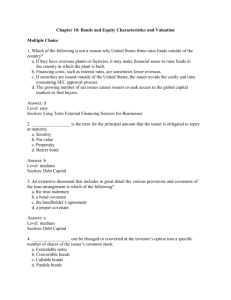

ch01_SOL B Exercise

advertisement

CHAPTER 16 SOLUTIONS TO B EXERCISES E16-1B (15–20 minutes) 1. 2. Cash ($50,000,000 X 1.02) ............................. Bonds Payable ........................................ Premium on Bonds Payable .................. 51,000,000 Unamortized Bond Issue Costs ................... Cash ........................................................ 750,000 Cash ............................................................... Bonds Payable ........................................ Premium on Bonds Payable .................. Paid-in Capital—Stock Warrants ........... 35,350,000 Value of bonds plus warrants ($35,000,000 X 1.01) Value of warrants (35,000 X $6.50) Value of bonds 3. 50,000,000 1,000,000 750,000 35,000,000 122,500 227,500 $35,350,000 227,500 $35,122,500 Debt Conversion Expense ............................ Bonds Payable .............................................. Premium on Bonds Payable ......................... Common Stock ....................................... Paid-in Capital in Excess of Par ............ Cash ........................................................ 355,000 60,000,000 155,000 600,000 59,555,000* 355,000 *[($60,000,000 + $155,000) – $600,000] Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) 16-1 E16-2B (15–20 minutes) (a) Interest Payable ($900,000 X 4/6) .......................... Interest Expense ($900,000 X 2/6) + $1,890 ............. Discount on Bonds Payable ........................... Cash ($15,000,000 X 12% ÷ 2) ......................... 600,000 301,890 1,890 900,000 Calculations: Par value Issuance price Total discount $15,000,000 14,550,000 $ 450,000 Months remaining Discount per month ($450,000 ÷ 476) Discount amortized (2 X $945) 476 $ 945 $1,890 (b) Bonds Payable ....................................................... Discount on Bonds Payable............................ Common Stock (60,000 X $1) .......................... Paid-in Capital in Excess of Par ..................... 7,500,000 221,218 60,000 7,218,782* *($7,500,000 – $221,220) – $60,000 Calculations: Discount related to 1/2 of the bonds ($450,000 X 1/2) Less: Discount amortized [($225,000 ÷ 476) X 8] Unamortized bond discount $225,000 3,782 $221,218 E16-3B (10–20 minutes) Conversion recorded at book value of the bonds: Bonds Payable ............................................................... Premium on Bonds Payable ......................................... Common Stock (5,600 X 10 X $1) .......................... Paid-in Capital in Excess of Par (Common Stock) ................................................ 16-2 Copyright © 2014 John Wiley & Sons, Inc. 5,600,000 150,000 Kieso, Intermediate Accounting, 15/e, Exercise B Solutions 56,000 5,694,000 (For Instructor Use Only) E16-4B (15–20 minutes) (a) Cash ................................................................. Bonds Payable ......................................... Premium on Bonds Payable ................... 26,500,000 (b) Bonds Payable ................................................ Premium on Bonds Payable (Schedule 1) ................................................. Common Stock, $0.50 par (Schedule 2) ......................................... Paid-in Capital in Excess of Par ............. 10,000,000 25,000,000 1,500,000 510,000 100,000 10,410,000 Schedule 1 Computation of Unamortized Premium on Bonds Converted Premium on bonds payable on July 1, 2013 ............... $1,500,000 Amortization for 2013 ($1,500,000 ÷ 10 X 6/12) ........... $ 75,000 Amortization for 2014 ($1,500,000 ÷ 10) ...................... 150,000 225,000 Premium on bonds payable on January 1, 2015......... 1,275,000 Bonds converted (10/25) .............................................. 40% Unamortized premium on bonds converted ............... $ 510,000 Schedule 2 Computation of Common Stock Resulting from Conversion Number of shares convertible on January 1, 2013: Number of bonds ($25,000,000 ÷ $1,000).................................................... 25,000 Number of shares for each bond .............................. X 10 250,000 Stock split on January 1, 2014 ...................................... X 2 Number of shares convertible after the stock split ..... 