Legislative changes relating to Payroll Charitable Giving

LEGISLATIVE CHANGES RELATING TO PAYROLL CHARITABLE GIVING – DRAFT

SECONDARY LEGISLATION, “THE CHARITABLE DEDUCTIONS (APPROVED

SCHEMES) (AMENDMENT) REGULATIONS 2014 ”

2

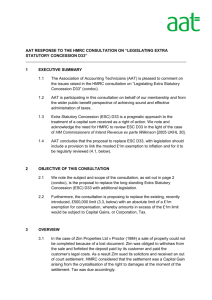

1 EXECUTIVE SUMMARY

1.1 The Association of Accounting Technicians (AAT) is responding to issues raised in the HMRC consultation document on “Legislative changes relating to

Payroll Charitable Giving – draft secondary legislation for comment” from an operational perspective and on behalf of our operationally skilled Members in

Practice, who may represent employers (sole traders, partnerships, limited companies, LLPs, charities etc).

1.2 AAT believes that the payment period for charitable donations should be 30 days, rather than the 35 days being proposed in the draft legislation.

REDUCTION IN THE PAYMENT PERIOD FOR CHARITABLE DONATION FROM

PAYROLL

2.1 AAT is pleased to note that the time in which a payroll giving agency must pass over donations received from an employer is to be reduced considerably. Nevertheless we are disappointed in the 35 days pass-over time chosen, for following two reasons:

2.1.1 in this age of instantaneous financial transactions it would be reasonable to expect a payroll giving agency to swiftly identify, if not automatically at the time of receipt, which charity the receipt needs to be redistributed to and make electronic payment well inside of a 30 day period

2.1.2 in the majority of industry and business sectors the usual creditor arrangement is settlement within 30 days. We do not believe that the redistribution of a cleared donation should, as a minimum, be more favourable that those relating to the terms of settlement of commercial debts.

2.2 Further to our comments made in 2.1.2, the proposed 35 day pass-over period does not meet the business accepted standard that is reflected in the

Late Payment of Commercial Debts (Interest) Act 1996 which specifies a payment period of 30 days, in the absence of alternative trading terms, before the right to statutory interest applies. We believe that it would not be unreasonable to expect that the redistribution of a cleared donation should be subject to settlement within a period that is within normal credit terms.

2.3 The contrasting of the treatment of donations with commercial debts has an added dimension in that it would not be unreasonable to expect charitable donations to be treated with even greater respect than a commercial debt and accordingly ascribed a faster turn-around-time.

2.4 Given the comment in 10.1 of the Impact Statement that most intermediaries already pay across donated funds within 35 days we note that in practice nothing has changed, especially when taking into account that there can be circumstances where the intermediary can still take 60 days to make the payment.

CONCLUSION 3

3.1 AAT believes that the payment period for charitable donations should be reduced to at least 30 days, for the reasons outlined above (2.1 - 2.4).

3.2 We are also concerned that, whilst the original consultation exercise covered many more issues than just the payment period, no reference has been made to what else might be considered. Whilst we accept that many of the other proposals and responses would not require legislation it would still have been very useful to have seen comment about how this proposed legislative change might fit in the context of the overall changes the government might intend to make.

4 ABOUT AAT

4.1 AAT has over 50,000 full and fellow members and 80,000 student and affiliate members worldwide. Of the full and fellow members, there are 3,900

Members in Practice (MIPs) who provide accountancy and taxation services to individuals, not-for-profit organisations and the full range of business types.

1

4.2 AAT is a registered charity whose objects are to advance public education and promote the study of the practice, theory and techniques of accountancy and the prevention of crime and promotion of the sound administration of the law.

4.3 In pursuance of those objects AAT provides a membership body. We have drafted our response on behalf of our membership.

1 Figures correct as at 31 December 2013

5 FURTHER ENGAGEMENT

5.1 If you have any questions or would like to consult further on this issue then please contact AAT at: email: consultation@aat.org.uk

and aat@palmerco.co.uk

telephone: 020 7397 3088

FAO. Aleem Islan

Association of Accounting Technicians

140 Aldersgate Street

London

EC1A 4HY