Exponential Smoothing Model

advertisement

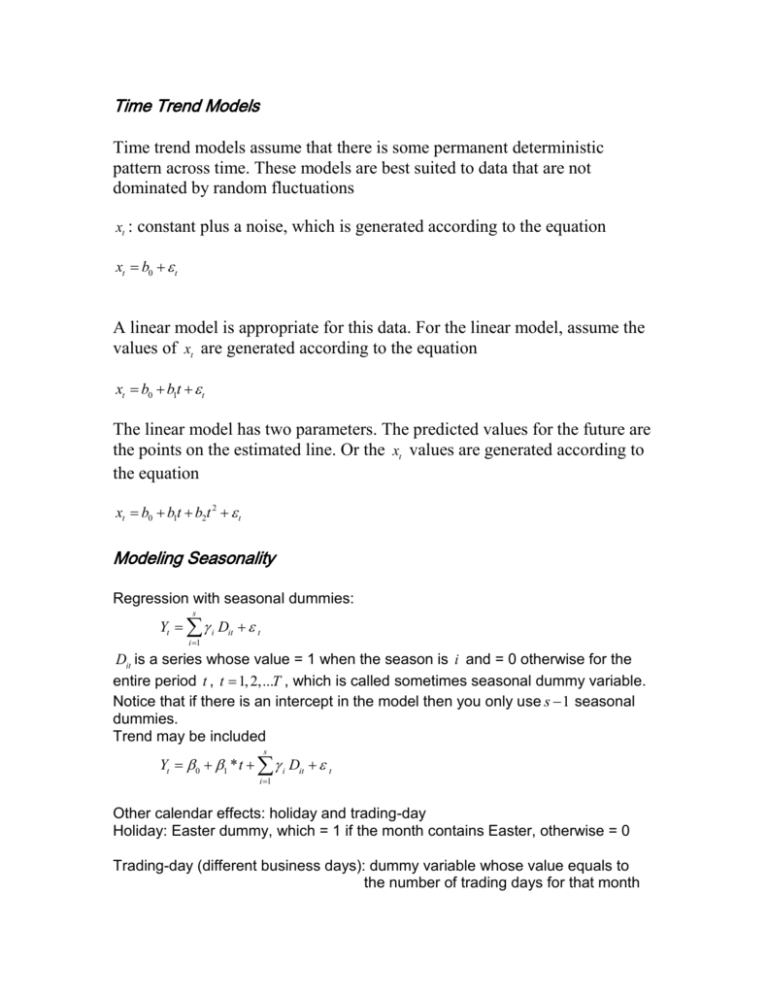

Time Trend Models

Time trend models assume that there is some permanent deterministic

pattern across time. These models are best suited to data that are not

dominated by random fluctuations

xt : constant plus a noise, which is generated according to the equation

xt b0 t

A linear model is appropriate for this data. For the linear model, assume the

values of xt are generated according to the equation

xt b0 b1t t

The linear model has two parameters. The predicted values for the future are

the points on the estimated line. Or the xt values are generated according to

the equation

xt b0 b1t b2t 2 t

Modeling Seasonality

Regression with seasonal dummies:

s

Yt i Dit t

i 1

Dit is a series whose value = 1 when the season is i and = 0 otherwise for the

entire period t , t 1, 2,...T , which is called sometimes seasonal dummy variable.

Notice that if there is an intercept in the model then you only use s 1 seasonal

dummies.

Trend may be included

s

Yt 0 1 * t i Dit t

i 1

Other calendar effects: holiday and trading-day

Holiday: Easter dummy, which = 1 if the month contains Easter, otherwise = 0

Trading-day (different business days): dummy variable whose value equals to

the number of trading days for that month

Forecasting future values using the regression model.

Use SAS to show the data generating process and estimation.

SAS Program

data a;

retain date '01dec1990'd;

do i = 1 to 100;

date=intnx('month',date,1);

month=month(date);

year=year(date);

e1=rannor(1283) ;

if month=12 then do;

x=10+6+e1;

end;

else if month=1 then do;

x=10-5.5+e1;

end;

else do;

x=10+e1;

end;

output;

end;

run;

proc print;

id i year month;

var x;

run;

%macro PLOT(var,data);

goptions reset=global htitle=.5;

symbol1 interpol=join value=dot height=.1;

axis1 label=none;

axis2 label=none;

title1 "&var";

proc gplot data=&data;

plot &var*date/

haxis=axis1 vaxis=axis2;

run;

quit;

%mend;run;

%plot(x,a);

data b;

set a;

if month=12 then dum12=1;else dum12=0;

if month=1 then dum1=1;else dum1=0;

proc model;

endo x;

x=b0+b1*i+d1*dum1+d12*dum12;

fit;

run;

quit;

Exponential Smoothing Model

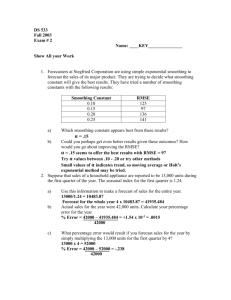

Exponential smoothing fits a time trend model using a smoothing scheme in

which the weights decline geometrically as you go backward in time. The

forecasts from exponential smoothing are a time trend, but the trend is based

mostly on the recent observations instead of on all the observations equally.

How well exponential smoothing works as a forecasting method depends on

choosing a good smoothing weight for the series.

Suppose X t is actual observations and Yt is smoothed series, t 1, 2,...n .

Assume:

Yt X t (1 ) X t 1 (1 )2 X t 2 (1 )3 X t 3 ....

(1)

where 0 1.

Notice that (1 ) (1 )2 .... 1

To see that, let (1 ) then

1 2 3 ....

1

1

1

1 1 (1 )

Since equation (1) is true for all t , it should hold true for t 1 .

Yt 1 X t 1 (1 ) X t 2 (1 )2 X t 3 ....

(2)

Multiplying (2) by (1 ) , we have

(1 )Yt 1 (1 ) X t 1 (1 )2 X t 2 ....

(3)

Subtracting equation (3) from (1) we have

Yt (1 )Yt 1 xt

or

Yt Xt (1 )Yt 1

(4)

How to choose ?

Define

et X t Yt 1 and S et2

t 3

should be chosen such that S is minimum.

It will yield constant forecasts for all future value of a time series, which is Yt .

(Excel Example)

Holt’s Linear Trend Algorithm

Yt ( X t ) (1 )(Yt 1 Tt 1 )

Tt (Yt Yt 1 ) (1 )Tt 1

0 1

0 1

Yt and Tt are estimates of level and increment at time t , and , are smoothing

constants.

How does it work?

At time t 1 , the latest estimates of level and slope are Yt 1 and Tt 1 a

new level Yt based on (Yt 1 Tt 1 ) for time t .

and are chosen to minimize one step ahead forecast errors.

(Excel Example)

Holt-Winters Algorithm for Seasonal Time Series

Yt , Tt and Ft are estimates of level, increment and season factor at time t , and

, and are smoothing constants.

Additive

Yt ( X t Ft S ) (1 )(Yt 1 Tt 1 )

0 1

Tt (Yt Yt 1 ) (1 )Tt 1

0 1

0 1

Ft ( X t Yt ) (1 )Ft S

If X t is monthly, S=12; if quarterly, S=4.

Multiplicative

Yt

Yt

(1 )(Yt 1 Tt 1 )

Ft s

Tt (Yt Yt 1 ) (1 )Tt 1

Xt

(1 )Ft S

Yt

(Excel Example)

Ft