Business IX - jimakers.com

advertisement

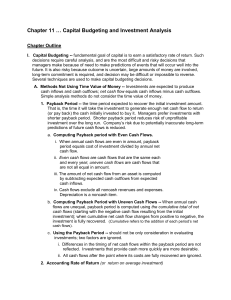

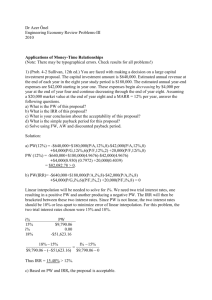

Chapter 3 1 1. Explain six criteria for a useful project selection/screening model. 2. Understand how to employ checklists and simple scoring models to select projects. 3. Use more sophisticated scoring models, such as the Analytical Hierarchy Process. 4. Learn how to use financial concepts, such as the efficient frontier and risk/return models. 5. Employ financial analyses and options analysis to evaluate the potential for new project investments. 6. Recognize the challenges that arise in maintaining an optimal project portfolio for an organization. 7. Understand the three keys to successful project portfolio management. 2 Firms are inundated with project opportunities No organization has unlimited resources to work on these opportunities Screening models help managers pick winners from a pool of projects Screening models can be qualitative and simple or quantitative and complex When considering a project selection model, look for: Realism (provides a realistic result?) Capability, Comparability (works for ST/LT projects?) Flexibility (adjustable?) Ease of use (understandable?) Cost effectiveness (cheap to use) see “Prioritizing Spreadsheet” 3 A list of factors to be considered when evaluating project alternatives ◦ Risk – unpredictability to the firm, technical, safety, financial, legal ◦ Commercial Impact – reflects market potential, ROI, payback ◦ Impact to internal operations – employee training, safety issues, equipment needs ◦ Additional factors – impact on image, patent, strategic fit Strategic direction of the company will highlight certain criteria over others All models only partially reflect reality and have both objective and subjective factors imbedded 4 Checklist Simple scoring models Analytic hierarchy process Profile models Financial models Let’s look at each of these… 5 A checklist is a list of criteria applied to possible projects. A fairly simple device Requires agreement on criteria Assumes all criteria are equally important Checklists work best in a group setting and are valuable for recording opinions and encouraging discussion 6 Performance on Criteria Project Criteria Project Alpha Cost Profit Potential Time to Market Development Risks Project Beta Project Gamma Project Delta Cost Profit Potential Time to Market Development Risks Cost Profit Potential Time to Market Development Risks Cost Profit Potential Time to Market Development Risks High Medium Low (3) (2) (1) Which do you choose? X X X X Why? X X X X X X X X X X X X * good place to make use of a rubric 7 Each project receives a score that is the weighted sum of its grade on a list of criteria. Scoring models require: ◦ agreement on criteria ◦ agreement on weights for criteria ◦ a score assigned for each criteria Score (Weight Score) 8 (A) Project (B) (A) x (B) Importance Weight Score Cost 1 3 3 Profit Potential 2 1 2 Development Risk 2 1 2 Time to Market 3 2 6 Criteria Weighted Score Project Alpha Total Score Which do you choose? Why? 13 Project Beta Cost 1 2 2 Profit Potential 2 2 4 Development Risk 2 2 4 Time to Market 3 3 9 Total Score 19 9 Developed to address the technical and managerial problem with scoring models Similar to simplified scoring model except these scores are comparable due to ranking of importance The AHP is a four step process: 1. 2. 3. 4. Construct a hierarchy of criteria and subcriteria Allocate weights to criteria through pairwise comparison Assign numerical values to qualitative characteristics with a Likert scale Scores determined by summing the products of numeric evaluations and weights Analytic Hierarchy Process/Example Car http://en.wikipedia.org/wiki/Talk:Analytic_Hierarchy_Process/Example_Car 10 Allows one to plot risk vs. return options for various projects. Select the project with the maximum return and minimum acceptable risk. Makes use of a financial management concept called the efficient frontier. ◦ A set of options that offers the maximum return for a given level of risk or the minimum risk for a level of return. 11 10 Maximum Desired Risk X6 9 8 X2 7 Risk 6 X4 5 X5 4 X3 3 Efficient frontier 2 X1 1 0 0% 20% 40% Minimum Desired Return 60% 80% 100% 120% Return 12 Based on the time value of money principal – comparing what a dollar is worth today to another time period o o o o Discounted cash flow analysis Payback period Net present value Internal rate of return All of these models use discounted cash flows 13 The discounted cash flow (or DCF) describes a method of valuing a project using the time value of money. All future cash flows are estimated and discounted to give their present values. The discount rate reflects two things based on risk: ◦ the time value of money – projecting a future value to today’s dollars. ◦ a cost of capital – a corporate charge for using cash. Very similar to net present value. 14 Determines how long it takes for a project to reach a breakeven point Investment Payback Period Annual Cash Savings Cash flows should be discounted Lower numbers are better (faster payback) 15 A project requires an initial investment of $200,000 and will generate cash savings of $75,000 each year for the next five years. What is the payback period? Year Cash Flow Cumulative 0 ($200,000) ($200,000) 1 $75,000 ($125,000) 2 $75,000 ($50,000) 3 $75,000 $25,000 Divide the cumulative amount by the cash flow amount in the third year and subtract from 3 to find out the moment the project breaks even. 25, 000 3 2.67 years 75, 000 16 Advantage ◦ Easy to understand and use ◦ Emphasizes the early recovery of capitol ◦ Cashflow beyond the payback period are uncertain, so they are ignored Disadvantage ◦ Ignores timing of the cash flow within the payback period ◦ Emphasis is on the recovery of capital, not on profitability ◦ Does not provide a decision criterion for acceptance How do you decide on the maximum allowable payback period? 