#1

Understanding

the Financial

Planning Process

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted

to a publicly accessible website, in whole or in part.

The Rewards of

Sound Financial Planning

• Maintain and improve

standard of living

• Control spending in order to

live well today and tomorrow

• Accumulate wealth

Improving Your Standard

of Living

Average American Family

The Personal Financial

Planning Process

Systematic process that considers

important elements of an

individual’s financial

affairs in order to

fulfill financial goals

Six-Step Financial

Planning Process

1. Define financial goals

2. Develop financial plans and strategies

3. Implement financial plans and strategies

4. Develop and implement budgets

5. Use financial statements to evaluate results

6. Redefine goals, revise plans as situations

change

The Role of Money

• Medium of exchange used to

measure value

• Utility amount of satisfaction

derived from purchases

versus cost

• Link to personal psychological

concepts and key role in

personal relationships

Attain Your Financial Goals

• Set specific goals and focus on results

• Make goals realistic

• Involve family members

and others

• Prioritize goals and set

a time frame

Put Target Dates on

Financial Goals

• Short-term

in the next year

• Intermediate-term

the next 2-5 years

• Long-term

6 years or more

From Goals to Plans:

A Lifetime of Planning

•

•

•

•

•

•

Early childhood

High school and college

Family formation

Career development

Pre-retirement

Retirement

Personal Financial Planning

Life Cycle

How a $1,000 Investment

Grows over Time

Plans to Achieve Your Financial

Goals

• Asset acquisition planning

• Liability and insurance planning

• Savings and investment planning

• Employee benefits planning

• Tax planning

• Retirement and estate planning

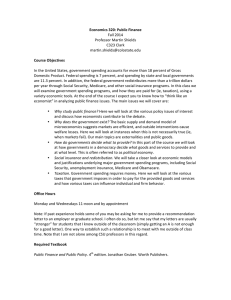

Using Professional Financial

Planners

Types of planners

• Commission-based – earn commission

on financial products sold

• Fee-only – charge fees based on

complexity of the plan

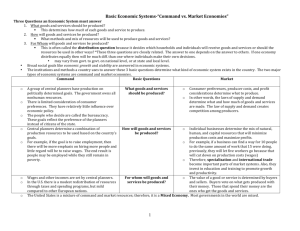

The Planning Environment

Financial planning takes place in a

dynamic economic environment

created by the actions of

Government

Business

Consumers

Financial Planning Environment

Government

• Federal government plays a major

role in regulating the level of

economic activity

• Taxation and regulation constrain

personal financial planning

The Economy

Monetary Policy

• Controls money

supply

• Used to stimulate or

contract economic

growth

Fiscal Policy

• Controls levels of

taxation

• Sets levels of

government

spending

The Economy

Economic Cycles

Inflation

• Stages related to

employment and

production levels

• Growth measured

by changes in

GDP

• Measured by changes

in CPI

• Affects purchasing

power and interest

rates

• Affects financial plans

and goals

The Economic Cycle

What Determines Your

Personal Income?

• Demographics and income

– Age, marital status

• Education

• Where you live

• Career