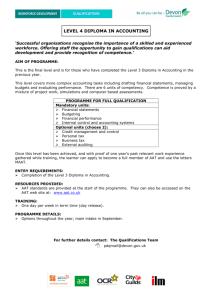

'above the line' credit for Research and Development

RESPONSE TO HM TREASURY Consultation on an

‘Above the Line’ credit for Research and Development

INTRODUCTION

The AAT is pleased to comment on the issues raised in the HM Treasury consultation document on Above the Line credit for Research and Development.

We have over 50,000 full and fellow members and 68,500 student and affiliate members worldwide. Of the full and fellow members, there are approximately 3,650

Members in Practice who provide accountancy and taxation services to individuals, not-for-profit organisations and the full range of business types.

The AAT is a registered charity whose objects are to advance public education and promote the study of the practice, theory and techniques of accountancy and the prevention of crime and promotion of the sound administration of the law.

In pursuance of those objects the AAT provides a membership body. We are participating in this consultation as part of our contribution towards the public benefit of achieving sound and effective administration of taxes. We also feel that the issues raised in this consultation paper will affect our members in practice.

OBJECTIVES OF THE DRAFT LEGISLATION

AAT notes that:

The aim of the consultation is that tax relief for R & D expenditure is given as a credit to offset against relevant expenditure and clearly visible in the firms accounts.

HM Treasury propose that this method of giving recompense is only available to large firms – not SMEs.

CONSULTATION QUESTION RESPONSES

1.

AAT agrees that the criteria of simplicity of administration of an ATL scheme, certainty in usage and alignment with international accounting standards should enhance the UK as a base for R & D firms.

2.

For the basic model of ATL credit for a profit making company the disclosure of the credit in the financial statement fulfils the criteria.

3.

Providing that the rates of relief will clearly lead to the same tax liability, then fairness of treatment dictates that the credit can be taxable. The presumption is that the ATL credit is similar to a grant against revenue expenditure it does not create turnover.

4.

Where the credit is payable and timings are clearly earlier, then the improvement to cash flow planning will help to sustain R & D firms to the end of projects, especially those firms with no tax liability.

5.

The basic model for the credit is good.

6.

AAT has practice-tested the propositions and is unable to suggest any alternative models for the payable part of the credit at this stage.

7.

There are likely to be some difficulties allocating costs to the correct periods during transitional year. The requirement for a split computation in the transitional year may also be difficult. It is important that the shift to ATL is wholesale for each firm.

8.

The most helpful position for Government will be to agree and to confirm the unused relief under the existing scheme to be carried forward. Of next importance is to have the resources to quickly process claims as soon as they are made. It may be prudent to ask R & D firms to move their year end to 31 March if switching to ATL credit.

9.

AAT’s view is that the choice of claim system should not be discretionary. This is to ensure certainty of understanding by the user.

10.

There is no clear reason for having two systems, except in the transitional year.

11.

The objective of ATL is to achieve the same overall objective as the R&D tax credits with the additional objective of improving the attractiveness of the UK as a location for R&D investment. Therefore, assuming all other factors remain the same, then there should be insignificant changes to the costing and pricing of contractual arrangements by businesses providing R&D services to the Government,

12.

AAT has no comments on this question.

13.

AAT agrees that in certain group arrangements relief arising from R & D could be utilised elsewhere in the group as group relief. ATL credit is specific to the R&D firm. An option must be available for unused credit of the R & D firm to be made available to its group instead of a discounted payment to the R & D firm.

14.

On page 17 of the Consultation Document it states, “The Government’s current understanding is that these types of business (US based multinationals) do not benefit from the existing scheme.” This suggests that the existing scheme is not attractive enough to encourage US based multinationals to undertake R&D in the UK.

15.

AAT would prefer to see ATL applied to all R & D claims regardless of size of firm.

The disparity between the relief rates for SMEs and larger firms would need to be considered. For SMEs cash flow difficulties are often greater because whilst R & D work is being undertaken this bars limited resources from producing turnover. For

SMEs later classified as large firms there would be no difference in treatment of R &

D credit.

16.

Where the schemes for SMEs and large firms remain different then there may be unused credits at the point of reclassification and this issue will need to be addressed.

17.

Linking the availability of the ATL credit for overseas companies with UK Branches to the level of Employer NIC contributions acknowledges the need for human input into R & D projects. However this input may not be high where computers are used for modelling or sub-contractors produce prototypes.

18.

There should be a rule to prevent arrangements that will forestall a reduced credit.

19.

AAT does not see any other particular opportunities for avoidance at this stage.

20.

AAT has not undertaken R & D work so this won’t have had an impact on business decisions to date. Looking ahead if AAT was to receive tax relief on R&D expenditure in the future it is possible that this would be re-invested into extra R&D dependent upon the needs of the business at that time.

A1

The preferred accounting treatment under IAS20 would indicate that the ATL amount is treated as a grant against R & D expenditure.

A2

The full payable credit (net of tax) should be shown ATL.

A3

Where a firm opts for a reduced payment then this should be shown ATL.

A4

AAT’s main concern is that the credit should be of a uniform nature for all firms, regardless of size. Also, AAT believes that the claim process should be clear and certain in its operation.

CONCLUSIONS

Making R & D credit more visible might encourage further investment in R & D projects creating employment, and generating employment and taxes if the projects prove to be successful.

AAT would recommend a robust process where taxpayers can be assured that any

HMRC guidance and decisions can be clearly understood.

AAT broadly supports the introduction of the Above the Line credit for large firms who have expenditure for R & D work. The examples suggest that this can improve the effectiveness of support for large firms by clearly showing that R & D work creates a profit.