CHAPTER 4

advertisement

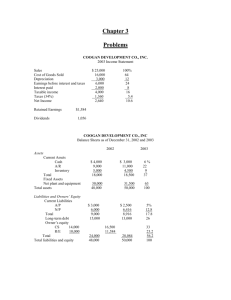

CHAPTER 4 ANALYSIS OF FINANCIAL STATEMENTS 1. A firm wants to strengthen its financial position. Which of the following actions would increase its quick ratio? a. Offer price reductions along with generous credit terms that would (1) enable the firm to sell some of its excess inventory and (2) lead to an increase in accounts receivable. b. Issue new common stock and use the proceeds to increase inventories. c. Speed up the collection of receivables and use the cash generated to increase inventories. d. Use some of its cash to purchase additional inventories. e. Issue new common stock and use the proceeds to acquire additional fixed assets. Answer: a 2. Amram Company’s current ratio is 2.0. Considered alone, which of the following actions would lower the current ratio? a. Borrow using short-term notes payable and use the proceeds to reduce accruals. b. Borrow using short-term notes payable and use the proceeds to reduce long-term debt. c. Use cash to reduce accruals. d. Use cash to reduce short-term notes payable. e. Use cash to reduce accounts payable. Answer: b A quick scan of the alternatives would indicate that b is obviously correct —it would lower the CR. Since there is only one correct answer, b must be the right answer. The following equation can also be used. If you add equal amounts to the numerator and denominator, then if Orig CR = or > 1.0, CR will decline, but if Orig CR < 1.0, CR will increase. Obviously, if you add to one but not the other, CR will increase or decrease in a predictable manner. This is the situation with choice b. CR = (Orig CA +/- ∆)/(Orig CL +/- ∆). a is false; it would leave the QR unchanged. b would obviously reduce the CR—CA remain constant and CL would increase. c is false, given that the initial CR > 1.0. d is false, given that the initial CR > 1.0. e is false, given that the initial CR > 1.0. 3. Which of the following statements is CORRECT? If a security analyst saw that a firm’s days’ sales outstanding (DSO) was higher than the industry average, and was increasing and trending still higher, this would be interpreted as a sign of strength. b. A high average DSO indicates that none of its customers are paying on time. In addition, it makes no sense to evaluate the firm's DSO with the firm's credit terms. c. There is no relationship between the days’ sales outstanding (DSO) and the average collection period (ACP). These ratios measure entirely different things. d. A reduction in accounts receivable would have no effect on the current ratio, but it would lead to an increase in the quick ratio. e. If a firm increases its sales while holding its accounts receivable constant, then, other things held constant, its days’ sales outstanding will decline. Answer: e a. 4. Which of the following statements is CORRECT? a. If one firm has a higher debt ratio than another, we can be certain that the firm with the higher debt ratio will have the lower TIE ratio, as that ratio depends entirely on the amount of debt a firm uses. b. A firm’s use of debt will have no effect on its profit margin. c. If two firms differ only in their use of debt--i.e., they have identical assets, sales, operating costs, interest rates on their debt, and tax rates--but one firm has a higher debt ratio, the firm that uses more debt will have a lower profit margin on sales and a lower return on assets. d. The debt ratio as it is generally calculated makes an adjustment for the use of assets leased under operating leases, so the debt ratios of firms that lease different percentages of their assets are still comparable. e. If two firms differ only in their use of debt--i.e., they have identical assets, sales, operating costs, and tax rates--but one firm has a higher debt ratio, the firm that uses more debt will have a higher operating margin and return on assets. Answer: c a is false, because the TIE also depends on the interest rate and EBIT. b is false, because interest affects the profit margin. c is correct, because the more interest the lower the profits, hence the lower the profit margin and ROE. d is simply incorrect. e is incorrect. Operating margin would be identical because EBIT is in the numerator and return on assets would be lower. 