Quiz chpt 10 11 Fall 2009[1]

advertisement

![Quiz chpt 10 11 Fall 2009[1]](http://s3.studylib.net/store/data/005849483_1-1498b7684848d5ceeaf2be2a433c27bf-768x994.png)

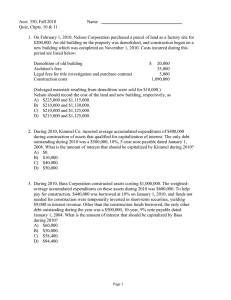

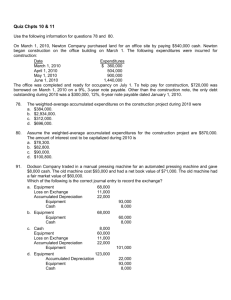

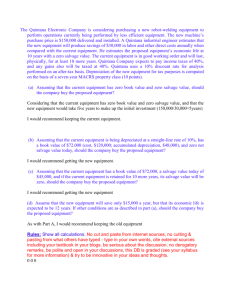

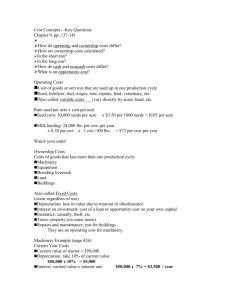

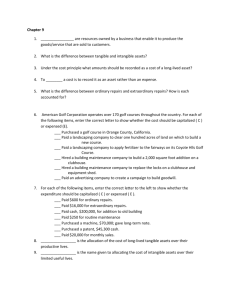

Acct. 350, Fall 2009 Quiz, Chpts. 10 & 11 Name 1. On February 1, 2010, Nelson Corporation purchased a parcel of land as a factory site for $200,000. An old building on the property was demolished, and construction began on a new building which was completed on November 1, 2010. Costs incurred during this period are listed below: Demolition of old building Architect's fees Legal fees for title investigation and purchase contract Construction costs $ 20,000 35,000 5,000 1,090,000 (Salvaged materials resulting from demolition were sold for $10,000.) Nelson should record the cost of the land and new building, respectively, as A) $225,000 and $1,115,000. B) $210,000 and $1,130,000. C) $210,000 and $1,125,000. D) $215,000 and $1,125,000. 2. During 2010, Kimmel Co. incurred average accumulated expenditures of $400,000 during construction of assets that qualified for capitalization of interest. The only debt outstanding during 2010 was a $500,000, 10%, 5-year note payable dated January 1, 2008. What is the amount of interest that should be capitalized by Kimmel during 2010? A) $0. B) $10,000. C) $40,000. D) $50,000. 3. During 2010, Bass Corporation constructed assets costing $1,000,000. The weightedaverage accumulated expenditures on these assets during 2010 was $600,000. To help pay for construction, $440,000 was borrowed at 10% on January 1, 2010, and funds not needed for construction were temporarily invested in short-term securities, yielding $9,000 in interest revenue. Other than the construction funds borrowed, the only other debt outstanding during the year was a $500,000, 10-year, 9% note payable dated January 1, 2004. What is the amount of interest that should be capitalized by Bass during 2010? A) $60,000. B) $30,000. C) $58,400. D) $94,400. Page 1 Use the following to answer questions 4-5: Below is the information relative to an exchange of assets by Stanton Company. The exchange lacks commercial substance. Old Equipment Book Value Fair Value $75,000 $85,000 $50,000 $45,000 Case I Case II Cash Paid $15,000 $7,000 4. Which of the following would be correct for Stanton to record in Case I? Record Equipment at: Record a gain of (loss) of: A) $90,000 $0 $100,000 $10,000 $75,000 $(5,000) $90,000 $10,000 B) C) D) 5. Which of the following would be correct for Stanton to record in Case II? Record Equipment at: Record a gain of (loss) of: A) $57,000 $5,000 $50,000 $2,000 $52,000 $(5,000) $50,000 $(2,000) B) C) D) 6. Durler Company traded machinery with a book value of $180,000 and a fair value of $300,000. It received in exchange from Hoyle Company a machine with a fair value of $270,000 and cash of $30,000. Hoyle's machine has a book value of $285,000. What amount of gain should Durler recognize on the exchange? A) $ -0B) $12,000 C) $30,000 D) $120,000 Page 2 7. Hoyle Company traded machinery with a book value of $285,000 and a fair value of $270,000. It received in exchange from Durler Company a machine with a fair value of $300,000. Hoyle also paid cash of $30,000 in the exchange. Durler's machine has a book value of $285,000. What amount of gain or loss should Hoyle recognize on the exchange? A) $30,000 gain B) $ -0C) $1,500 loss D) $15,000 loss 8. Jamar Company purchased a depreciable asset for $150,000. The estimated salvage value is $10,000, and the estimated useful life is 8 years. The double-declining balance method will be used for depreciation. What is the depreciation expense for the second year on this asset? A) $17,500 B) $26,250 C) $28,125 D) $37,500 9. A plant asset has a cost of $24,000 and a salvage value of $6,000. The asset has a threeyear life. If depreciation in the third year amounted to $3,000, which depreciation method was used? A) Straight-line B) Declining-balance C) Sum-of-the-years'-digits D) Cannot tell from information given 10. On January 1, 2010, Graham Company purchased a new machine for $2,100,000. The new machine has an estimated useful life of nine years and the salvage value was estimated to be $75,000. Depreciation was computed on the sum-of-the-years'-digits method. What amount should be shown in Graham's balance sheet at December 31, 2011, net of accumulated depreciation, for this machine? A) $1,695,000 B) $1,335,000 C) $1,306,666 D) $1,244,250 Page 3 11. Robertson Inc. bought a machine on January 1, 2000 for $300,000. The machine had an expected life of 20 years and was expected to have a salvage value of $30,000. On July 1, 2010, the company reviewed the potential of the machine and determined that its undiscounted future net cash flows totaled $150,000 and its discounted future net cash flows totaled $105,000. If no active market exists for the machine and the company does not plan to dispose of it, what should Robertson record as an impairment loss on July 1, 2010? A) $ 0 B) $ 8,250 C) $15,000 D) $53,250 12. Marsh Corporation purchased a machine on July 1, 2008, for $750,000. The machine was estimated to have a useful life of 10 years with an estimated salvage value of $42,000. During 2011, it became apparent that the machine would become uneconomical after December 31, 2015, and that the machine would have no scrap value. Accumulated depreciation on this machine as of December 31, 2010, was $177,000. What should be the charge for depreciation in 2011 under generally accepted accounting principles? A) $106,200 B) $114,600 C) $123,000 D) $143,250 13. In March, 2010, Maley Mines Co. purchased a coal mine for $6,000,000. Removable coal is estimated at 1,500,000 tons. Maley is required to restore the land at an estimated cost of $720,000, and the land should have a value of $630,000. The company incurred $1,500,000 of development costs preparing the mine for production. During 2010, 450,000 tons were removed and 300,000 tons were sold. The total amount of depletion that Maley should record for 2010 is A) $1,374,000. B) $1,518,000. C) $2,061,000. D) $2,277,000. On January 1, 2010, Guzman Company purchased a machine costing $150,000. The machine is in the MACRS 5-year recovery class for tax purposes and has an estimated $30,000 salvage value at the end of its economic life. 14. Assuming the company uses the general MACRS approach, the amount of MACRS deduction for tax purposes for the year 2010 is A) $30,000. B) $60,000. C) $48,000. D) $24,000. Page 4 Answer Key 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. D C C A C B D C C B D or B B D A Page 5