17 Needs to be accounted for in the capital investment decision Main reason: capital could be used for something else Capital has an opportunity cost in any given use 18 One of the most common project selection metrics. Predicts the change in the firm’s value if a project is undertaken. We attempt to equate all cash flows to current dollars. Ft NPV I o (1 r pt )t where Ft = net cash flow for period t R r = required rate of return I o= initial cash investment Higher NPV values are better! A positive value indicate the firm will make money Pt = inflation rate during period t 19 NPV takes into account a discount factor The discount factor is simply the reciprocal of the discount rate 1 discount factor (1 r p)t r rate of return p inflation rate t time period 20 Should you invest $60,000 in a project that will return $15,000 per year for five years? You have a minimum return of 8% and expect inflation to hold steady at 3% over the next five years. Year 0 1 Net flow Discount -$60,000 1.0000 $15,000 0.9009 2 3 4 $15,000 $15,000 $15,000 0.8116 0.7312 0.6587 5 $15,000 0.5935 The NPV NPV -$60,000.00 column total is negative, so $13,513.51 don’t invest! $12,174.34 $10,967.87 $9,880.96 $8,901.77 -$4,561.54 21 Answers the question: What rate of return will this project earn? It is the interest rate at which the NPV of the cash flows is equal to zero. A project must meet a minimum rate of return before it is worthy of consideration. Need to be solved with MSExcel or a financial based calculator – by hand is an iterative (guessing) process t ACFt IO n 1 (1 IRR )t where Higher IRR values are better! ACFt = annual after tax cash flow for time period t IO = initial cash outlay n = project's expected life IRR = the project's internal rate of return 22 A project that costs $40,000 will generate cash flows of $14,000 for the next four years. You have a rate of return requirement of 17%; does this project meet the threshold? Year Net flow Discount NPV 0 -$40,000 1.0000 -$40,000.00 1 $14,000 0.8696 $12,173.91 2 $14,000 0.7561 $10,586.01 3 $14,000 0.6575 $9,205.23 4 $14,000 0.5718 $8,004.55 -$30.30 This table has been calculated using a discount rate of 15% Actual IRR is 14.9625% The project doesn’t meet our 17% requirement and should not be considered further. 23 The systematic process of selecting, supporting, and managing the firm’s collection of projects. Portfolio management requires: ◦ Decision making on continued support of projects ◦ Prioritization of resources ◦ Review of potential projects ◦ Realignment with strategic fit ◦ Reprioritization of a firm’s projects 24 Flexible structure and freedom of communication ◦ Cannot be constrained by bureaucracy, poor communication, rigid processes Low-cost environmental scanning Time-paced transition ◦ Finding a way to “test the waters” before full commitment ◦ Market testing a number of experimental product prototypes ◦ Having a process to transition from one project to another 25 Conservative technical communities ◦ Technical reps holding onto projects too long Out of sync projects and portfolios ◦ Projects must stay aligned with the current strategic direction of the firm Unpromising projects ◦ Willing to “kill” a project when it is necessary? Scarce resources ◦ No one has unlimited resources ◦ Resources need to be allocated where they are most beneficial 26 Eclipse 500 Airbus A380 Tiny? 6 passengers Boeing 787 Dreamliner Jumbo? between 550 to 800 passengers Midsize? between 290 to 330 passengers 27 1. 2. 3. 4. 5. If you were to prioritize the criteria for a successful screening model, which of those criteria do you rank at the top of your priority list? Why? What are the benefits and drawbacks of project checklists for screening alternatives? How does use of the Analytical Hierarchy Process (AHP) aid in project selection? In particular, what aspects of the screening process does the AHP seem to address and improve directly? What are the benefits and drawbacks of the profile model for project screening? Be specific about the problems that may arise in identifying the efficient frontier. How are financial models superior to other screening models? How are they inferior? 28 6. 7. 8. 9. 10. How does the options model address the problem of non-recoverable investment in a project? What advantages do you see in the GE Tollgate screening approach? What disadvantages do you see? How would you alter it? Why is project portfolio management particularly challenging in the pharmaceutical industry? What are the keys to successful project portfolio management? What are some of the key difficulties is successfully implementing portfolio management practices? 29 GoodAnswers’ controller, Sal Reigh, has negotiated a four-year lease agreement with Columbia Management. Included in the agreement is ◦ Option #1, a lump sum payment of $40,000 upon signing the four-year lease to pay for the cost of configuring the office to meet the needs of GoodAnswers. -or ◦ Option #2, to pay nothing up front, but to incur an annual lease in the amount of $11,000 paid at the end of each year for the four-year term of the lease. Assuming GoodAnswers has a cost of capital of 10%, which option should Sal choose? 30