5. Which of the following statements is CORRECT? a. b. If Firms X and Y have the same P/E ratios, then their market-to-book ratios must also be equal. If Firms X and Y have the same net income, number of shares outstanding, and price per share, then their P/E ratios must also be the same. c. If Firms X and Y have the same earnings per share and market-to-book ratio, they must have the same price/earnings ratio. d. If Firm X’s P/E ratio exceeds that of Firm Y, then Y is likely to be less risky and/or be expected to grow at a faster rate. e. If Firms X and Y have the same net income, number of shares outstanding, and price per share, then their market-to-book ratios must also be the same. Answer: b No reason for a to be true. b must be true, as EPS and P will be equal. No reason for c to be true. Wrong, because high risk and low growth lead to low P/Es. No reason for e to be true. 6. You observe that a firm’s ROE is above the industry average, but its profit margin and debt ratio are both below the industry average. Which of the following statements is CORRECT? a. Its total assets turnover must be above the industry average. b. Its return on assets must equal the industry average. c. Its TIE ratio must be below the industry average. d. Its total assets turnover must be below the industry average. e. Its total assets turnover must equal the industry average. Answer: a Thinking through the DuPont equation, we can see that if the firm's PM and equity multiplier are below the industry average, the only way its ROE can exceed the industry average is if its total assets turnover exceeds the industry average. The following data illustrate this point: Firm Industry ROE = 30% 25% PM 9% 10% × TATO 2.0 1 × Eq. Mult. 1.67 2.50 ROA 18% 10% The above demonstrates that a is correct, and that makes d and e incorrect. Now consider the following: NI/Assets = NI/Sales × Sales/Assets ROA = PM × TATO 7. Taggart Technologies is considering issuing new common stock and using the proceeds to reduce its outstanding debt. The stock issue would have no effect on total assets, the interest rate Taggart pays, EBIT, or the tax rate. Which of the following is likely to occur if the company goes ahead with the stock issue? a. The ROA will decline. b. Taxable income will decline. c. The tax bill will increase. d. Net income will decrease. e. The times-interest-earned ratio will decrease. Answer: c MEDIUM a is false because reducing debt will lower interest, raise net income, and thus raise ROA. b is false for the above reason. c is true for the above reason. d is false The TIE will increase because interest charges will be smaller due to less debt. 8. Which of the following statements is CORRECT? a. The ratio of long-term debt to total capital is more likely to experience seasonal fluctuations than is either the DSO or the inventory turnover ratio. b. If two firms have the same ROA, the firm with the most debt can be expected to have the lower ROE. c. An increase in the DSO, other things held constant, could be expected to increase the total assets turnover ratio. d. An increase in the DSO, other things held constant, could be expected to increase the ROE. e. An increase in a firm’s debt ratio, with no changes in its sales or operating costs, could be expected to lower its profit margin. Answer: e MEDIUM a. Sales fluctuations would have more effects on the DSO and S/Inventory ratios. b. ROE = ROA × Equity multiplier, so the more debt, the higher ROE for a given ROA. c. DSO = Receivables/Sales per day. With sales constant, an increase in DSO would mean an increase in receivables, hence a decline, not a rise, in the TATO (S/TA). d. An increase in the DSO might increase or decrease ROE, depending on how it affected sales and costs. e. More debt would mean more interest, hence a lower NI, given a constant EBIT. This would lower the profit margin = NI/Sales. 9. Companies HD and LD have the same sales, tax rate, interest rate on their debt, total assets, and basic earning power. Both companies have positive net incomes. Company HD has a higher debt ratio and, therefore, a higher interest expense. Which of the following statements is CORRECT? a. Company HD pays less in taxes. b. Company HD has a lower equity multiplier. c. Company HD has a higher ROA. d. Company HD has a higher times-interest-earned (TIE) ratio. e. Company HD has more net income. a MEDIUM Under the stated conditions, HD would have more interest charges, thus lower taxable income and taxes. Thus, a is correct. All of the other statements are incorrect. 10. Which of the following statements is CORRECT? a. If a firm has high current and quick ratios, this always indicate that the firm is managing its liquidity position well. b. If a firm sold some inventory for cash and left the funds in its bank account, its current ratio would probably not change much, but its quick ratio would decline. c. If a firm sold some inventory on credit, its current ratio would probably not change much, but its quick ratio would decline. d. If a firm sold some inventory on credit as opposed to cash, there is no reason to think that either its current or quick ratio would change. e. The inventory turnover ratio and days sales outstanding (DSO) are two ratios that are used to assess how effectively a firm is managing its current assets. Answer: e 11. Which of the following statements is CORRECT? a. b. Other things held constant, the more debt a firm uses, the higher its operating margin will be. Debt management ratios show the