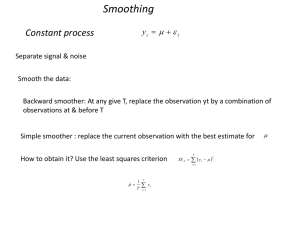

Average

advertisement

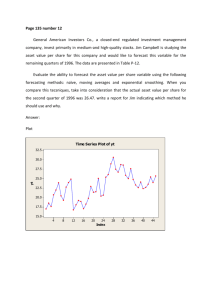

Dr. Ron Lembke All-Time Average To forecast next period, take the average of all previous periods Advantages: Simple to use Disadvantages: Ends up with a lot of data Gives equal importance to very old data 4/7/2009 Opening day 2010 Farm Angels: Ty 1.000 (first 6 at-bats) MLB-Long-Run More Representative Best season-ending (or to date) averages, active MLB players MLB nothing changes over time. We want increasing sales 2010 Farm Angels: Noah 0.823, Ty 0.767, Aidan 0.531 Moving Average Compute forecast using n most recent periods Jan Feb Mar Apr May Jun Jul 3 month Moving Avg: June forecast: FJun = (AMar + AApr + AMay)/3 If no seasonality, freedom to choose n If seasonality is N periods, must use N, 2N, 3N etc. number of periods Moving Average Advantages: ▫ ▫ ▫ Ignores data that is “too” old Requires less data than simple average More responsive than simple average Disadvantages: ▫ ▫ ▫ Still lacks behind trend like simple average, (though not as badly) The larger n is, more smoothing, but the more it will lag The smaller n is, the more over-reaction Simple and Moving Averages Period Demand All-Time 10 1 10 12 2 11.0 14 3 12.0 15 4 12.8 16 5 13.4 17 6 14.0 19 7 14.7 21 8 15.5 23 9 16.3 10 3MA 12.0 13.7 15.0 16.0 17.3 19.0 21.0 Centered MA • CMA smoothes out variability • Plot the average of 5 periods: 2 previous, the current, and the next two • Obviously, this is only in hindsight • FRB Dalls graphs Centered Moving Average • • • • • Take average of n periods, Plot the average in the middle period Not useful for forecasting More stable than actuals If seasonality, n = season length (4wks, 12 mo, etc.) CMA - # Periods to Average • What if data has 12-month cycle? Ja F M Ap My Jn Jl Au S O N D Ja F Avg of Jan-Dec gives average of month 6.5: (1+2+3+4+5+6+7+8+9+10+11+12)/12=6.5 Avg of Feb-Jan gives average of month 6.5: (2+3+4+5+6+7+8+9+10+11+12+13)/12=7.5 How get a July average? Average of other two averages M Stability vs. Responsiveness • Responsive ▫ Real-time accuracy ▫ Market conditions • Stable ▫ Forecasts being used throughout the company ▫ Long-term decisions based on forecasts ▫ Don’t whipsaw those folks Old Data Comparison of simple, moving averages clearly shows that getting rid of old data makes forecast respond to trends faster Moving average still lags the trend, but it suggests to us we give newer data more weight, older data less weight. Weighted Moving Average FJun = (AMar + AApr + AMay)/3 = (3AMar + 3AApr + 3AMay)/9 Why not consider: FJun = (2AMar + 3AApr + 4AMay)/9 FJun = 2/9 AMar + 3/9 AApr + 4/9 AMay Ft = w1At-3 + w2At-2 + w3At-1 Complicated: • Have to decide number of periods, and weights for each • Weights have to add up to 1.0 • Most recent probably most relevant, gets most weight • Carry around n periods of data to make new forecast Weighted Moving Average Period Demand 3WMA 1 10 2 12 3 14 4 15 12.6 5 16 14.1 6 17 15.3 7 19 16.3 8 21 17.8 9 23 19.6 10 21.6 Wts = 0.5, 0.3, 0.2 F4= 0.5*14+ 0.3*12+ 0.2*10 = 12.6 Setting Parameters • Weighted Moving Average ▫ Number of Periods ▫ Individual weights • Trial and Error ▫ Evaluate performance of forecast based on some metric Exponential Smoothing Ft Ft 1 At 1 Ft 1 F10 = F9 + 0.2 (A9 - F9) Ft 1 Ft 1 At 1 F10 = 0.8 F9 + 0.2 (A9 - F9) At-1 Actual demand in period t-1 Ft-1 Forecast for period t-1 Smoothing constant >0, <1 Forecast is old forecast plus a portion of the error of the last forecast. Formulas are equivalent, give same answer Exponential Smoothing • Smoothing Constant between 0.1-0.3 • Easier to compute than moving average • Most widely used forecasting method, because of its easy use • F1 = 1,050, = 0.05, A1 = 1,000 • F2 = F1 + (A1 - F1) • = 1,050 + 0.05(1,000 – 1,050) • = 1,050 + 0.05(-50) = 1,047.5 units • BTW, we have to make a starting forecast to get started. Often, use actual A1 Exponential Smoothing Period Demand 1 10 2 12 3 14 4 15 5 16 6 17 7 19 8 21 9 23 10 Alpha = 0.3 ES 10.0 10.0 10.6 11.6 12.6 13.6 14.7 16.0 17.5 19.1 Exponential Smoothing Period Demand 1 10 2 12 3 14 4 15 5 16 6 17 7 19 8 21 9 23 10 Alpha = 0.5 ES 10.0 10.0 11.0 12.5 13.8 14.9 15.9 17.5 19.2 21.1 Exponential Smoothing We substitute the formula for F11 into F12, etc. Older demands get exponentially less weight F12 A11 1 F11 F11 A10 1 F10 F12 A11 1 A10 1 F10 2 F12 A11 1 A10 1 A9 1 A8 1 A7 ... 2 3 4 Choosing • Low : if demand is stable, we don’t want to get thrown into a wild-goose chase, over-reacting to “trends” that are really just short-term variation ▫ = 0 F10= F9= F8 – F never changes • High : If demand really is changing rapidly, we want to react as quickly as possible • = 1 F10= A9 – F is just the naïve – very responsive Ft Ft 1 At 1 Ft 1 Summary • • All-Time average – too stable Moving average – more responsive, still lags the trend ▫ • Centered Moving average – just FYI Weighted Moving average ▫ • How many periods to use? Weights to be set Exponential Smoothing – most popular ▫ Easy to implement, one parameter to set