Direct Payment

advertisement

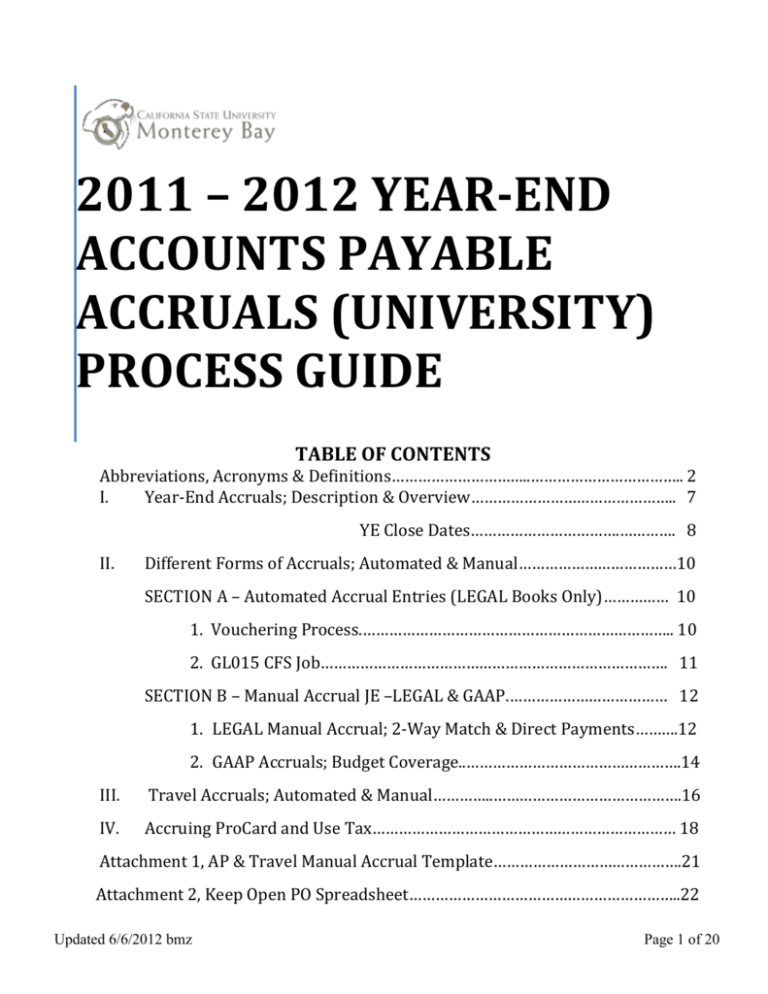

2011 – 2012 YEAR-END

ACCOUNTS PAYABLE

ACCRUALS (UNIVERSITY)

PROCESS GUIDE

TABLE OF CONTENTS

Abbreviations, Acronyms & Definitions…………………………..…………………………….. 2

I.

Year-End Accruals; Description & Overview……………………………………….. 7

YE Close Dates…………………………….…………. 8

II.

Different Forms of Accruals; Automated & Manual………………………………10

SECTION A – Automated Accrual Entries (LEGAL Books Only)…………… 10

1. Vouchering Process.…………………………………………………………….. 10

2. GL015 CFS Job……………………………………………………………………. 11

SECTION B – Manual Accrual JE –LEGAL & GAAP.……………………………… 12

1. LEGAL Manual Accrual; 2-Way Match & Direct Payments……….12

2. GAAP Accruals; Budget Coverage..………………………………………….14

III.

Travel Accruals; Automated & Manual…………..…………………………………….16

IV.

Accruing ProCard and Use Tax…………………………………………………………… 18

Attachment 1, AP & Travel Manual Accrual Template…………………………………….21

Attachment 2, Keep Open PO Spreadsheet……………………………………………………..22

Updated 6/6/2012 bmz

Page 1 of 20

FY11/12 ANNUAL ACCOUNTS PAYABLE ACCRUALS

ABBREVIATIONS, ACRONYMS & DEFINITIONS

2-Way Match Purchase Order (PO)

Requires a match between the quantity and amount on the PO and an invoice. Usually a blanket PO is used for

service contracts and does not require receiving within CFS Finance.

3-Way Match Purchase Order (PO)

Requires a match between a PO, an invoice and a receiver. The item purchased has to be received into CFS

Finance through the Receiving Department.

Account

The object of expenditure.

AP

See Accounts Payable for definition.

AP Liability

An AP liability created when the Accounts Payable Department vouchers an invoice into CFS Finance, Accounts

Payable module. This liability account number begins with a ‘2’. The liability is cleared when a check/ACH payment

is processed, completing the payment process.

Accrual

An event that is included on the accounting records regardless of whether any cash changed hands. A fiscal

recording of items pertaining to a current period which would not have appeared on the General Ledger until a future

period in the normal course of payment or receipt of the items.

Accrual Basis (Method)

A method of reporting income when it is earned and expenses when incurred, even though they may not have been

received or actually paid.

Accounts Payable

AP – List of debts currently owed i.e. services, inventory and supplies. As noted below in the accrual definition, a

purchase is recognized when it occurs, and as the payment will take place and be recorded at a later date, it is kept

track by entering the transaction into an A/P area (also known as a subledger, or in computerized terms, module).

Also a term used to refer to the accounting department area responsible for making payments.

“Actuals” Ledger

See LEGAL Ledgers for definition.

Balance Sheet

also called the statement of financial condition. This financial statement discloses the assets, liabilities, and equities

of an entity at a specified date in conformity with generally accepted accounting principles (GAAP) for governmental

accounting.

Budget

A financial plan that estimates the costs of conducting future activities.

Budget Adjustment

The act of amending the budget by moving funds.

Updated 6/6/2012 bmz

Page 2 of 20

Budget Balance Available (BBA)

The remaining amount available after allowing for all funds disbursed or obligated to be disbursed against the

budget for a particular cost center.

Capital Asset

A capital asset is defined as real or personal property that has a unit acquisition cost equal to or greater than $5,000

and an estimated life greater than one year. Note: Demolition of buildings is not considered a capital asset. See

Business and Support Services website, http://finance.csumb.edu/property-department for more information on

property.

