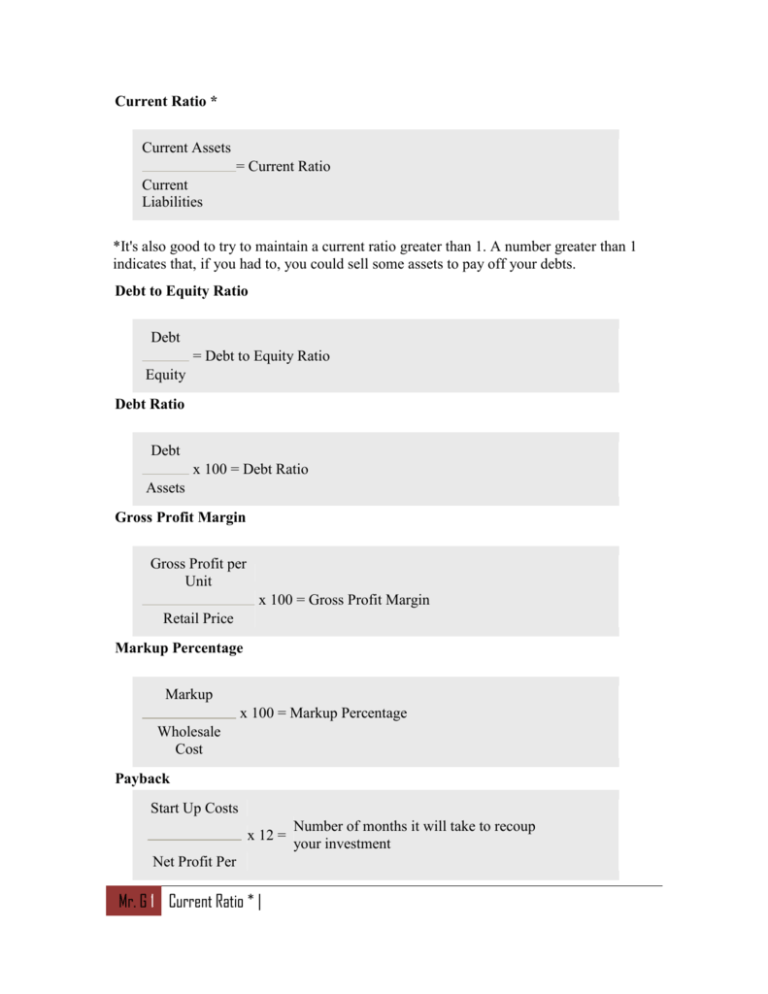

Current Ratio *

advertisement

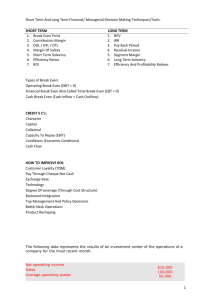

Current Ratio * Current Assets = Current Ratio Current Liabilities *It's also good to try to maintain a current ratio greater than 1. A number greater than 1 indicates that, if you had to, you could sell some assets to pay off your debts. Debt to Equity Ratio Debt = Debt to Equity Ratio Equity Debt Ratio Debt x 100 = Debt Ratio Assets Gross Profit Margin Gross Profit per Unit x 100 = Gross Profit Margin Retail Price Markup Percentage Markup x 100 = Markup Percentage Wholesale Cost Payback Start Up Costs x 12 = Net Profit Per Mr. G 1 Current Ratio * | Number of months it will take to recoup your investment Year Profit Margin Profit x 100 = Profit Margin Sales Quick Ratio (Analyze a business' liquidity, ability to convert its assets into cash) * Cash + Marketable Securities = Quick Ratio Current Liabilities *Quick ratio should always be greater than 1, this means that you have enough cash at your disposal to cover all your current short-term debts. Return On Investment (ROI) Ending Wealth - Beginning Wealth x 100 = ROI (XX%) Beginning Wealth Return on Sales (ROS) Net Profit x 100 = ROS Total Sales This figure tells investors how much profit your business is making on every dollar it brings in. Rule of 72- How many years it takes for money to double in value? * 72 = Number of years it will takes for money to double in value ROI * The ROI might be equal to the interest rate, if the money is being held in a bank. Mr. G 2 Profit Margin | Break-Even (in Units) Monthly Fixed Cost = Break-Even Units Gross Profit per Unit C = Cost P = Price M# = Magic Number P = C x M# C= P M# M# = ROI + 1 P – C x 100 C ROI = Mr. G 3 |