Economic Concepts Related To Appraisals

Economic Concepts Related to

Appraisals

Time Value of Money

• The basic idea is that a dollar today is worth more than a dollar tomorrow

• Why?

– Consumption

– Risk (uncertainty)

– Investment

– Inflation

– Other?

Present Value

• Present value (PV) is the value today of a sum of money to be received in the future

• This can be the value of an amount at one time period in the future or it can be the value of a stream of payments into the future

• The PV is determined by discounting, the future value is ‘discounted’ to the present

• The interest rate used is sometimes referred to as the discount rate

Present Value, cont.

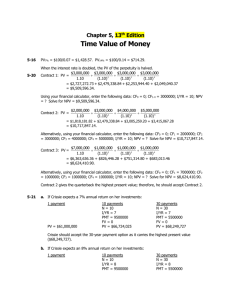

• Lump sum

• PV = Future value/ (1 + i) n = FV*1/(1+i) n where:

– i = the interest or discount rate

– n = the time period

• PV of $8,000 in 10 years at a 4% discount rate

– PV = $8000* 1 / (1 + .04) 10 = $8000 * .6756 =

$5,405

Present Value, cont.

• PV of an annuity or series of payments over time is:

– PV = Payment * (1-(1 + i) -n / i )

• Tables have been developed to use for either the present value factor for a lump sum or a series of payments. Excel is very useful

• If we assume an infinite number of years and equal payments the PV formula reduces to:

– PV = Pmt/i

$3 500

$3 250

$3 000

$2 750

$2 500

$2 250

$2 000

$1 750

$1 500

$1 250

$1 000

$750

$500

$250

$0

$5 500

$5 250

$5 000

$4 750

$4 500

$4 250

$4 000

$3 750

Present Value of a $100 Annuity

$5,000

$1,667

$2,500

2%

Number of Years

4% 6%

Impact of Changing Income on Present Value

$8 000

$7 000

$6 000

$5 000

$4 000

$3 000

$2 000

$1 000

$0

10 20 30 40 50 75 100 110 120 130 150 160 170 180 190 200 250

Number of Years

$50 $100 $200 $300

Example 1

• What is the present value of an annuity of

$150 for:

– 25 years at 4%

• $150 * 15.62208 = $2,343

– 25 years at 2%

• $150 * 19.52346 = $2,929

– 22 years at 6%

• $150 * 12.04158 = $1,806

Example 2

• What is the present value of $150 at 6% in perpetuity?

– $150/.06 = $2,500

• What is the payment used if the present value is $5,064 and the interest rate is 4%

– $5,064 = X/.04 = $5,064 * .04 = X X = $203

Example 3

• You want to know what will have the lowest cost to control erosion, building a dam or changing tillage practices and using cover crops. The discount rate is 4%

– Dam costs $5,000 to build, $5 a year to maintain and in 25 years there will need to be major repairs for $1,000. Expected life is 75 years

– Cover crop will be $135 a year.

Present value Example 3

• Dam

• Maintenance

• $5 * (1-(1+i)

-n

)/I = 5*23.68041

• Rebuild

• $1,000 * 1 / (1+i) n

= 1000*.3751

$5,000

$ 118

$ 375

$5,493

• Cover Crop

• $135 * 23.68041 = $3,197

Example 4

• What is the value of an orchard if the initial cost of the trees is $1,000 and there is a $60 expense in year 2, $30 expenses in years 3, 4, and 5 and then there is income of $125 for the next 50 years? Use a 6% discount rate.

• Expenses $1,000

– $60 * .8900 = $53

– $30 * .8396 + 30*.7921 + 30*.7473 =

– 25 + 24 + 22 = $71

• PV of expenses $1000 + $53 + $71 = $1,124

Example 4 Cont

• Income

– PV $125 for 50 years at 6%

– $125 * 15.76186 = $1,970

• PV of orchard

$1,970 - $1,124 - $527 = $319

Future Value

• The future value is the amount of money to be received at some point in the future or it is the amount a present value will grow to when invested at a given interest rate.

• The present value is discounted but the future value is compounded.

• Compounding and discounting are the opposite of each other

Future Value, cont.

• FV = PV * (1 + i) n where the variables are the same as before

• FV of an annuity;

– FV = PMT * ((1 + i) n – 1) / i

• Rule of 72; if you divide 72 by the interest rate you get the approximate time it takes an investment to double

$

PV

$

Time

FV

?

$

PMT PMT PMT PMT

$ $ $ $

Time

Future Value

FV

?

$

PV

?

Time

FV

$

$

PV

?

