What is Accounting?

advertisement

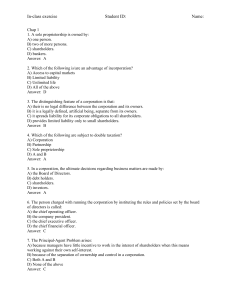

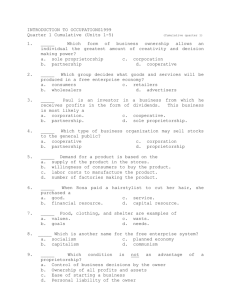

What is Accounting? Accounting is a system of dealing with financial information that provides information for decisionmaking. G.E. Syme & T.W. Ireland What is Accounting? Accounting is the language of business. Art Lightstone The Five functions of Accounting 1. Gathering financial information. The Five functions of Accounting 2. Preparing and collecting permanent records. The Five functions of Accounting 3. Rearranging, summarizing and classifying financial information. The Five functions of Accounting 4. Preparing information reports and summaries. The Five functions of Accounting 5. Establishing controls to promote accuracy and honesty among employees. Types of Business All businesses fall into three general categories… 1. service Sells effort (ie. work, talent) that does not result in a material item. A haircut would be an example of a service. A service is often viewed as an expense by the buyer. 2. manufacturing Combines effort and materials to produce a new product. These products may be viewed by the buyer as an expense (ie. fuel) or an asset (ie. car). 3. merchandising Purchases a manufacturer’s product and resells it to another customer for a higher price. Again, such products may be viewed as assets or expenses by the buyer. Forms of Business Organization There are three forms of business organization. They are: • Sole Proprietorship • Partnership • Corporation Sole Proprietorship •An unincorporated business owned by a single individual. •The law does not distinguish between the business and the owner. Sole Proprietorship Advantages • low start-up cost • great freedom from regulation • all profits to owner • owner has complete control Sole Proprietorship Disadvantages • unlimited liability • difficult to raise capital • limited to owner’s knowledge • lack of continuity • profits taxed at personal rate Partnership •An unincorporated business owned by more than one individual. •The law does not distinguish between the business and the owners. Partnership Advantages • ease of formation • broader management skills • limited regulations • more capital resources Partnership Disadvantages • unlimited liability • possible disagreements • divided authority • difficult to find partners • partners liable for each other Corporation •A business which is an individual in the eyes of the law. •The law views the business as a separate entity from the owner(s). Corporation •Profits of the corporation are distributed to the shareholders by way of "dividends". •The more shares one owns, the more dividends they will receive. example Dividends: $1.00 / share Shareholder owns: 1000 shares Shareholder receives: $1,000.00 Corporation Advantages •limited liability of shareholders (However, directors and officers can be liable in certain circumstances.) •possible lower taxation rate •can sue / be sued in the corporate name •more prestige •continuity of business Corporation Disadvantages •higher start-up costs and greater formalities •requires annual maintenance from accountant and lawyer •losses cannot offset personal income Corporation Structure Executive: (ie. President, Treasurer, Secretary. Run the day to day operations of the business.) Directors: (Hire executive, guide mission, distribute profits between business & shareholders) Shareholders: (provide capital, elect directors, receive dividends) 1. In groups of four to five students, answer the following Chapter Review questions: #1, 8, 9, 10, and 11. 1. List the five main activities involved in accounting. 8. Identify three kinds of businesses besides a service business. 9. List the three forms of business ownership. 10. Give examples of a routine accounting activity and a periodic accounting activity. 11. Define the accounting cycle. Bonus Question: Explain the paradox involved in the answer to question #8. The Accounting Cycle 1. Originating Transaction Data 2. Journalizing 8. Post-closing Trial Balance 7. Closing Entries A = L + OE 3. Posting 4. Trial Balance 6. Financial Statements 5. Worksheet