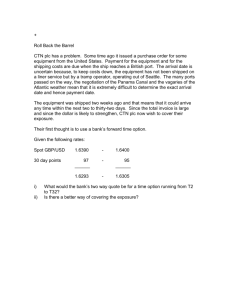

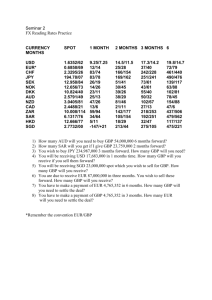

FX Options

advertisement

Traded 1 Definition An option is the right but not the obligation to buy (call) or sell (put) a currency at an agreed rate (strike price or exercise price) over a certain period of time. For this right a premium is paid (usually at the start). 2 Terminology American, the option may be exercised (or not) at any time in the option period European, the option may be exercised (or not) only at expiry OTC, over the counter or bespoke options Traded, where options are traded on an exchange and therefore the contracts have to be precisely specified 3 The Specification Contract size Premium Expiry date 4 In, At and Out of the Money GBP call i.e. (call for GBP give USD) SP 1.43 Current Spot 1.45 1.43 1.41 Option is In At Out of the money 5 Dec call, SP 1.46, premium 1 cent 2 cents 1 cent 1.43 Value in cents 1.44 1.45 1.46 1.47 1.48 Rate at expiry 0 - 1 cent - 2 cents 6 Which cash price is the underlying? September GBP call with SP 165 Today is June 20th Current spot is 1.6930 3 Mo fwd is 1.6785 You have two alternatives. Exercise today or sell sterling forward, Which action will give you most profit as it is against this that the seller will base the price? 1) Exercise today Give USD1.6500 Get GBP 1 Get USD 1.6930 Give GBP 1 Net 430 Or, Sell GBP forward to expiry day and exercise on expiry Give USD 1.6500 Get GBP 1 Get USD 1.6785 Give GBP 1 Net 285 So underlying is spot 7 Ref the underlying Note GBP is at a discount to the dollar therefore is ‘strongest’ at spot so Call = spot is underlying Put = forward is underlying For currencies at a premium to the USD, then vice versa 8 Effective rate Suppose we decide to buy a GBP call i.e. will give USD to get GBP Then if the SP is 1.65 and the premium is 1 cent the effective rate if we exercise will be 1.65 +.01 1.66 If this had been a put but using same SP and premium, then the effective rate would be 1.65 -.01 1.64 Note that the premium is always a cost therefore for the call we pay more USD and for the put we receive less USD 9 Today is July 23rd We have a September GBP call, SP 165 Today’s spot rate is 1.6930 And the current premium for the option in the market is 5.62 cents We need the GBP today We could exercise in which case the cost would be (ignoring the sunk cost of the premium paid) - 1.6500 Or we could sell and receive 5.62 cents = +0.0562 We would need to buy GBP spot - 1.6930 Net cost - 1.6368 10 Intrinsic and Time Value GBP Call at 1.8250 for September Current Spot 1.8840 5.90 cents: Intrinsic Value Premium 6.05 .15 Time Value 11 x Value at expiry x Out of the money At the money In the money 12 SP Call March underlying Time Value. 1.500 1.5756 Intrinsic Premium Value 7.90 7.56 .34 1.525 5.48 5.06 .42 1.550 3.13 2.56 .57 1.575 1.27 .06 1.21 1.600 .31 - .31 1.625 .02 - .02 13 Value Today Time to Expiry Expiry 14 GBP 000’s 725 720 715 710 705 700 690 1.39 Forward 1.4286 685 680 675 670 1.40 1.41 1.42 1.43 1.44 1.45 1.46 1.47 1.48 1.49 1.50 1.51 1.52 1.53 Option SP144 Leave open 15 Decide whether to use options or not versus leave open or cover. Issues:cost, policy, view of fx movements If yes then, 1. Puts or calls? 2. How many contracts? 3. Expiry Date, sometime beyond exposure date but how far? 4. Strike price? 16 If yes then, 1. Puts or calls? Well what is the exposure? 2. Assuming traded options to be used - How many contracts? - What is contract size? - Over /under hedge 17 3. Expiry Date? - Sometime beyond exposure date but how far? - Cost of time, versus decay, versus view of volatility 18 Strike price? - In, At or Out of the money - Need to know ‘underlying’ - Premium 19