Cash Basis Accounting

A major accounting method that recognizes revenues and expenses at the time physical cash is actually received or paid

out. CSUMB operates on a cash basis until fiscal year-end where follow generally accepted accounting principles. This

contrasts to the other major accounting method, accrual accounting, which requires income to be recognized in CSUMB’s

books (FYE June 30) at the time the revenue is earned (but not necessarily received) and records expenses when

liabilities are incurred (but not necessarily paid for).

Cash Management Operations

CMO - Department at the Chancellor’s Office responsible for oversight of systemwide cash management activities

including cash planning, forecasting, transfers to/from investments, and interagency transfers.

Cash Posting Order

CPO – Transaction notice initiated by the Cash Management Operations office to transfer cash balances between or

with CSU banking institutions and SWIFT agency accounts.

CFS

Common Finance System. Replaced CMS Finance on April 1, 2011.

Chartfield String or Chartstring

Combining a series of chartfields together creates a chartstring. A chartstring is used to define, identify, categorize

and sort a transaction. At CSUMB the chartfields commonly used in a chartstring are Fund, Account, Department,

Class Code, Program Code and Project Number.

Chart of Accounts

A list of accounts in the general ledger, systematically classified by title and number, in order to be compatible with

the organizational structure of CSUMB (Stateside), and to allow us to generate the financial report we need.

CMO

See Cash Management Operations for definition.

Commodity

Any tangible good.

Cost Center

Cost pool. A distinctly identifiable department, division, or unit within the university whose managers are

responsible for all its associated costs and for ensuring adherence to its budgets but does not necessarily generate

revenue directly.

CR

See Credit for definition.

CPO

See Cash Posting Order for definition.

Updated 6/6/2012 bmz

Page 3 of 20

Credit – CR

Entries on the right-hand side of the General Ledgers. A credit transaction decreases an asset account or an

expense, and increases a liability, equity account, or revenue account.

Current Year

CY – The current fiscal year.

Debit – DR

Entries on the left-hand side of the General Ledgers. A debit transaction increases an asset account or an expense,

and decreases a liability, equity account, or revenue account.

Deferral

In accounting deferral means to defer or to delay recognizing certain revenues or expenses on the income

statement until a later, more appropriate time. Revenues are deferred to a balance sheet liability account until they

are earned in a later period. When the revenues are earned they will be moved from the balance sheet account to

revenues on the income statement. Expenses are deferred to a balance sheet asset account until the expenses are

used up, expired, or matched with revenues. At that time they will be moved to an expense on the income

statement.

Direct Payment

Payments made straight to the actual payee, without sending it through the State Controller’s Office (SCO) to pay

the vendor directly (claimable funds only) or going through Procurement to set up a Purchase Requisition.

Examples of direct payment vouchers are Personal Reimbursements, Petty Cash Reimbursements, Payment

Requests, Travel Advances and Travel Reimbursements.

Disbursement

Payments.

Disbursement Invoices

Invoices that are paid through Accounts Payable such as direct payments and invoices associated with Purchase

Orders (3-way match POs and 2-way match POs).

DR

See Debit for definition.

Encumbrance

A firm commitment or obligation placed against funds of a department, in the form of purchase orders or

agreements, to cover a later expenditure required when goods are delivered or services are rendered.

Expenditure

Expense - An account to which payment is charged.

FIRMS

Financial Information Record Management System.

FISCAL YEAR for CSUMB

FY - Pertaining to fiscal matters. The 12-month period beginning July 1 and ending the following June 30.

FISCAL PERIOD for CSUMB

The 12-month period beginning from July 1 and ending the following June 30 (crosses two calendar years).

Fund

The source of the money you are spending.

Updated 6/6/2012 bmz

Page 4 of 20

FY

See Fiscal Year for definition.

General Ledger

GL - The general ledger is where financial information from all aspects of CSUMB's business is maintained. The

General Ledger is the heart of the accounting system. Activity to the GL is visible on the Departmental Activity

Reports.

GAAP

See Generally Accepted Accounting Principles for definition.

GAAP Ledger

Accounting records kept according to GAAP (Generally Accepted Accounting Principles). The GAAP Ledgers are

not kept in business unit MB000 and therefore, departments cannot view this activity on CFS Departmental Reports

and does not affect Departments Budget.

Generally Accepted Accounting Principles

GAAP – The basis of accounting used for preparation of financial statements. Conventions, rules, and procedures

that define accepted accounting practice, including broad guidelines as well as detailed procedures. The campuses

of the CSU maintain their financial records and reports on the legal basis of accounting which varies from GAAP. In

order to prepare financial statements in accordance with GAAP, adjustments must be made to convert from the

legal basis to the GAAP basis of accounting.

GL015

A report of goods received in CFS but not yet vouchered or paid; a CFS report generated to automatically accrue at

year-end. Also known as YAOBL (Year-End Annual Obligation).

Goods

Species of Property that is not real estate.

Invoice (disbursement ~ demand note)

A request for payment (bill) from a vendor for specific materials or supplies furnished or services rendered to the

University. Disbursement invoices are invoices that are paid through Accounts Payable such as direct payments

and invoices associated with Purchase Orders (3-way match POs and 2-way match POs).

GL

See General Ledger for definition.

JE

Journal Entry – Recording of a transaction in an accounting journal. Accounting journal – book, typically to record

accounting transactions as they occur.

LEGAL Ledgers

ACTUALS Ledgers containing period 1-12 (July-June) that includes year-end accruals. Departments can view this

activity on CFS Departmental Reports.

Liability

A debt or obligation.

PFA

Plan of Financial Adjustment – Allows agency to pay out of one appropriation and then identify costs properly

belonging to other appropriations. The State Controller transfers these expenditures from the originally charged

appropriation to the alternately charged appropriation upon request by the campus or CO (TC-36).

Updated 6/6/2012 bmz

Page 5 of 20

Prepaid Expense

A type of asset that arises on a balance sheet as a result of CSUMB making payments for goods and services to be

received in the near future. While prepaid expenses are initially recorded as assets, their value is expensed over

time as the benefit is received onto the income statement, because unlike conventional expenses, the business will

receive something of value in the near future. In short, amounts that are paid prior to the period they cover. Such

expenses can include insurance, rent, telephone bill, utilities and travel.

