Slides

advertisement

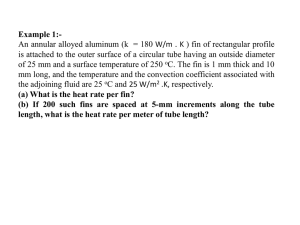

Agenda Recap: - A useful duration formula (CT1, Unit 13, Sec. 5.3) - Redington immunisation conditions (CT1, Unit 13, Sec. 5.5) A warning about immunisation 1 October 28, 2010 MATH 2510: Fin. Math. 2 Comments on Course Work #2: - Exercise 4.4 and other useful Excel things - Accrued interest, clean vs. dirty prices - Treating time-shifted payments - General Q&A 2 October 28, 2010 MATH 2510: Fin. Math. 2 New Hand-Outs These slides Exercises for Workshop #5 Updated Course Plan (blue) 3 October 28, 2010 MATH 2510: Fin. Math. 2 A Bond Duration Formula The duration of a bond w/ coupon payments D and notional R (R=0: annuity) is D( Ia) n| Rnvn Dan| Rvn where v (1 i ) 1 1 vn an| i (1 i )an| nvn ( IA) n| i 4 October 28, 2010 MATH 2510: Fin. Math. 2 Redington Immunisation 3 conditions on assets (A) and liabilities (L) PVA (i0 ) PVL (i0 ) A (i0 ) L (i0 ) c A (i0 ) cL (i0 ) 5 October 28, 2010 MATH 2510: Fin. Math. 2 Operational Immunization Liabilities are fixed. We buy x units of bonds #1, y units of bond #2, where x and y solve the equations xPV (bond#1) yPV (bond#2) PVL (i0 ) PV (bond#1) (bond#1) PV (bond#2) (bond#2) x y L (i0 ) PVL (i0 ) PVL (i0 ) The convexity condition is treated by conderisering how spread out assets and liabilities are around the duration; the more spread out, the higher the convexity. 6 October 28, 2010 MATH 2510: Fin. Math. 2 Immunisation isn’t the be-all-and-endall of interest rate risk management Note that an immunised portfolio is looks very much like an arbitrage. That tells us that considering only parallel shifts to flat yield curves isn’t the perfect way to model interest rate uncertainty. And models with genuinely random behaviour is next week’s topic. 7 October 28, 2010 MATH 2510: Fin. Math. 2 Exercise 4.4: Useful Excel Stuff Formulas: Start w/ ”=”. (And LOG is base 10.) Copying: Relative (”default”) vs. absolute ($) references. Solver Yearfrac [playing around w/ file] 8 October 28, 2010 MATH 2510: Fin. Math. 2 Accrued Interest When you buy a bond you must compensate the seller for interest since last payment date, i.e. you have to pay (now) accured interest of coupon * #years since last payment. (You can guess what happens w/ other payment frequencies. And here we ignore the fine points of day-counting.) You receive the next coupon in full. 9 October 28, 2010 MATH 2510: Fin. Math. 2 Accrued interest has to be added to the quoted (so-called ”clean”) price to get the left-hand side (the so-called ”dirty price”) for yield (and other) calculations. Why do you think the convention is to quote clean prices, i.e. prices without accrued interest? 10 October 28, 2010 MATH 2510: Fin. Math. 2 Duration for a Standard Bond with Shifted Payment Dates See and solve exercise 5.4 for the Wed. Nov. 3 Workshop. [scribbling on whiteboard] Can save you some copying and pasting in Questions 1 and in Course Work #2. 11 October 28, 2010 MATH 2510: Fin. Math. 2 Other Questions Re. Course Work #2? 12 October 28, 2010 MATH 2510: Fin. Math. 2