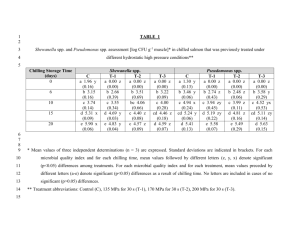

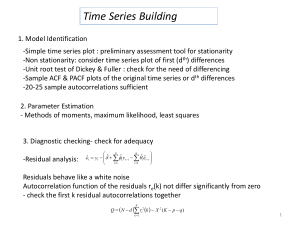

Identifying ARIMA Mo..

advertisement

Identifying ARIMA Models

What you need to know

1

Autoregressive of the second order

• X(t) = b1 x(t-1) + b2 x(t-2) + wn(t)

• b2 is the partial regression coefficient

measuring the effect of x(t-2) on x(t)

holding x(t-1) constant

• Since x(t) is regressed on itself lagged, b2

can also be interpreted as a partial

autoregression coefficient of x(t) regressed

on itself lagged twice.

2

continued

• In one more step b2 can be defined as the

partial autocorrelation coefficient at lag 2,

b2 = pacf(2)

• Solving the yule-Walker equations:

• b2 = {acf(2) – [acf(1)]2 }/[1 – [acf(1)]2

• We know that if the process is

autoregressive of the first order, then

acf(2) = [acf(1)]2 and so b2 = 0

3

So now we are back to

autoregressive of the first oder

• x(t) = b x(t-1) + wn(t)

• There is only one regression coefficient, b,

so acf(1) = pacf(1) = b

4

In summary

• The partial autocorrelation function, pacf(u)

indicates the order of the autregressive process.

If only pacf(1) is significantly different from zero,

then the autoregressive process is of order one.

If the pacf(2) is significantly different from zero,

then the autoregressive process is of order two,

and so on.

• Thus we use the partial autocorrelation function

to specify the order of the autoregressive

process to be estimated

5

The autocorrelation function

• The autocorrelation function, acf(u) is used

to determine the order of the moving

average process

• If acf(1) is significantly different from zero

and there are no other significant

autocorrelations, then we specify a first

order MA process to be estimated

6

Cont.

• If there is a significant autocorrelation at

lag two and none at higher lags, then we

specify a second order moving average

process

7

Moving Average Process

• X(t) = wn(t) + a1wn(t-1) + a2wn(t-2) + a3wn(t-3)

• Taking expectations the mean function is zero,

Ex(t) = m(t) = o

• Multiplying by x(t-1) and taking expectations,

E[x(t)x(t-1)] =

• EX(t) = wn(t) + a1wn(t-1) + a2wn(t-2) + a3wn(t-3)

X(t-1) = wn(t-1) + a1wn(t-2) + a2wn(t-3) + a3wn(t4), γx,x (1) = [a1 + a1 a2 + a2 a3 ] σ2

8

Continuing

• The autocovariance at lag 2, γx,x (2) = E x(t) x(t-2)

• EX(t) = wn(t) + a1wn(t-1) + a2wn(t-2) + a3wn(t-3)

X(t-2) = wn(t-2) + a1wn(t-3) + a2wn(t-4) + a3wn(t-5), γx,x

(2) = [a2 + a1 a3 ] σ2

• The autocovariance at lag 3, γx,x (3) = E x(t) x(t-4)

• EX(t) = wn(t) + a1wn(t-1) + a2wn(t-2) + a3wn(t-3)

X(t-3) = wn(t-3) + a1wn(t-4) + a2wn(t-5) + a3wn(t-6), γx,x

(3) = [a3 ] σ2

• The autocovariance at lag 4 is zero, E x(t)x(t-4) = 0, so

the autocovariance function determines the order of

the MA process

9

Specifying ARMA Processes

• x(t) = A(z)/B(z)

• The autocovariance function divided by the variance,

i.e. the autocorrelation function, acf(u), indicates the

order of A(z) and the partial autocorrelation function,

pacf(u) indicates the order of B(z)

• In Eviews specify x(t) c ar(1) ar(2) ….ar(u) for a uth

order B(z) and include ma(1) ma(2) ….ma(u) for a uth

order A(z),

• i.e. X(t) c ar(1) ar(2) …ar(u) ma(1) ma(2) …ma(u)

10

Summary of Identification

•

•

•

•

•

•

•

Spreadsheet

Trace: Is it stationary?