500,000 % of bonds converted ................................................... X 40% Number of shares issued .............................................. 200,000 Par value/per share ........................................................ $0.50 Total par value ............................................................... $100,000 Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) 16-3 E16-5B (10–20 minutes) Interest Expense ............................................................ Discount on Bonds Payable [$110,050 ÷ 162 = $679; $679 X 5] ..................... Cash (12% X $2,500,000 X 1/2) .............................. 153,395 Bonds Payable ............................................................... Loss on Retirement of Debt .......................................... Discount on Bonds Payable ($110,050 – $3,395) ...... Cash ........................................................................ Common Stock (1,250 X 15 X $10) ........................ Paid-in Capital in Excess of Par............................ 2,500,000 53,327** 3,395 150,000 106,655 1,250,000 187,500 1,009,172* *[$1,250,000 – ($106,655 X 1/2)] – $187,500 **[$1,250,000 – ($106,655 X 1/2)] – $1,250,000 E16-6B (25–35 minutes) (a) (b) December 31, 2013 Bond Interest Expense ............................................ Premium on Bonds Payable ($100,000 X 1/15 X 6/12) ...................................... Cash ($1,000,000 X 12% X 6/12)....................... January 1, 2014 Bonds Payable ......................................................... Premium on Bonds Payable .................................... Common Stock (400 X 4 X $5) ......................... Paid-in Capital in Excess of Par ...................... Total premium ($1,000,000 X .10) Premium amortized ($100,000 X 2/15) Balance Bonds converted ($400,000 ÷ $1,000,000) Related premium ($86,667 X 40%) 16-4 Copyright © 2014 John Wiley & Sons, Inc. 56,667 3,333 60,000 400,000 34,667 8,000 426,667 $100,000 13,333 $ 86,667 40% 34,667 Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) E16-6B (Continued) (c) May 31, 2014 Bond Interest Expense ............................................ Premium on Bonds Payable .................................... Bond Interest Payable ($400,000 X 12% X 5/12)................................ Bonds Payable ......................................................... Premium on Bonds Payable .................................... Common Stock (400 X 4 X $5) ......................... Paid-in Capital in Excess of Par ...................... 18,889 1,111 20,000 400,000 33,556 8,000 425,556 Premium as of January 1, 2014, for $400,000 of bonds $34,667 $34,667 ÷ 13 years remaining X 5/12 (1,111) Premium as of May 31, 2014, for $400,000 of bonds $33,556 (d) June 30, 2014 Bond Interest Expense ............................................ Premium on Bonds Payable .................................... Bond Interest Payable .............................................. Cash................................................................... 11,333 667** 20,000 32,000* ***Total to be paid: ($200,000 X 12% ÷ 2) + $20,000 = $32,000 ***Original premium 2012 amortization 2013 amortization Jan. 1, 2014 write-off May 31, 2014 amortization Mar. 31, 2014 write-off Premium to be amortized: $17,332/13 X 6/12 Copyright © 2014 John Wiley & Sons, Inc. $100,000 (6,667) (6,667) (34,667) (1,111) (33,556) $ 17,332 667 Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) 16-5 E16-7B (10–15 minutes) (a) Basic formulas: Value of bonds without warrants X Issue price = Value assigned to bonds Value of bonds without warrants + Value of warrants Value of warrants X Issue price = Value assigned to warrants Value of bonds without warrants + Value of warrants $775,000 $775,000 + $75,000 X $825,000 = $752,206 Value assigned to bonds $75,000 $775,000 + $75,000 X $825,000 = $72,794 Value assigned to warrants Cash .......................................................................... Discount on Bonds Payable .................................... ($850,000 – $752,206) ....................................... Bonds Payable ................................................. Paid-in Capital—Stock Warrants ..................... 