Corporate Capital Structure - CBA

advertisement

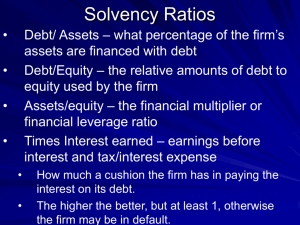

Corporate Capital Structure: Recent Research and Events Kevin Davis Commonwealth Bank Chair of Finance, University of Melbourne Director, Melbourne Centre for Financial Studies kevin.davis@melbournecentre.com.au 03 9666 1010 1 Outline • • • • • Lessons of the sub-prime crisis Thinking about Capital Structure Capital Structure Theory Capital Structure Evidence Some Current Issues and Techniques 2 Lessons of the sub-prime crisis • Capital structure matters – Potential exposure to financial distress costs • High leverage • Rollover risk • Undiversified financing • Robustness of “untested” financing innovations • Complex, opaque corporate structures – Credit risk premiums variable and important 3 Thinking about Capital Structure • Leverage (Gearing) – debt/equity – Market value or book value? – Effect on share price volatility • Interest coverage • Credit ratings and market ratings (CDS spreads) • Hybrids • Maturity • Governance and Market Discipline implications – eg infrastructure funds, market value leverage covenants 4 Capital Structure Theory • Ongoing debate – “trade-off” versus “pecking-order” • Compromise – reality? – Firms issue cheapest securities • “windows of opportunity” – undervalued equity – Firms don’t closely manage “market value” leverage – Reluctance to issue equity • Information effects and negative market response) – Consequently • Long lasting fluctuations around some “target’ • Capital structure is cumulation of past decisions • Market value leverage inversely related to recent stock price movement • Management builds up financial slack when possible 5 Some Facts • Debt ratios vary more by country than by industry – Generally in range 0.2-0.3 (of assets) – Australia has low ratio • Imputation – what is the gain to shareholders from reducing company tax? • Average debt maturity relatively low – Around 6 months internationally • Australian corporate debt market relatively small – Both long term and short term (CP) – “intermediated debt” and role of banks 6 Firm characteristics and leverage Firm Characteristic Leverage Larger Higher Growth Lower Tech sector Lower More tangible assets Higher More profitable Less Past performers Less 7 Capital Structure Management Developments • Increased importance of share buybacks – Off-market buybacks and franking credits • Rights issues versus placements and retail subscription offers • Increased use of hybrids – Evolution of converting preference share structure • Use of dividend underwriting – Maintenance of cash position with high, stable dividend rates • Future role of ratings and CDS spreads • Impact of Sons of Gwalia judgement 8 Concluding remarks • Important to understand and consider – Relative cost of equity and debt (and tax issues) – Real cost of options inherent in hybrid, innovative financing – Information effects of announcements – Organizational structure consequences and market perceptions of opportunistic financing involving subsidiaries and intra-firm linkages – Potential governance implications • Currently: high cost of capital; premium on liquidity; importance of having both bank relationships and funding flexibility 9