Investment and Financing Decisions

advertisement

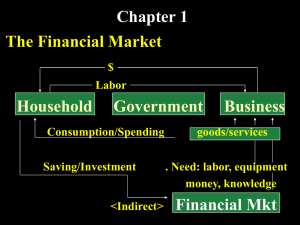

Introduction to Finance Lecture 1 1-1 Goals and Governance of the Corporation This chapter introduces the corporation, its goals, and the roles of financial managers. Number of Firms in the U.S. 1,011,973 1,292,081 Corporation S-Corporation Partnership Sole Proprietorship 622,908 2,584,427 Source: U.S. Census 2008 SUSB Annual Data 1-2 Investment and Financing Decisions The Investment Decision – Decision to invest in tangible or intangible assets. Also known as the “capital budgeting” or “CAPEX” decision. Real Assets: Assets used to produce goods and services. • The Financing Decision – The form and amount of financing of a firm’s investments. Financial Assets – Financial claims to the income generated by the firm’s real assets. 1-3 Investment and Financing Decisions Are the following capital budgeting or financing decisions? Apple decides to spend $500 million to develop a new iPhone. GE borrows $400 million from bond investors. Microsoft issues 100 million shares to buy a small technology company. 1-4 What is a Corporation? Corporation-A business organized as a separate legal entity owned by stockholders. Types of Corporations: Public Corporations Private Corporations 1-5 Benefits of the Corporation Limited liability Infinite lifespan Ease of raising capital 1-6 Drawbacks of the Corporation Corporations face the problem of double taxation Double Taxation – Corporations pay taxes on their profits and the shareholders are taxed again when they receive dividends realize capital gains. or Improper corporate structures may lead to “Agency Problems” Agency Problem – Managers are agents of the shareholders, but the managers may act in their own interests rather than maximize value. 1-7 Goals of The Corporation Shareholders want wealth maximization Wealth maximization vs. profit maximization: Pitfall: Profits from which period? A corporation can make short term wasteful investments to increase profits, but long-term profits and value will be damaged. Pitfall: Cutting dividends to increase cash reserves A company may increase future profits by cutting today’s dividend and reinvesting the cash in the firm. In most cases, this decreases the value of shareholder investment in the firm. 1-8 The Ethics of Maximizing Value Does value maximization justify unethical behavior? Recent examples: Enron WorldCom Bernard Madoff 1-9 Agency Problem Do managers really maximize value? Agency Problems • Managers are agents for stockholders, but the managers may act in their own interests rather than maximizing value Shareholders vs. Stakeholders Shareholders want managers to maximize the market value of the firm. However, managers are often obliged to appease not only the shareholders but all of the stakeholders as well. 1-10 Agency Problem Different Information Stock prices vs. returns Dividend Policy Financing Decisions Different Objectives Managers vs. shareholders Top managers vs. lower managers Stockholders vs. banks and lenders 1-11 Agency Problem Solutions Compensation plans Provide managers with incentive schemes that produce big returns if shareholders gain but little or nothing if they do not. Board of Directors Through a vote, the board of directors gives shareholders an opportunity to have a say in the operations of a firm. Blockholders Individual investors who hold 5% or more of the company. These blockholders may offer some solutions to agency problems by closely monitoring the firm. 1-12 Agency Problem Solutions Takeovers Poorly performing companies are more likely to be taken over by another firm. The further a company’s stock price falls, the easier it is for another company to buy up a majority of its shares. Specialist Monitoring Managers are subject to the scrutiny of specialists. Their actions are monitored by the security analysts who advise investors to buy, hold, or sell the company’s shares Legal and Regulatory Requirements CEOs and financial managers have a legal duty to act responsibly and in the interests of investors. 1-13 Role of the Financial Manager Firm’s Operations (1) (2) Investors Financial Manager (4a) Financial Assets Real assets (3) (4b) 1. Cash raised from investors (how?) 2. Cash invested in firm 3. Cash generated by operations 4A. Cash reinvested in the firm 4B. Cash returned to investors 1-14 The Financial Manager Most large companies have 3 top-level financial managers: 1-15