Prior Year

PY – The prior fiscal year.

PPY – The prior, prior fiscal year.

Purchase Order (PO)

Written sales contract between buyer and seller detailing the exact merchandise or services to be rendered from a

single vendor. It will specify payment terms, delivery dates, item identification, quantities, shipping terms and all

other obligations and conditions. Purchase orders are generally preprinted, numbered documents generated by the

buyer's financial management system which shows that purchase details have been recorded and payment will be

made.

Receipts

Cash received.

Receiver (Packing List/Slip)

Statement of the contents of a shipment, usually attached to the container so the quantity of merchandise may be

counted by the person who opens the container.

Restricted Funds

Funds, the use of which must be made in accordance with restrictions, directions, or instructions placed on them by

donors or outside entities.

Reverted Funds

Funds remaining in an appropriation at the end of the liquidation period that are automatically returned (reverted) to

the source appropriation. Reversion of funds may occur prior to the expiration period by Public Works Board action

or by legislation.

Sensitive Equipment

Sensitive property items are defined as highly desirable and portable items (e.g., computers, digital and video

camera equipment, Personal Data Assistants, televisions, VCRs, cell phones, kindles, I-pads, all similar electronic

items, etc.) It is highly recommended that departments with theft sensitive property valued less than $1,000 record

the receipt of these items. The make, model, serial number, value, vendor, should be noted and recorded in

departmental records and information furnished to the Department of Business and Support Services – Asset

Management. Items costing between $1,000 and $4,999.99 will be bar coded and tracked by Asset Management,

but will not be capitalized for accounting purposes. Any sensitive equipment that is taken home, to conferences,

etc. from the work place, requires an off campus office permit. See Business and Support Services website,

http://finance.csumb.edu/property-department for more information on property.

Vendor

An individual, partnership, or corporation that sells something or charges for a service.

Voucher

Documents a liability and provides authorization to pay the debt.

Vouchering term as used by the CSUMB Accounting Dep’t, AP has entered an invoice into CFS Finance, Accounts

Payable module.

Year End

YE – FYE (for year ending) 06/30/XXXX.

Updated 6/6/2012 bmz

Page 6 of 20

More abbreviations, acronyms & definitions are available on the Accounting website at http://finance.csumb.edu/glossary .

I. YEAR-END ACCRUALS – DESCRIPTION AND OVERVIEW

Within this guide the term ‘invoice’ is used generically and it includes personal reimbursements, payment requests and

vendor invoices/billing; direct payment and disbursement invoices. The ‘AP & Travel Manual Accrual Template’ is also

referred to as ‘Accrual Template’ within.

Expenses incurred, meaning that the goods or services have been received prior to year-end

(including Travel), are required to reflect as expense for that year. Through the voucher/payment

process an expense will reflect on the ledgers. Placing an expense in the fiscal year it incurred may

require special processing. Whenever possible, the expenses should be recorded in CFS LEGAL

books (period 1-12) prior to the close. If that is not possible, the expenses should be recorded in the

CFS GAAP ledger (period 998 also known as period 13). The instructions on how to place the

expense in the fiscal year it incurred is explained in this guide.

Accrual entries are used to record these incurred expenses. They are generally recorded as a debit to

the expense accounts with the opposing credit to Accounts Payable (AP) Liability Account (using the

full CFS chartfield string). Properly recording an accrual in the LEGAL books will help departments

avoid having to use New Year’s departmental funds to pay for Prior Year’s expenses as opposed to

the GAAP Ledgers.

Definition of an Accrual: When you hear the word accrual, try and remember the word timing! Basically accrual

means we record things as they happen, not when the cash changes hands. When an expense is incurred it is

recorded upon receipt with the date of payment being irrelevant.

The LEGAL Books, or Actuals Ledger, is represented on all of CFS Departmental Reports used by

the departments. The GAAP Ledger is not visible to the departments. It is used by the Accounting

Department for Financial Reporting purposes only. For GAAP Accruals there may be Budget

Coverage provided on MB500 funds only in the following fiscal year depending if meet eligibility

requirements. Regardless of the Fund type, all expenses where goods and services were received

by fiscal year end that has not been paid, need to be accrued in either LEGAL or GAAP prior to

closing the fiscal books.

Terminology:

The term voucher (ing) used within this Process Guide means that Accounts Payable has entered

an invoice into CFS-Finance, Accounts Payable module. By posting a voucher, the activity reflects in

the Actuals Ledgers (expenditure recorded) and offsets an AP liability in the balance sheet. Since

CSUMB pays Vendors, net 30 days, the voucher sits on the books until AP pays the invoice.

Payment of the invoice clears the AP liability and decreases Cash.

Updated 6/6/2012 bmz

Page 7 of 20

ACCRUALS MAY EITHER BE IN THE FORM OF

A. AUTOMATED ACCRUAL ENTRIES (LEGAL books only)

1. Invoice vouchered in FY11/12 by 6/30/2012 but not paid by

6/21/2012, which is the last large check run of the fiscal year.

2. Liability based on receiver which is accrued by running CFS job

GL015.

OR

B.

MANUAL ACCRUAL JOURNAL ENTRIES

1. LEGAL (Actuals Ledger)

2. GAAP (Only used by Accounting for Financial Reporting)

YE CLOSE DATES:

June 11, 2012 is the departmental deadline for approved invoices and payment requests to be

submitted and received by the Accounts Payable Department to guarantee payment by 6/21/2012.

Anything received after 6/11/2012 will be date stamped and handled in the order received. Late

submittals are not guaranteed for payment from FY11/12 funds since AP may not have time to

voucher. Depending on time restraints, AP will manually accrue into either LEGAL or GAAP ledgers.

If the GAAP deadlines are not met, then Departments risk not getting the accrual into GAAP and

possibly not receiving budget coverage.

