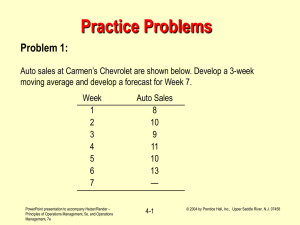

Decision Making Under Uncertainty

advertisement

Chapter 3 Fundamentals of Decision Theory Models To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-1 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Learning Objectives Students will be able to: • List the steps of the decisionmaking process • Describe the types of decisionmaking environments • Use probability values to make decisions under risk • Make decisions under uncertainty, where there is risk but probability values are not known • Use computers to solve basic decision-making problems To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-2 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Chapter Outline 3.1 Introduction 3.2 The Six Steps in Decision Theory 3.3 Types of Decision-Making Environments 3.4 Decision Making Under Risk 3.5 Decision Making Under Uncertainty 3.6 Marginal Analysis with a Large Number of Alternatives and States of Nature To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-3 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Introduction • Decision theory is an analytical and systematic way to tackle problems • A good decision is based on logic. To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-4 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 The Six Steps in Decision Theory 1) Clearly define the problem at hand 2) List the possible alternatives 3) Identify the possible outcomes 4) List the payoff or profit of each combination of alternatives and outcomes 5) Select one of the mathematical decision theory models 6) Apply the model and make your decision To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-5 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Decision Table for Thompson Lumber Alternative Construct a large plant Construct a small plant Do nothing To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna State of Nature Favorable Unfavorable Market Market $200,000 -$180,000 $100,000 -$20,000 $0 0 3-6 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Types of DecisionMaking Environments • Type 1: Decision-making under certainty • decision-maker knows with certainty the consequences of every alternative or decision choice • Type 2: Decision-making under risk • The decision-maker does know the probabilities of the various outcomes • Decision-making under uncertainty • The decision-maker does not know the probabilities of the various outcomes To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-7 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Tile Replacement on the Space Shuttle Define problem Develop solution Replacement of tiles on space shuttle Decision-making model: partitions on shuttle surface Probability values: debonding, loss of adjacent tile, burnthrough, critical failure Risk-criticality scale Test solution Test of model Analyze results Improved maintenance would help New maintenance model implemented Develop model Acquire data Implement results To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-8 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Critical Decisions in a Nuclear World Define problem Develop model Acquire data Develop solution Tritium replacement: supply exhausted in 2011; how to produce additional 11 alternatives U.S. Dept. of Energy, Secretary of Energy, Office of Defense Programs, Weapons Complex Reconfiguration Program Further investigate two alternatives Test solution Test: schedule, capacity, availability, cost, environmental analysis Analyze results Two new offices: Commercial Reactor Production, Accelerator Production Implement results Result to be implement To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-9 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Decision-Making Under Risk Expected Monetary Value EMV(Alternative) n Payoff S j * P( S j ) j 1 where n number of stages of nature. To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-10 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Decision Table for Thompson Lumber Favorable Unfavorable Market Market Alternative State of Nature Construct a $200,000 -$180,000 $10,000 large plant Construct a $100,000 -$20,000 $40,000 small plant Do nothing $0 0 0.50 To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 0.50 3-11 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Expected Value of Perfect Information (EVPI) • EVPI places an upper bound on what one would pay for additional information • EVPI is the expected value with perfect information minus the maximum EMV To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-12 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Expected Value With Perfect Information (EV | PI) n EV | P I (Best outcomefor st at eof nature)* P (Sj ) j1 n number of st at esof nature. To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-13 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Expected Value of Perfect Information • EVPI = EV|PI - maximum EMV To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-14 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Expected Value of Perfect Information State of Nature Alternative Favorable Unfavorable EMV Market Market Construct a $200,000 large plant Construct a small plant $40,000 Do Nothing 0 0.50 To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 0.50 3-15 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Expected Value of Perfect Information EVPI = expected value with perfect information - max(EMV) = $200,000*0.50 + 0*0.50 - $40,000 = $60,000 To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-16 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Expected Opportunity Loss • EOL is the cost of not picking the best solution • EOL = Expected Regret To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-17 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Computing EOL - The Opportunity Loss Table State of Nature Alternative Large Plant Favorable Market ($) 200,000 - 200,000 Unfavorable Market ($) 0 - (-180,000) Small Plant 200,000 - 100,000 0 -(-20,000) Do Nothing 200,000 - 0 0-0 Probabilities 0.50 0.50 To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-18 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 The Opportunity Loss Table continued State of Nature Alternative Large Plant Favorable Market 0 Unfavorable Market) $180,000 Small Plant $100,000 $20,000 Do Nothing $200,000 0 Probabilities 0.50 0.50 To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-19 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 The Opportunity Loss Table - continued Alternative Large Plant Small Plant Do Nothing EOL (0.50)*$0 + $90,000 (0.50)*($180,000) (0.50)*($100,000) $60,000 + (0.50)(*$20,000) (0.50)*($200,000) $100,000 + (0.50)*($0) To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-20 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Sensitivity Analysis EMV(Large Plant) = $200,000P - (1P)$180,000 EMV(Small Plant) = $100,000P $20,000(1-P) EMV(Do Nothing) = $0P + 0(1-P) To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-21 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Sensitivity Analysis continued 250000 EMV Values 200000 150000 Point 1 Point 2 Small Plant 100000 50000 0 -50000 0 -100000 0.2 0.4 0.6 0.8 Large Plant EMV -150000 -200000 Values of P To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-22 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 1 Decision Making Under Uncertainty • Maximax • Maximin • Equally likely (Laplace) • Criterion of Realism • Minimax To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-23 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Decision Making Under Uncertainty Maximax - Choose the alternative with the maximum output State of Nature Alternative Favorable Unfavorable Market Market Construct a 200,000 -180,000 large plant Construct a 10,000 -20,000 small plant Do nothing 0 0 Probabilities To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 0.50 3-24 0.50 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Decision Making Under Uncertainty Maximin - Choose the alternative with the maximum minimum output Alternative Construct a large plant Construct a small plant Do nothing State of Nature Favorable Unfavorable Market Market 200,000 -180,000 100,000 -20,000 0 0 Probabilities To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-25 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Decision Making Under Uncertainty Equally likely (Laplace) - Assume all states of nature to be equally likely, choose maximum Average Alternative Construct Large Plant Construct small plant Do nothing States of Nature Favorable Unfavorable Avg. Market Market $200,000 -$180,000 10,000 100,000 -20,000 40,000 0 0 0 To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-26 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Decision Making Under Uncertainty Criterion of Realism (Hurwicz): CR = *(row max) + (1-)*(row min) State of Nature Alternative Favorable Unfavorable Market Market CR Construct large plant $200,000 -180,000 124,000 Construct small plant Do nothing $100,000 -20,000 76,000 0 0 0 0.80 0.20 To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-27 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Decision Making Under Uncertainty Minimax - choose the alternative with the minimum maximum Opportunity Loss States of Nature Alternative Favorable Unfavorable CR Market 0$ Market $180,000 $180,000 $100,000 20,000 100,000 200,000 0 200,000 Construct a large plant Construct a small plant Do nothing To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-28 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Marginal Analysis • P = probability that demand is greater that or equal to a given supply • 1-P = probability that demand will be less than supply • MP = marginal profit • ML = marginal loss • Optimal decision rule is: P*MP (1-P)*ML • or ML P MPML To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-29 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Marginal Analysis Discrete Distributions Steps using Discrete Distributions: • Determine the value for P • Construct a probability table and add a cumulative probability column • Keep ordering inventory as long as the probability of selling at least one additional unit is greater than P To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-30 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Café du Donut Example Daily Sales (Cartons) Probability of Sales at this Level Probability that Sales Will Be at this Level or Greater 4 0.05 1.00 5 0.15 0.95 6 0.15 0. 80 7 0.20 0.65 8 0.25 0.45 9 0.10 0.20 10 0.10 0.10 1.00 To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-31 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Café du Donut Example continued Marginal profit = selling price - cost = $6 - $4 = $2 Marginal loss = cost Therefore: ML P ML MP 4 4 0.667 42 6 To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-32 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Café du Donut Example continued Daily Sales Probability of Probability that Sales (Cartons) Sales at this Level Will Be at this Level or Greater 4 5 6 7 8 9 10 To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 1.00 0.66 0.95 0.66 0. 80 0.66 0.65 0.45 0.20 0.10 0.05 0.15 0.15 0.20 0.25 0.10 0.10 1.00 3-33 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Marginal Analysis Normal Distribution • = average or mean sales • = standard deviation of sales • MP = marginal profit • ML = Marginal loss To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-34 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Marginal Analysis Discrete Distributions • Steps using Normal Distributions: • Determine the value for P. P ML MLMP • Locate P on the normal distribution. For a given area under the curve, we find Z from the standard Normal table. X - * • Using Z we can now solve for X* To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-35 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Joe’s Newsstand Example A • ML = 4 • MP = 6 • = Average demand = 50 papers per day • = Standard deviation of demand = 10 To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-36 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Joe’s Newsstand Example A - continued ML 4 Step 1: p 0.40 ML MP 4 6 Step 2: Look in the Normal table for P = 0.6 (i.e., 1 – 0.4) X * - 50 Z 0.25 10 . or X 10 * 0.25 50 * 52.5 or 53 newspapers To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-37 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Joe’s Newsstand Example A continued To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-38 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Joe’s Newsstand Example B • ML = 8 • MP = 2 • = Average demand = 100 papers per day • = Standard deviation of demand = 10 To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-39 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Joe’s Newsstand Example B - continued ML 8 0.80 • Step 1: p ML MP 8 2 • Step 2: Z = -0.84 for an area of 0.80 and or: X - 1000 - 0.84 10 * X * 0 - 0.84(10) 100 91.6 or 92 newspapers To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-40 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458 Joe’s Newsstand Example B continued To accompany Quantitative Analysis for Management, 8e by Render/Stair/Hanna 3-41 © 2003 by Prentice Hall, Inc. Upper Saddle River, NJ 07458