The Forward Market and the Forward Exchange Rate

advertisement

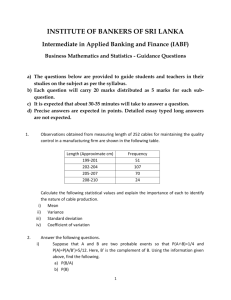

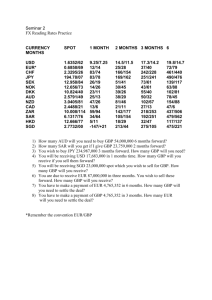

Lecture 6: The Forward Exchange Market Understanding Forward Exchange Quotes and the Use of the Forward Market Where is this Financial Center? Foreign Exchange Rate Quotes and the Use of the Market Recall that exchange rates can be quoted for two possible settlement dates: Immediate settlement (actually 1 or 2 business days): Called the Spot Rate. Settlement at some date in the future: Called the Forward Rate. Use of the forward market: To protect foreign currency cash flows against foreign currency exposure (specifically against unanticipated changes in exchange rates). Examples of Spot and Forward Quotes Monday, October 4, 2010 GBP/USD Spot: 1 month Forward 3 month Forward 6 month Forward Rate Pip Difference (From Spot) 1.5833 1.5829 - 4 1.5822 - 11 1.5812 - 21 USD/JPY Spot 1 month Forward 3 month Forward 6 month Forward 83.42 83.39 83.33 83.22 - 3 - 9 -20 Source: Wall Street Journal: http://online.wsj.com/mdc/public/page/2_3021-forex.html Forward Discounts and Premiums GBP/USD (i.e., American Terms): GBP Selling at a Forward Discount Against the USD USD/GBP (i.e., European Terms): USD Selling at a Forward Premium Against the GBP $1.5835 $1.5833 $1.5830 0.6326 0.6324 $1.5829 $1.5825 0.6324 0.6322 $1.5822 $1.5820 0.632 $1.5815 0.632 0.6318 $1.5812 $1.5810 0.6316 $1.5805 0.6314 $1.5800 0.6312 Spot 1-mos 3-mos 6-mos forward forward forward 0.6318 0.6316 Spot 1-mos forward 3-mos forward 6-mos forward Forward Discounts and Premiums USD/JPY (i.e., European Terms): USD Selling at a Forward Discount Against the JPY 83.45 83.4 JPY/USD (i.e., American Terms): JPY Selling at a Forward Premium Against the USD $0.012020 83.42 $0.012010 83.39 83.35 $0.012017 $0.012015 $0.012005 $0.012001 $0.012000 83.33 83.3 $0.011995 83.25 $0.011990 83.2 83.22 $0.011992 $0.011988 $0.011985 $0.011980 83.15 $0.011975 83.1 $0.011970 Spot 1-mos forward 3-mos forward 6-mos forward Spot 1-mos 3-mos 6-mos forward forward forward Forward Premium or Discount? Currency Exchange Rate: Foreign Currency Sept 27, 2011 Forward Discount or Premium in Pips USD/CHF Spot 0.8959 1-month 0.8955 3-month 0.8941 6-month 0.8921 AUD/USD Spot 0.9911 1-month 0.9871 3-month 0.9803 6-month 0.9713 USD: Forward Discount or Premium in Pips Forward Premium or Discount? Currency Exchange Rate: Foreign Currency Sept 27, 2011 Forward Discount or Premium in Pips USD: Forward Discount or Premium in Pips USD/CHF Spot 0.8959 1-month 0.8955 Premium (+4 pips) Discount (-4 pips) 3-month 0.8941 Premium (+18 pips) Discount (-18 pips) 6-month 0.8921 Premium (+38 pips) Discount (-38 pips) AUD/USD Spot 0.9911 1-month 0.9871 Discount (-40 pips) Premium (+40 pips) 3-month 0.9803 Discount (-108 pips) Premium (+108 pips) 6-month 0.9713 Discount (-198 pips) Premium (+198 pips) Forward Exchange Contracts Forward exchange contracts are over the counter instruments written by market maker banks Market maker banks quote bid and ask prices for various currencies for forward periods upon request. Bids are prices at which they will buy “base” currency and ask are prices at which they will sell the “base” currency. Popular journals publish forward quotes for standard time periods. For example the Wall Street Journal publishes 1, 3 and 6 months forward. However, forward contracts are not limited to these standard periods. Quotes can be obtained for specific time periods as requested by bank customers (thus tailored to client needs). Large banks will quote forward rates up to one year in the majority of currency pairs and further out in the major currencies (out to 5 and 10 years). Outright Forwards An outright forward exchange contract is a transaction to buy or sell one currency against another for a fixed forward value date. The fixed forward value date is the contract’s settlement date (note: this is similar to the spot value date on a spot contract). The forward exchange rate is fixed on the date of dealing (called the forward trade date) and is set against the current spot rate (i.e., on the spot trade date). An outright forward contract is a contractual obligation on both parties, i.e., the bank and the client. Forward Quote Example 4/4/2011 Complete Quote (bid/ask) Spot (GBP/USD): 6 month Forward (GBP/USD): 1.5833/1.5836 1.5812/1.5816 Thus the market maker will: Buy GBP spot at $1.5833 and sell GBP spot at $1.5836; spot trade date 4/4/2011 and spot value date (settlement date) 4/6/2011. Or: Buy GBP in 6 months at $1.5812 and sell GBP in 6 months at $1.5816. Note: The fixed forward value date (settlement) is 6 months from the spot value date (4/6/2011), or October 6, 2011 (see next slide for calendar). 2011 Calendar Using the Forward Market to Hedge (Cover) an Open Short Position Assume: A U.S. firm has a British pound liability due in 6 months. The liability totals 1million GBP Problem with an “uncovered” (open) short position. Firm has an open short position in GBP. If the GBP spot rate strengthens in 6 months, it will cost more in USD to pay the liability. Solution: U.S. company can “lock” in the USD cost of the GBP liability by buying GBP 6 months forward at the forward rate quoted. In doing so, the U.S. firm has “covered” (i.e., hedged) its GBP liability due in 6 months. Example: Using the Forward Market to Hedge (Cover) an Open Short Position Use the information on the previous slide (a U.S. firm has a 1million GBP 6 month open short position) and assume the following market maker quotes for GBP/USD: Spot 1.5634/1.5637 1 month 1.5629/1.5632 3 month 1.5620/1.5624 6 month 1.5608/1.5610 Question: What is the known USD liability in 6 months if the U.S. firm uses a forward contact to hedge its foreign exchange exposure? ____________________________ Example: Using the Forward Market to Hedge (Cover) an Open Short Position Use the information on the previous slide (a U.S. firm has a 1million GBP 6 month open short position) and assume the following market maker quotes for GBP/USD: Spot 1.5634/1.5637 1 month 1.5629/1.5632 3 month 1.5620/1.5624 6 month 1.5608/1.5610 Question: What is the known USD liability in 6 months if the U.S. firm uses a forward contact to hedge its foreign exchange exposure? ₤1,000,000 x 1.5610 = $1,561,000 Using the Forward Market to Hedge (Cover) an Open Long Position Assume: A U.S. firm has a British pound account receivable due in 3 months. The receivable totals 1 million GBP Problem with an “uncovered” (open) long position. Firm has an open long position in GBP. If the GBP spot rate weakens in 3 months, the U.S. firm will receive fewer U.S. dollars. Solution: U.S. company can “lock” in the USD return of the GBP account receivable by selling GBP 3 months forward at the forward rate quoted. In doing so, the U.S. firm has “covered” (i.e., hedged) its GBP receivable due in 3 months. Example: Using the Forward Market to Hedge (Cover) an Open Long Position Use the information on the previous slide (a U.S. firm has a 1million GBP 3 month open long position) and assume the following market maker quotes for GBP/USD: Spot 1.5634/1.5637 1 month 1.5629/1.5632 3 month 1.5620/1.5624 6 month 1.5608/1.5610 Question: What is the known USD equivalent expected in 3 months if the U.S. firm uses a forward contact to hedge its foreign exchange exposure? _______________________ Example: Using the Forward Market to Hedge (Cover) an Open Long Position Use the information on the previous slide (a U.S. firm has a 1million GBP 3 month open long position) and assume the following market maker quotes for GBP/USD: Spot 1.5634/1.5637 1 month 1.5629/1.5632 3 month 1.5620/1.5624 6 month 1.5608/1.5610 Question: What is the known USD equivalent expected in 3 months if the U.S. firm uses a forward contact to hedge its foreign exchange exposure? ₤1,000,000 x 1.5620 = $1,562,000 Using the Forward Market to Hedge (Cover) an Open Short Position Assume: A British firm has a 1 million USD liability due in 1 month. Assume the following market maker quotes for GBP/USD: Spot 1.5634/1.5637 1 month 