Departments are to make sure tangible goods are received in CFS (3-way match PO) otherwise

cannot be processed by AP and will cause interruption to vouchering/paying or manually accruing.

If the June 11th deadline was not met, departments are to continue to send authorized invoices to AP

as soon as possible. As noted above, the Accounting Department will make determination on how

best to process the late arrivals upon receipt.

July 2nd from 8:00 am to 5:00 pm, departments must provide a list to AP, using the accrual

template, of expected expenses for June activities (good or services delivered on or before June 30,

2012), where an invoice from the vendor has not been received and/or has not been submitted to AP

(excluding goods received on 3-way match POs). Without meeting this deadline, the Accounting

Department cannot guarantee the posting of the requested manual accrual into the LEGAL (Actuals)

books. Send ‘AP & Travel Manual Accrual Template’ on July 2 and no sooner, if goods and services

were received by June 30th but the invoice has not been received. Departments may want to call

vendor to obtain invoice ASAP or to get the amount due to the vendor to place on the accrual

Updated 6/6/2012 bmz

Page 8 of 20

template. Otherwise the department may estimate the amount that is due but the estimate should be

close to the actual cost incurred. Do not forget to include sales tax, use tax and freight. Departments

to email this listing to AP using the ‘AP & Travel Manual Accrual Template’ (see attachment 1) with

proof goods and services have been received by 6/30/2012 (i.e. copy of packing slip). AP email

address is accounts_payable@csumb.edu. Departments to provide proof that goods or services

have been received and when received by attaching a copy of the receiver to the invoice after

tangible goods are received in CFS or any proof/verification that services have been rendered

satisfactorily such as a document stating the date service was rendered. For further instructions use

‘Departmental Receiving Requirements’ document available on the Accounting>Accounts

Payable>Procedures website at http://finance.csumb.edu/site/x5604.xml .

If the manual accrual was understated in Actuals (where amount accrued is less than actuals) then

the difference, an increase in expenditures, will be accrued in GAAP by the Accounting Department.

Departments are to notify AP when they become aware of any variances between the GL and invoice

amount.

If the manual accrual was overstated in Actuals (where amount accrued is more than actuals) then

the difference, decrease in expenditures, will be accrued in GAAP by the Accounting Department.

Departments are to notify AP when they become aware of any variance between the GL and invoice

amount.

June 29, 2012 at 2:00 p.m. is the cutoff deadline to voucher and receive into CFS. Departments to

check their CFS Departmental Reports, on July 2 (8:00 a.m. to 5:00 p.m.), to make sure that

expenditure has not already been paid or accrued (automatically or manually) by 6/30/2012 before

requesting a manual accrual.

Be careful to not duplicate an accrual by having posted into the LEGAL Books and also in

GAAP. Separate travel manual accruals from AP manual accruals (all others). Departments can

send manual accruals sooner but it is strongly recommended that Departments wait until July 2, so

that they can double check their Departmental Reports to verify the expense is not already on the

LEGAL books for FY11/12. This is to help avoid duplicate transactions.

TIMING OF ACCRUALS

June 21 @ noon

Last Large Check Run

Thru June 29 @ 2:00 pm Voucher as many invoices as possible by deadline

June 29 @ 2:31 pm

End of day cut off receiving into CFS

June 29 after 3:15 pm

Run GL015 to accrue goods rec’d on 3-way match POs

July 2 @ 5:00 pm

Cutoff LEGAL manual accrual journals from departments

July 3 – Aug 16

Updated 6/6/2012 bmz

PY expenditures paid during this time frame are recorded

as GAAP Accruals

Page 9 of 20

DIFFERENCE BETWEEN MANUAL AP ACCRUAL LISTING AND OPEN PO LISTING:

For clarification purposes: there is a difference between the AP Manual Accrual Listing that

Accounting is requesting for Monday, July 2, 2012 versus the Open Purchase Order Listing that

Procurement is requesting for June 22, 2012 from each department in order to keep Purchase Orders

from being closed on June 29. Manual accruals will not be posted unless Accounts Payable receives

the ‘AP & Travel manual Accrual Template’, and Purchase Orders (POs) will not be kept open unless

Procurement receives the completed ‘Keep Open’ purchase orders spreadsheet. These are two very

different listings, used for different purposes and processes. The ‘AP & Travel Manual Accrual

Template’ and the ‘Keep Open PO’ spreadsheet are attached for your review (Attachment 1 and 2).

They even look different.

Note: You may request that Procurement keep a specific blanket Purchase Order open by using the

‘PO Keep Open Spreadsheet.’. On this same PO you may be accruing services received against this

blanket PO by June 30 on the AP & Travel Manual Accrual template. In FY12/13 the invoice that was

accrued will be vouchered and paid against this PO that you requested to keep open otherwise

payment would not have be possible.

II. DIFFERENT FORMS OF ACCRUALS

AUTOMATED AND MANUAL

SECTION A

AUTOMATED ACCRUAL ENTRIES (LEGAL books only)

VOUCHERING PROCESS AND GL015 CFS JOB

Automated accruals occur in two (2) circumstances; 1) Vouchering Process

2) GL015 CFS Job

1.

VOUCHERING PROCESS:

Normally and automatically through the vouchering process. If an invoice is vouchered, but

the check has not been issued, the system carries the accrual. The accrual is reversed when

the check is issued, even if the dates straddle fiscal years. Thus, whenever possible, invoices

should be vouchered prior to year-end to properly account for the liability (i.e. invoices

vouchered after the check run, June 21, 2012 and until June 29, 2012 (last work day of the

fiscal year) will be accrued in this manner unless there is not enough time to process through

the vouchering process).

AP will normally only be vouchering (accruing) for services received through 6/30/2012. If

service dates straddle FY11/12 and FY12/13 on an invoice, then FY12/13 needs to be accrued

as prepaid services. FY11/12 and FY12/13 portions can be estimated. Departments can

assist by forwarding the split between the years to AP, and attach the calculations with the

invoice. For example will require a detailed telephone bill listing all phone activity; dates, times

and cost per call in order to split the activity between the two fiscal years. AP will voucher the

entire invoice but will track portion to be accrued as prepaid. A journal will be posted moving

the expense into prepaid expense (account # 107809).

