichever is shorter.

The operating cycle is the time period from the arrival of stock of raw materials until the receipt of cash that accrues from the product (converted from the raw materials) when sold. That is, it begins when an order (for raw materials or finished goods) is received (in the inventory) and ends when cash is collected from the sale of the goods produced or inventory. The length of the operating cycle is equal to the sum of the lengths of the inventory and accounts receivable periods. The inventory period is the length of the time required to order, produce and sell a product. The accounts receivable period is the length of the time required to collect cash receipts.

The cash cycle or cash flow cycle begins when cash is paid for the raw materials and ends when cash is collected from receivables – that is, it is the time between cash disbursement and cash collection, from accounts payables to accounts receivables. A cash flow cycle is the pattern in which cash moves in and out of the firm. The primary consideration in managing the cash flow cycle is to ensure that inflows and outflows of cash are properly synchronized for transaction purposes. Technically, however, the cash cycle is operating cycle minus the accounts payable period. The accounts payable period is the length of the time the firm is able to negotiate to delay payment on the purchase of various resources such as raw materials and wages.

The cash flow time line consists of an operating cycle and a cash cycle. The activities listed in Table

4.8

create patterns of cash inflows and cash outflows that are both unsynchronized and uncertain. In preparing efficient cash forecast, each item listed in Figure 4.1

must be estimated by using corresponding questions listed in Table 4.8

. The need for short-term financial decision-making is a function of the gap between the cash inflows and cash outflows – that is, the length of the operating cycle and the accounts payable period. The wider or longer the gap, the more complicated the production process, the longer the production cycle, the longer the marketing cycle, and longer and heavier the financial decisions during the operating cycle. The gap is managed by borrowing or by holding a liquidity reserve. The gap can be shortened by various strategies such as just-in-time inventory, reducing inventory, and reducing accounts receivable and payable periods.

16

Tracking Your Cash Flow

Managers often fool themselves when it comes to cash-flow management and its importance (Kort

1999). Cash flow management implies that cash is king. However, many business executives or entrepreneurs are unlikely to accept the fact that cash is king. Entrepreneurs, especially, are impatient with the methodical task of tracking the dollars that come in and go out. If they can afford it, this job is delegated to the financial controller or officer. When cash runs short (either because of fast growth or slowing sales), most entrepreneurs become optimists and prefer to wait until next month or next quarter when things will surely improve, rather than take immediate action to confront and correct a cash-flow imbalance (Wexler 2002). This entrepreneurial delusion can tempt one to spend now and hold off paying vendors, employees, and taxes. Often, entrepreneurs spend on new projects without waiting to make money from the current business. They may not have a business plan that projects when the company will break even – that is, when it will be taking in as much cash as it is paying out. Before they realize, the cash crisis has already set in.

All companies benefit by tracing and controlling their cash flows. Every investor would be wise to check out a company’s cash flow before investing. Every creditor, supplier, and even customers, would benefit from checking the financial health of the company they are involved in from its statement of cash flows.

When insolvent, the court is satisfied if your company is failing to pay your debts when due: this is the “cash-flow test.” Alternatively, the court is satisfied if your liabilities (including contingent and prospective ones) significantly exceed your assets: this is the “balance sheet test.” Interestingly, though, not every company prepares a specific statement of its cash flows. Not all countries require such statements (e.g., Austria, India), and the most countries that do, require cash flow statements under different forms. Here we define, derive and analyze cash flow statements as per requirements in the

United States of America.

Businesses can run out of cash for several reasons (Blayney 2002: 30; Wexler 2002):

1.

Lack of profit: the available cash has been drained away by losses.

2.

Excess non-liquid assets: too much capital (cash) has been tied in fixed assets such as plant, machinery, land, slow-moving stock, or in developing new products that did not roll out.

3.

Too much growth: the business’ transactions are expanding faster that the cash resources needed to fund them; that is, the company is overtrading or over-expanding.

4.

Too many accumulating receivables.

5.