1.5629/1.5632 3 month 1.5620/1.5624 6 month 1.5608/1.5610 Question: What is the known GBP liability in 1 month if the British firm uses a forward contact to hedge its foreign exchange exposure? _______________________ Using the Forward Market to Hedge (Cover) an Open Short Position Assume: A British firm has a 1 million USD liability due in 1 month. Assume the following market maker quotes for GBP/USD: Spot 1.5634/1.5637 1 month 1.5629/1.5632 3 month 1.5620/1.5624 6 month 1.5608/1.5610 Question: What is the known GBP liability in 1 month if the British firm uses a forward contact to hedge its foreign exchange exposure? 1/1.5629 = 0.6398362 x $1,000,000 = ₤639,836.20 Using the Forward Market to Hedge (Cover) an Open Long Position Assume: A British firm has a 1 million USD account receivable which it expects to receive in 3 months. Assume the following market maker quotes for GBP/USD: Spot 1.5634/1.5637 1 month 1.5629/1.5632 3 month 1.5620/1.5624 6 month 1.5608/1.5610 Question: What is the known GBP equivalent expected in 3 months if the British firm uses a forward contact to hedge its foreign exchange exposure? ________________________ Using the Forward Market to Hedge (Cover) an Open Long Position Assume: A British firm has a 1 million USD account receivable which it expects to receive in 3 months. Assume the following market maker quotes for GBP/USD: Spot 1.5634/1.5637 1 month 1.5629/1.5632 3 month 1.5620/1.5624 6 month 1.5608/1.5610 Question: What is the known GBP equivalent expected in 3 months if the British firm uses a forward contact to hedge its foreign exchange exposure? 1/1.5624 = 0.6400409 x $1,000,000 = ₤640,040.90 Forward Exchange Contract Risks Credit Risk (counterparty risk): The risk that the currency contracted to be purchased or sold on some future date will not be delivered. (1) Bank Risk (“Herstatt Risk”*): Risk that the bank which sold the client a forward contract will default prior to payment. *Named after German bank I.D. Herstatt which unexpectedly closed in 1974 and thus defaulted on its FX commitments (both spot and forwards). (2) Client Risk: Risk that client who purchased a forward contract fails to deliver currency. Client might go bankrupt, or Foreign currency account receivable is not paid (to client). Protecting Against Counterparty Risk Bank Risk: Deal with only the top (and most credit worthy) banks. Stay away from banks with overexposures in high risk areas. Client Risk: Ensure payment on foreign currency account receivables through bankers’ acceptances. Bankers’ acceptances: Payment is guaranteed by commercial bank (not dependent upon the foreign company). Forward Quotes Day’s close (in actual rates) http://online.wsj.com/mdc/public/page/2_3021forex.html Rates (in pips from spot) http://www.forexpros.com/rates-bonds/forwardrates We will examine this site in more detail in the next lecture (The Forward Market and the Forward Exchange Rate) Bankers’ Acceptances A bankers acceptance is a time draft drawn on a bank, and is typically used to finance an international transaction where an exporter is unwilling to offer their goods or services on credit to an importer. A banker's acceptance is issued by the importer and is an order for its bank to pay an exporter certain amount of money at a predetermined date. Once the bank accepts this order, they are liable for payment to the exporter. Once the Bankers acceptance has been signed by the bank on behalf of the importer, the exporter may either hold the acceptance until maturity date or sell it on the secondary market at a discount of its par. Bankers acceptances are a major part of the U.S. money markets, providing liquidity to exporters and low risk interest income to secondary market buyer . They are typically traded at a spread above the U.S. T-bills and the rate is referred to as the Banker's Acceptance rate. For current bankers’ acceptances rates view: http://online.wsj.com/mdc/public/page/2_3020-moneyrate.html Life Cycle of a Bankers’ Acceptance A Bankers’ Acceptance (Madura, page 567)