Updated 6/6/2012 bmz

Page 10 of 20

Example of an automated accrual – in FY11/12 that is paid in FY12/13 (use the full CFS chartstring)

Expense

AP

Cash

________________________________

FY11/12 – AP Vouchers an Invoice

6XXXXX (Expense Account)

Debit (+)

201001 (Accounts Payable Liability Account) Credit (-)

Note the expenditure posts in FY11/12.

$100.00

($100.00)

FY12/13 – AP cuts a check in FY11/12 for the voucher entered in FY11/12

201001

(Accounts Payable Liability Account) Debit (+)

$100.00

108090

(CASH – Wells Fargo)

Credit (-)

($100.00)

Note the liability no longer exists when voucher is paid.

______________________________________

Balance:

$100.00

$0.00

($100.00)

- Payments offset encumbrances through automated process

2. GL015 CFS JOB:

If purchasing tangible goods then departments should set up a 3-way match PO, where receiving

is required, otherwise the GL015 cannot automatically accrue any receiving against this PO if not

vouchered or paid. Let the system do the work for you. Set up your PO correctly.

PO – 3- way match which requires a PO, an invoice, and a receiver that has been entered

into CFS through the Receiving Department. The PO must be created in FY11/12 by 06/21/2012.

When a receiver is recorded in CFS related to a three-way match, an accrual will be generated

at year-end for those items received on a Purchase Order (PO) but not vouchered nor paid.

The GL015 entry produces an accrual for all unpaid receivers at year-end via YAOBL

journals. GL015 process liquidates encumbrances as of 6/30/2012 in FY11/12. This accrual

entry is reversed on 7/1/2012 in FY12/13.

Tax and freight is not accrued through the GL015 process and will need to be submitted on the

accrual template if pertains and is significant in dollar amount.

EXCEPTIONS TO THE RULE due to error where automatic accrual not generated on a 3-way match PO:

i. If a three-way match PO is closed in error, it cannot be received in CFS, therefore the

department will need to notify Procurement immediately to re-open the PO. If notice PO

is closed after the GL015 job has been processed, then the department will have to

manually accrued the items received. AP will have to request Procurement to lift the

‘Receiving Requirement’.

ii. If there is an error in receiving into CFS contact the Shipping and Receiving

Department immediately to correct otherwise will not be automatically accrued through

the GL015 process. Departments will have to manually accrue if error caught after the

GL015 job is ran. Departments can view in CFS if goods have been received. Follow

the CFS quick steps on ‘CFS & Data Warehouse - Year End Resources’ available on

the Accounting website at http://finance.csumb.edu/accounts-payable.

Updated 6/6/2012 bmz

Page 11 of 20

SECTION B

MANUAL ACCRUAL JOURNAL ENTRIES

LEGAL AND GAAP

Accounts Payable will collect information to manually accrue payments for (Depts

do not place on manual accrual template; AP will process for the Depts):

Airline Tickets (BTA)

Arrowhead

Cost-Per-Click

Claims on claimable funds i.e. Capital Outlay Projects

DGS (Department of General Services Auto Rental)

Enterprise (CRBTA)

Office Max (**Send AP & Travel Accrual Template for emergency orders after May 17)

Payroll (GAAP Accrual Only except for ESF)

Procurement Card

Travel (where the RAT with travel advances have been submitted to the Travel Desk)

Utilities i.e. Central Plant requires special treatment

Unvouchered, approved Invoices sent to AP with proof of receiving

DEPARTMENTS must process all other manual accruals by sending email to AP documenting

existing liabilities (July 2) except for goods received on 3-way match POs in CFS.

**Exception is Office Max. Emergency orders after May 17 will have to be accrue on the ‘AP & Travel

Manual Accrual Template’ if not accrued by the Accounting Department.

If you know of an existing liability that Accounting should have posted by June 30, 2012 for you but it

is not reflecting in the General Ledgers, please contact Accounts Payable or the General Accounting

Manager immediately. You may have to place on the ‘AP & Travel Manual Accrual Template’ (Actual

Ledgers by 7/2/2012 and GAAP Ledgers by 8/9/2012).

1. LEGAL MANUAL ACCRUAL ( 2-WAY MATCH & DIRECT PAYMENT):

After AP stops vouchering invoices on 6/30/2012 at 2:00 pm for FY11/12, any invoices where

goods and services have been received by 06/30/2012 and the invoices have not been vouchered

into FY11/12, will be manually accrued (journal entry posted by Accounting Department) into

FY11/12 LEGAL books by Accounting Department no later than 7/3/2012.

**Office Max/Office Depot: 5/17/2012 is the last date to order supplies from Office Max for the merchant to bill

charge(s) on the last invoice of FY11/12. Please note that the order will not be billed until the order is shipped.

After May 17, refrain from placing orders unless an emergency. Departments to submit manual accrual, using

the ‘AP & Travel Manual Accrual Template’, if the emergency order is received by June 30, 2012. Verify that

the purchase has not already been expensed or accrued against your department by reviewing your CFS

Departmental Report at 8:00 a.m. on 7/2/2012. If not expensed or accrued by June 30, 2012, then submit the

manual accrual no later than 5:00 p.m. on July 2, 2012 with proof of receiving.

Updated 6/6/2012 bmz

Page 12 of 20

Listing of information required on ‘AP & Travel Manual Accrual Template’: The manual accrual

template is to be used for Travel and all other types of AP manual accruals. Separate travel accruals

from the rest by placing on a separate template (see section III on Travel Accruals). Other than travel

manual accruals, listing is to include the vendor name, description of Goods and Services, dollar

amount to be accrued (invoice amount or amount on PO for what was received by June 30 or close

estimate if invoice has not been received), purchase order number, and chart field as applicable.

Also specify if capital asset or sensitive equipment purchase (see definitions on pages 3 and 6). Also

require date goods received with proof of receiving, or contract service dates, with a copy of contract.

Listing how payment is being processed also helps AP to avoid duplication (Payment Type). See

attached sample of the ‘AP & Travel Manual Accrual Template’ (see attachment 1). Template is

either signed by the approving authority or emailed by the approving authority to AP. Departments

will email list to: accounts_payable@csumb.edu.

