Estimation of Intel Stock Using Moving Average

advertisement

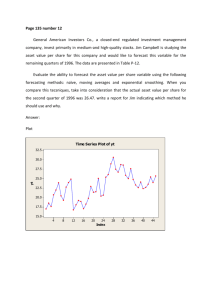

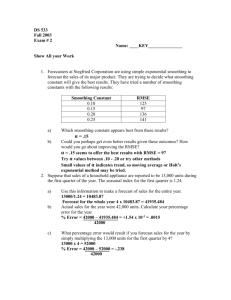

Estimation of Intel Stock Using Moving Average and Exponential Smoothing Techniques I collected the monthly adjusted closing prices for Intel Corporation (INTC) stocks for the sixty-month period January 1, 2005 to December 31, 2009. The close price obtained from the website http://finance.yahoo.com is adjusted for dividends and splits. In this report I will produce an estimated stock price for January 2010 using moving average and exponential smoothing techniques. Table 1 summarizes the adjusted closing prices for Intel stocks over the sixty-month period. Graph 1 displays the stock prices over the sixty-month period. Table 1. Summary Measures for Intel Corporation's Adjusted Closing Stock Prices, January 2005 - December 2009 Mean 19.5388 Standard Deviation 3.10985 Sample Variance 9.67115 Range 12.67 Minimum 12.35 Maximum 25.02 Source: http://finance.yahoo.com Graph 1. Scatter Plot of Intel's Stock Price 30 25 20 Stock Price 15 ($) Adj Close 10 5 0 1/14/2004 5/28/2005 10/10/2006 2/22/2008 7/6/2009 11/18/2010 Time: Jan. 2005 - December 2009 I calculated an estimated stock price for January 2010 using moving average as well as exponential smoothing techniques with a smoothing constant of 0.2 and 0.8. I also calculated the mean square error (MSE) and the mean absolute deviation (MAD) under both techniques to forecast the most reliable estimate. Both exponential smoothing techniques produced a more reliable estimate of the stock price than the moving average method. This was determined because the exponential smoothing methods produced a lower MSE and MAD than the moving average method. In addition, the smoothing constant of 0.8 produced a lower MSE and MAD than a constant of 0.2 and therefore forecasted a more precise estimate of the stock price. Table 2 shows each time series analysis method and their corresponding MSE, MAD, and stock price estimate values. Table 2. Time Series Data Using Moving Average and Exponential Smoothing Methods Moving Average 11.57 2.88 MSE MAD Stock Price Estimate Exponential Smoothing, α = 0.2 6.35 2.04 $16.86 $18.42 Exponential Smoothing, α = 0.8 2.66 1.29 $20.00 Conclusively, the exponential smoothing method with a smoothing constant of 0.8 forecasted an adjusted closing stock price of $20.00 (compared to a $16.86 estimate using a moving average and an $18.42 estimate using exponential smoothing with a smoothing constant of 0.2). This was the closest estimate to the actual adjusted closing stock price of Intel’s stock for January 2010 of $19.25.