Analysis of Financial Statements PPT

advertisement

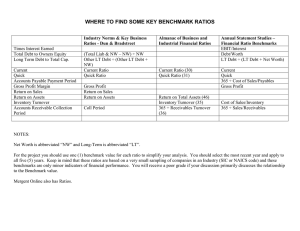

Analysis of Financial Statements Financial analysis is designed to determine the relative strengths and weaknesses of a company Investors need this information to estimate both future cash flows from the company and the riskiness of those cash flows Information is provided by analysis both to evaluate a company’s past performance and to map future plans Overview Financial statement analysis involves a study of the relationships between income statement and balance sheet accounts, how these relationships change over time (trend analysis), and how a particular company compares with other companies in its industry (comparative ratio analysis) Financial Statements Are used to help predict the company’s future earnings and dividends Financial Ratios Financial ratios are designed to show relationships between financial statement accounts Liquidity Ratios Are used to measure a firm’s ability to meet its current obligations as they come due Current Ratio Quick, or Acid Test, Ratio Current Ratio Measures the extent to which the claims of short-term creditors are covered by short-term assets It is determined by dividing current assets by current liabilities Quick, or Acid Test, Ratio Is calculated by deducting inventory from current assets and then dividing the remainder by current liabilities Inventory is excluded because it may be difficult to liquidate it at full book value Asset Management Ratios Measure how effectively a firm is managing its assets and whether or not the level of those assets is properly related to the level of operations as measured by sales Inventory Turnover Ratio Days Sales Outstanding (DSO) Fixed Assets Turnover Ratio Total Assets Turnover Ratio Inventory Turnover Ratio Is defined as sales divided by inventory It is often necessary to use the average inventory figure rather than the year-end figure, especially if a firm’s business is highly seasonal Days Sales Outstanding (DSO) Is used to appraise accounts receivable, and it is calculated by dividing average daily sales into accounts receivable to find the number of days’ sales tied up in receivables DSO represents the average length of time that a company must wait after making a sale before receiving cash Fixed Assets Turnover Ratio Is the ratio of sales to net fixed assets It measures how effectively the firm uses its plant and equipment Total Assets Turnover Ratio Is calculated by dividing sales by total assets It measures the utilization of all the firm’s assets Debt Management Ratios Measure the extent to which the firm is using debt financing, or financial leverage, and the degree of safety afforded to creditors Debt Ratio Times-Interest-Earned (TIE) Ratio Fixed Charge Coverage Ratio Debt Ratio Or ratio of total debt to total assets, measures the proportion of funds provided by creditors The lower the ratio, the greater the protection afforded creditors in the event of liquidation Times-Interest-Earned (TIE) Is determined by dividing earnings before interest and taxes (EBIT) by the interest charges The TIE measures the extent to which operating income can decline before the company is unable to meet its annual interest costs Fixed Charge Coverage Ratio Is similar to the TIE ratio, but it is more inclusive because it recognizes that many companies lease assets and incur long-term obligations under lease contracts and sinking funds. Review Financial Analysis Financial Statements Financial Ratios Liquidity Ratios Asset Management Ratios Debt Management Ratios Time to Answer a Few Questions