ADDITIONAL INFORMATION:

BUDGETARY FUNDING FOR LEGAL ACCRUALS: Besides accurately reporting the financial

results of the year and properly accruing liabilities in the LEGAL database, the accruals assist in

providing the appropriate level of budget support for the departments.

Expenses that are manually accrued at the end of the year are reversed on July 1 of the following

year in the next fiscal year. The result is a negative expense showing up in the affected department,

which results in an increase in their Budget Balance Available (BBA). Thus, when the invoices are

finally paid, the payment offsets the accrual reversal resulting in a zero net expenditure in the new

fiscal year. No Budget Office interaction is necessary to fund payments of accruals (automatic and

manual accruals in the Actual Ledgers) in the subsequent year.

Example of manual accrual (use the full CFS chartstring):

Expense

AP

Cash

BBA

________________________________________

FY11/12 – Journal Entry

6XXXXX (Expense Account)

Debit (+)

201800 (Accounts Payable Liability Account) Credit (-)

Note the expenditure posts in FY11/12.

NET BBA FY11/12

$100.00

($100.00)

FY12/13 – Reverse Journal Entry

201800

(Accounts Payable Liability Account) Debit (+)

6XXXXX (Expense Account)

Credit (-) ($100.00)

FY12/13 – Pay Vendor with Check

6XXXXX (Expense Account)

Debit (+)

108090

(Cash – Wells Fargo)

Credit (-)

Note the net effect on expenditures in FY12/13 is zero

NET BBA FY12/13

(100.00)

($100.00)

$100.00

100.00

$100.00

(100.00)

($100.00)

$0.00

_________________________________________

Balance:

Updated 6/6/2012 bmz

$100.00

$0.00

($100.00)

($100.00)

Page 13 of 20

ACTUALS ACCRUAL

TYPE

DIRECT PAYMENT

PO 2-WAY MATCH

PO 3-WAY MATCH

PO

Receiver in

CFS (Goods

& Services

received by

6/30/2012)

NO

Receiving not

required in

CFS

YES

Receiving not

required in

CFS

(Services)

YES

Receiving is

required in

CFS

INVOICE

*YES

received

by

6/30/2012

*YES

received

by

6/30/2012

NO would

be an auto

accrual if

AP has

invoice to

voucher

AUTO ACCRUAL

MANUAL ACCRUAL

*INVOICE

Vouchered not

paid by AP

Invoice not received or

submitted to AP.

Complete Template

*INVOICE

Vouchered not

paid by AP

Invoice not received or

submitted to AP.

Complete Template

Run CFS Job

(GL015) - Requires

receiver but not

invoice

PO closed in error. Did

not accrue auto.

Complete Template

In FY11/12 an encumbrance journal entry is posted by Accounting Department to decrease the

encumbrance balance for the amount of the accrual for accruals associated with a PO. This encumbrance JE

is reversed on July 1, 2012 in FY12/13.

2. GAAP ACCRUALS: Invoices that meet the criteria and should have been accrued into the

LEGAL book for FY11/12 but were not, will be recorded in the GAAP database by Accounting.

Departments will not see the GAAP accrual on their CFS Departmental Reports. Instead there

may be Budget Coverage*** provided in FY12/13 if it meets eligibility requirements.

***BUDGET COVERAGE - The Budget Office may provide additional budgetary funding in the new

fiscal year in MB500 (only) for Operating Fund expenditures that were manually accrued for GAAP

purposes. To receive funding, the accrued invoice must be paid by August 16 and if it meets

eligibility requirements. The Budget Office will provide the budget coverage subsequent to this date,

after all amounts have been verified. The Budget coverage is based on invoice amount (actual

amount paid). The Budget Department may de-allocate budget for accruals that are overstated.

GAAP ACCRUAL & BUDGET COVERAGE

NOT POSTED TO

ACTUALS

GAAP ACCRUAL

(Budget Coverage

MB500 Only)

PO

FY11/12

PO

Open

Updated 6/6/2012 bmz

RECEIVER

(Goods & Services

rec'd by 6/30/2012)

INVOICE

YES

*Approved

Invoice to

AP after

noon on

8/9/2012 up

to 8/16/2012

Page 14 of 20

*If cannot obtain invoice, but have proof goods/services received by 6/30/2012, place on “AP &

Travel Accrual Template’. Attach proof of receiving services and goods. YOU DO NOT HAVE TO

HAVE AN INVOICE IN ORDER TO ACCRUE THE ACTIVITY. YOU JUST NEED TO PROVIDE

PROOF THAT GOODS AND SERVICES HAVE BEEN RECEIVED BY 6/30/2012.

TWO DIFFERENT SCENARIOS FOR GAAP ACCRUAL AND BUDGET COVERAGE

DIRECT PAYMENT AND 2-WAY MATCH

i.) GAAP ACCRUAL & BUDGET COVERAGE –

PAYMENT REQUEST AND PERSONAL REIMBURSEMENTS (DIRECT PAYMENT)

If Goods are received and/or Services rendered by 6/30/2012, and the invoice not received and

paid by 6/30/2012 but paid by 8/16/2012, the Accounting Department will make a GAAP accrual

entry, and Budget Coverage will likely be provided through a budget transfer by the Budget Office

in FY12/13 (MB500) only if it meets eligibility requirements.

If Goods are received and/or Services rendered by 6/30/12 and the approved invoice is received

by AP between 7/3/2012 and 8/16/2012, the Accounting Department will make a GAAP accrual

entry, and Budget Coverage is likely to be provided by the Budget Office in FY12/13 for MB500

expenditures only if it meets eligibility requirements.

IMPORTANT: Departments should denote which invoices forwarded to AP in FY12/13 are to be

accrued in GAAP. This will assist AP in making the determination to accrue manually in GAAP.

ii). GAAP ACCRUAL & BUDGET COVERAGE

BLANKET PO (Purchase Order) – 2 way match which requires a PO and an invoice,

no receiver required.