extent to which a firm's managers are attempting to magnify returns on owners' capital through the use of financial leverage. c. Other things held constant, the more debt a firm uses, the higher its profit margin will be. d. Other things held constant, the higher a firm's debt ratio, the higher its TIE ratio will be. e. Debt management ratios show the extent to which a firm's managers are attempting to reduce risk through the use of financial leverage. The higher the debt ratio, the lower the risk. Answer: b 12. Which of the following statements is CORRECT? a. b. c. d. In general, if investors regard a company as being relatively risky and/or having relatively poor growth prospects, then it will have relatively high P/E and M/B ratios. The basic earning power ratio (BEP) reflects the earning power of a firm's assets after giving consideration to financial leverage and tax effects. The "apparent," but not necessarily the "true," financial position of a company whose sales are seasonal can change dramatically during a given year, depending on the time of year when the financial statements are constructed. The market/book (M/B) ratio tells us how much investors are willing to pay for a dollar of accounting book value. In general, investors regard companies with higher M/B ratios as being more risky and/or less likely to enjoy higher future growth. e. It is appropriate to use the fixed assets turnover ratio to appraise firms' effectiveness in managing their fixed assets if and only if all the firms being compared have the same proportion of fixed assets to total assets. Answer: c 13. Helmuth Inc's latest net income was $1,250,000, and it had 225,000 shares outstanding. The company wants to pay out 45% of its income. What dividend per share should it declare? a. $2.14 b. $2.26 c. $2.38 d. $2.50 e. $2.63 Answer: d Net income Shares outstanding Payout ratio EPS = NI/shares outstanding = DPS = EPS × Payout % = 14. Faldo Corp sells on terms that allow customers 45 days to pay for merchandise. Its sales last year were $325,000, and its year-end receivables were $60,000. If its DSO is less than the 45-day credit period, then customers are paying on time. Otherwise, they are paying late. By how much are customers paying early or late? Base your answer on this equation: DSO - Credit Period = Days early or late, and use a 365-day year when calculating the DSO. A positive answer indicates late payments, while a negative answer indicates early payments. a. 21.27 b. 22.38 c. 23.50 d. 24.68 e. 25.91 Answer: b Credit period Sales Sales/day = Sales/365 = Receivables Company DSO = Receivables/Sales per day = Company DSO − Credit Period = Days early (−) or late (+) = 15. $1,250,000 225,000 45% $5.56 $2.50 45 $325,000 $890.41 $60,000 67.38 22.38 Wie Corp's sales last year were $315,000, and its year-end total assets were $355,000. The average firm in the industry has a total assets turnover ratio (TATO) of 2.4. The firm's new CFO believes the firm has excess assets that can be sold so as to bring the TATO down to the industry average without affecting sales. By how much must the assets be reduced to bring the TATO to the industry average, holding sales constant? a. $201,934 b. $212,563 c. $223,750 d. $234,938 e. $246,684 Answer: c MEDIUM Sales Actual total assets Target TATO = Sales/Total assets = Target assets = Sales/Target TATO = $315,000 $355,000 2.40 $131,250 Asset reduction = Actual assets − Target assets = 16. A new firm is developing its business plan. It will require $615,000 of assets, and it projects $450,000 of sales and $355,000 of operating costs for the first year. Management is reasonably sure of these numbers because of contracts with its customers and suppliers. It can borrow at a rate of 7.5%, but the bank requires it to have a TIE of at least 4.0, and if the TIE falls below this level the bank will call in the loan and the firm will go bankrupt. What is the maximum debt ratio the firm can use? (Hint: Find the maximum dollars of interest, then the debt that produces that interest, and then the related debt ratio.) a. 41.94% b. 44.15% c. 46.47% d. 48.92% e. 51.49% Answer: e Assets Sales Operating costs Operating income (EBIT) Target TIE Maximum interest expense = EBIT/Target TIE Interest rate Max. debt = Max interest expense/Interest rate Maximum debt ratio = Debt/Assets 17. $615,000 $450,000 $355,000 $95,000 4.00 $23,750 7.50% $316,667 51.49% Chang Corp. has $375,000 of assets, and it uses only common equity capital (zero debt). Its sales for the last year were $595,000, and its net income was $25,000. Stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15.0%. What profit margin would the firm need in order to achieve the 15% ROE, holding everything else constant? a. 9.45% b. 9.93% c. 10.42% d. 10.94% e. 11.49% Answer: a Total assets = Equity because zero debt Sales Net income Target ROE Net income req'd to achieve