Exercises for Linear Programming (Cht

advertisement

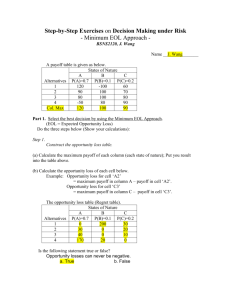

Exercises for Chapter 3, Decision Analysis BSNS2120, J. Wang Name ______________________ 1. Decision making is for ______________. a. determining what to do next or in the future b. evaluating what we did in the past c. Both a and b. 2. “Making decision” is to select a state of nature. a. True b. False 3. As the result of decision making, ______________. a. one and only one state of nature will be selected b. more than one state of nature can be selected c. one and only one decision alternative is selected d. more than one decision alternative can be selected 4. A decision maker does not have much control on _____________. a. selecting a decision alternative b. states of nature 5. When making decision, the decision maker ______ which state of nature will actually occur. a. knows b. does not know 6. The selection of decision alternatives will affect the actual occurrence of the state of nature. a. True b. False 7. The actual payoff is affected by the selected decision alternative. a. True b. False 8. The actual payoff is affected by which state of nature will actually occur. a. True b. False 9. In a decision table, a state of nature is associated with a _______. a. row b. column 10. In a payoff table, probabilities are given for __________. a. decision alternatives b. states of nature c. Both a and b. 11. In the decision theory, the term ‘decision making under uncertainty’ refers to __________ . a. the possible risk in a decision. b. the feature of danger in the process of decision making. c. a type of decision making in which probabilities for the states of natures are known. d. a type of decision making in which probabilities for the states of natures are unknown. 12. ___________ is the criterion for making the decision in ‘decision making under risk’. a. Expected monetary value (EMV) b. Expected value of perfect information (EVPI) c. Probabilities of decision alternatives d. Probabilities of states of nature 13. Which is the correct interpretation of “EMV”? a. The EMV is the expected payoff of all decision alternatives under all states of nature. b. An EMV is the expected payoff of a decision alternative. c. An EMV is the expected payoff of a state of nature. 1 14. What is the correct interpretation of “EVPI”? a. EVPI is the dollar amount that is asked by a consulting firm for the perfect information. b. EVPI is the benchmark up to which a decision maker would be willing to pay for additional information.. c. EVPI is the expected monetary value of an alternative. d. EVPI is the maximum expected monetary value. 15. Which is not a criterion (approach) for decision making under risk? a. Max EMV b. Min EOL c. EVPI 16. What is not a criterion for decision making under uncertainty? a. Max EMV b. MaxiMax c. MaxiMin d. Max Hurwicz value e. Equally likely f. MiniMax Regret 17. Which criterion is for a very conservative ‘risk-averter’ ? a. MaxiMax b. MaxiMin 18. If a decision maker is kind of optimistic and loving taking risk, then he would set the coefficient of realism, , ________ when he is using the Hurwicz approach. a. smaller b. larger 19. The five criteria (methods), maximax, maximin, minimax regret, Hurwicz, and equal likelihood, are for a. decision making under risk. b. decision making under uncertainty. 20. Expected payoff (EMV) is the criterion used in a. decision making under risk. b. decision making under uncertainty. 21. The opportunity cost (regret, or opportunity loss) is what you may have earned but you gave it up. a. True b. False 22. Which of the following approaches needs to develop a regret table in order to make a decision? a. Hurwicaz b. Max EMV c. Min EOL 23. Suppose the payoffs of three alternatives in state of nature Y are: 300 for Alt.A, 700 for Alt.B, 500 for Alt.C. What is the opportunity loss (opportunity cost) if Alt.A is selected and state of nature turns out to be Y? a. 300 b. 400 c. 700 d. 200 e. 400 if selected B and 200 if selected C 24. The five criteria (methods), maximax, maximin, minimax regret, Hurwicz, and equal likelihood, always select the same alternative as the decision. a. True b. False 25 We have learned two decision making approaches for decision making under risk: Max EMV and Min EOL. The two approaches always select the same alternative as the best decision. a. True b. False 26 In a case of decision making under risk, the value of the minimum EOL is always the same as ___________. a. Max EMV b. EVPI c. EVwPI d. EVw/oPI 27. EVPI = EVwPI – EVw/oPI. a. True b. False 28. EVw/oPI = Max EMV. a. True b. False 2 29 EVwPI = expected value of column maximums in the payoff table. a. True b. False 30 In a case of decision making where the probabilities of states of nature are not given, which of the following decision approaches can be used? a. MiniMax regret b. Min EOL c. Either a or b. 31. If =1 in the Hurwicz method, then it is equivalent to the __________ method. a. Maximax b. Maximin c. Equal likelihood. d. None of above. 