The Blanket PO, no receiving required, must be created in FY11/12 by 6/21/2012. No receiver

required since only services are being rendered.

If Services rendered by 6/30/2012, and the invoice not received and paid by 6/30/2012 but paid

by 8/16/2012, the Accounting Department will make a GAAP accrual entry, and Budget Coverage

will likely be provided through a budget transfer by the Budget Office in FY12/13 (MB500 only)

only if it meets eligibility requirements.

If Services are rendered by 6/30/12 and the approved invoice is received by AP between 7/3/2012

and 8/16/2012, the Accounting Department will make a GAAP accrual entry, and Budget

Coverage is likely to be provided by the Budget Office in FY12/13 for MB500 expenditures only if it

meets eligibility requirements.

IMPORTANT: Departments should denote which invoices forwarded to AP in FY12/13 are to be

accrued in GAAP. This will assist AP in making the determination to accrue manually in GAAP.

Updated 6/6/2012 bmz

Page 15 of 20

WHAT DO I DO IFTHE ITEM WAS NOT ACCRUED IN LEGAL OR GAAP?

Budget coverage is dependent on receipt of goods and services by June 30 th. The Budget Office

has certain guidelines and restraints that they must follow. Contact the Budget Office if an item

was not accrued that meets the accrual requirements. Also let the Accounting Department know,

since unrecorded liabilities are reported to the Auditors by the Accounting Department.

WHAT ABOUT EXCEPTIONS TO THE RULES?

The Accounting Department must follow Generally Accepted Accounting Principles. There are no

exceptions to the rule according to Accounting. If you have special funding needs, then forward

your budget needs to your management, who may choose to take it forward to the Provost or

your division’s Vice-President as a one-time need from the campus reserves.

III. TRAVEL ACCRUALS

Place travel accruals on a separate ‘AP & Travel Manual Accrual Template’. Do not

mix with other types of AP accruals.

TRAVEL DEADLINES:

June 11, 2012 - Travel expense claims (TEC) for checks to be processed by June 22. This is

for travel that concluded by June 9th. Registration payment requests with payment deadlines by or

before June 30. See prepaid expense below.

Auto Accrual in LEGAL:

After June 11, 2012 continue to send TEC, where trip concluded by June 30, to the Travel

Desk. Travel accountant will accrue through vouchering into CFS.

CPO Travel Deadline:

June 11, 2012 – Deadline date to submit TEC in order to be reimbursed by CO for June 2012

travel only (Cash Posting Order {CPO} CO deadline is June 15 to be issued by July 5). Need to

use project # CHANCLOR for Travel reimbursement from the CO or other CSUs.

Travel Advance Deadline:

June 15, 2012 – Request for Approval to Travel (RAT) to Accounts Payable (advances only).

A travel advance check will be cut on June 21. Travel advances will not be processed after this

date. Travel advance check is only issued for travel commencing by June 30.

Manual Accrual in LEGAL:

July 2, 2012 - If travel concludes by June 30 but TEC not completed, submit an ‘AP & Travel

manual Accrual Template’ to manually accrue the travel expense in FY11/12. If you already

submitted a RAT for the same travel, in order for a travel advance to be processed, then do not

place on the template. Deanna will accrue the travel expense from the information on the RAT.

Be careful not to request a duplicate accrual.

Updated 6/6/2012 bmz

Page 16 of 20

If a trip straddles two years, FY11/12 and FY12/13, place the portion for FY11/12 on a

separate RAT from the FY12/13 portion of the trip (2 RATS, one trip). You will need to submit a

manual accrual for the prior year portion of the trip. Make sure you state the destination and the

date of the trip on the accrual form. Do not split airline tickets between fiscal years. Place 100%

of the airline cost on the prior year RAT. Submit one (1) TEC for the two (2) RATS after the trip

commences.

Prepaid expense – account # 107809:

If the date traveling is after 6/30/2012 it is consider FY12/13 travel. FY12/13 travel is to be

vouchered and paid in FY12/13 unless paying in FY11/12 to secure airline tickets, etc. If

vouchering or paying FY12/13 travel in FY11/12, this is recorded as prepaid travel expense in

account # 107809. In FY12/13 the prepaid journal is reversed placing the expense into the fiscal

year in which the travel occurred.

See Section IV ‘Prepayments on ProCard’ on how to handle and ‘Year-End Deferral

(University) Process Guide’ on more details on Prepaid Expenses.

Paying airfares early in order to secure economical rates, where travel commences in FY12/13, is

permissible but 100% needs to be recorded as prepaid expense. Justification is required for the

prepayment. Notify Travel Accountant of all prepaid travel since this is tracked and posted by

Accounting for year-end close.

On July 2, 2012, verify that all of your travel prepaid expenses are reflecting on your CFS

Departmental Reports. If not contact Travel Accountant.

Cancelation of trip need to notify Travel Accountant immediately so that any accruals will be

reversed. If you do not notify Travel Accountant then your departmental expenses in FY11/12 will

be overstated.

If a trip is cancelled, the traveler is also responsible for:

Cancelling or changing any travel reservations

Justification required if additional fee incurred

All refundable deposits to be returned to the university promptly

Lost refunds due to failure to act will not be reimbursed

Over accrual of travel happens when the actual expense is less than the accrued amount.

Preferably you would want to fix in LEGAL if the books are still open (up to July 2) otherwise the

variance will be recorded in GAAP. Notify Travel Accountant immediately of any variances

between accrued amount and actual amount as soon as you are aware.

Under accrual of travel happens when the actual expense is more than the accrued

amount. Preferably you would want to fix in LEGAL if the books are still open (up to July 2)

otherwise the variance will be recorded in GAAP. Notify Travel Accountant immediately of any

variances between accrued amount and actual amount as soon as you are aware.

Updated 6/6/2012 bmz

Page 17 of 20

Listing of information required on ‘AP & Travel Manual Accrual Template’:

traveler’s name

destination

date of trip

amount to accrue

how paid (payment type, i.e. BTA, CRBTA, Direct Payment (Cash), PO (2-way match or 3-way match) &

ProCard, etc.)