Histogram: is it normal?

Correlogram: order of A(z) and B(z)

Unit root test: is it stationary?1111

Specification

estimation

11

ARMA Processes

• Identification

• Specification and Estimation

• Validation

– Significance of estimated parameters and DW

– Actual, fitted and residual

– Residual tests

• Correlogram: are they orthogonal? Also the

Breusch-Godfrey test for serial correlation

• Histogram; are they normal?

• Forecasting

12

Example: Capacity utilization mfg.

13

Spreadsheet

14

Histogram

60

Series: MCUMFN

Sample 1972:01 2010:03

Observations 459

50

40

30

20

10

Mean

Median

Maximum

Minimum

Std. Dev.

Skewness

Kurtosis

78.98322

79.30000

88.50000

65.20000

4.647918

-0.603442

3.051589

Jarque-Bera

Probability

27.90780

0.000001

0

66 68 70 72 74 76 78 80 82 84 86 88

15

Correlogram

16

Unit root test

17

Pre-Whiten

Gen dmcumfn =mcumfn – mcumfn(-1)

18

Spreadsheet

19

Trace

2

1

0

-1

-2

-3

-4

75

80

85

90

95

DMCUMFN

00

05

10

20

histogram

120

Series: DMCUMFN

Sample 1972:02 2010:03

Observations 458

100

80

60

40

20

Mean

Median

Maximum

Minimum

Std. Dev.

Skewness

Kurtosis

-0.023799

0.000000

1.800000

-3.900000

0.660698

-1.109196

7.351042

Jarque-Bera

Probability

455.1915

0.000000

0

-4

-3

-2

-1

0

1

2

21

Correlogram

22

Unit root test

23

Specification

Dmcumfn c ar(1) ar(2)

24

Estimation

25

Validation

2

0

4

-2

2

-4

0

-2

-4

75

80

85

Residual

90

95

Actual

00

05

10

Fitted

26

Correlogram of the residuals

27

Breusch-Godfrey Serial correlation test

28

Re-Specify

29

Estimation

30

Validation

2

0

4

-2

2

-4

0

-2

-4

75

80

85

Residual

90

95

Actual

00

05

10

Fitted

31

Correlogram of the Residuals

32

Breusch-Godfrey Serial correlation test

33

Histogram of the residuals

100

Series: Residuals

Sample 1972:05 2010:03

Observations 455

80

60

40

Mean

Median

Maximum

Minimum

Std. Dev.

Skewness

Kurtosis

8.09E-05

0.010460

2.669327

-2.954552

0.583609

-0.316126

6.875041

Jarque-Bera

Probability

292.2558

0.000000

20

0

-3

-2

-1

0

1

2

34

Forecasting: Procs. Workfile range

35

Forecasting: Equation

window.forecast

36

Forecasting

2.0

1.5

1.0

0.5

0.0

-0.5

-1.0

-1.5

10:04 10:05 10:06 10:07 10:08 10:09 10:10 10:11 10:12

DMCUMFNF

± 2 S.E.

37

Forecasting: Quick, show

38

Forecasting

39

Forecasting: show, view, graph-line

2

1

0

-1

-2

-3

00

01

02

03

04

DMCUMFN

FORECAST

05

06

07

08

09

10

+2*SEF

FORECAST-2*SEF

40

Reintegration

41

Forecasting mcumfn

42

Forecast mcumfn, quick, show

43

Forecasting mcumfn

84

80

76

72

68

64

00

01

02

03

04

MCUMFN

MCUMFNF

05

06

07

08

09

10

MCUMFNF+2*SEF

MCUMFNF-2*SEF

44

What can we learn from this forecast?

• If, in the next nine months, mcumfn grows

beyond the upper bound, this is new

information indicating a rebound in

manufacturing

• If, in the next nine months, mcumfn stays

within the upper and lower bounds, then

this means the recovery remains sluggish

• If mcumfn goes below the lower bound,

run for the hills!

45