825,000 97,794 850,000 72,794 (b) When the warrants are nondetachable, separate recognition is not given to the warrants. The accounting treatment parallels that given convertible debt because the debt and equity element cannot be separated. The entry if warrants were nondetachable is: Cash .......................................................................... Discount on Bonds Payable .................................... Bonds Payable ................................................. 16-6 Copyright © 2014 John Wiley & Sons, Inc. 825,000 25,000 Kieso, Intermediate Accounting, 15/e, Exercise B Solutions 850,000 (For Instructor Use Only) E16-8B (10–15 minutes) Cash ........................................................................... Unamortized Bond Issue Costs ............................... Bonds Payable (10,000 X $1,000) ..................... Premium on Bonds Payable—Schedule 1 ....... Paid-in Capital—Stock Warrants— Schedule 1 ..................................................... 10,135,000 65,000 10,000,000 125,000 75,000 Schedule 1 Premium on Bonds Payable and Value of Stock Warrants Sales price (10,000 X $1,020) .................................................... $10,200,000 Face value of bonds .................................................................. 10,000,000 200,000 Deduct value assigned to stock warrants (10,000 X 3 = 30,000; 30,000 X $2.50) ...................................... 75,000 Premium on bonds payable ...................................................... $ 125,000 E16-9B (10–15 minutes) (a) Cash ($1,000,000 X 1.05) ................................... Bonds Payable ............................................. Premium on Bonds Payable (0.02 X $1,000,000) ..................................... Paid-in Capital—Stock Warrants ................. 1,050,000 1,000,000 20,000 30,000* *$1,050,000 – ($1,000,000 X 1.02) (b) Market value of bonds without warrants ($1,000,000 X .1.02)........................................................... Market value of warrants (1,000 X $8) ............................... Total market value .............................................................. $1,020,000 X $1,050,000 = $1,041,828 $1,028,000 $8,000 X $1,050,000 = $8,172 $1,028,000 Copyright © 2014 John Wiley & Sons, Inc. $1,020,000 8,000 $1,028,000 Value assigned to bonds Value assigned to warrants Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) 16-7 E16-9B (Continued) Cash .................................................................. Bonds Payable ............................................. Premium on Bonds Payable ........................ Paid-in Capital—Stock Warrants ................ 1,050,000 1,000,000 41,828 8,172 E16-10B (15–25 minutes) 7/1/14 1/1/15 12/31/15 12/31/16 12/31/17 2/1/18 No entry on adoption of plan No entry (total compensation cost is $660,000) Compensation Expense............................. 220,000 Paid-in Capital—Stock Options................. 220,000 [To record compensation expense for 2015 (1/3 X $660,000)] Compensation Expense............................. 220,000 Paid-in Capital—Stock Options................. 220,000 [To record compensation expense for 2016 (1/3 X $660,000)] Compensation Expense............................. 220,000 Paid-in Capital—Stock Options................. 220,000 [To record compensation expense for 2017 (1/3 X $660,000)] Cash (100,000 X $66) .................................. 6,600,000 Paid-in Capital—Stock Options ................. 660,000 Common Stock (100,000 X $1) .......... 100,000 Paid-in Capital in Excess of Par ........ 7,160,000 (Note: The market price of the stock has no relevance in the prior entry and the following one.) 16-8 Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) E16-11B (15–25 minutes) 1/1/14 No entry – total compensation expense is $1,250,000 7/1/14 No entry – compensation total is now only $1,150,000 12/31/14 Compensation Expense............................. Paid-in Capital—Stock Options ($1,150,000 X 1/2)........................... 575,000 Compensation Expense............................. Paid-in Capital—Stock Options ($1,150,000 X 1/2)........................... 575,000 Cash (130,000 X $86) .................................. Paid-in Capital—Stock Options ($1,150,000 X 130,000/230,000) ................ Common Stock ................................ Paid-in Capital in Excess of Par ..... 