Instruction for filling in Section “D” of the Application Form

advertisement

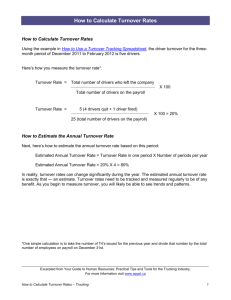

INSTRUCTION FOR FILLING IN SECTION “D” OF THE APPLICATION FORMMANDATORY DATA FOR FISCAL, SOCIAL INSURANCE, HEALTHCARE AND LABOR PURPOSES The registration of the subject in the Commercial Register constitutes the simultaneous registration with the tax administration authorities, the social and health insurance scheme and the employment inspectorate. (Law no. 97263, dated 03.05.2007 “On the National Registration Center”, Article 59). A. Initial Registration- Natural person In case of application (Initial Registration - Natural person), the applicant should delcare the mandatory data, according to the tax, social and health insurance and statistical legislation in force, based on the respective form (Article 59/2, Law no.9723/2007). Based on these declarations, the official in the service window assists the applicant when filling in the form with all the mandatory data, including Section D. When filling in Section D, at the beginning, the applicant should declare the Annual Turnover. A.1. Calculation of the Annual turnover. To calculate the Annual Turnover for the remaining months (since not all subjects are registered at the beginning of the year) is processed as following: After the declaration of the annual turnover from the applicant (the turnover determines whether the business will be classified as small business or large business), the value will be divided by 12 (the months of the year) and the value obtained will be multiplied by the remaining months, including the month of the initial application. Section D should be completed depending on this final value, as for taxes and tariffs. Example: In case the applicant, submits a registration request as a natural person on the 1-st of March of the current year at the NCR window service, and foresees to have an annual turnover of 8.000.000 ALL (will be declared as a small business), in order to determine the turnover for the remaining months of the year, should be processed as such: 8.000.000 All/12=666.666 All x3= 1.999.998 ALL. 1- If the value of the Annual Turnover declared is under 5.000.000 ALL (excluding 5.000.000 ALL), select these options from Section D: Small Business, Social and Healthcare Insurance. 2- If the value of the Annual Turnover declared various from 5.000.000 ALL to 8.000.000 All (including 8.000.000 ALL), select these options from Section D: Small Business, VAT (Value Added Tax), Social and Healthcare Insurance. 3- If the value of the Annual Turnover declared is over 8.000.000 ALL, select these options from Section D: Income Tax, VAT, (Value Added Tax), Social Security and Healthcare Insurance. 4- If the value of the Annual Turnover declared is up to 5.000.000 ALL (excluding 5.000.000 ALL) and the Applicant requests to be registered with VAT (Value Added Tax), then he should declare at the end of the application form that he requests to be registered with VAT (Value Added Tax). In this case, select these options from Section D: Small Business, VAT (Value Added Tax), Social and Healthcare Insurance. 5- For taxpayers, who provide economic based services, such as: lawyers, notaries, specialized doctor, dentist, specialized dentist, pharmacist, nurse, midwife, veterinarian, architect, engineer, physician - laboratory, designer, economist, agronomist, registered auditor, authorized accountant and assessor of property, as well as guest and hotel services, should select VAT, despite the declared annual turnover. All other taxes are subject to the declared annual turnover. A. 2 Social Insurance and Healthcare Categories - Natural Person In case the Applicant requires to be registered as: 1- Self-employed with employees, should submit: Personal Income Tax (TAP). 2- Self-employed with employees and unpaid family employees should submit: Personal Income Tax (TAP). 3- Self-employed without employees should not submit Personal Income Tax (TAP). 4- Self-employed without employees and without unpaid family employees should not submit Personal Income Tax (TAP). Attention: In the initial registration form as natural person, the box “Employer” should not be filled in. B. Initial Registration – Companies and Branch of Foreign Companies B.1. Declared Annual Turnover - The annual turnover will be calculated in the same way as for the natural person (refer to the above paragraph). B.2. Social Insurance and Healthcare Categories Attention: In the initial registration form as a Company, boxes: “Employer” and “Personal Income Tax” should always be filled in. NACE CODE Depending on the scope of the activity a NACE CODE should be checked (The Code of Economic Nomenclature) which description should match or align with the scope of the activity that will be pursued by the subject. C. The representative office of a foreign company In case of application for initial registration of a representative office of a foreign company, boxes: Social Insurance, Health Insurance, Personal Income Tax, and Employer, must be filled in.