AD322

advertisement

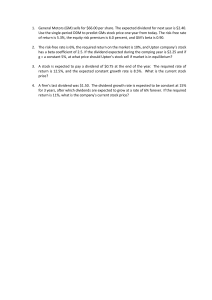

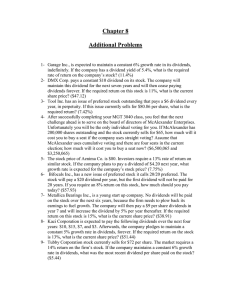

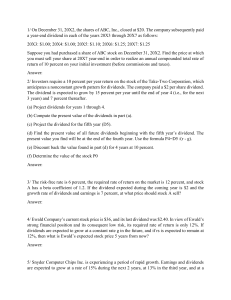

AD 322 Managerial Finance II Randy Nelson 238 Miller Library e-mail: ranelson Phone: 3567 Office Hours: MWF: 1:00 - 4:00 Required Texts Fundamentals of Corporate Finance (5th edition) by Ross, Westerfield, and Jordan A Random Walk Down Wallstreet (6th edition) by Burton Malkiel Recommended Texts: Student Problem Manual for Use with Fundamentals of Corporate Finance (5th Edition), by Tom Eyssell. This is the second course in a two course sequence designed to provide students with an introduction to the field of corporate finance. The primary goal is to acquaint students with many of the problems faced by financial managers, and to develop the tools necessary to solve these problems. The only prerequisite for the course is AD 311, or an equivalent introductory course in Managerial or Corporate Finance. Your grade in the course will be determined by your performance three exams, to be given at roughly equal intervals throughout the semester, and class participation, which will count for 15% of your final grade. You are expected to have read the material before coming to class, and to be prepared to discuss it. Anyone failing to take an exam at the scheduled time will receive an F for the test unless you notify me in advance of your absence. You are strongly encouraged to do all of the problems in the back of the assigned chapters to prepare for the exams. Subscribing to the Wall Street Journal is recommended, but not required. Student subscriptions are available at reduced rates. The Journal provides daily examples of the topics we will cover in class. In addition, reading the Journal is an excellent way to provide for job interviews. Course Outline I. Continuation of Capital Budgeting Chapter 10 - Making Capital Investment Decisions, pp. 278-282, 298-307 Chapter 11 – Project Analysis and Evaluation “Break-Even Analysis for Lockheed’s TriStar: An Application of Financial Theory,” U. Reinhardt, Journal of Finance, (September 1973) pp. 821-838. II. Cost of Capital and Long-Term Financial Policy Chapter 14 - Cost of Capital Chapter 16 - Financial Leverage and Capital Structure Policy “The Capital Structure Puzzle: Another Look at the Evidence,” M. Bradley and C. Smith, Journal of Applied Corporate Finance (Spring 1999), pp. 8-20. “The Benefits of High Leverage: Lessons from Kroger’s Leveraged Recap and Safeway’s LBO”, D. Denis, Journal of Applied Corporate Finance,” (Winter 1995) pp. 20-37. "Estimating the Tax Benefits of Debt," J. Graham, Journal of Applied Corporate Finance, (Spring, 2001), pp. 42-54. Chapter 15 – Raising Capital “The Market’s Problem with Initial Public Offerings,” R. Ibbotson, J. Sindelar, and J. Ritter, Journal of Applied Corporate Finance, (Spring 1994) pp. 66-74. “Raising Capital: Theory and Evidence,” C. Smith, Midland Corporate Finance Journal, (1986), pp. 178-187. Chapter 17 - Dividends and Dividend Policy “The Dividend Cut ‘Heard Round the World’: The Case of FPL,” D. Soter, E. Brigham, and P. Evanson, Journal of Applied Corporate Finance,” (Spring, 1996), pp. 4-15. "Disappearing Dividends: Changing Firm Characteristics or Lower Propensity to Pay?" Journal of Applied Corporate Finance,” E. Fama and K. French, (Spring, 2001), pp. 6779. "What do We Know About Stock Repurchases?", G. Gustavo and D. Ikenberry, Journal of Applied Corporate Finance (Spring, 2000), pp. 31-51. III. International Considerations Chapter 25 - International Corporate Finance IV. Risk Management Chapter 21 - Risk Management: An Introduction to Financial Engineering Chapter 22 - Options and Corporate Securities Chapter 11 in Random Walk Down Wall Street: How Pork Bellies Acquired an Ivy League Suit: A Primer on Derivatives (including appendix), pp. 277-314.