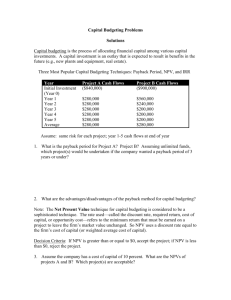

Tentative Outline

advertisement

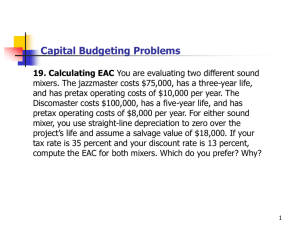

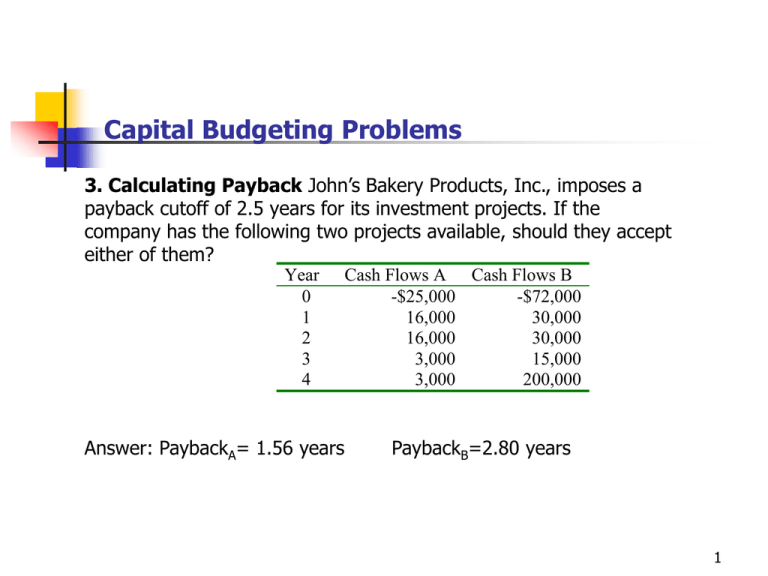

Capital Budgeting Problems 3. Calculating Payback John’s Bakery Products, Inc., imposes a payback cutoff of 2.5 years for its investment projects. If the company has the following two projects available, should they accept either of them? Year 0 1 2 3 4 Answer: PaybackA= 1.56 years Cash Flows A Cash Flows B -$25,000 -$72,000 16,000 30,000 16,000 30,000 3,000 15,000 3,000 200,000 PaybackB=2.80 years 1 Capital Budgeting Problems 4. Calculating Discounted Payback An investment project has annual cash inflows of $500, $600, $700, and $800, and a discount rate of 10 percent. What is the discounted payback period for these cash flows if the initial cost is $1,000? Answer: Discounted PaybackA= 2.09 years 2 Capital Budgeting Problems 12. NPV versus IRR The Heitman Group, Inc., has identified the following two mutually exclusive projects: Year 0 1 2 3 4 Cash Flows L Cash Flows S -$10,000 -$10,000 200 5,000 500 6,000 8,200 500 4,800 500 a. What is the IRR for each of these projects? If you apply the IRR decision rule, which project should the company accept? Is this decision necessarily correct? b. If the required return is 9 percent, what is the NPV for each of these projects? Which project will you choose if you apply the NPV decision rule? c. Over what range of discount rates would you choose Project L? Project S? At what discount rate would you be indifferent between these two projects? Answer: IRRL= 10.12% Crossover rate=8.73% IRRS=11.46% NPVL=$336.67 NPVS=$377.54 3 Capital Budgeting Problems 13. NPV versus IRR Consider the two mutually exclusive projects below: Year 0 1 2 3 Cash Flows M Cash Flows N -$50 -$50 40 5 20 5 5 65 Sketch the NPV profiles for M and N over a range of discount rates from zero to 25 percent. What is the crossover rate for these two projects? Answer: Crossover rate=11.24% 4 Capital Budgeting Problems 29. NPV Intuition Projects A and B have the same cost, and both have conventional cash flows. The total undiscounted cash inflows for A are $1,900, and for B the total is $1,500. The IRR for A is 18 percent; the IRR for B is 15 percent. What can you deduce about the NPVs for Projects A and B? What do you know about the crossover rate? Under what circumstances would you choose Project A over Project B? How about B over A? 5 Capital Budgeting Problems 33. NPV Valuation The Grim Reaper Corporation wants to set up a private cemetery business. The cemetery project will provide a net cash inflow of $25,000 for the firm during the first year, and these cash flows are projected to grow at a rate of 6 percent per year forever (the Grim Reaper keeps pretty busy). The project requires an initial investment of $400,000. a. If the Grim Reaper requires a 12 percent return on investment, should the cemetery business be started? b. The company is somewhat unsure about the assumption of a 6 percent growth rate in its cash flows. At what constant growth rate would the company just break even if it still requires a 12 percent return on investment? Answer: NPV=$16,667 g=5.75% 6