Overspending to build market share at the expense of profit.

6.

Your company is operating at less than break-even point, and for too long.

Under all these cases, the company can lose cash-flow control. The third reason seems to occur more often in the case of turnarounds. For instance, a growth-oriented firm that has grown too fast may continue to be quite profitable while at the same time get into a severe cash flow crisis (Slatter and Lovett

1999: 2). The first reason, however, is also very plausible. The profit picture of the typical turnaround situation is several years of successively low profits culminating in a loss situation and a cash-flow crisis.

Most cash flow problems occur when big customers postpone payment or pay in notes payable or by signing mortgages payable. Waiting for their payments may be nerve-wracking. Sometimes, payments from big customers may come, if ever, just a few hours before the biweekly or monthly payroll causing much anxiety, and that could seriously impair one’s abilities to function and channel energies in much needed areas of the business.

17

Stay on top of your collections. High receivables and high inventory are trouble signs, even though the balance sheet may call them “assets.” Cash is an asset. You can buy groceries with it. However, you cannot buy groceries with your receivables and inventory. In fact, high receivables and inventories should be called liabilities, especially when they grow. Accumulating inventory or receivables is the first warning that the product or service is slipping while your income statement shows profits. Sales collected in the only true cash flow (Sutton 2002: 216). Receivables should be viewed as nothing more than test market expenses until they are paid. There is no sale assumed, no customer satisfaction believed, and no commission paid until the money arrives (Sutton 2002: 215).

Your accountants may say that your business is profitable. However, their assessment is mostly based on the profit-and-loss statement (which tracks non-cash items as well as dollars but not cash) or the balance sheet (which is a snapshot of assets and liabilities at one particular point in time – the end of the fiscal year). Making profits does not necessarily imply that your company is successful unless you generate cash or have access to cash when you need it. Irrespective of the health of the underlying business, if the operating cash flow cannot finance the debt and equity obligations, the company will remain fatally damaged. In such circumstances, the only solution is a financial restructuring. The objective of any financial restructuring is a) to restore the business to solvency on both cash-flow and balance sheet bases, b) to align the capital structure with the level of projected operating cash flow, and c) to ensure that sufficient financing in the form of existing cash and new money is available to finance the implementation of a turnaround plan (Slatter and Lovett 1999:90).

Cash flows are different from profits, yet both are required for long-term success of an enterprise.

Eroding profits may take a long time to cause a problem for a company, but a sudden decrease in cash flow will cause immediate discomfort (Caplan 2003: 28). On the other hand, sufficient cash flow could mask potentially serious organizational distress. For example, restaurants and retail shops may have a steady flow of cash collected from daily customers and may be able to pay the most pressing bills keeping creditors at bay. However, if at the same time the owners were to draw large sums of money, say for expansionary purposes, then a large accumulating debt could throttle their business.

Measures of Cash Flow Management

In accounting practice, the inventory period, the accounts receivable (A/R) period, and the accounts payable (A/P) period are measured by days in inventory, days in receivables, and days in payables , respectively.

Cash as Generated by Inventory Management

From the balance sheet and consolidated income statement in Tables 4.5 and 4.6 of XYZ Inc., a diversified manufacturing company, we may derive the following:

Average inventory during 2002-2003 = (1,045,00 + 700,000)/2 = $872,500 (1).

Inventory turnover ratio = (cost of goods sold)/(average inventory) = 2,000,000/872,500 = 2.29 (2).

The inventory cycle occurs 2.29 times a year or the days in inventory is 365/2.29 = 159.39 days (3).

Cash as Generated by Accounts Receivable Management

Assuming XYZ Inc. makes no cash sales but only credit sales we may calculate the following ratios:

Average accounts receivable = (700,000 + 560,000)/2 = $530,000 (4).

Average receivables turnover = (Net credit sales)/ (Average accounts receivable)

= 4,025,000/530,000 = 7.594 (5).

18

That is, the average A/R cycle occurs 7.594 times a year or the days in receivables is

= 365/7.594 = 48.06 (6).

