Cash flow forecasts PowerPoint Presentation

advertisement

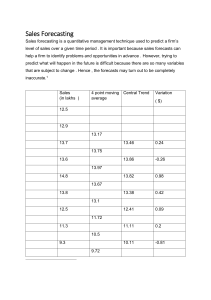

Cash flow forecasts Cash flow forecasts predict… • Cash flow in • Cash flow out • Cash left …for a given period (usually a year) Benefits of cash flow forecasting: • Forewarns any cash flow shortfalls or peaks • Helps business owners prepare for them • Exposes debt collection issues Cash is… ... any liquid asset… …that can be turned into cash to pay an urgent debt Cash flow forecasting in 4 steps: Cash flow forecasting in 4 steps: 1. 2. 3. 4. Identify cash in Identify cash out Calculate net cash flow Adjust bank balances Step 1: Identify cash in Cash in can be… • Cash sales • Interest on savings • Debts repaid • Cash from a loan … plus other types of easily accessible income Step 2: Identify cash out Cash out can be… • Purchases • Utility bills • Wages … however, depreciation does not count even though interest counts as a “cash in” source Step 3: Calculate net cash flow Subtract “cash out” from “cash in” to find net cash flow The equation is simple - the hard part is accurately identifying the sources defining the flow of cash Step 4: Adjust bank balances Add net cash flow to bank balance for the beginning of the month to predict what’s going to happen by the end of the month Just be careful… At the end of every month you can compare forecast to reality Just make sure you leave the correct closing bank figure in your records… If you don’t future forecasts will be inaccurate Find out more with Business.govt.nz: Business.govt.nz provides free access to a wide range of resources, including tools and interactive content. It acts as a gateway to government and private sector business information, news and services. Next steps: • Cash flow forecasting • Introduction to raising capital • Can you afford to start a business • Finding sources of capital • SWOT analysis • Assess if you are ready to start up