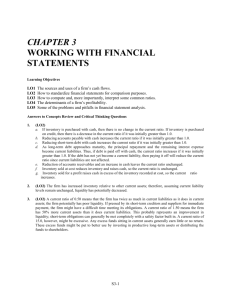

Ch3 Problems

advertisement

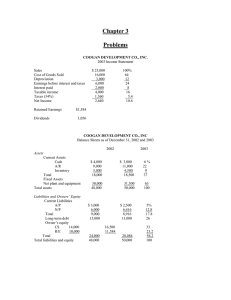

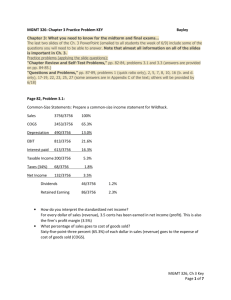

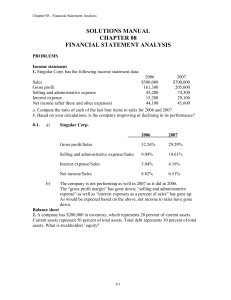

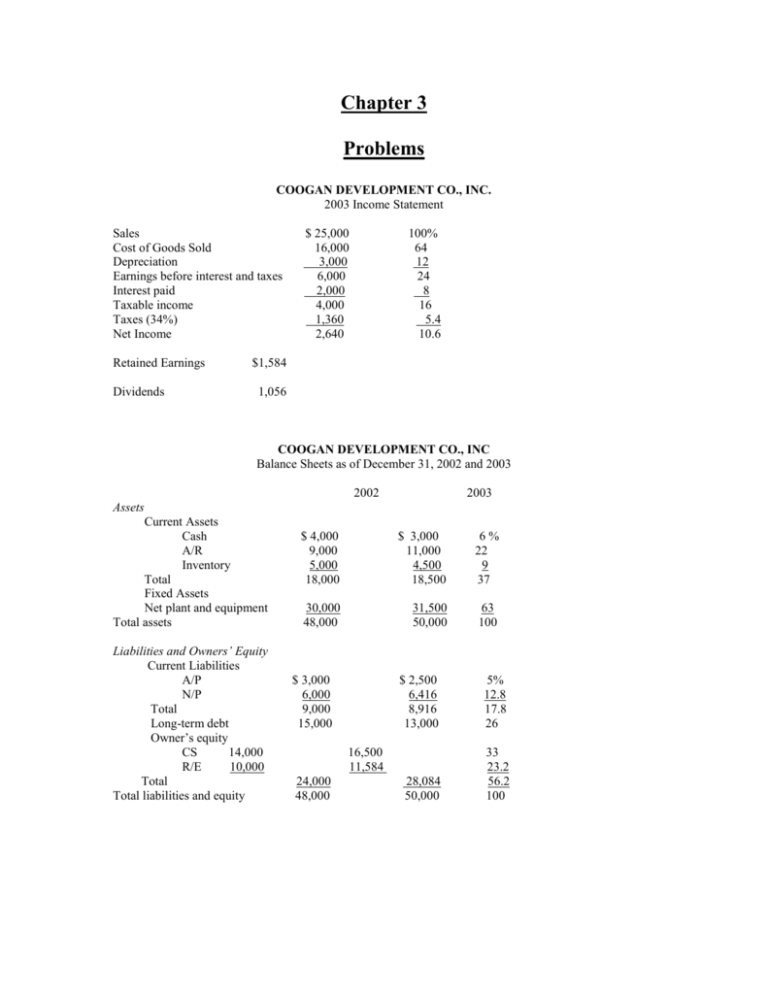

Chapter 3 Problems COOGAN DEVELOPMENT CO., INC. 2003 Income Statement Sales Cost of Goods Sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (34%) Net Income Retained Earnings Dividends $ 25,000 16,000 3,000 6,000 2,000 4,000 1,360 2,640 100% 64 12 24 8 16 5.4 10.6 $1,584 1,056 COOGAN DEVELOPMENT CO., INC Balance Sheets as of December 31, 2002 and 2003 2002 2003 Assets Current Assets Cash A/R Inventory Total Fixed Assets Net plant and equipment Total assets Liabilities and Owners’ Equity Current Liabilities A/P N/P Total Long-term debt Owner’s equity CS 14,000 R/E 10,000 Total Total liabilities and equity $ 4,000 9,000 5,000 18,000 $ 3,000 11,000 4,500 18,500 6% 22 9 37 30,000 48,000 31,500 50,000 63 100 $ 3,000 6,000 9,000 15,000 $ 2,500 6,416 8,916 13,000 5% 12.8 17.8 26 28,084 50,000 33 23.2 56.2 100 16,500 11,584 24,000 48,000 1- Compute the measures of short-term solvency (current ratio, quick ratio, and cash ratio) using the 2003 financial statement data. (2.07, 1.57, 0.34) 2- Compute the measures of long-term solvency (total debt ratio, debt/equity ratio, equity multiplier, times interest earned, and cash coverage ratio) using the 2003 financial statement data (43.83%, 78.04%, 1.78, 3.00 times, 4.50 times) 3- Compute the asset management measures (inventory turnover, days sales in inventory, receivables turnover, days sales outstanding, fixed asset turnover, and total asset turnover) using the 2003 financial statement data (3.56 times, 103 days, 2.27 times, 161 days, 0.79 times, 0.50 times) 4- Compute the profitability measures (profit margin, ROA, and ROE) using the 2003 balance sheet and income statement data. (10.56%, 5.28%, 9.4%) 5- Use the DuPont identity to compute return on equity (ROE) and return on assets (ROA) for Coogan Development (ROA = 0.1056 x 0.5 = 5.28%, ROE = 0.1056% x 1.78 = 9.4%) 6- Suppose that Coogan Development has 1,000 shares of common stock outstanding, and that the market price per share is $40. Compute EPS, the P-E ratio, and the market-to-book ratio. ($2.64, 15.15, 1.42 times) 7- Suppose the firm decides to reduce its total debt ratio to 20% from 43.38% by selling new common stock and using the proceeds to repay principal on some outstanding long-term debt. Compute each of the following: debt/equity ratio, equity multiplier, and return on equity. Also, how much equity financing will Coogan have to obtain in order to accomplish this reduction in the total debt ratio? (0.25, 1.25, 6.6%, $11,916) 8- Suppose Coogan Development increases its total debt ratio to 80% by borrowing additional long-term funds and using the proceeds to buy some of its outstanding common stock. Compute the following: debt/equity ratio, equity multiplier, and return on equity. (4.0, 5.0, 26.4%) 9- Suppose the firm decides to reduce its average collection period (ACP) to 120 days from 161 days. How much of its currently outstanding accounts receivable must be collected to accomplish this? If collected fund are held as cash, how would this affect the firm’s current and quick ratios? If the collected funds were used to repay notes payable, how would this affect the current and quick ratios? ($2,780.23, no change, no change, 2.56, 1.83)