Cash as Generated by Accounts Payable Management

Average accounts payable = (350,000 + 262,500)/2 = $306,250 (7).

Average payables turnover = (Cost of goods sold)/ (Average accounts payable)

= 2,000,000/306,250 = 6.531 (8).

That is, the average A/P cycle occurs 6.531 times a year or the days in payables is

= 365/6.531 = 55.89 days (9).

Thus, the operating cycle = days in inventory + days in receivables, which from equations (3) and (6), = 159.39 + 48.06 = 207.45 days (10).

The cash cycle = operating cycle – days in payables, which from equations (9) and (10)

= 207.45 – 55.89 = 151.56 days (11).

Defining Cash in Terms of other Elements of the Balance Sheet

The balance sheet equation is:

Net working capital + fixed assets = Long-term debt + stockholders’ equity (12).

Now, Net working capital = Cash + (Currents assets other than cash – current liabilities) (13).

Rearranging (13) and substituting net working capital from (12), we have:

Cash = net working capital – (current assets other than cash - current liabilities)

= long-term debt + equity – fixed assets – (current assets other than cash - current liabilities)

= long-term debt + equity – fixed assets – net working capital (excluding cash) (14).

Δ cash = Δ long-term debt + Δ equity – Δ fixed assets – Δ net working capital (excluding cash) (15).

That is, a change (Δ) in cash is a function of change in the long-term debt of the firm, change in the equity, change in fixed assets, and change in the non-cash part of the working capital.

Equations (14) and (15) imply that some of the corporate policies for increasing cash in the firm are:

1.

Increase long-term debts (such as bonds).

2.

Increase stockholders’ equity (common and preferred stock).

3.

Decrease investment in fixed assets (like land, building, machinery and office equipment).

4.

Decrease net working capital excluding cash (which means increase accounts payable, notes payable, accrued expenses payable and taxes payable and decrease accounts receivable, inventories, marketable securities and prepaid rent).

Each of these four major policies and the implied fifteen sub-policies (within brackets) can certainly help cash flow management in turnaround situations. Much would depend, however, upon the nature, size, industry, country, competition, and legal implications of your company and its offerings. For instance, what should be the optimal size of your firm’s investments in current assets such as cash, marketable securities, accounts receivable and inventories? The solution would be a function of the level of your firm’s total operating revenues. A flexible short-term financial policy would maintain a high ratio of current assets to sales, whereas a restrictive short-term policy would do the opposite: maintain a low ratio

19

of current assets to sales. Similarly, how should your firm finance its current assets? The answer is a function of your firm’s ratio of short-term debt to long-term debt. Here again, a flexible short-term financial policy would advocate less short-term debt and more long-term debt. A restrictive policy, however, would dictate otherwise.

Short-Term Financial Policies as a Function of

Carrying Costs and Shortage Costs

Any short-term financial policy has at least two sets of costs:

Carrying costs: these are costs that rise with the level of investment in current assets. For instance, a flexible short-term financial policy would keep large balances of cash and marketable securities, would maintain large inventories, and grant liberal credit terms that result in high accounts receivable. All these policies imply high carrying costs, especially opportunity costs of money and costs of maintaining the asset’s economic value.

Shortage costs: these are costs that fall with increasing investments in current assets. For instance, holding high cash balances will enable you to pay all short-term debts and liabilities without borrowing or selling marketable securities. Also, future cash flows are highest with a flexible financial policy: sales are stimulated by easy credit terms; you never run short of products and you can deliver quickly when you maintain a high finished goods inventory; and some firms could even charge higher prices for easy credit terms and quick delivery.

The opposite, however, would happen, that is, shortage costs would rise, if you decreased investments in current assets such as in maintaining low inventories of a) unfinished goods (trading and order costs would be high in this case) and b) finished goods (costs of lost sales, lost customer goodwill, disruption of production and shelving schedules would be high in this case).

Table 4.9

summarizes this argument.