target ROE = Target ROE × Equity = Profit margin needed to achieve target ROE = NI/Sales = 9.45% 18. $223,750 $375,000 $595,000 $25,000 15.00% $56,250 Brookman Inc's latest EPS was $2.75, its book value per share was $22.75, it had 3 15,000 shares outstanding, and its debt ratio was 44%. How much debt was outstanding? a. $4,586,179 b. $4,827,557 c. $5,081,639 d. $5,349,094 e. $5,630,625 Answer: e EPS BVPS Shares outstanding Debt ratio $2.75 $22.75 315,000 44.0% Total equity = Shares outstanding × BVPS = Total assets = Total equity/(1 − Debt ratio) = Total debt = Total assets − Equity = 19. Last year Harrington Inc. had sales of $325,000 and a net income of $19,000, and its year-end assets were $250,000. The firm's total-debt-to-total-assets ratio was 45.0%. Based on the DuPont equation, what was the ROE? a. 13.82% b. 14.51% c. 15.23% d. 16.00% e. 16.80% Answer: a Sales Assets Net income Debt ratio Debt = Debt % × Assets = Equity = Assets − Debt = Profit margin = NI/Sales = TATO Equity multiplier = Assets/Equity = ROE 20. $7,166,250 $12,796,875 $5,630,625 $325,000 $250,000 $19,000 45.0% $112,500 $137,500 5.85% 1.30 1.82 13.82% Last year Rennie Industries had sales of $305,000, assets of $175,000, a profit margin of 5.3%, and an equity multiplier of 1.2. The CFO believes that the company could reduce its assets by $51,000 without affecting either sales or costs. Had it reduced its assets by this amount, and had the debt ratio, sales, and costs remained constant, how much would the ROE have changed? a. 4.10% b. 4.56% c. 5.01% d. 5.52% e. 6.07% Answer: b Sales Original assets Reduction in assets New assets = Old assets − Reduction = TATO = Sales/Assets = Profit margin Equity multiplier ROE = PM × TATO × Eq. multiplier = Change in ROE 21. Old $305,000 $175,000 1.74 5.30% 1.20 11.08% New $305,000 $51,000 $124,000 2.46 5.30% 1.20 15.64% 4.56% Last year Jandik Corp. had $295,000 of assets, $18,750 of net income, and a debt-to-total-assets ratio of 37%. Now suppose the new CFO convinces the president to increase the debt ratio to 48%. Sales and total assets will not be affected, but interest expenses would increase. However, the CFO believes that better cost controls would be sufficient to offset the higher interest expense and thus keep net income unchanged. By how much would the change in the capital structure improve the ROE? a. b. 2.13% 2.35% c. 2.58% d. 2.84% e. 3.12% Answer: a Assets Old debt ratio Old debt = Assets × Old debt % = Old equity New debt ratio New debt = Assets × New debt % = New Equity = Assets − New debt = Net income New ROE = New income/New Equity Old ROE = Old income/Old Equity Increase in ROE 22. $295,000 37% $109,150 $185,850 48% $141,600 $153,400 $18,750 12.22% 10.09% 2.13% Last year Kruse Corp had $305,000 of assets, $403,000 of sales, $28,250 of net income, and a debt-to-totalassets ratio of 39%. The new CFO believes the firm has excessive fixed assets and inventory that could be sold, enabling it to reduce its total assets to $252,500. Sales, costs, and net income would not be affected, and the firm would maintain the same debt ratio (but with less total debt). By how much would the reduction in assets improve the ROE? a. 2.85% b. 3.00% c. 3.16% d. 3.31% e. 3.48% Answer: c MEDIUM Assets Sales Net income Debt ratio Debt = Assets × debt % = Equity = Assets − Debt = ROE = NI/Equity = Increase in ROE Original $305,000 $403,000 $28,250 39.00% $118,950 $186,050 15.184% New $252,500 $403,000 $28,250 39.00% $98,475 $154,025 18.341% 3.16% (The following information applies to Problems 23 through 25.) The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) Assets 2007 Cash and securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Notes payable Accruals 5,500 $ 2,500 11,500 16,000 $30,000 $20,000 $50,000 $ 9,500 7,000 Total current liabilities Long-term bonds Total debt Common stock Retained earnings Total common equity Total liabilities and equity $22,000 $15,000 $37,000 $ 2,000 11,000 $13,000 $50,000 Income Statement (Millions of $) Net sales Operating costs except depreciation Depreciation Earnings bef interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes Net income 2007 $87,500 81,813 1,531 $ 4,156 1,375 $ 2,781 973 $ 1,808 Other data: Shares outstanding (millions) Common dividends Int rate on notes payable & L-T bonds Federal plus state income tax rate Year-end stock price 500.00 $632.73 6.25% 35% $43.39 23. What is the firm's days sales outstanding? Assume a 365-day year for this calculation. a. 39.07 b. 41.13 c. 43.29 d. 45.57 e. 47.97 Answer: e DSO = Accounts receivable/(Sales/365) = 47.97 24. What is the firm's book value per share? a. $22.29 b. $23.47 c. $24.70 d. $26.00 e. $27.30 Answer: d MEDIUM BVPS = Common equity/Shares outstanding = $26.00 25. What is the firm's equity multiplier? a. 3.85 b. 4.04 c. 4.24 d. 4.45 e. 4.68 Answer: a Equity multiplier = Total assets/Common equity = 3.85