PRESENT VALUE

PMT PMT PMT PMT

$ $ $ $

Time

Example 1

• Land is worth $1,500 today. You expect that it will increase in value by 3% a year. What will be the value of the land in 15 years?

• $1,500 * 1.5580 = $2,337

Example 2

• Assume we had a farm that sold for $500, 000 seven years ago. What would we have to sell it for today to earn 6% on the investment?

• FV of $500,000 today earning 6% for 7 years

– $500,000 * 1.5036 = $751,800

Example 3

• You think you’ll need $30,000 for your child to go to college in 8 years. You deposit $4000 a year into an 5% savings account. How much will you have when they start school?

• $4,000 * 9.5491 = $38,196

• How much should you have saved to just have

$30,000?

– $30,000 / 9.5491 = $3,142

Investment Analysis

• Investment analysis or capital budgeting is used to determine profitability and/or compare alternatives

• Investment analysis requires knowing:

Initial costs

Actual total expenditure not just down payment or list price

Investment Analysis, cont.

Need to know continued

Net cash flow for each time period over the life of the investment

Only cash revenues and expenses; DO NOT include depreciation or any financing charges

Terminal value (salvage value);

For land estimate of the market value when investment is terminated or if assumed to be held indefinitely the terminal value can be ignored

Investment Analysis, cont.

4. Discount rate

Opportunity cost of capital, cost of borrowing, weighted average,

Risk premium especially when comparing alternatives with different risks

Other adjustments to remember when considering a discount rate include; tax differences and inflation

Increasing discount rate lowers value of investment

Net Present Value

• Preferred method of evaluation

– Also called discounted cash flow method

• NPV is the sum of the present values for each year’s net cash flow minus the initial cost of the investment

• NPV = P

1

/(1+i) + P

2

/(1+i) 2 + … + P n

/(1+i) n – C

• Calculations in Excel or from Present Value factor tables

Net Present Value, cont

• NPV > 0 accept

• NPV < 0 reject

• NPV = 0 indifferent

• NPV > 0 means rate of return higher than the discount rate; C could be higher and investor could still receive the discount rate

• Discount rate is critical

Internal Rate of Return

• Internal rate of return (IRR) is another technique used to compare investments

• IRR is the discount rate that makes the NPV just equal 0

• 0 = (.)-C C = (.) so that the IRR is the i to make C = 0

• IRR > cost of capital is profitable, some people only invest if IRR is greater than a certain level

• Hard to calculate; doesn’t account for size; assumes same rate possible every period

Financial Feasibility

• IRR and NPV don’t consider the financing except through the discount rate

• It is important to think about financing when considering an investment

• Financing can affect the cash flows, especially in the early years; some cases with negative cash flows may not even be possible

• Something can be profitable but not feasible because of the cash flow associated with financing

Example 1

• Which would you prefer, an investment A that returns $3,000 a year for 5 years or investment B that returns

– Year 1 $1,000

– Year 2 $2,000

– Year 3 $3,000

– Year 4 $4,000

– Year 5 $6,000

• Both Cost $10,000 and use a 6% discount rate

Example 1 cont

• Investment A

– $3,000 * .9434 = $2,830

– $3,000 * .8900 = $2,670

– $3,000 * .8396 = $2,519

– $3,000 * .7921 = $2,376

– $3,000 * .7473 = $2,242

– Total $12,637

– Less cost $10,000

NET PRESENT VALUE $ 2,637

• Investment B

– $1,000 * .9434 = $943

– $2,000 * .8900 = $1,780

– $3,000 * .8396 = $2,519

– $4,000 * .7921 = $3,168

– $6,000*

– Total

.7473 = $4,484

– Less costs

– NPV

$12,894

$10,000

$ 2,894

• Investment A

• Investment B

NPV $2,637

NPV $2,894

• Both earn more than 6%

• Could afford to pay more for either investment

• What if there had been a terminal or salvage value

Other thoughts

• Discount rate;

– Inflation adjustments

• Adjust if some costs and/or revenues will move differently over time; Otherwise NPV will be the same

• Inflation premium should be ADDED to the real discount rate to obtain the adjusted rate

– Risk adjustments

• Adjust for risk if there is a difference in the perceived risks of the investment

• Risk premium so you add to the real discount rate because you need a higher rate of return

Other Economic Considerations with Land

• There is an intrinsic value to land; people just want to own it especially a particular parcel of land

• There is a social value to land; land is the basis for many societies and for the wealth of a society;

How we treat the land says who we are

• Why people own land is not always as an investment; legacy; security, retirement

• Don’t own land to make money but own land to own it