11,180,000 12/31/15 3/31/16 575,000 575,000 650,000 130,000 11,700,000 E16-12B (15–25 minutes) 7/1/13 No entry 12/31/13 Compensation Expense............................. Paid-in Capital—Stock Options ($350,000 X 1/2 X 1/2) .................... 87,500 Compensation Expense............................. Paid-in Capital—Stock Options ......... 175,000 Compensation Expense............................. Paid-in Capital—Stock Options ......... 87,500 12/31/14 6/30/15 Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions 87,500 175,000 87,500 (For Instructor Use Only) 16-9 E16-12B (Continued) 7/1/15 Cash (35,000 X $58) ..................................... Paid-in Capital—Stock Options .................. Common Stock (35,000 X $1) .............. Paid-in Capital in Excess of Par .......... 2,030,000 245,000* 35,000 2,240,000 *($350,000 X 35,000/50,000) 6/30/17 Paid-in Capital—Stock Options .................. Paid-in Capital from Expired Stock Options ($350,000 – $245,000)......... E16-13B (10–15 minutes) 105,000 (a) 1/1/14 Unearned Compensation .......................... Common Stock (10,000 X $1) ............... Paid-in Capital Excess of Par .............. 260,000 12/31/15 Compensation Expense ............................ Unearned Compensation ($260,000 ÷ 5)....................................... 52,000 (b) 2/22/16 Common Stock .......................................... Paid-in Capital Excess of Par ................... Unearned Compensation ..................... Compensation Expense (2 X $52,000) ....................................... 105,000 10,000 250,000 52,000 10,000 250,000 156,000 104,000 E16-14B (10–15 minutes) (a) 1/1/14 Unearned Compensation ...................... Common Stock ($1 X 50,000) ........... Paid-in Capital in Excess of Par ....... 12/31/15 Compensation Expense ($1,100,000 ÷ 4) ................................... Unearned Compensation ................... (b) 8/1/17 Common Stock ...................................... Paid-in Capital in Excess of Par ........... Compensation Expense .................... Unearned Compensation .................. 16-10 Copyright © 2014 John Wiley & Sons, Inc. 1,100,000 50,000 1,050,000 275,000 275,000 50,000 1,050,000 Kieso, Intermediate Accounting, 15/e, Exercise B Solutions 825,000 275,000 (For Instructor Use Only) E16-15B (15–25 minutes) (a) 10,000,000 shares: 2012 weighted-average number of shares previously computed .............................................. Retroactive adjustment for stock split .................................. (b) 11,500,000 shares: Jan. 1, 2013–Mar. 31, 2013 (5,000,000 X 3/12) ........................ Apr. 1, 2013–Dec. 31, 2013 (6,000,000 X 9/12) ....................... Retroactive adjustment for stock split ....................... (c) 14,950,000 shares: 2013 weighted average number of shares previously computed .................................................. Retroactive adjustment for stock dividend ........................... (d) 15,600,000 shares Jan. 1, 2014–Jun. 30, 2014 (12,000,000 X 6/12) ...................... Retroactive adjustment for stock dividend ........................... Jan. 1, 2014–Jun. 30, 2014, as adjusted................................. Jul. 1, 2014–Dec. 31, 2014 (15,600,000 X 6/12) ...................... 5,000,000 X 2 10,000,000 1,250,000 4,500,000 5,750,000 X 2 11,500,000 11,500,000 X 1.30 14,950,000 6,000,000 X 1.30 7,800,000 7,800,000 15,600,000 E16-16B (10–15 minutes) (a) Event Beginning balance Issued shares Reacquired shares Stock dividend Reissued shares Stock split Dates Outstanding Shares Outstanding Jan. 1–Mar. 1 Mar. 1–Apr. 1 Apr. 1–Jul. 1 Jul. 1–Sep. 1 Sep. 1–Oct. 1 Oct. 1–Dec. 31 2,650,000 2,900,000 2,700,000 3,240,000 3,480,000 6,960,000 Restatement 1.2 X 2.0 1.2 X 2.0 1.2 X 2.0 2.0 2.0 Fraction of Year 2/12 1/12 3/12 2/12 1/12 3/12 Weighted-average number of shares outstanding (b) Earnings per share = $8,352,000 – $1,800,000 = $0.98 6,660,000 (weighted-average shares) (c) Earnings per share = $8,352,000 = $1.25 6,660,000 Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions Weighted Shares 1,060,000 580,000 1,620,000 1,080,000 580,000 1,740,000 6,660,000 (For Instructor Use Only) 16-11 E16-16B (Continued) (d) Income from continuing operationsa Loss from discontinued operationsb Net income a Net income available for common Add: Loss from