Slides

advertisement

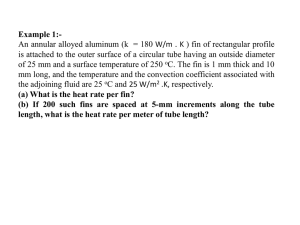

Agenda 1 Recap: Yield to maturity (or: to redemption). CT1, Unit 13, Sec. 4.2. Par yield. CT1 Unit 13, Sec. 4.3. And the solution of Q9 from the April 2009 CT1-exam. Messing w/ youd head: Something that isn’t the yield curve. Estimating the yield curve by bootstrapping: Hull Chapter 4, Sec. 5 October 19, 2010 MATH 2510: Fin. Math. 2 2 More practical complications in yield curve estimation. CT1 Unit 13, Sec. 5: Risk or sensitivity measures; duration. October 19, 2010 MATH 2510: Fin. Math. 2 Yield to Maturity (or: to Redemption) Consider a bond with cash-flows ct at times t = 1, 2, …, T, and price P. Its yield to maturity, i, is the solution to the equation: T ct P . t t 1 (1 i ) This is a non-linear equation; must be solved numerically. 3 October 19, 2010 MATH 2510: Fin. Math. 2 Par Yield The par yield , ycn, is the bullet bond coupon rate that makes a n-term bullet bond trade at par, i.e. have a price of £1 per £1 notional. Or in symbols: 1 Pn ( yc n ) j 1 Pj n ( yc n ) 1 Pn n j 1 . Pj With a non-flat yield curve, par yield and yield to maturity is not the same. (Artimetic vs. geometric effect.) 4 October 19, 2010 MATH 2510: Fin. Math. 2 April 2009 CT1-Exam Q9 [different slides, old hand-out] 5 October 19, 2010 MATH 2510: Fin. Math. 2 Teaser: A Graph I Got From Bloomberg Mid-Oct. 2010 yields to maturity of UK government bonds (y-axis) for different maturities (x-axis). 6 October 19, 2010 MATH 2510: Fin. Math. 2 Questions (0. How do you like the scaling?) 1. Why is that not the (zero coupon spot) yield curve? 2. What do we do about that? How do we estimate the yield curve? 7 October 19, 2010 MATH 2510: Fin. Math. 2 Estimating the Yield Curve Consider the small principal/notional-100 bullet bond market from Hulls’s Table 4.3: Time to maturity Coupon Price 0.25 0% 97.5 0.50 0% 94.9 1.00 0% 90.0 1.50 8% 96.0 2.00 12% 101.6 8 October 19, 2010 MATH 2510: Fin. Math. 2 Let’s assume that coupons are paid semi-anually. work with continuously compounded zero coupon (spot) rates We can now determine – ”estimate” - the yield curve by working from short to lond maturities. This is called bootstrapping. 9 October 19, 2010 MATH 2510: Fin. Math. 2 The Bootstrap Method The 3 month rate solves the equation 100e R0.25 0.25 97.5 This means 10.127% with continuous compounding. Similarly the 6 month and 1 year rates are 10.469% and 10.536% with continuous compounding. 10 October 19, 2010 MATH 2510: Fin. Math. 2 To calculate the 1.5 year rate we solve 4e 0.104690.5 4e 0.105361.0 104e R1.5 1.5 96 to get R1.5 = 0.10681 or 10.681%. Notice how the previously calculated rates are used. Similarly the 2 year rate is 10.808% 11 October 19, 2010 MATH 2510: Fin. Math. 2 The Resulting Yield Curve Determining Zero Coupon Rates: Hull's Bootstrapping Example in Chapter 4, Sec. 5 0.109 0.108 Interest rate 0.107 0.106 0.105 Zero coupon rate 0.104 0.103 0.102 0.101 0.1 0 0.5 1 1.5 2 2.5 Maturity 12 October 19, 2010 MATH 2510: Fin. Math. 2 Yield Curve Estimation in Practice Yield curve estimation (also known as ”yield curve stripping”) is the back-bone/the ”meat and potatoes” of any bank’s fixed income department. Complication: More cash-flow dates than bonds. Solution: Use some interpolation scheme. (Piecewise constant, linear, NelsonSiegel.) 13 October 19, 2010 MATH 2510: Fin. Math. 2 Complication: Which products to use? Particularly in focus ”post Credit Crunch”. This will be the topic of Course Work #2. 14 October 19, 2010 MATH 2510: Fin. Math. 2 Duration Consider this situation: You … … are a pension fund. … have to pay out £30m in 20 years … have collected £12m in premiums and invested the money in 5-year (zero coupon) bonds 15 October 19, 2010 MATH 2510: Fin. Math. 2 Assume the interest rate is 5% per year. Your assets (the zero coupon bonds) are worth £12m; you own 15.32m of them (15.32 * (1.05)-5=12) Your liabilities (the future pension payments) have a present value of £30m* (1.05)-20=£11.31m So all is well; you are nice and solvent. (You might report a solvency percentage of (12 – 11.31)/11.31 ~6%.) 16 October 19, 2010 MATH 2510: Fin. Math. 2 Now the interest rate changes to 4%. You assets are now worth £15.32m * (1.04)-5=£12.59m, whereas the present value of your liabilities is £30m* (1.04)-20=£13.69m. Thus: You are no longer solvent. What just happened here? And how do we avoid such nasty surprices? 17 October 19, 2010 MATH 2510: Fin. Math. 2 Calculate not only the present values of our positions, but also their sensitivity to interest rate changes. This is what duration (CT1, Unit 13, Sec. 5) is about. 18 October 19, 2010 MATH 2510: Fin. Math. 2 Set-up: Cash-flows Ct at tk Yield curve flat at i (or continuously compounded/on force form: ) Present value of cash-flows: k A k Ct k (1 i) tk 19 October 19, 2010 MATH 2510: Fin. Math. 2 Effective duration The effective duration (or: volatility, or: modified duration) is defined as t C (1 i) 1 k k tk v : A A i A ( t k 1) So: Duration is a sensitivity to shifts in the yield 20 October 19, 2010 MATH 2510: Fin. Math. 2 Macauley Duration The Macauley duration (or: discounted mean term ) is defined by : k tk Ctk (1 i) A tk (1 i)v So duration can also be intepreted as a weighted average of payment dates. (Also: Sensitivity to shifts in the force of interest.) 21 October 19, 2010 MATH 2510: Fin. Math. 2