32. If =0.5 in the Hurwicz method, then it is equivalent to __________ method. a. Maximax b. Maximin c. Equal likelihood d. None of above. 33. If =0 in the Hurwicz method, then it is equivalent to __________ method. a. Maximax b. Maximin c. Equal likelihood d. None of above. 34. Suppose EVPI=$2,000. Is it cost-effective to hire a consultant at $2,200 to do research and provide better information about the states of nature? a. Yes b. No 35. Suppose EVPI=$2,000. Is it cost-effective to hire a consultant at $1,990 to do research and provide better information about the states of nature (Do not expect the consultant would provide you with ‘perfect’ information). a. Yes b. No 36. Kay White is considering whether to put $5,000 to the stock market that can be good or bad in the coming year. In the example, states of nature are _________________. a. investing the $5,000 to the stock market, or not. b. good stock market, or bad stock market, in the coming year. For question 37 – 39: Ben is a manager of a grocery store. He is to decide how many cases of milk should be stocked every three days. Of course, he wants to sell as many as possible. But if he stocks too much, he has to dump the un-sold milk. If he stocks too little, he would lose customers and business. According to the past data, the 3-day demand of milk can be anywhere between 60 to 70 cases (i.e., 11 possible values: 60, 61, 62, ..., 70). 37. What does Ben want to decide? a. How many cases demanded in three days. b. How many cases to stock for the next three days. c. Get all stocked cases of milk sold, or not. 38. What are decision alternatives? a. Number of cases of milk sold in the next three days, with 11 choices: 60, 61, 62, ..., 70. b. Number of cases of milk to stock for the next three days, with 11 choices: 60, 61, 62, ..., 70. c. Number of cases of milk demanded in the next three days, with 11 choices: 60, 61, 62, ..., 70. d. Build a large plant, a small plant, and doing nothing. 39. What are the states of nature? a. Get the stocked milk sold or unsold, with two possibilities: Sold and unsold. b. Good market, Fair market, and poor market. c Number of cases of milk sold in the next three days, with 11 choices: 60, 61, 62, ..., 70. d. Number of cases of milk to stock for the next three days, with 11 choices: 60, 61, 62, ..., 70. e. Number of cases of milk demanded in the next three days, with 11 choices: 60, 61, 62, ..., 70. 3 For Question 40 – 42, use the following payoff data: State-of-nature 1 State-of-nature 2 Alternative X 80 20 State-of-nature 3 35 40. What is the Hurwicz value for alternative X with =0.3? a. 38 b. 62 c. 80 d. 48.5 e. 30 41. What is the Hurwicz value for alternative X with =0.5? a. 35 b. 50 c. 45 d. 57.5 e. 80 42. What is the average payoff of alternative X in the criterion of "equal likelihood"? a. 35 b. 50 c. 45 d. 20 e. 80 For questions 43 – 47, use the information in this payoff table : States of Nature A Alternatives P(A)=0.2 1 $3,000 2 $1,500 3 $2,500 B P(B)=0.8 $1,000 $2,000 $3,500 43. If you chose Alternative 2, then the expected monetary value (EMV) would be $____________. 44. If you chose Alternative 2 and the state of nature turned out to be ‘B’, then the opportunity loss (regret) would be $___________. 45. The best payoff under the state of nature of B is $____________? 46. Which alternative would you select if ‘perfect information (PI)’ said that the state of nature would be ‘A’ ? a. Alternative 1 b. Alternative 2 c. Alternative 3 47. Calculate the expected value with perfect information, EVwPI. 48. EVPI is the value of information from _____________ standpoint of view. a. information generator’s b. information user’s 49. Suppose Company X is negotiating with a consulting firm C on purchasing information about prediction of economy development in the next year. In this case, EVPI is a benchmark on the value of information for ____________. a. Company X b. Consulting firm C 50. In a decision making problem, Max EMV = 400, EVwPI = 700. Calculate EVPI. 51. In a decision making problem, Max EMV = 400, EVwPI = 700, and the additional information is believed to be perfect with 70% of probability. Calculate EVAI, expected value of the additional information. 4 Answers: 1.a 2.b 3.c 4.b 5.b 6.b 7.a 8.a 9.b 10.b 11.d 12.a 13.b 14.b 15.c 16.a 17.b 18.b 19.b 20.a 21.a 22.c 23.b 24.b 25.a 26.b 27.a 28.a 29.a 30.a 31.a 32.d 33.b 34.b 35.b 36.b 37.b 38.b. 39.e 40.a 41.b 42.c 43.1900 44.1500 45. 3500 46.a 47.3400 48.b 49.a 50. 700-400=300 51.(700*70%)-400=90. 5