Hence, in general, if carrying costs are low and shortage costs are high, the optimal policy will be a flexible one that carries high level of current assets. If carrying costs are high and shortage costs are low, then a restrictive policy of maintaining low level of current assets may be optimal.

Cash Flow Statements

Given the primary importance of cash, cash flows, and cash flow management to any business, the statement of cash flows has become one of the central financial statements. It provides a thorough explanation of the changes that occurred in the firm’s cash balances during the entire accounting period.

The statement of cash flows enables both investors and managers to keep their fingers on the pulse of any company’s lifeblood: cash. Companies that lose too much cash become critically ill or bankrupt.

Bankruptcy is loosely used to refer to companies that are unable to meet their financial obligations.

In the United States, prior to 1971, companies were required to prepare only the balance sheet and income statement. That year, a statement showing the changes in financial position between balance sheets was added. However, financial problems, mainly inflation in the 1970s and 1980s, caused many economists and accountants to call for a greater emphasis on cash management. In response, in 1987, the

Financial Accounting Standards Board (FASB) required the preparation and presentation of the statement of cash flows in its present form.

While the balance sheet shows the financial status of a company at a single point in time, the statement of cash flows and income statements show the performance of a company over a period of time.

20

Both explain why the balance sheet items have changed. The statement of cash flows explains where cash came from during a period and where it went.

The statement of cash flows reports all the cash activities (both receipts and payments) of a company during a given period. It also explains the causes for the change in cash by providing information about operating, financing, and investing activities.

Operating activities are generally activities or transactions that involve producing and selling goods and services, and they affect the income statement (e.g., sales are linked to collections from customers, and wage expenses are related to cash payments to employees).

Investing activities reflect increases and decreases in long-term assets. They involve the purchase and sales of long-term assets such as land, building, computers, software, equipment, and investments in other companies. Loans to others, and collection of loans from others, are investing activities.

Financing activities involve obtaining resources as a borrower or issuer of securities and repaying creditors and owners. These activities include issuing stock, borrowing money, buying and selling treasury stock, and paying dividends to stockholders.

Note, however, that financing and investing activities are really opposite sides of the same coin. For instance, when stock is issued for cash to an investor, the issuer treats it as a financing activity while the investor treats it as an investing activity. Financing cash flows relate to long-term liabilities and owners’ equity. Table 4.10

lists operating, investing and financing activities, their nature as inflows or outflows, and their impact on cash. The relationship of these activities to cash is fairly straightforward and obvious.

What is not always obvious is the classification of some activities as operating, investing or financing.

For instance, interest payments and dividend payments are both outflows whose impact on cash is negative, and both seem to be disbursements related to financing activities. After much debate, however, the FASB decided to classify interest payments as cash flows associated with operations and dividends payments as financing cash flows.

Table 4.10

reflects this decision. This classification maintains the long-standing distinction that dividend transactions with the owners cannot be treated as expenses, while interest payments to creditors are expenses incurred for operations (Horngren, Sundem, and Elliott 2002: 411).

According to FASB, the purpose of cash flow statements is (Harrison and Horngren 2004: 546-7):

1.

It shows the relationship of net income to changes in cash balances. For instance, cash balances can decline despite positive net income, and vice versa. Usually cash and net income move together.

High levels of income tend to lead to increases in cash, and vice versa. A company’s cash flow, however, can suffer even when net income is high.

2.

The cash flow statement reports cash flows as an aid to predict future cash flows, to evaluate the way the management generates and uses cash, and to determine a company’s ability to pay interest and dividends and to pay debts when they are due. Past cash receipts and payments are good predictors of future cash flows.

3.

It identifies changes in the mix of productive assets.

4.

It can evaluate management decisions. The statement of cash flows reports cash flows from operating activities, investing activities and financing activities. This gives investors and creditors cash flow information for evaluating management decisions.

5.

Determine the company’s ability to pay dividends to stockholders and interest and principal to creditors.

6.

The statement of cash flows can help investors and creditors predict whether the business can make these payments.

21