discontinued operations Income from continuing operations $1.06 (0.08) $0.98 $6,552,000 500,000 $7,052,000 $7,052,000 = $1.06 6,660,000 b $(500,000) = $(0.08) 6,660,000 E16-17B (12–15 minutes) Dates Shares Event Outstanding Outstanding Beginning balance Jan. 1–Apr. 1 600,000 Reacquired shares Apr. 1–Jul. 31 585,000 Issued shares Jul. 31–Dec. 31 635,000 Weighted-average number of shares outstanding Fraction of Year 3/12 4/12 5/12 Earnings per share ($982,500/609,583)........................................... Income per share before extraordinary item ($982,500 – $300,000 = $682,500; $682,500 ÷ 609,583 shares)........................................................... Extraordinary gain per share, net of tax ($300,000 ÷ 609,583) ...................................................................... Net income per share ($982,500 ÷ 609,583) .................................... 16-12 Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions Weighted Shares 150,000 195,000 264,583 609,583 $1.61 $1.12 0.49 $1.61 (For Instructor Use Only) E16-18B (10–15 minutes) Event Dates Outstanding Shares Outstanding Beginning balance Jan. 1–Apr 1 500,000 Issued shares Apr 1–Oct. 1 1,300,000 Stock dividend Oct. 1–Dec. 31 1,820,000 Weighted-average number of shares outstanding Restatement Fraction of Year Weighted Shares 3/12 6/12 3/12 175,000 910,000 455,000 1,540,000 1.4 1.4 Net income ................................................................................. Preferred dividend (100,000 X $100 X 8%) ............................... $5,800,000 (800,000) $5,000,000 Net income applicable to common stock $5,000,000 = Weighted-average number of shares outstanding 1,540,000 = $3.25 E16-19B (20–25 minutes) Earnings per share of common stock: Income before extraordinary gain* .................................... Extraordinary gain, net of tax** .......................................... Net income***....................................................................... $2.40 0.29 $2.69 Income data: Income before extraordinary item ...................................... Deduct 6% dividend on preferred stock ............................ Common stock income before extraordinary item ........... Add extraordinary gain, net of tax ..................................... Net income available for common stockholders .............. $53,500,000 2,000,000 51,500,000 6,250,000 $57,750,000 *$51,500,000 ÷ 21,500,000 shares = $2.40 per share (income before extraordinary gain) **$6,250,000 ÷ 21,500,000 shares = $0.29 per share (extraordinary loss net of tax) ***$57,750,000 ÷ 21,500,000 shares = $2.69 per share (net income) Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) 16-13 E16-20B (10–15 minutes) Income before income tax ....................................................... Income taxes............................................................................. Net income ................................................................................ $9,862,000 3,944,800 $5,917,200 Per share of common stock: Net income*** $6.70 Dates Outstanding Shares Outstanding Fraction of Year Weighted Shares Jan. 1–Feb. 1 600,000 1/12 Feb. 1–Jun. 1 800,000 4/12 Jun. 1–Nov. 1 880,000 5/12 Nov. 1–Dec 31. 1,200,000 2/12 Weighted-average number of shares outstanding 50,000 266,667 366,666 200,000 883,333 *$5,917,200 ÷ 883,333 shares = $6.70 per share (net income) E16-21B (10–15 minutes) Event Beginning balance Issued shares Stock dividend Issued shares Dates Shares Restate- Fraction Weighted Outstanding Outstanding ment of Year Shares Jan. 1–Mar. 1 Mar. 1–Jul. 1 Jul. 1–Oct. 1 Oct. 1–Dec. 31 600,000 1,400,000 1,540,000 1,590,000 1.10 1.10 2/12 4/12 3/12 3/12 110,000 513,333 385,000 397,500 1,405,833 Net income Preferred dividend (200,000 X $100 X 6%) $2,689,000 (1,200,000) $1,489,000 Earnings per share for 2014: Net income applicable to common stock = $1,489,000 = $1.06 Weighted average number of common shares outstanding 1,405,833 16-14 Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) E16-22B (20–25 minutes) (a) Revenues ........................................................... Expenses Other than interest..................................... Bond interest (500 X $1,000 X .06) ............ Income before income taxes ............................ Income taxes (40%) ................................... Net income ......................................................... $156,500 $104,000 30,000 134,000 22,500 9,000 $ 13,500 Diluted earnings per share: $13,500 + (1 – .40)($30,000) = $31,500 = $1.05 25,000 + 5,000 30,000 (b) Revenues .............................................................. Expenses Other than interest........................................ Bond interest (500 X $1,000 X .06 X 4/12).... Income before income taxes ............................... Income taxes (40%) ...................................... Net income ............................................................ $156,500 $104,000 10,000 114,000 42,500 17,000 $ 25,500 Diluted earnings per share: $25,500 + (1 – .40)($10,000) = $31,500 = $1.18 25,000 + (5,000 X 1/3 yr.) 26,667 (c) Revenues ............................................................... Expenses Other than interest......................................... Bond interest (500 X $1,000 X .06 X 1/2)....... Bond interest (400 X $1,000 X .06 X 1/2)....... Income before income taxes ................................ Income taxes (40%) ....................................... Net income ............................................................. $156,500 $104,000 15,000 12,000 131,000 25,500 10,200 $ 15,300 Diluted earnings per share (see note): $15,300 + (1 – .40)($27,000) = $31,500 = $1.05 25,000 + (5,000 X 1/2 yr.) + 500 + (4,000 X 1/2) 30,000 Note: The answer is the same as (a). In both (a) and (c), the bonds are assumed converted for the entire year. Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) 16-15 E16-23B (15–20 minutes) (a) 1. Number of shares for basic earnings per share: Dates Outstanding Shares Outstanding Fraction of Year Jan. 1–Apr. 1 2,500,000 3/12 Apr. 1–Dec. 1 3,000,000 9/12 Weighted-average number of shares outstanding 2. Weighted Shares 625,000 2,250,000 2,875,000 Number of shares for diluted earnings per share: Dates Outstanding Shares Outstanding Fraction of Year Jan. 1–Apr. 1 2,500,000 3/12 Apr. 1–Jul. 1 3,000,000 3/12 Jul. 1–Dec. 31 3,025,000* 6/12 Weighted-average number of shares outstanding Weighted Shares 625,000 750,000 1,512,500 2,887,500 *3,000,000 + [($1,000,000 ÷ 1,000) X 25] (b) 1. 2. Earnings for basic earnings per share: After-tax net income .............................. Earnings for diluted earnings per share: After-tax net income .............................. Add back: Interest on convertible bonds (net of tax): Interest ($1,000,000 X .06 X 1/2) ..... Less: Income taxes (40%) ............. Total ........................................................ 16-16 Copyright © 2014 John Wiley & Sons, Inc. $13,600,000 $13,600,000 $30,000 12,000 Kieso, Intermediate Accounting, 15/e, Exercise B Solutions 18,000 $13,618,000 (For Instructor Use Only) E16-24B (20–25 minutes) (a) Net income for year ........................................................ Add: Adjustment for interest (net of tax) ..................... $26,860,000 525,000* $27,385,000 *Maturity value ................................................................ Stated rate ..................................................................... Cash interest ................................................................. Premium amortization [(1.00 – 1.05) X $10,000,000 X 1/20] ........................... Interest expense............................................................ 1 – tax rate (40%) ........................................................... After-tax interest ........................................................... $10,000,000 X 9% 900,000 X $ 25,000 875,000 .60 525,000 $10,000,000/$1,000 = 10,000 debentures Increase in diluted earnings per share denominator: 10,000 X 12 120,000 Earnings per share: Basic EPS Diluted EPS $26,860,000 ÷ 12,800,000 = $2.10 $27,385,000 ÷ 12,920,000 = $2.12 anti-dilutive Because diluted EPS is anti-dilutive, only the $2.10 EPS amount would be reported. (b) If the convertible security were preferred stock, basic EPS would be the same assuming there were no preferred dividends declared or the preferred was noncumulative. For diluted EPS, the numerator would be the net income amount, and the denominator would be 12,920,000. Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) 16-17 E16-25B (10–15 minutes) (a) Net income ......................................................................... Add: Interest savings (net of tax) [$2,000,000 X (1 – .30)] ................................................... Adjusted net income .......................................................... $50,000,000 ÷ $1,000 = $ 8,680,000 1,400,000 $10,080,000 50,000 bonds X 20 1,000,000 shares Diluted EPS: $10,080,000 ÷ (2,650,000 + 1,000,000) = $2.76 (b) Shares outstanding ............................................................. Add: Shares assumed to be issued (500,000* X 2) ........... Shares outstanding adjusted for dilutive securities ......... 2,650,000 1,000,000 3,650,000 *$50,000,000 ÷ $100 Diluted EPS: ($8,680,000 – $0) ÷ 3,650,000 = $2.38 Note: Preferred dividends are not deducted since preferred stock was assumed converted into common stock. E16-26B (20–25 minutes) (a) Shares assumed issued on exercise ....................................... Proceeds (25,000 X $20.50 = $512,500) Less: Treasury shares purchased ($512,500/$26) ................. Incremental shares ................................................................... Diluted EPS = Diluted 25,000 19,711 5,289 $650,000 = $7.12 (rounded) 86,000 + 5,289 16-18 Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) E16-26B (Continued) (b) Oct. 1, 2014, issue Shares assumed issued on exercise ....................................... Proceeds (10,000 X $27 = $270,000) Less: Treasury shares purchased ($270,000/$29.50) ............ Incremental shares.................................................................... Diluted EPS = Diluted 10,000 9,153 847 X 3/12 212 $650,000 = $7.10 (rounded) 86,000 + 5,289 + 212 E16-27B (10–15 minutes) (a) Because the earnings level is not being currently attained, contingent shares are not included in the computation of diluted earnings per share. (b) The contingent shares would have to be reflected in diluted earnings per share because the earnings level is currently being attained. E16-28B (15–20 minutes) (a) Dilutive The warrants are dilutive because the option price necessary to acquire one share of common stock ($30 for two warrants) is less than the average market price ($32). Proceeds from assumed exercise: (50,000 warrants/2 warrants per share X $30 exercise price) .. $750,000 Treasury shares purchasable with proceeds: ($750,000 ÷ $32 average market price).................................. 23,438 Incremental shares issued: (25,000 shares issued less 23,438 purchased)..................... 1,562 Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) 16-19 E16-28B (Continued) (b) Basic EPS = $5.10 $2,650,000 ÷ 520,000 shares (c) Diluted EPS = $5.08 $2,650,000 ÷ (520,000 shares + 1,562 shares) *E16-29B (15–25 minutes) (a) (b) (c) Exercis e Cumulative Price Cumulative Expense Current Market (250,000 Expense % Accrued to Year Year Price SARs) Recognizable Accrued Date Expense 2013 $51 $50 $ 250,000 25% $ 62,500 $ 62,500 2014 48 50 –0– 50% –0– (62,500) 2015 56 50 1,500,000 75% 1,125,000 1,125,000 2016 54 50 1,000,000 100% 1,000,000 (125,000) SAR Liability ......................................................... Compensation Expense (SAR) ................... 125,000 SAR Liability ......................................................... Cash ............................................................. 1,000,000 125,000 1,000,000 *E16-30B (15–25 minutes) (a) Exercise Cumulative Price Cumulative Expense Current Market (50,000 Expense % Accrued to Year Year Price SARs) Recognizable Accrued Date Expense 2014 $19 $20 $ –0– 33% $ –0– $ –0– 2015 23 20 150,000 67% 100,000 100,000 2016 25 20 250,000 100% 250,000 150,000 16-20 Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions (For Instructor Use Only) *E16-30B (Continued) (b) 2014 2015 2016 (c) No entry Compensation Expense (SAR) .................. SAR Liability ....................................... 100,000 Compensation Expense (SAR) .................. SAR Liability ....................................... 150,000 SAR Liability ............................................... Cash .................................................... 250,000 Copyright © 2014 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Exercise B Solutions 100,000 150,000 250,000 (For Instructor Use Only) 16-21