Slides

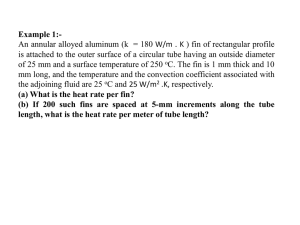

advertisement

Agenda A lot of hand-outs Comments to Course Work #1 The put-call parity (Hull Ch. 9, Sec. 4) Duration (CT1, Unit 13, Sec. 5.3) A few explicit formulas Generalization to non-flat yield curves 1 October 21, 2010 MATH 2510: Fin. Math. 2 Today’s Hand-Outs: Collect ’em All Graded Course Works #1 Solution to Course Work #1 Course Work #2 Exercises for Workshop #4 Today’s slides w/ Hull Ch. 9, Sec. 4 attached Updated course plan (blue paper) Solutions to Workshops #2 & #3 2 October 19, 2010 MATH 2510: Fin. Math. 2 The Final Exam Earlier I may have been fuzzy, but now: The final exam will be closed book. Reason, I: ”Local customs.” Reason, II: Exemptions from having to take the ”professional” CT1-exams – which are closed book. You will get ”very life-like” exam papers to practice on. 3 October 19, 2010 MATH 2510: Fin. Math. 2 Course Work #1 Generally: Good work. Common errors and/or what to do about them: 1.26: Borrow money too 1.27:Tell customer he may loose all w/ options 1.29-1.30: Draw the pay-off profile 1.32: Short put 4 October 19, 2010 MATH 2510: Fin. Math. 2 The Put-Call Parity As seen in Hull Assignment 1.32, a position that is long one call and short one put pays off S(T) – K. Algebraically because (S (T ) K ) (K S (T )) S (T ) K This has interesting consequences. 5 October 19, 2010 MATH 2510: Fin. Math. 2 If we happen to come across a strike-price, say K*, such that the call and the put cost the same, then the forward price must (”or else arbitrage”) equal K*, irrespective of any dividends. This follows ”from first principles”. 6 October 19, 2010 MATH 2510: Fin. Math. 2 If the underlying pays no dividends (during the life of the options), then the (long call, short put) payoff is replicated by being long the underlying and short K zero coupon bonds bonds w/ maturity T. Thus (”or else aribtrage”): Call(0) Put(0) S (0) P(T ) K 7 October 19, 2010 MATH 2510: Fin. Math. 2 This formula/relationship is called the (basecase) put-call parity. It is surprisingly useful. Dividends: See Workshop #4. 8 October 19, 2010 MATH 2510: Fin. Math. 2 Duration Measures the sensitivity of present values/prices to changes in the interest rate. It has ”dual meaning”: A derivative wrt. the interest rate A value-weighted average of payment times (so: its unit is ”years”) 9 October 19, 2010 MATH 2510: Fin. Math. 2 Set-up: Cash-flows at tk C Yield curve flat at i (or continuously compounded/on force form: ) Present value of cash-flows: tk A k Ct k (1 i) tk k Ct k P(tk ) 10 October 19, 2010 MATH 2510: Fin. Math. 2 Macauley Duration The Macauley duration (or: discounted mean term) is defined by : k tk Ctk (1 i) tk A Clearly a weighted average of payment dates. But also: Sensitivity to changes in the force of interest. Or put differently: To parallel shifts in the (continuously compounded) yield curve. 11 October 19, 2010 MATH 2510: Fin. Math. 2 Some Duration Formulas The duration of a zero coupon bond is its maturity. The duration of an n-year annuity making payments D is ( Ia) n| a n| where as usual 12 , an| (1 v ) / i with v=1/(1+i), n October 19, 2010 MATH 2510: Fin. Math. 2 and IA is the value of an increasing annuity n ( 1 i ) a nv n| v 2v 2 3v3 ... nvn : ( IA)n| , i as shown in CT1, Unit 6, Sec. 3.2. Using exactly similar reasoning, the duration of a bullet bond w/ coupon payments D and notional R is D( Ia) n| Rnvn Dan| Rvn 13 October 19, 2010 MATH 2510: Fin. Math. 2 Duration w/ a Non-Flat Yield Curve If the yield curve is not flat, it is the natural to define duration as t C P(tk ) F W k k tk : . A This is called the Fisher-Weil duration. Can still be intepreted as sensitivity to parallel shifts in the yield curve. (But reminds us that other deformations may occur.) 14 October 19, 2010 MATH 2510: Fin. Math. 2 The Macauley duration can also calculated with a nonflat yield curve. In that case the Macauley and Fisher-Weil durations are not equal. The Fisher-Weil duration of a portfolios is a ”straightforward” weighted average of its constituents; Macauley duration is not. To calculated F-W duration we must know the yield curve; not so for Macauley. 15 October 19, 2010 MATH 2510: Fin. Math. 2