Template is either signed by the approving authority or emailed by the approving authority to AP.

Attach copy of TEC that has not been sent to the Travel Desk for processing if available.

GAAP:

After July 2, 2012 – Continue to forward ‘AP & Travel Manual Accrual Template’ or denote on

TEC to accrue in GAAP travel that commenced by June 30, 2012 that was not accrued in LEGAL.

IV. ACCRUING PROCARD AND USE TAX

USE TAX is assessed on tangible goods purchased from vendors that do not have a California

presence. AP can verify if a particular vendor has California presence or not.

Cash/Check Payments:

If the Department processes a manual accrual on goods that were received by June 30, 2012 from

out-of-State, then the Department must also include the use tax (budget for it), if applicable, for any

payment method used. Manual accruals should only be submitted on July 2, 2012 by the Department

for the LEGAL close. Departments are to first review their 'Departmental Report's to see if the

expense for the purchase, that they are considering to accrue manually, is not already reflecting in

the General Ledgers before submitting the manual accrual to AP for processing. If the expense is

reflecting in the General Ledgers (FYE 6/30/2012), then do not place on the manual accrual template

(the cost of the goods plus the Use Tax, if applicable). The expenditure will reflect on the LEGAL

books if the invoice has been paid or vouchered, or accrued through GL015, which is based on

receiving on 3-way match PO, or accrued manually by AP/Accounting. When AP vouchers a

payment, AP will identify and process the Use Tax at the same time, if applicable (some times this

gets missed and will need to manually accrued instead). ProCard payments are handled

differently because the supporting documentation is sent to Procurement by the Departments

not until after the ProCard billing cutoff date.

ProCard Payments:

Accruing Use Tax on ProCard Purchases after May 18:

It is the purchases through ProCard that need to be monitored very closely by Departments for Use

Tax assessment. There is almost a 2 month lag before Use Tax is identified and assessed on

ProCard purchases by Procurement/AP. Departments know firsthand if ProCard purchases they are

making are with an out-of-state vendor. Procurement and Accounting do not know this until the

support is sent to Procurement by the Departments. Departments should start tracking Use Tax for

ProCard purchases after May 18 approx. (when the May ProCard is cut off) through to June 30, 2012.

Place on the accrual template July 2, 2012 only after verifying that AP has not already accessed the

Use Tax for the ProCard activity. Only accrue the Use Tax if the expenditure for the purchase of the

goods is also reflecting in LEGAL books. The purchase and Use Tax should be posted in the same

Updated 6/6/2012 bmz

Page 18 of 20

place together, either the LEGAL books or in GAAP. If posted in GAAP, Departments will not receive

Budget Coverage for Use Tax.

ProCard cutoff is June 20:

Year-End Procurement Card Deadline: The billing cutoff date for the CSUMB ProCard is the 20th

of each month. Items must be purchased prior to June 20 and posted by the merchant to the

ProCard account by June 20 to guarantee funding from the FY11/12 budget. Cardholders will receive

an email from Procurement when the file is available for review. Last day to review ProCard chartfield

is June 26. If the deadline is missed, contact Travel desk to fix the chartstring no later than Monday,

July 2.

NEW PROCARD PROCESS for FY11/12 for ProCard purchases after June 20: As part of the

year-end process, Accounting will accrue funds for purchases charged and posted to the ProCard

between June 21 and June 28, 2012. Cardholders will receive an email from Eva Salas on June 29,

2012 to review the ProCard chartfield; otherwise AP will use the default PeopleSoft chartfield string.

Departments only have the day of the 29th to review ProCard chartfields. The activity will be uploaded

into the General Ledgers for June 30. Departments will be able to review the activity on July 2 before

processing manual accruals. Do not include any ProCard purchases on the accrual template unless

you can prove you received goods/services by 6/30/2012 but the ProCard charge was not paid or

accrued. Contact the Travel desk to fix the chartstring, if the deadline of June 29 is missed, no later

than Monday, July 2.

Departments are to accrue May and June ProCard Use Tax for out-of-state ProCard payments on

the accrual template if Use Tax does not already reflect in the General Ledgers for the ProCard

purchase. Accounting will not be accruing Use Tax for the departments since this information is not

available timely. It is up to the departments to calculate Use Tax and submit for accrual. Any charges

posted to the ProCard statement after June 30, 2012 will not be tracked and accrued by the

Accounting Department. If the ProCard Holder is going to be absent and cannot meet these

deadlines, then please assign someone to submit your reports in your absence. That person must

also request training and access to CFS ProCard. If the Approving Official will be absent or

unavailable, identify and obtain approval from another official authorized to approve expenses

for your department.

Prepayments on ProCard:

Departments need to be tracking prepaid expenses in ProCard for May and June because of the two

month lag before Accounting will be able to identify. Departments can email the Travel Accountant

for prepaid travel, registration (account # 660832 no training aspect and account # 660009 including

training), memberships (account # 660804) and subscriptions (account # 660804), and email

Accounts Payable on the other types of prepaid expenses that were paid by ProCard. Otherwise

Departments can wait until July 2, 2012 when AP will send out the ‘Prepaid EXCEL Spreadsheet’ for

verification to provide this information to include on the spreadsheet. Depending on the type of

activity, it will either be posted into LEGAL or GAAP.

After July 2, AP will continue to track prepaid expenses for GAAP. On August 9, 2012 a final

‘Prepaid Excel Spreadsheet’ will be sent to the Departments to verify the prepaid expenses that will

be posted into GAAP only since LEGAL is closed. This is an opportunity to identify what prepaid

expenses were not posted into LEGAL.

Updated 6/6/2012 bmz

Page 19 of 20

Justification Requirements on Processing Prepayments:

Prepayments must be justified demonstrating a significant cost benefit to the campus in prepaying,

etc. Prepayments usually have to be pre-approved by Procurement since they are contractual and

represent a commitment on behalf of the university. Exceptions include travel registration,

memberships and some types of subscriptions (only those subscriptions posted to account # 660804

named ‘membership and subscription’) since they are contractual and represent a commitment on

behalf of the university.

Updated 6/6/2012 bmz

Page 20 of 20